Markets Slide As Traders Put Oil Crunch On Backburner, Turn To Fed

Global stocks and US equity futures dipped, with the E-mini back under 3,000 again, as attention turned to the Fed (and the slight possibility Powell may disappoint investors again)…

… while Brent shed some of its massive gains on Tuesday as the United States de-escalated concerns of an imminent war with Iran and also flagged the possible release of crude reserves.

Investors, desperate for more love from money printers, were unsure what to do ahead of tomorrow’ interest rate cut from the Fed, which is fully priced in by the market even if tiny doubt appears to have crept in with 5% odds of “no change” which would crash the markets, as well as the next round of U.S.-China trade talks on Thursday.

MSCI’s All-Country World Index was down 0.1% on the day.

European shares opened lower, with energy stocks giving up gains as crude prices eased. Europe’s broad STOXX 600 index dropped 0.2%, led by declines in banks and automakers shares, even though Germany showed clear green shoots, and signs of sentiment rebound after the ZEW Economic Sentiment surged to -22.5 from -44.1, smashing the Expected print of -37.0.

Earlier in Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.66%. Chinese shares fell 1.07%, while Hong Kong shares slumped 1.18% after China’s central bank disappointed investors when it refrained from lowering a key interest rate.

US stocks futures were flat to slightly lower, indicating subdued open on Wall Street later, with the S&P set to open below 3,000 once again.

All eyes were on oil however, which gave back only a bit of Monday’s record surge: Brent crude oil fell 0.1% to $68.96 per barrel on Tuesday. On Monday, it surged as much as 14.6% for its biggest one-day percentage gain since at least 1988. In the US, West Texas Intermediate futures were down 0.87% to $62.25 per barrel following a 14.7% surge on Monday, the biggest one-day gain since December 2008.

Saudi Aramco now faces weeks or months before the majority of output is restored at the giant Abqaiq processing plant after the attack, adding a fresh headwind for the global economy. The developments in the Middle East are testing sentiment after a bullish start to the month for global equities and other riskier assets. Meanwhile, Iran won’t negotiate with the U.S. on any level, anywhere, the Islamic Republic’s supreme leader said.

“The key thing to think about is do we have an oil shock or a short-term disruption?” said Virginie Maisonneuve, chief investment officer at Eastspring Investments, in a Bloombergv TV interview. “You’re seeing this wait-and-see attitude, and that’s why the markets are quite nervous.”

Meanwhile, president Trump authorized the release of emergency crude stockpiles if needed, which could ease some upward pressure on crude futures. Trump said on Monday it looked like Iran was behind the attacks but stressed that he did not want to go to war, striking a slightly less bellicose tone than his initial reaction.

“Although Saudi Arabia’s spare capacity and U.S. Strategic Petroleum Reserves could plug some of the lost output, where oil trades in the near term will be influenced by how long it takes for Saudi production to fully recover,” said Lukman Otunuga, research analyst at FXTM. “It is this concern over negative supply shocks amid geopolitical tensions which should keep oil prices buoyed in the short term.”

Middle-eastern events overshadowed investor concerns about the simmering trade war. American and Chinese working-level trade negotiators are set to resume talks in the next week, before a meeting of top officials in October. Meanwhile, President Donald Trump said the U.S. and Japan have reached an initial trade accord over tariffs.

In other news, late on Monday Trump said that the United States has reached initial trade agreements with Japan, but traders are also focused on the U.S.-Sino trade war. “In the next week, positive developments on Brexit and/or Iran have the potential to move markets higher from here. It shows why staying strategically invested in equities is important,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “But with scope for central banks to disappoint and global growth continuing to slow, we see little reason to change our tactically more cautious stance.”

Deputy-level talks between the United States and China are scheduled to start in Washington on Thursday, paving the way for high-level talks next month aimed at resolving a bitter trade row that has dragged on for more than a year.

In rates, the recent blowout in interest rates continued to fade, as the yield on benchmark 10-year Treasury notes fell slightly to 1.8292%, while the surge in overnight repo rates eased. Euro zone government debt yields edged lower as geopolitical uncertainty stemming from the attack on Saudi underpinned a cautious tone in bond markets.

In currencies, the dollar gained versus all of G-10 peers as the Fed kicks-off its two-day monetary policy meeting and tensions in the Middle East fail to dictate market sentiment. Investors are focusing on reasons to fade any greenback weakness – ECB easing, a no-deal Brexit, dovish RBA minutes – and the Bloomberg Dollar Spot Index is up 0.1% and approaching a two week high, after forming a bullish outside day on Monday. Elsewhere, the pound slipped 0.2% to 1.2403, down a second day as PM Boris Johnson’s lawyers were set to defend his Brexit strategy in the U.K.’s highest court. The Euro was down 0.1% below 1.10, to 1.0992 as option-related bids above 1.1000 failed to absorb leveraged pressure. On the other side of the world, the Australian dollar led losses in G-10 with AUD/USD down 0.5% to 0.6831, lowest since Sept. 6. The Reserve Bank of Australia said wages growth appears to have stalled and the job market is set to moderate in its September minutes. AUD/USD was also sold by macro and leveraged funds due to the decline in Chinese stocks, according to Asia-based FX traders.

Elsewhere, Gold moves sideways, holding on to recent gains that saw the precious metal jump back above USD 1500/oz; though it has struggled to stay above this mark. Separately, the Indian Government may be considering a full exit from Hindustan Copper as according to reports.

Economic data include industrial production for August. FedEx is due to publish earnings

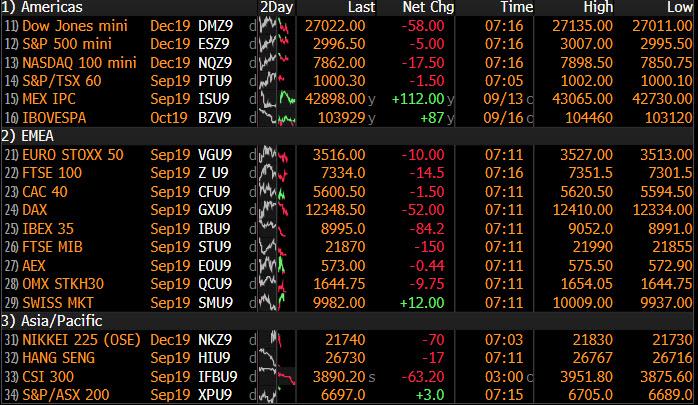

Market Snapshot

- S&P 500 futures down 0.1% to 2,997.25

- STOXX Europe 600 down 0.1% to 389.01

- MXAP down 0.4% to 159.03

- MXAPJ down 0.7% to 510.32

- Nikkei up 0.06% to 22,001.32

- Topix up 0.3% to 1,614.58

- Hang Seng Index down 1.2% to 26,790.24

- Shanghai Composite down 1.7% to 2,978.12

- Sensex down 1.4% to 36,604.95

- Australia S&P/ASX 200 up 0.3% to 6,695.25

- Kospi up 0.01% to 2,062.33

- German 10Y yield fell 0.6 bps to -0.486%

- Euro up 0.2% to $1.1021

- Brent Futures up 0.3% to $69.21/bbl

- Italian 10Y yield fell 3.7 bps to 0.504%

- Spanish 10Y yield fell 0.3 bps to 0.254%

- Brent Futures down 0.5% to $68.65/bbl

- Gold spot up 0.1% to $1,497.72

- U.S. Dollar Index down 0.03% to 98.58

Top Overnight News from Bloomberg

- One of the key U.S. borrowing markets saw a massive surge Monday, a sign the Federal Reserve is having trouble controlling short-term interest rates.

- American and Chinese senior trade negotiators are expected to resume negotiations in the next week and a half, with much work remaining to reach a comprehensive deal, U.S. Chamber of Commerce Chief Executive Officer Thomas Donohue said.

- Swiss National Bank chief Thomas Jordan is out of the hot seat for now — perhaps until Brexit hits.

- Gulf dollar bonds went into the weekend as investor darlings and came out as risky assets. Money managers poured into the Gulf region in the weeks running up to Saturday’s unprecedented attack on Saudi Arabia’s key oil facilities.

- Saudi Aramco is growing less optimistic there will be a rapid recovery in oil production from the weekend’s attack and now faces weeks or months before the bulk of output is restored at its Abqaiq processing plant

- Oil’s record-breaking advance paused as the market awaits clarity on how long it’ll take Saudi Arabia to restore output

- President Donald Trump said his administration has reached an initial trade accord with Japan and he intends to enter into the agreement in coming weeks

- Chinese working-level trade officials are scheduled to travel to the U.S. this week to prepare for a meeting of top negotiators in October, the Ministry of Commerce said

- Boris Johnson will see his decision to suspend Parliament under scrutiny in the first of three days of hearings at the U.K.’s Supreme Court

- In minutes of its Sept. 3 meeting, Reserve Bank of Australia said “the upward trend in wages growth appeared to have stalled” and forward-looking indicators suggested employment growth would moderate

- Argentina’s central bank modified capital control rule to allow sovereign bond payments to be made abroad

- Trump said he “probably” won’t travel to Pyongyang for the next round of nuclear talks with Kim Jong Un, but would be willing to visit the North Korean capital in the future

Asian equity markets were mixed/lower following a subdued lead from Wall St where the S&P 500 slipped back below the 3k milestone and the DJIA snapped an 8-day win streak after attacks on Saudi’s oil facilities, while participants continue to await the looming billow of central bank policy updates. ASX 200 (+0.3%) and Nikkei 225 (+0.1%) were lacklustre in which weakness in Australia’s mining and materials sectors overshadowed the continued rise in energy stocks as oil prices took a breather from the prior day’s record surge, while the Japanese benchmark lacked conviction amid a choppy currency and with SoftBank among the worst performers due to a delay of the WeWork IPO which the Co. and its affiliates hold about a 29% stake in. Hang Seng (-1.2%) and Shanghai Comp. (-1.7%) were the laggards after the PBoC refrained from open market operations and although it announced to lend CNY 200bln through its Medium-term Lending Facility, this was below the CNY 265bln maturing today and the rate was maintained at 3.3% to the disappointment of the increased speculations for a cut. Finally, 10yr JGBs initially gained to reclaim the 154.00 level amid safe-haven flows and with the BoJ also present in the market for JPY 760bln of JGBs in the belly to the shorter-end of the curve, although prices later reversed gains in conformity with the indecision seen across Japanese asset classes.

Top Asian News

- Singapore Woos Banks in Battle of Asia’s Biggest Forex Hubs

- South Korea Latest Asian Nation Hit by African Swine Fever

- Jokowi Orders Crackdown on Arsonists: SE Asia Haze Update

- China Stocks Fall, Yuan Weakens as Central Bank Holds Loan Rate

Major European indices are tentative following a mixed lead from the Asia Pacific Session, as the market awaits an update on the damages from the Saudis at 18.00 BST re. the weekend’s attacks, and ahead of tomorrow’s FOMC meeting, with major bourses little changed overall this morning. Energy sector (+1.1%) continues to outperform, as crude prices cling on to the recent outsized gains, which continues to weigh on airline names including EasyJet (-1.3%) and RyanAir (-2.5%). Meanwhile, some strength in the more defensive utilities (+0.6%), health care (+0.9%) and consumer staples (+0.8%) sectors is suggestive of a fragile risk tone, although the risk sensitive tech sector (+0.3%) is also in the green. Leading the laggards are Financials (-1.2%), with this week’s fall in yields and pronounced curve flattening failing to provide any support. In terms of stock specifics; Zalando (-9.1%) is the notable underperformer, after the Co. announced the placement of over 13mln new shares. Total (+1.7%) is deriving support not only from higher crude prices but also the news of a 30% output increase in one of its South Korean ethylene plants. AB InBev (+0.7%) is supported by news that the co. is looking to raise USD 4.8bln (according to a company statement) in the IPO of its AsiaPac unit in Hong Kong; although this is below the pre-market reports that they were seeking around USD 7bln. Finally, ThyssenKrupp (-0.8%) failed to garner support from reports that Advent International and Cinven & Abu Dhabi Investment Authority had teamed up to place a bid on the co.’s elevator unit, which could put them in competition with the likes of Kone (-0.3%).

Top European News

- Boris Johnson’s Brexit Plan Goes to Court With EU Talks in Chaos

- Balkan Leader Boosts Re-Election Bid With 500 Euro Wage Pledge

- Sweden Unemployment Reaches 4-Year High in New Blow to Riksbank

- EON Wins Conditional EU Approval to Take Over Innogy

In FX, SEK/AUD marked G10 underperformers and both undermined by Central Bank releases to varying degrees, while worrying data from Sweden has also undermined the Crown as unemployment jumped in August and total employment declined. Eur/Sek has rallied from around 10.6240 to 10.7150+ in wake of minutes from the Riksbank revealing deeper divisions on the repo rate path with Janssen unsure whether it is appropriate to maintain guidance for a hike around the turn of the year. Meanwhile, Aud/Usd has retreated further from recent peaks towards 0.6830 as the RBA remains ready to ease again to support growth and keep inflation on course to reach target, adding that it is reasonable to expect the OCR to be low for a lengthy period of time.

- NZD/GBP/CHF – The Kiwi is also on the back foot and hovering around 0.6325 vs its US counterpart after a dip in Westpac’s Q3 consumer survey overnight, but holding up a bit better in Aud/Nzd cross terms within a 1.0827-1.0790 range ahead of NZ Q2 current account data and the latest GDT auction. Meanwhile, Sterling is struggling to survive a stringent test of 1.2400 and support just below at 1.2385 following a fruitless journey to Luxembourg by UK PM Johnson and pending the Supreme Court judgement on his suspension of parliament, and the Franc is trying to contain losses circa 0.9950/1.0950 against the Buck and Euro respectively in the run up to the Fed and SNB tomorrow and Thursday.

- JPY/CAD – The Yen has lost a degree of its Saudi safe-haven premium, with Usd/Jpy firmer above the 108.00 level amidst reports that the US and Japan have agreed tentative trade deal terms, while the Loonie is unwinding some oil-inspired gains ahead of Canadian manufacturing sales, as Usd/Cad pivots 1.3250 compared to lows of just a few pips off 1.3200 at one stage yesterday.

- EUR – The single currency has made a better fist of overcoming downside pressure at a big figure/psychological marker than the Pound, albeit with some assistance from a much more pronounced improvement in German ZEW economic sentiment than anticipated. Indeed, Eur/Usd has reclaimed 1.1000+ status after another probe below to 1.0990 (close to the 1.0985 pre-ECB base) even though the Dollar is firmer in general with the DXY comfortably back above 98.500 within a 98.573-749 band ahead of US ip data and the aforementioned Fed on Wednesday. However, decent option expiries layered between 1.1025-30 and 1.1040-50 (1 bn each time) may cap further Euro recovery gains vs the Greenback.

- RBA Minutes (Sept 3rd) reiterated the board would consider further policy easing if needed to support growth and inflation targets, while it is reasonable to expect extended period of low rates to achieve employment and inflation targets. Furthermore, minutes noted the Australian economy could sustain lower rates of unemployment and that there are further signs of a turnaround in the housing sector, although the turnover is still low and outlook for consumption growth is a key uncertainty.

In commodities, the crude complex consolidated on Tuesday morning, and holds on to the lion’s share of yesterday’s outsized gains which came on the combination of an uptick in geopolitical risk premia and supply shock after an attack left a significant portion of Saudi oil production offline. Brent Nov’ 19 futures, although well off yesterday’s extreme near USD 72/bbl highs, has lost the USD 68.0/bbl handle, while WTI Oct’ 19 futures range places it around the USD 62.0/bbl mark. The market now awaits an official update from the Saudis at 18.00/18:15 BST regarding the extent of the damage to the country’s oil producing infrastructure; mixed reports thus far, some suggested about 40% of the disrupted output has been restored and the remaining production could be back online as soon as month-end, but others were less optimistic and anticipate a return to full output could take months. In terms of commentary, US Energy Secretary Perry, when asked about tapping the US SPR, said that he is confident the markets are well supplied, and that the US will take a wait and see approach when it comes to its potential use. Russian Energy Minister Novak said there is still no information regarding the weekend’s Saudi Oil attacks and that the price spike following the attacks reflects uncertainty and risk. Meanwhile, as the dust settles in wake of the attack, evidence of supply disruptions continue to emerge; Saudi Aramco have reportedly delayed some oil loading grades by a number of days following and have asked some customers to accept different oil grades. Moreover, Indian State refiners are reportedly mulling switching crude oil grades to avoid supply disruptions from Saudi Aramco. Elsewhere, Gold moves sideways, holding on to recent gains that saw the precious metal jump back above USD 1500/oz; though it has struggled to stay above this mark. Separately, the Indian Government may be considering a full exit from Hindustan Copper as according to reports.

US Event Calendar

- 9:15am: Industrial Production MoM, est. 0.2%, prior -0.2%; Manufacturing (SIC) Production, est. 0.2%, prior -0.4%

- 10am: NAHB Housing Market Index, est. 66, prior 66

- 4pm: Net Long-term TIC Flows, prior $99.1b

- 4pm: Total Net TIC Flows, prior $1.7b

DB’s Jim Reid concludes the overnight wrap

Yesterday was one of the most unexciting, exciting days for markets for a long time. After the huge initial moves in the Asian session for oil, things settled down into a relatively tight range in most markets through most of the Asian, European and US sessions. WTI closed up +12.82% at $61.88, which was the biggest one day move higher since February 2009, with the move taking WTI back up to its highest level since May. Similarly, Brent closed up +14.61% at $69.02, breaking higher towards the session close. The moves weren’t just confined to crude though with Gasoline also rallying +11.45%, while natural gas rose +2.79%. Overnight WTI (-1.41%) and Brent (-1.10%) are both erasing a small amount of yesterday’s gains.

It was no great surprise then that markets elsewhere were dictated by the oil moves with the broad-based move being a moderate risk-off (with the weak China data also a factor). In equity markets the magnitude of the moves were actually fairly minor outside of energy. The S&P 500 closed down -0.31% with a +3.29% rally for the energy sector helping to buffer the slide. The likes of Apache (+16.89%), Hess (+11.18%) and Marathon (+11.57%) were the big winners at a stock level with the move for Apache the biggest since 2008. The DOW (-0.52%) and NASDAQ (-0.28%) also closed lower along with the STOXX 600 (-0.58%), although again the STOXX Oil and Gas index was up +2.13%. Arguably one of the areas of markets most sensitive to oil is US HY credit where spreads at a broad index level finished +0.5bps wider, with energy spreads rallying -24bps to help offset the risk off. It was a similar trend in CDS where there were big moves tighter for the likes of higher beta Chesapeake and Whiting in particular. One credit which did struggle though was A-rated Saudi Aramco where the spread on the 2049s traded about +7.5bps wider.

The risk-off tone also helped fuel a bid for Gold (+0.67%) and Silver (+2.33%) while in FX the oil-sensitive Norwegian Krone (+0.27%) and Canadian Dollar (+0.33%) also benefited. As for rates, most DM markets did their best to reverse a small amount of last week’s selloff but were fairly stable after the initial move. In the end 10y Treasuries ended -4.9bps (down a further -2.1bps this morning) lower at 1.847% having touched as low as 1.810% intraday, while the 2s10s curve fell -0.9bps to 8.3bps (7.9bps this morning). In Europe Bunds rallied -3.3bps and BTPs -3.8bps.

Overnight we have some fresh trade headlines to throw into the mix with China’s Ministry of Commerce saying in a statement that Chinese working-level trade officials are scheduled to travel to the US this week to prepare for a meeting of top negotiators in October. The statement added that Liao Min, deputy director of the Office of the Central Commission for Financial and Economic Affairs and vice finance minister, will lead a delegation to visit the US tomorrow for trade consultations. Separately, USTR Rober Lighthizer spoke with the US Chamber of Commerceyesterday post which the group’s CEO Thomas Donohue said that “there’s much more work” to be done on a trade deal with China while adding that Lighthizer indicated that there’s some movement on China buying US farm products and other issues but it’s “an extraordinary challenge” to get a complete deal. Donohue also said that Lighthizer said there are staff-level meetings between Chinese and U.S. negotiators on Friday, with senior negotiators to meet in the ensuing week or week and a half.

Continuing with trade, President Trump said late yesterday that his administration has reached an initial trade accord with Japan over tariffs and that he intends to enter into the agreement in the coming weeks. USTR Robert Lighthizer has said earlier that the limited trade deal will cover agriculture, industrial tariffs and digital trade. Trump didn’t provide details about what was in the initial deal and didn’t mention whether the limited deal will end his threat to slap tariffs on Japanese auto imports as part of the trade deal.

Asian markets are trading mixed this morning on all the above headlines with the Nikkei (-0.02%) trading largely flat while the Topix (+0.25%) is up as Japanese markets re-opened post a holiday. The Hang Seng (-1.01%), Shanghai Comp (-1.02%), CSI (-0.94%) and Shenzhen Comp (-1.38%) are all down while the kospi (+0.11%) is up. The onshore Chinese yuan is trading weak, down -0.30% to 7.0886, alongside most Asian EM Fx. The Hang Seng seems to be dragged down by the prospect of US sanctions as the city’s prominent local activist Joshua Wong is set to address US lawmakers today who are considering changes to special trade privileges for the financial hub. Ahead of the address, Hong Kong leader Carrie Lam said that “I uphold this principle of accountability, but at the moment it is all for us to see that Hong Kong is undergoing a very difficult situation, and sanctions or punishment are not going to help lift Hong Kong out of this very difficult situation.” Elsewhere, futures on the S&P 500 are trading flattish (-0.06%).

In other overnight news, Bloomberg reported that Former Italian Prime Minister Matteo Renzi is leaving the Democratic Party to found his own movement but pledged continued support for Prime Minister Giuseppe Conte. The report also added that Renzi could announce his move as early as today while Italian news agency ANSA reported that in a telephone call to Conte last night, Renzi assured the premier that his move won’t threaten the newly formed administration.

Coming back to the oil shock, ourUS economists noted that barring a more substantial geopolitical flare-up that leads to a sharp tightening of financial conditions, this move in oil should have only modest effects on the US economy. Reflecting the tension this creates for the Fed’s dual mandate, the recent increase in oil prices, if sustained, could syphon about $12bn away from consumer spending on non-energy items and provide a meaningful lift to five-year, five-year breakeven inflation rates, but with little impact on core inflation. With the Fed worried about too-low inflation expectations and downside risks to the growth outlook, on balance these effects should reinforce the Fed’s already dovish bias. See more here . Looking at the Euro Area angle and its sensitivity to an oil price shock, Peter Sidorov (link here ) writes that a EUR 10 oil price move would add c. 0.25pp to inflation over the short term and reduce around 0.2pp from private consumption after one year.

Away from the oil story we did hear from the ECB’s Lane yesterday, where the most relevant takeaway was the reference “we also retained the so-called easing bias by stating our expectation to keep the key ECB interest rates “at present or lower” levels. We judge that, if needed, we can further lower the deposit facility rate and, with it, the overnight money market rate. As a result, there is no reason for the distribution of future short-term rate expectations to be skewed upwards.” This suggests that the ECB can cut more which is not necessarily something that Draghi indicated last week, although given the publicly expressed views of the hawks on the Governing Council such as Bundesbank President Weidmann, there would certainly be questions as to the degree of support for further ECB action.

As for the latest on Brexit, PM Johnson went to Luxembourg yesterday to meet European Commission President Juncker and Prime Minister Bettel. However, with mass protests and chaotic scenes the joint press conference between Johnson and Bettel was cancelled by the British after their request to hold it inside was turned down. One wag on Twitter suggested that if the British and Luxembourg governments can’t agree on how to hold a press conference then the chances of agreeing a Brexit deal by October 31st are looking quite challenging. The mood music didn’t sound too positive either, with the European Commission’s statement saying that when it came to viable proposals from the UK to replace the backstop “Such proposals have not yet been made.” PM Johnson still said to the BBC that the UK will leave on October 31st regardless of any agreement with Brussels but that he would also obey the law, which says that unless MPs have approved a Brexit deal by October 19 or explicitly approved a no-deal exit then Johnson is required to request a 3-month extension from the EU. So how that circle is squared is anyone’s guess. The implication is that loopholes may be used. Events continue today as the Supreme Court hears the cases relating to the prorogation of Parliament, which will take place over the next 3 days.

In other news, the only data release of note yesterday – other than the early morning China data – came in the US where the September empire manufacturing print declined 2.8pts to 2.0 (vs. 4.0 expected). Notably, capex fell 19pts to the lowest since 2016 which points toward continued weakness in the manufacturing sector while new orders were also lower. The one bright spot was employment which climbed over 10pts to the highest since April.

To the day ahead, which for data this morning includes the September ZEW survey in Germany, while the data due in the US includes August industrial production, September NAHB housing market index and August import price index. Away from that we’re due to hear from a number of ECB speakers including Villeroy, Lane and Coeure. As mentioned the legal challenge to PM Johnson’s suspension of parliament arrives at the Supreme Court, a general election is being held in Israel, while the UN General Assembly opens in New York.

Tyler Durden

Tue, 09/17/2019 – 07:52

via ZeroHedge News https://ift.tt/2NkuD4n Tyler Durden