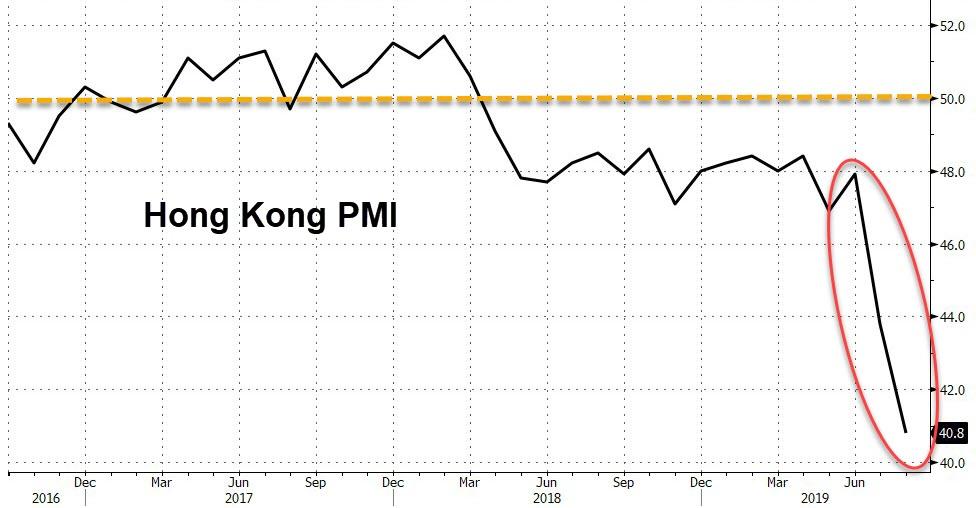

If the nightly images of water cannons and molotov cocktails were not enough to spark fears about the state of Hong Kong’s economy, tonight’s almost unprecedented collapse in IHS Markit Hong Kong Purchasing Manager’s Index should slap reality back to the top of mind.

The whole economy PMI crashed to 40.8, the lowest reading since Feb 2009.

Business activity fell at the steepest rate since the end of 2008, reflecting a sharper decline in new order intakes. Pessimism spread to more firms, with business confidence slumping to its lowest on record.

“The rates of decline in output, new orders and export sales accelerated sharply in August, with the only other time that the PMI survey has recorded a steeper downturn, in its more than two decades of history, been during the SARS epidemic in 2003 and the global financial crisis in 2008-2009.”

Nearly half of survey respondents reported reduced Chinese demand, citing the ongoing US-China trade dispute, a sharp depreciation in the renminbi and large-scale protests as reasons.

Commenting on the latest survey results, Bernard Aw, Principal Economist at IHS Markit, said:

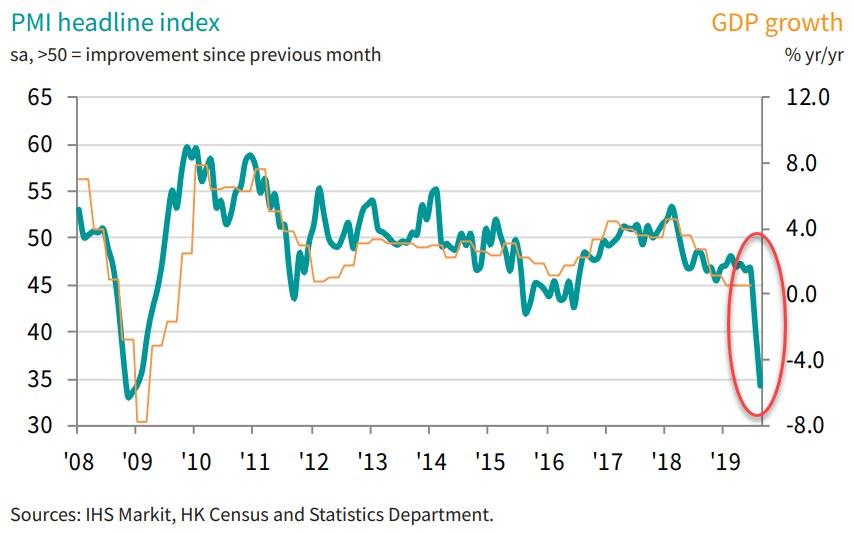

“The latest PMI data reveal a Hong Kong economy flirting with recession in the third quarter as business activity is increasingly aggravated by protest-related paralysis.

“The executive authorities of the Hong Kong SAR recently unveiled an economic stimulus plan to support flagging growth momentum, but any further economic weakness will mean policymakers are likely to consider larger stimulus measures.

Finally, Aw warns, “the survey is now broadly indicative of the economy contracting at an annual rate of around 4.0-4.5%.”

A bloodbath that we are sure China will be perfectly ok with.

via ZeroHedge News https://ift.tt/2HIxcJ7 Tyler Durden