Japanese Bond Crash, Margin Call Sends Shockwaves Around The Globe

For a dramatic preview of what will happen in a flash to all those record low interest rates without the backstop of central banks and ravenous pension fund, look no further than what happened in Japan overnight, where bond futures suffered the biggest one-day crash since August 2, 2016, sliding as much as 0.97 yen to 154.05, and triggering margin calls for investors after the worst 10-year debt auction in three years.

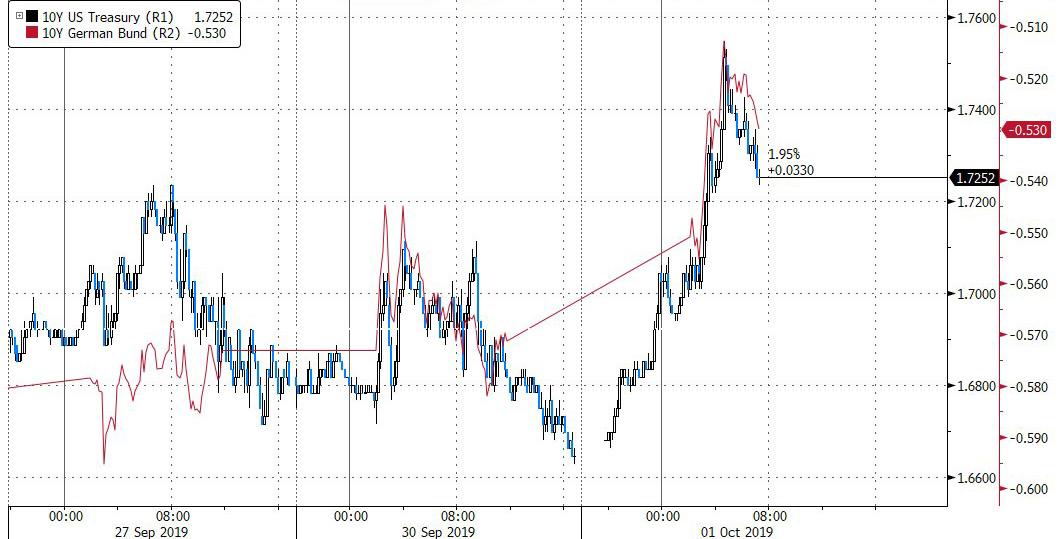

More ominously, once the rout started it quickly spread outside of Japan, because as yields jumped, the sell-off spilled into US Treasuries and European debt.

There were three things behind the swift collapse: the first catalyst was the Bank of Japan’s Monday decision to slash bond purchases in October for the four major maturity buckets in order to steepen the curve and avoid further flattening which Kuroda has repeatedly expressed concern about in the past; the BOJ had indicated it may even stop buying debt of more than 25 years. It also sought to anchor yields from the one-to-three year zone by raising purchases in a regular operation earlier in the day and lifting the purchase band for the sector in October.

“The BOJ is showing its clear intention to correct distortions in the curve through flexible adjustments in market operations,” said Mari Iwashita, chief market economist at Daiwa. “While cutting the lower end of purchases in bonds maturing over 25 years to zero looks shocking, the BOJ will probably cut buying in this zone slowly.”

“The BOJ’s operation change had a huge psychological impact,” said Eiji Dohke, chief bond strategist at SBI Securities in Tokyo. “Investors are reluctant to buy given the risk of the BOJ skipping a purchase.”

Then, there was the announcement by Japan’s Government Pension Investment Fund (GPIF) that it was pivoting toward buying more FX-hedged foreign debt. Specifically, the world’s largest pension fund said it will consider currency-hedged overseas bond holdings as similar to domestic debt investments. That would allow GPIF to buy more foreign debt, as it’s already close to the 19% limit in its current mandate; and while good news for US Treasurys this was bad news for local JGBs.

Takahiro Sekido, a strategist at MUFG Bank, estimated GPIF may allocate more than 30% of its existing JGB holdings to currency hedged-foreign bonds: “There could be many funds following GPIF’s allocation change,” said Sekido, a former BOJ official.

As it turned out, he was right, and as Bloomberg put it, “all of a sudden, investors were left wondering what other changes were in store.”

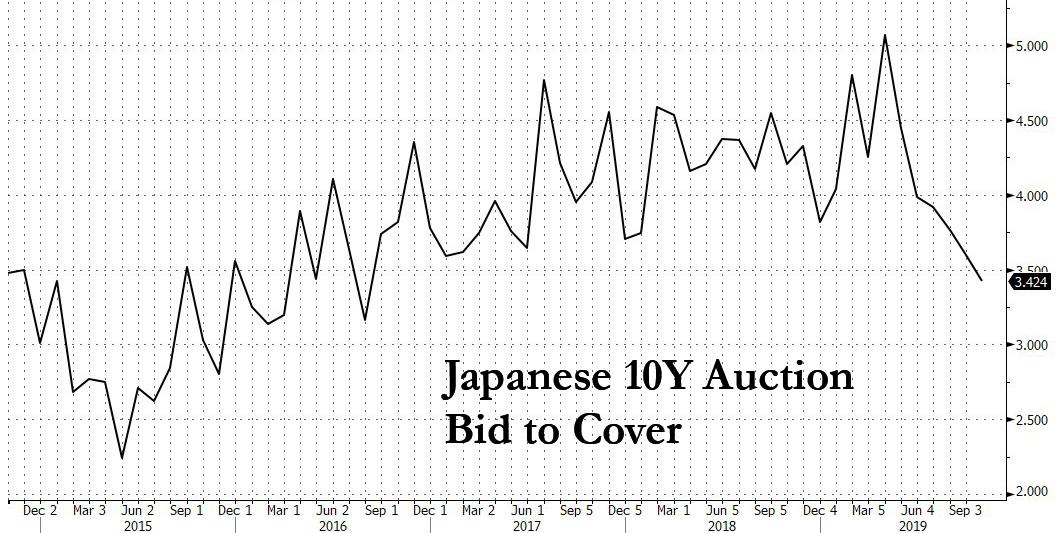

Then the cherry on top came on Tuesday morning, when the latest 10-year JGB auction confirmed the investor panic as the debt drew a bid-to-cover ratio of 3.42, the lowest since 2016, with the cut-off price of 102.33 falling short of the 102.64 estimated by traders, while the 0.29 tail was widest since March 2015. If Japan can ever have a failed bond auction, this was about as close to it as it could get.

The “auction results were much worse than expected amid increased caution after the BOJ cut bond purchases on Monday”, says Eiji Dohke, chief bond strategist at SBI Securities in Tokyo. He noted that the “results reflect caution that the central bank may refrain from buying bonds during one of its regular operations in October” and said that given the weak outcome of Tuesday’s sale, JGB volatility is likely to remain elevated until the BOJ’s policy meeting at month-end and investors will be wary about taking positions.

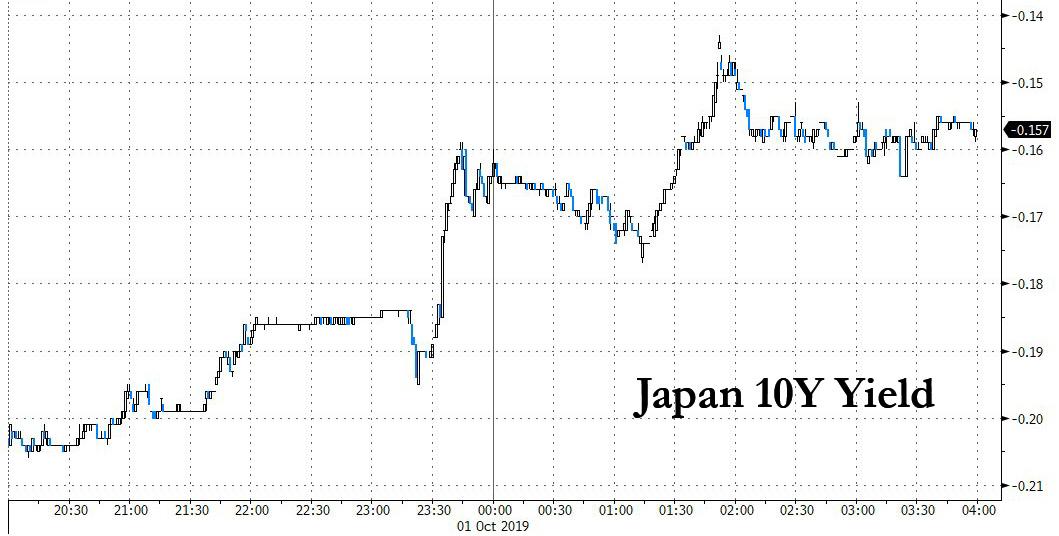

Following this three-peat of doom for bond bulls, yields on Japan’s 10-year cash bond rose 5.5 basis points to minus 0.16%. The heavy selling sparked a margin call at the Japan Securities Clearing Corp, which then drove prices even lower in a second acute selloff about two hours later.

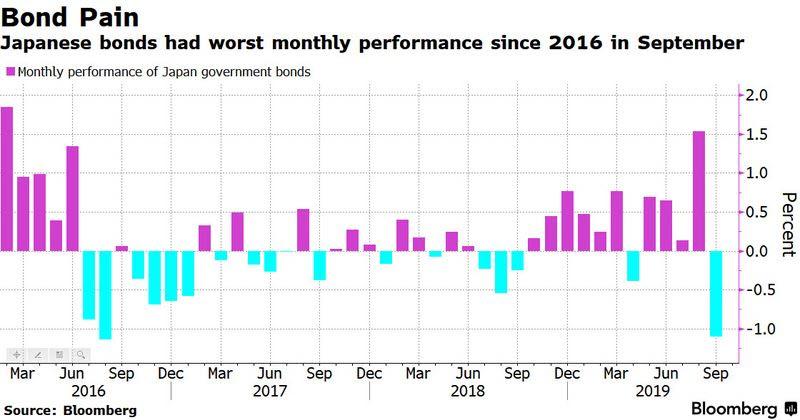

Tuesday’s rout was merely the latest hit for Japanese sovereign bonds, which were already reeling from a dismal September, when they lost 1.1%, their first monthly drop since April.

And as JGBs dumped, so did Bunds and US Treasurys in a coordinated global move that saw yields in the US and German both spike as a result of tremors started in little, old Japan, confirming that once the central banks lose control, the collapse will be quick and painful (this is for all you MMT watchers out there).

Summarizing this ominous day for Japan’s bond market – and economy – MUFG Bank’s Takahiro Sekido put it best: “Japanese bonds have reached the point where it’s almost impossible to buy.”

For the sake of Japan, the global bond market, and the entire global financial system, he better be wrong.

Tyler Durden

Tue, 10/01/2019 – 07:33

via ZeroHedge News https://ift.tt/2mAmQnj Tyler Durden