Why The US “Decoupling” Miracle Ends In 72 Hours

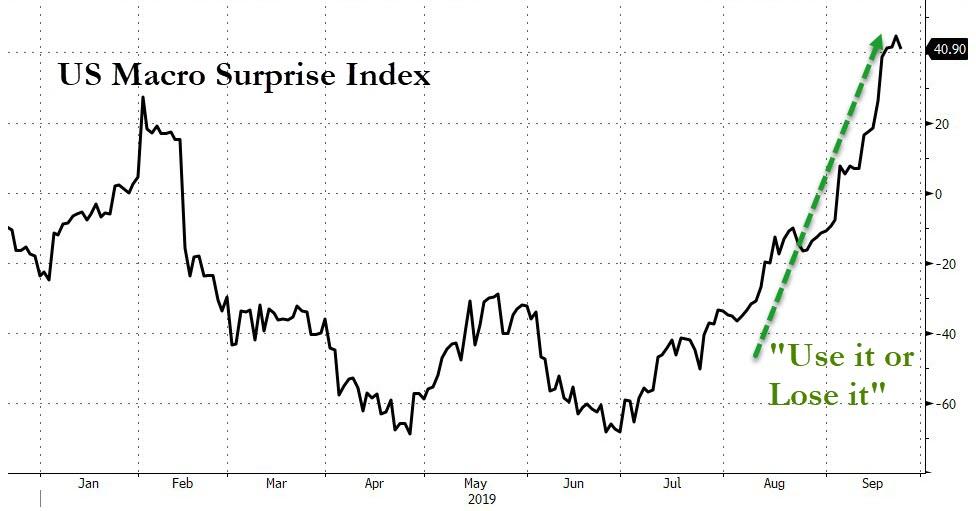

The last few weeks have seen a dramatic surge in US macro data surprises (to the upside), dramatically diverging from the rest of the world (and almost single-handedly improving the global data)…

Source: Bloomberg

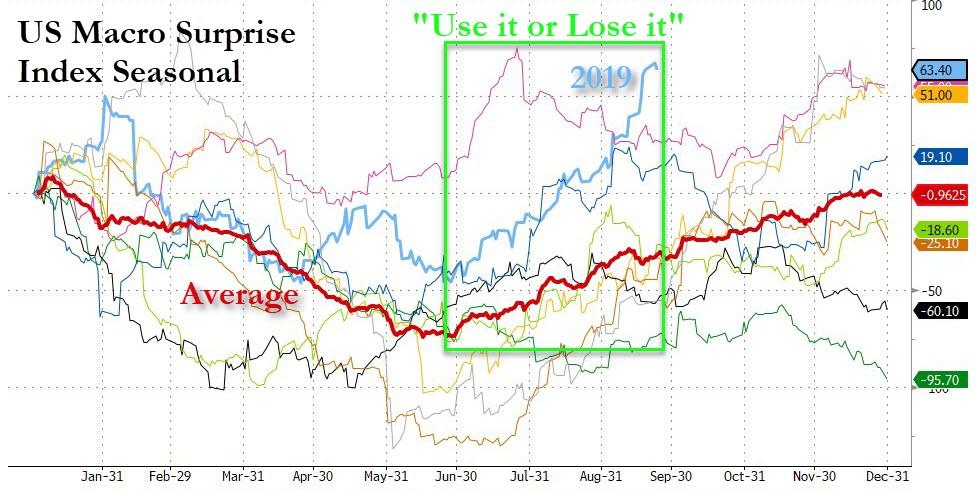

This sudden surge, however, is not a total surprise as we have noted the seasonal patterns in US economic data previously.

So why does this pattern exist – and why is it particularly strong in recent weeks?

Simple – as OpenTheBooks.com details – it is a reflection of the Federal Government’s “Use-It-Or-Lose-It” Spending Spree…

In the final month of the fiscal year, federal agencies scramble to spend what’s left in their annual budget. Agencies worry spending less than their budget allows might prompt Congress to appropriate less money in the next fiscal year. To avoid this, federal agencies choose to embark on an annual shopping spree rather than admit they can operate on less.

This is the “use-it-or-lose-it” spending phenomenon, and it happens every year.

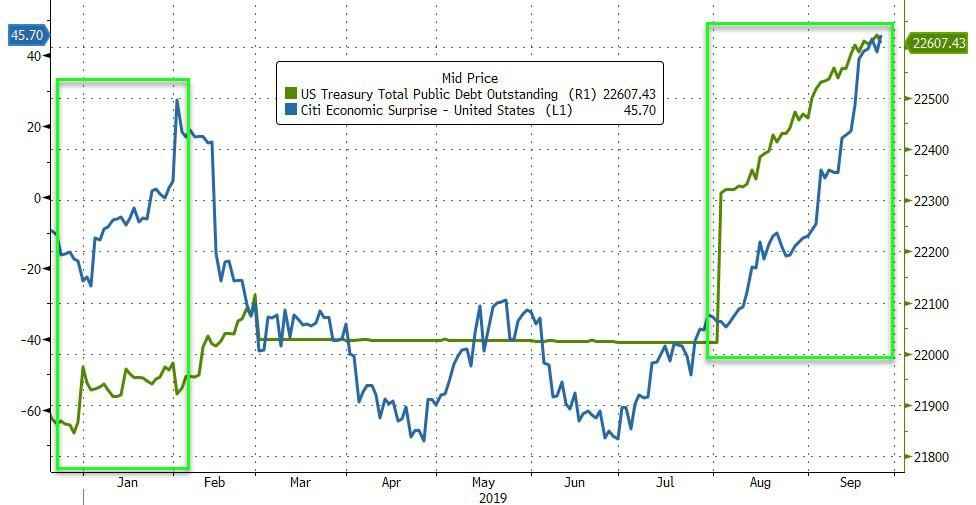

And that surge in spending coincides with this sudden ‘surprise’ burst to the upside.

Source: Bloomberg

For some context from last year:

-

In the final week of the fiscal year, federal agencies signed nearly 10 percent of all fiscal year 2018 contracts.

-

Between 2015 and 2018, federal spending during the final month of the fiscal year increased by 39 percent. From 2017 to 2018, September spending increased by 16 percent.

-

Contract spending in September 2018 totaled nearly $97 billion. In the final seven days of fiscal year 2018, federal agencies spent $53.3 billion – more than they spent in the entire month of August 2018 ($47 billion).

-

The federal government spent $544 billion on all fiscal year 2018 contracts, but nearly 18 percent of these contracts were purchased in the final month of the fiscal year.

And, we suspect, given the rapid surge in borrowing recently, that 2019 will be even more dramatic on the spending side (and thus the unprecedented spike in economic surprises)

Source: Bloomberg

All of which begs the question: is the only reason why the economy tends to pick up momentum dramatically as the summer ends just a function of a surge in government spending permeating the broader economy as agencies scramble to spend all the money they have before the end of the September 30 Fiscal Year End (just so they get allocated the same or greater budget in the coming fiscal year), which subsequently plunges or is outright halted as the case may be right now?

If so, it would explain so much, and certainly why year after year, the US economy seems to pick up in the mid-to-late Q3 period, only to dramatically fade away in the coming months, as government spending goes from a waterfall to a trickle.

It would also put the government’s role in generating transitory periodic spikes in economic output under a microscope, especially since it is so clearly staggered to recur every September as one after another government agency spends like a drunken sailor. And if that is the case, how long until the BLS or some other agency (upon reopening of course) is taken to task to normalize not only for hedonic indicators and climate-related seasonal factors, but also for what is now clearly an annual aberration of economic output trends?

Source: Bloomberg

Either way, within 72 hours, this artificial stimulus will be over, and we would not be surprised at all to see US data converge back to the weakness indicated elsewhere. Presumably that’s what the uber-doves are hoping for.

Tyler Durden

Sat, 09/28/2019 – 19:00

via ZeroHedge News https://ift.tt/2mItuHZ Tyler Durden