JPMorgan Quant Guru: Here Is Where Oil’s Price Spike Starts To Slam The Stock Market

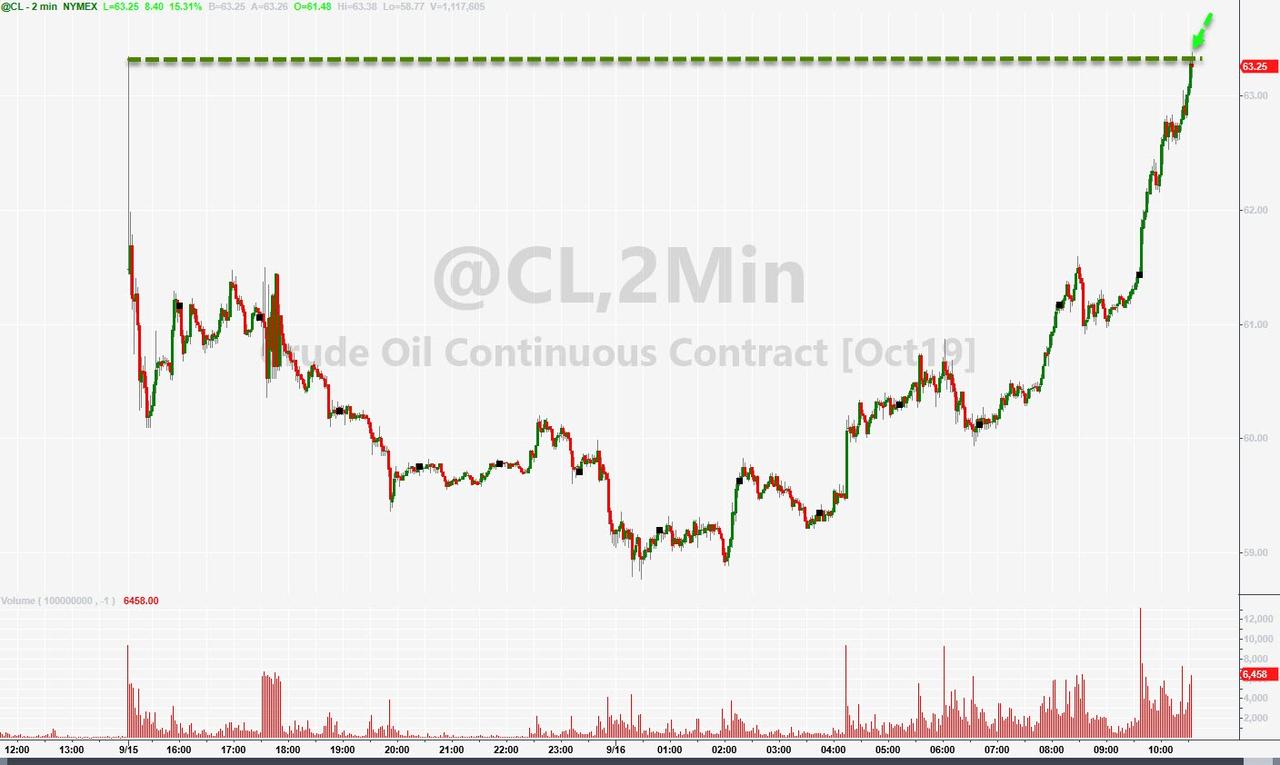

Too much of a good thing can be harmful and while the surge in oil prices in the last 24 hours has sent energy-related stocks higher, and taken a modest haircut off the broad stock market; JPMorgan’s quant guru Marko Kolanovic warns that if oil prices keep rising then than spoonful of inflationary medicine will start to weigh on stocks quite notably.

Notably, the recent shock in Oil prices came amid significant crowding in short oil and gas futures by systematic and macro investors, even more extreme shorting of oil and natural gas exploration and production stocks by hedge fund pods and quants, and puzzling investor complacency towards geopolitical risks.

Kolanovic notes that it is hard to be surprised by the recent geopolitical event given the string of escalating events involving Oil tankers in the Strait of Hormuz, Gulf of Oman, Gibraltar, downing of drones.

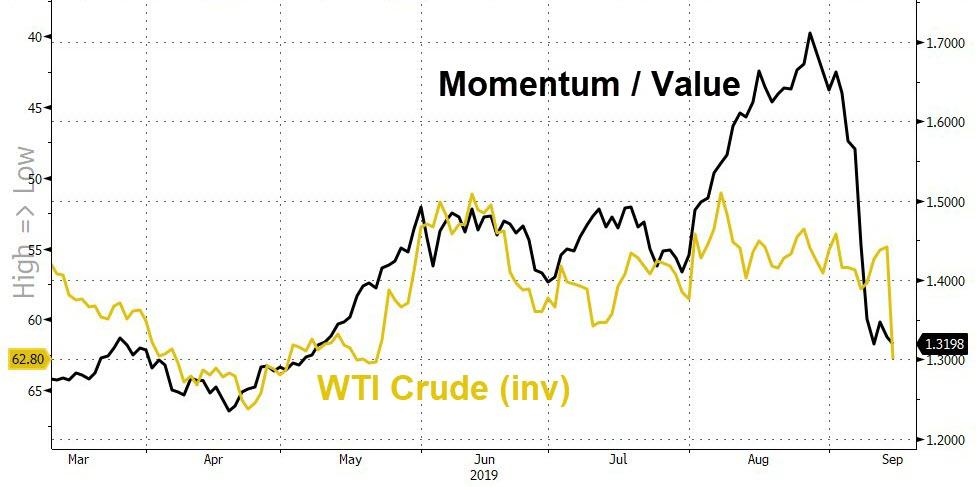

Furthermore, the risks of this type of disruption were presented to the market almost a year ago (here). Investors came off as complacent last week, with more selling of Energy on the seemingly immaterial news of John Bolton’s resignation as National Security Advisor. It is our view that energy (commodity and stocks) will continue going higher and the rotation from momentum to value will continue.

So what are the implications for the S&P 500:

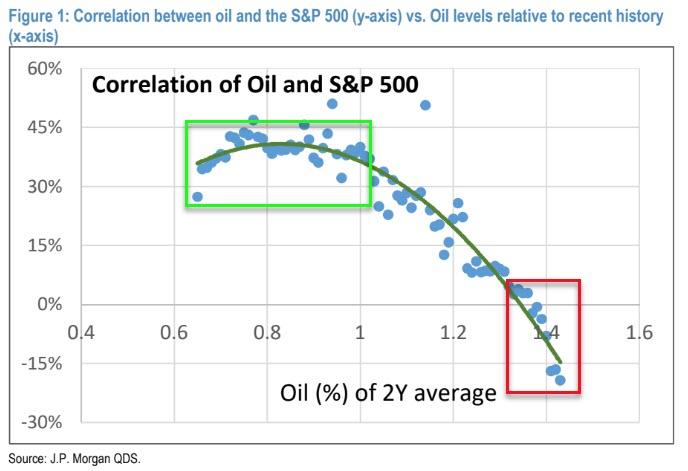

The question on many investors’ mind is how the spike in oil prices impact broad equity prices. On one side, a large increase of oil prices can weigh on the index by negatively impacting consumer activity, but there are also positives such as energy sector profits, alleviation of high yield credit concerns, and employment tied to the sector. To assess quantitatively at which point oil shocks negatively impact equities, we look at the correlation of Oil and S&P 500 prices.

Figure 1 below shows the correlation between Oil and S&P 500 at different levels of Oil (on horizontal axis as % of the cycle average Oil price).

Generally, Oil positively correlates with S&P 500 when Oil prices are stable. For large % increases in Oil, this correlations weakens, and eventually turns negative. Where is the break-even point when Oil starts hurting the S&P 500?

Taking into account the current price, Figure 1 above implies that we could start expecting a negative impact from Oil on the S&P 500 in an $80-$85 range for WTI. This is still far away from the current level of $60.

In addition to historical quantitative analysis, current macro fundamentals and global trade tensions may also play a role. In particular, we think that that elevated geopolitical risks in the Middle East and rising oil prices may incentivize both China and US to reach a timely trade agreement.

Additionally, amid the quant quake that markets suffered in the last week, Kolanovic notes that the recent spike in Oil will just accelerate this unwind and eventually lead to a capitulation of the short value/beta trade.

Commodity price developments should in turn continue to drive the value rotation and short covering of oil and natural gas stocks.

Tyler Durden

Mon, 09/16/2019 – 15:25

via ZeroHedge News https://ift.tt/2QbGmo8 Tyler Durden