Platts: 6 Commodity Charts To Watch This Week

Via S&P Global Platt’s ‘The Barrel’ blog,

Geopolitical risk and oil markets top this week’s pick of energy and commodities themes from S&P Global Platts editors. Plus, Ukraine’s role in European gas supply, steel scrap prices as a bellwether for economies, and a milestone approaches for US LNG exports.

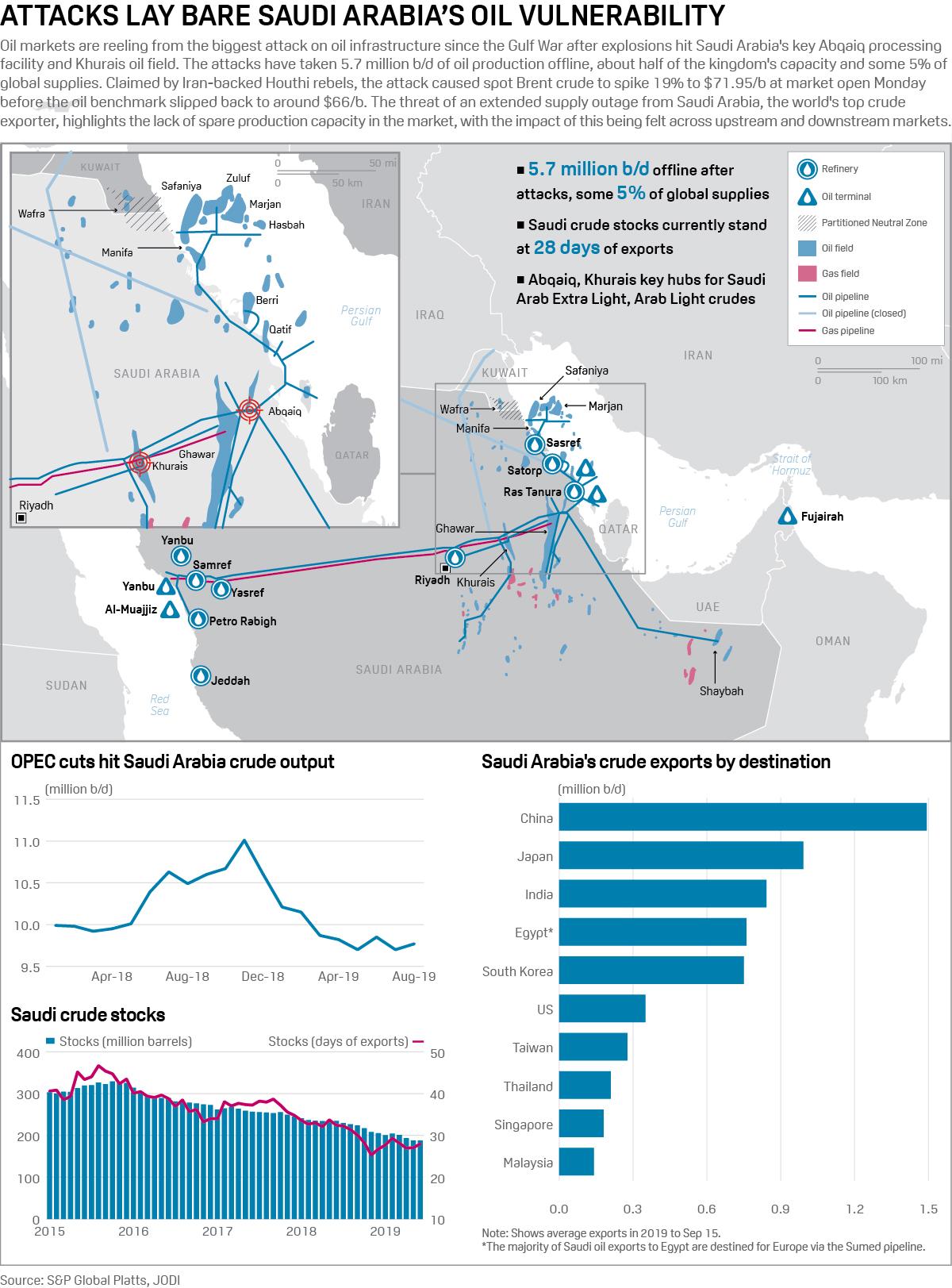

1. Global oil markets on alert after attacks on Saudi oil facilities

Click for full-size infographic

What’s happening? Attacks on Saudi Arabian oil facilities at Abaiq and the kingdom’s second-largest oil field, Khurais, have led to the temporary loss of 5.7 million barrels a day of output, causing oil prices to jump and bringing back into focus the geopolitical risk in the Persian Gulf region. Saudi Arabia produced 9.77 million barrels a day in August, of which it exported around 7 million, according to the latest S&P Global Platts survey.

What’s next? Saudi Arabia has tried to reassure markets there will be no disruption to physical supply, with energy minister Prince Abdulaziz bin Salman saying the country’s export customers will be supplied from stocks. According to the Joint Organization Data Initiative figures, Saudi Arabia in June had enough stocks to cover around 27 days of exports. But market participants will be monitoring responses from all sides carefully to see whether or not tensions escalate further. S&P Global Analytics said Saturday that the sudden change in geopolitical risk level could cause oil prices to test $80/b.

Go deeper – S&P Global Platts Factbox on Saudi attacks

2. Unease in Europe as Ukraine gas transit contract expiry looms

What’s happening? A key meeting will be held in Brussels on Thursday between Russia, Ukraine and the European Commission to hammer out gas transit terms for 2020 and beyond. The European Commission is worried that without a deal Russian gas supplies to the EU could be disrupted from January 1. Ukraine is currently Russia’s biggest single transit route to the EU, carrying over 40% of Russian supplies in 2018, and heading for a similar share this year.

What’s next? Russia’s access to alternative routes to Ukraine for 2020 is looking limited. Its planned Nord Stream 2 pipeline to Germany is still waiting for a key planning permit from Denmark, and an EU court ruling last week restricted its access to Germany’s OPAL gas link, which will limit how much Russia can flow through its Nord Stream 1 pipeline. So the pressure is on to reach a deal, and the market will be watching the outcome closely.

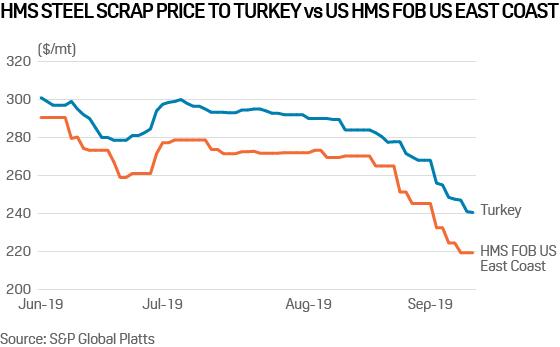

3. Steel scrap prices showing recessionary tendencies

What’s happening? Global prices of heavy melting steel scrap have declined sharply this summer to lows not seen since 2017. The US is the world’s major exporter and Turkey is the biggest importer of ferrous scrap.

What’s next? Most market players sense a price bottom, but they remain uncertain despite expectations for more deepsea trading starting in mid-September. Alan Greenspan, former chairman of the US Federal Reserve, was known for monitoring scrap prices as an economic indicator – in particular to gage the chances for a recovery or a recession. The recent downward trend is ominous, pointing to the latter.

Go deeper – Podcast: How low can scrap and rebar go?

4. Record demand causes ERCOT power prices to skyrocket

What’s happening? Average wholesale power prices for August in the Electric Reliability Council of Texas (ERCOT) footprint more than quadrupled year on year, into triple-digit territory. A heat wave combined with plunging wind output to cause two Energy Emergency Alerts, and hours when the systemwide real-time price was at the $9,000/MWh offer cap. For the first 10 days of September, the day-ahead on-peak averages for the four main hubs were more than 6.7 times the averages for the same period of 2018, as another heat wave sent day-ahead prices soaring.

What’s next? A second planned revision to ERCOT’s scarcity price adder that goes into effect in time for the summer of 2020 may result in more extreme pricing. The planning reserve margin has been forecast to be 10.5% in the summer of 2020, well above this summer’s 8.6%, but well below the target of 13.75% considered minimum to ensure a capacity-related power outage occurs no more than one day in 10 years.

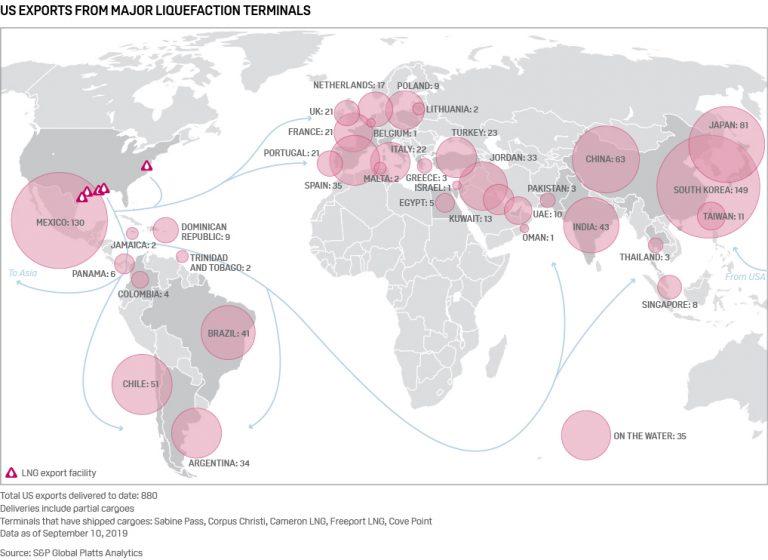

5. As US LNG facilities ramp up, exports near 1000 cargoes

Click to enlarge

What’s happening? The number of LNG export cargoes shipped from major liquefaction terminals in the US is nearing 1,000, according to S&P Global Platts trade flow software cFlow. The development comes amid a recent ramp-up in liquefaction from the five terminals that are actively shipping cargoes. America has become an increasingly important supplier in the global market since Cheniere Energy’s first export from its Sabine Pass facility in 2016. Terminals operated by Dominion Energy, Sempra Energy, Freeport LNG Development and a second one by Cheniere have joined the field since then.

What’s next? The ongoing trade war between Washington and Beijing will continue to push US cargoes to seek out other destinations in Asia, Europe and Latin America.

6. French nuclear fears stoke front quarter volatility

What’s happening? French power prices for Q4 2019 rose 24% last week after nuclear generator EDF announced it was examining sub-standard components in steam generators. Subsequent information confirmed 20 generators were affected across at least five reactors, implying around 5 GW of nuclear capacity could be facing extended outages this winter as the problems are fixed.

What’s next? EDF will propose its own solutions in the next few days, but forward supply uncertainty will continue until French nuclear regulator ASN has itself ruled on what needs to happen in one month’s time. Material French nuclear outages in the past have caused regional prices to rise as more expensive fossil-fuel power stations step up to fill the breach.

Tyler Durden

Mon, 09/16/2019 – 15:10

via ZeroHedge News https://ift.tt/2LVZTn5 Tyler Durden