Ignore At Your Peril: New Data Warns A Recession Is Looming!

Authored by Mac Slavo via SHTFplan.com,

While we don’t know the exact date that the recession will officially hit us nor do we know when the mainstream media will report the actual facts about the condition of the United States economy, we do know its decline is imminent. New data has come out that warns that the recession is not only imminent but could be right around the corner.

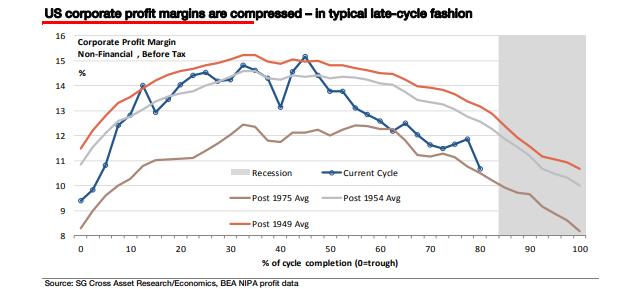

According to a report by Market Watch, you should “ignore this data at your peril.” According to Société Générale’s known bear Albert Edwards, who was schooling clients Thursday on an often-overlooked set of U.S. government numbers that reveal profits of all companies, including unlisted ones, published by the Bureau of Economic Analysis. Edwards says there is a recession right around the corner based on these data points released by the government.

Corporate profits are down by a lot. That’s nothing to sneeze at either. The corporate profit series (economic profits from current production in the second quarter) saw nearly 10% cut from the previous more upbeat 2019 first-quarter estimate, said Edwards.

“The latest revisions to U.S. whole economy profits – National Income and Product Account profits – were sufficiently large to suggest that the end of this record economic cycle is much closer than previously thought,” he said.

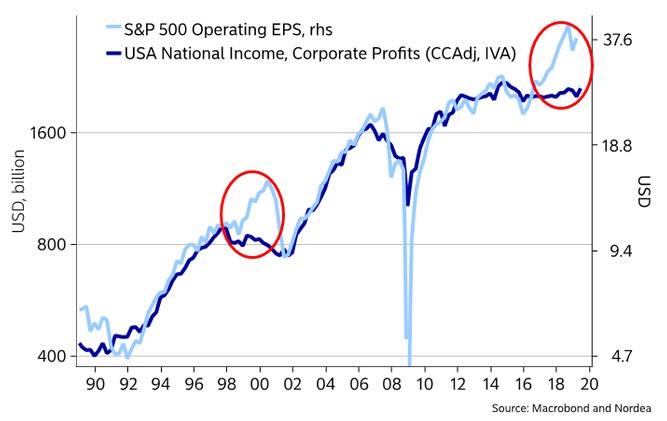

In sharp contrast to “booming stockmarket measures of profits,” the BEA’s NIPA data has been flatlining for a few years now, he said. That divergence is pretty normal just ahead of a recession, as those profits reveal the underlying trend.

“For it is at this late stage that we often see whole economy profits and margins declining sharply but this weakness does not usually appear in stock market reported profit measures until much later in the cycle – usually in the middle of ensuing recessions when companies sack their CEOs and write down years of inflated profits growth in one fell swoop,” said Edwards.

This is just one more piece of data showing that the U.S. economy is not as strong as we are being told.

Large sections of the economy are already in a recession, according to their data, and Americans are piling on debt at a record pace. If the economy was in such great shape, would there be a need to borrow excessive amounts of money when most debtors are already tapped out? Probably not. But hey, the stock market is good, and some people still have jobs, so there’s nothing to worry about!

Tyler Durden

Mon, 09/16/2019 – 11:50

via ZeroHedge News https://ift.tt/34XD5fA Tyler Durden