Fed Economists Shocked To Learn Market Wiping The Floor With Their Forecast, Bracing For Recession

Just one month after the San Fran Fed remarkably flipflopped on the topic of negative rates, and after praising NIRP as recently as February published a letter, titled “Negative Interest Rates and Inflation Expectations in Japan” which reached the diametrically opposite conclusion: that contrary to economist expectations – and we highlight “economist”, because this conclusion would have been obvious to anyone with a semi-functioning frontal cortex – Japan’s negative rate experience “resulted in decreased, rather than increased, immediate and medium-term expected inflation.“

In other words, NIRP actually compounded the problem it was meant to address, and hardly the panacea that the San Fran Fed said back in February is what would have helped quicken the recovery.

Here is the summary from the paper:

After Japan introduced a negative policy interest rate in 2016, market expectations for inflation over the medium term fell immediately. This can be seen by assessing how prices for Japanese bonds with embedded deflation protection responded to the policy announcement. The reaction stresses the uncertainty surrounding the effectiveness of negative policy rates as expansionary tools when inflation expectations are anchored at low levels. Japan’s experience also illustrates the desirability of taking preemptive steps to avoid the zero interest rate bound.

But… but… the San Francisco Fed in February said precisely the opposite.

Things indeed move fast when one is a modern day voodoo charlatan, also known as “economist.”

Why do we bring it up? Because earlier today, the same San Francisco Fed, which now occupies at least 3 honorary squares in the Hall of “Researchers” who “Research” the Patently Obvious To Anyone Who Is Not An Idiot, published a note in which it was shocked to find that the market is not only openly mocking the Fed’s own trivial – and traditionally worthless – exercise in forecasting, sometimes known as the “dot plot”, but expects the Fed’s rosy outlook on the economy over the next two years to be dead wrong.

Interest rate derivatives—financial investments whose value depends on interest rates—provide useful information about the risk of short-term rates falling again to the zero lower bound. According to new market-based estimates, the probability of a return to the lower bound by the end of 2021 is about 24%. This is roughly in line with other survey-based and model-based estimates of zero lower bound risk. In recent months, the market-based measure of lower bound risk has increased markedly.

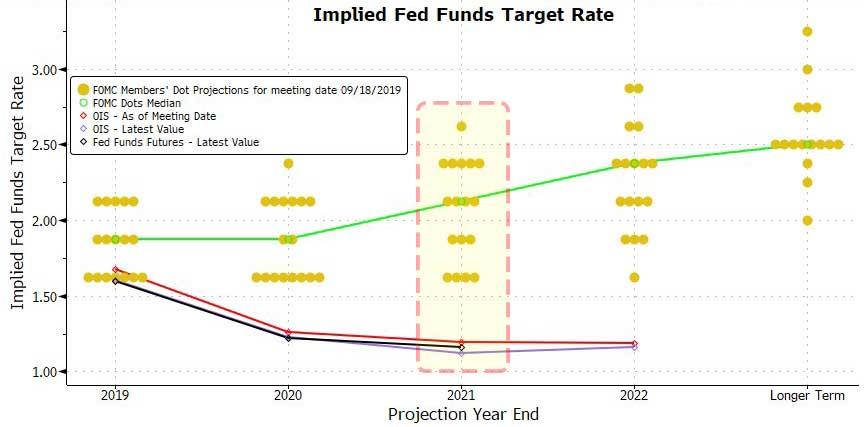

As a reminder, when it comes to the future of the Fed Funds rate, rarely has the market disagreed as profoundly with the Fed as it does now. To wit, as shown in the chart below, when it comes to 2021, whereas the average Fed “dot” expect a rate of 2.125%, or one hike from the current level, the market implied rate is about 100bps lower, or 1.16 according to Fed Fund Futures.

What is fascinating about the above chart, is not what it shows – it has been long known that the divergence between the Fed’s and the market’s forecasts has never been greater- but that the Fed only now appears to be figuring this out.

As San Fran Fed economists Michael D. Bauer and Thomas M. Mertens write in “Zero Lower Bound Risk according to Option Prices“, “accurately assessing and quantifying downside risks are of paramount importance to investors, policymakers, and professional forecasters” and go on to note that “this Economic Letter introduces and evaluates a new risk measure based on option prices in financial markets. Specifically, we use prices of Eurodollar options to estimate the probability that future short-term interest rates will return to levels near the zero lower bound (ZLB). The market’s view of this probability provides a useful model-free measure to assess both the current level of ZLB risk across different future horizons and the changes in risk perceptions over the past year.”

Yes, the career economists at the San Fran Fed which a year ahead of the biggest housing crisis (under Janet Yellen) failed to spot even a trace of the upcoming 2007/2008 housing bubble bursting – and we now know why – have finally discovered Eurodollar futures.

Bravo.

But it’s what they discover once they start digging into the details of the ED future that leaves them shocked: according to the market, there is now a 24% probability that the Fed Funds rate will hit the dreaded zero bound by 2021, to wit:

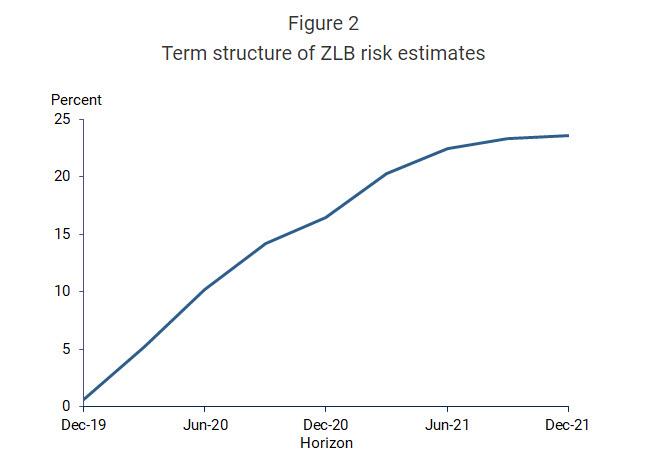

Figure 2 shows our current estimates of ZLB risk. Since Eurodollar options are available for a range of different expiration dates, we can calculate our risk measure for various future horizons. The resulting probabilities across horizons are what we call the term structure of ZLB risk, which Figure 2 plots for quarterly horizons from December 2019 to December 2021. The downside risk is small for the December 2019 horizon; this is not surprising, since LIBOR is currently around 2% and a drop to below 0.75% over the next few months is highly unlikely. The risk then increases significantly, reaching 16% by the end of 2020 and rising further to 24% by the end of 2021.

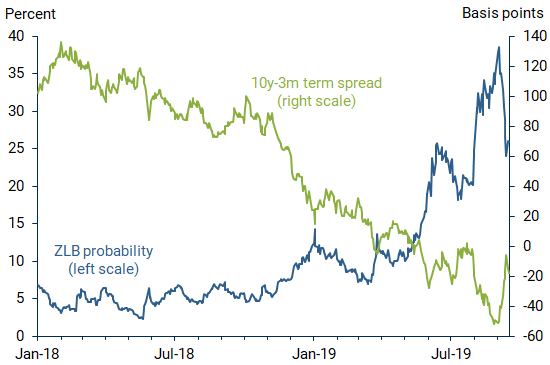

Another way to show the above is in the chart below, which plots daily estimates of ZLB probabilities for a constant three-year future horizon, from January 2, 2018, to September 17, 2019 (blue line). It also shows the 3M10Y spread, a widely accepted indicator of imminent recession.

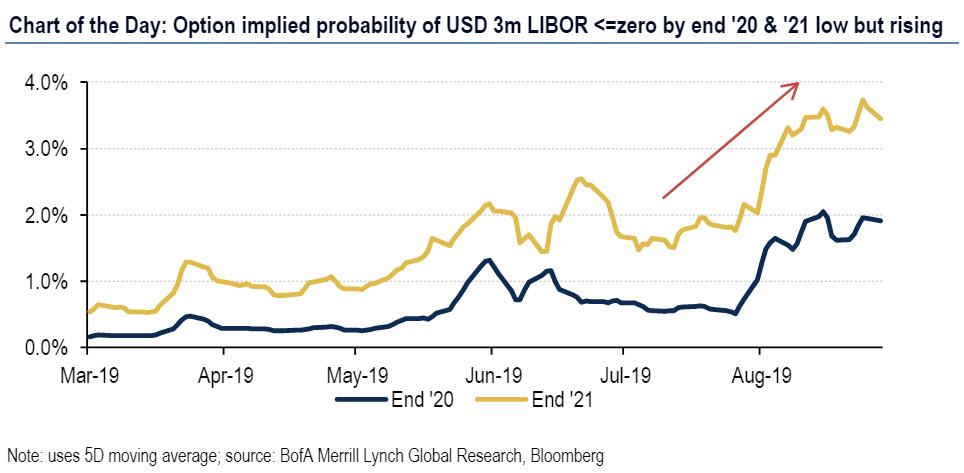

Of course, if the San Fran Fed had been reading Zerohedge, it would know that not only is the 0% odds rising by the day, but that – as we reported on Sept 4 – the probability of dreaded negative rates by 2021 is now a solid 4% and rising.

The San Fran Fed will eventually get there: we can’t expect too much from its employees – after all they are economists. So going back to the paper, which appears to have discovered interest rate derivatives as a source of “useful information about the economic outlook” (no really, they say that), here is the conclusion:

Current estimates suggest about a one-in-four chance of short-term rates dropping back to the ZLB within three years. While this implies the more likely outcome by a solid margin is that short-term rates will not return to the ZLB, the market’s view of this risk has increased substantially over the past year. Recent increases in our estimated ZLB probabilities have coincided with negative macroeconomic data and escalating international trade tensions. They also are in line with another prominent warning signal about the economic outlook: the yield curve has flattened and ultimately inverted.

What is the take home message from this amazing “discovery”? That the surging ZLB probability (according to market if not Fed estimates) and the inverted Treasury yield curve “suggest some growing concerns about the sustainability of the expansion, the possibility of a future recession, and a resulting easing of monetary policy that could push short-term rates back to their lower bound.“

While it is difficult to disentangle the exact drivers of the changes in ZLB risk, data indicating weakening economic conditions and increasing macroeconomic uncertainty appear to have played a major role. For example, the first peak in ZLB probability on January 3, 2019, coincided with a lower-than-expected Institute for Supply Management manufacturing data. The second significant spike occurred in March when the term spread turned negative for the first time since the Great Recession. And the most recent spikes this summer coincided with further deteriorating macroeconomic data, increased trade tensions, and rising global uncertainties.

In short, the market is saying the odds that the Fed is wrong are soaring by the day, and not only that, it is warning that whereas the Fed’s dot plot sees a rate of 2.15% by 2021, the probability of 0%, as calculated by the market, is now 24% and rising.

With that in mind, and in light of the San Fran Fed’s recent “discovery” that negative rates are actually, gasp, bad, the authors’ unspoken conclusion is simple: the Fed is shocked that the market is increasingly saying that it is not only trapped, but about to lose control. With that said, we eagerly look forward to what “research” papers the brain trust of San Fran Fed economists will be writing in 1 year when the Fed has not only launched NIRP but also QE.

Tyler Durden

Mon, 09/23/2019 – 18:45

via ZeroHedge News https://ift.tt/2l91koM Tyler Durden