The Risk To The Bullish View Of A Trade Deal

Authored by Lance Roberts via RealInvestmentAdvice.com,

In this past weekend’s newsletter, I discussed the bullish view of a trade deal with China.

“Assuming we are correct, and Trump does indeed ‘cave’ into China in mid-October to get a ‘small deal’ done, what does this mean for the market.

The most obvious impact, assuming all ‘tariffs’ are removed, would be a psychological ‘pop’ to the markets which, given that markets are already hovering near all-time highs, would suggest a rally into the end of the year.”

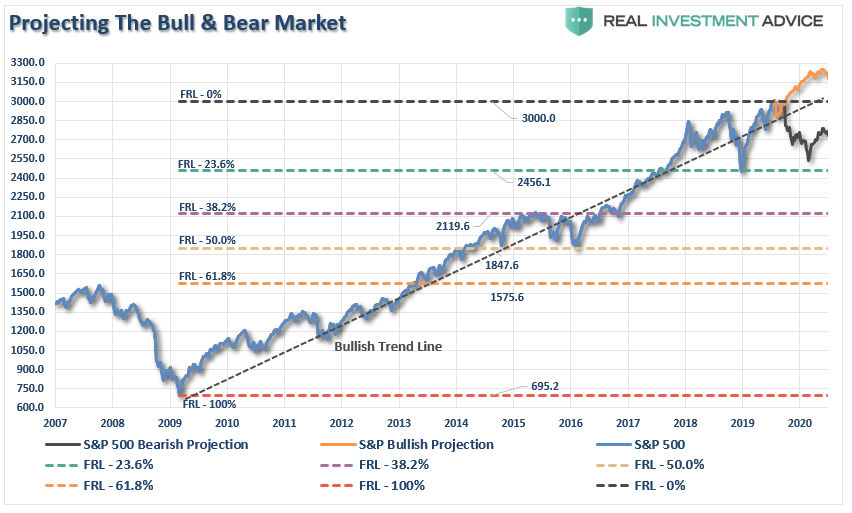

This is not the first time we presented our analysis for a “bull run” to 3300. To wit:

“The Bull Case For 3300

Momentum

Stock Buybacks

Fed Rate Cuts

Stoppage of QT

Trade Deal”

While I did follow those statements up with why a “bear market” is inevitable, I didn’t discuss the issue of what happens is Trump decides to play hardball and the “trade negotiations” fall apart.

Given Trump’s volatile temperament, this is not an unlikely “probability.” Also, there is more than just a little pressure from his base of voters to press for a bigger deal.

As I noted, China cannot agree to the biggest issues which have stalled negotiations so far:

-

Cutting the share of the state in the overall economy from 38% to 20%,

-

Implementing an enforcement check mechanism; and,

-

Technology transfer protections

For China, these items are an infringement on its sovereignty, and requires a complete abandonment the “Made in China 2025” industrial policy program. This is something that President Xi is extremely unlikely to do, particularly for a U.S. President who is in office for a maximum of 4-more years.

Of course, if talks break down, there are two potential outcomes investors need to consider for the portfolio:

-

Everything remains status quo for now and more talks are scheduled for a future date, or;

-

Talks breakdown and both countries substantially increase tariffs on their counterparts.

Given that current tariffs are weighing on Trump’s supporters in the Midwest, and both Silicon Valley and retail’s corporate giants have pressured Trump not to increase tariffs further, the most probable outcome is the first.

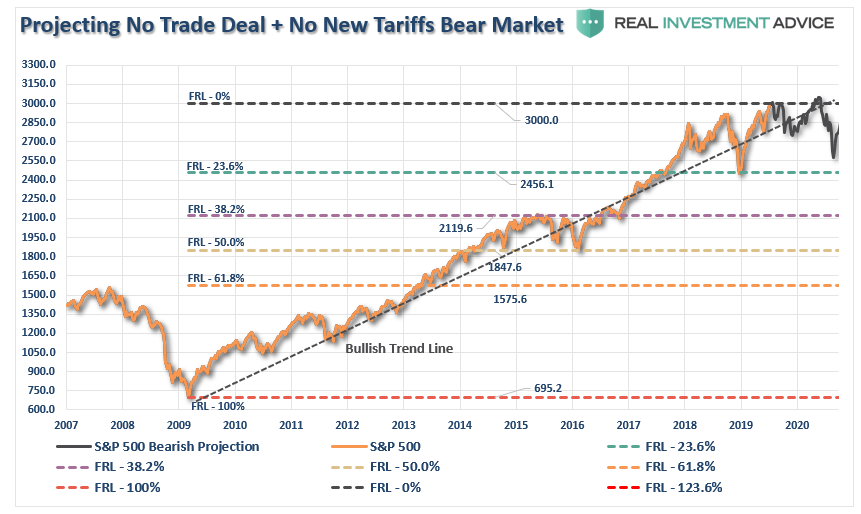

No Trade Deal, No New Tariffs

Unfortunately, that outcome does little for the market in the short-term as existing tariffs continue to weigh on corporate profitability, as well as consumption. Given that earnings are already on the decline, the benefits of tax cut legislation have been absorbed, and economic growth is weakening, there is little to boost asset prices higher.

Therefore, under this scenario, current tariffs will continue to weigh on corporate profitability, but “hopes” for future talks will likely continue to keep markets intact for a while longer. However, as we head into 2020, a potential retracement will likely occur as markets reprice for slower earnings and economic growth.

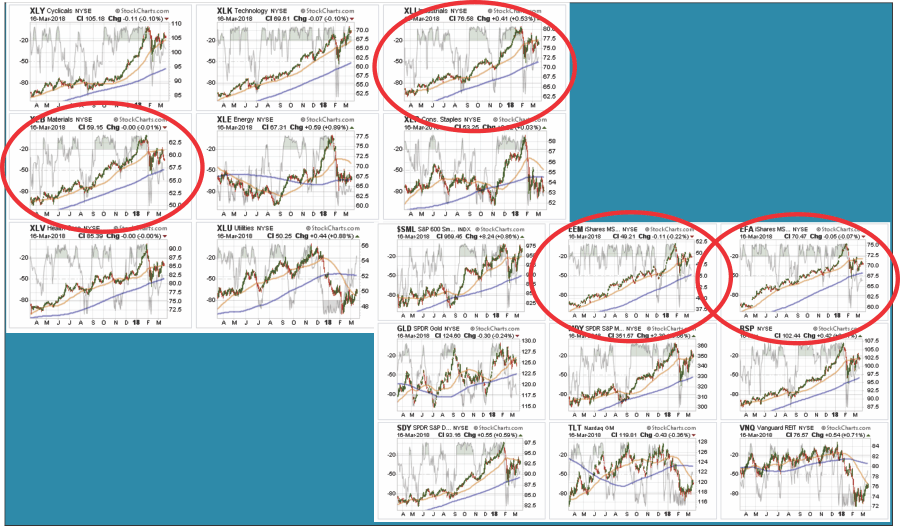

In this environment, we would continue to expect some underperformance by those sectors most directly related to the current tariffs which would be Basic Materials, Industrials, and Emerging Markets.

Since the beginning of the “trade war,” these sectors have lagged overall market performance and have been under-weighted in portfolios. We alerted our RIA PRO subscribers to this change in March, 2018:

“We closed out our Materials trade on potential “tariff” risk. Industrials are now added to the list of those on the “watch, wait and see” list with the break below its 50-dma. Tariff risk continues to rise and Larry Kudlow as National Economic Advisor is not likely to help the situation as his ‘strong dollar’ views will NOT be beneficial to these three sectors. Also, we reduced weights in international exposure due to the likely impact to economic growth from ‘tariffs’ on those markets which have continued to weaken again this week.”

That advice turned out well as those sectors have continued to languish in terms of relative performance since then.

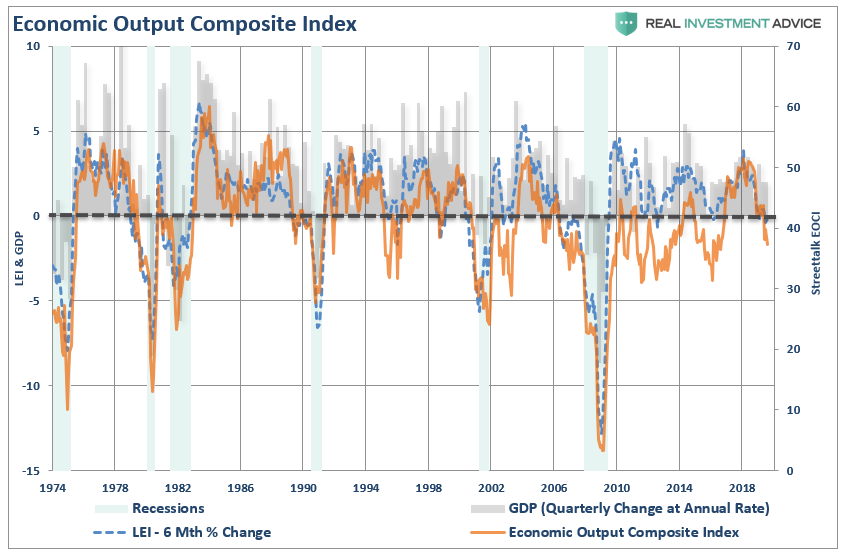

Furthermore, a “no trade deal, no tariff change” outcome does little to change to the current deterioration of economic data. As we showed just recently, our Economic Output Composite Index has registered levels that historically denote a contractionary economy.

All of these surveys (both soft and hard data) are blended into one composite index which, when compared to GDP and LEI, has provided strong indications of turning points in economic activity. (See construction here)”

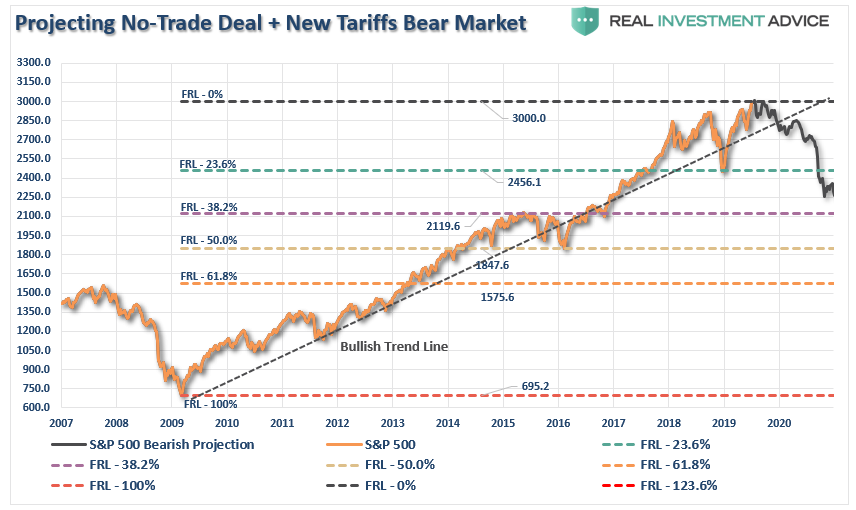

No Trade Deal Plus New Tariffs

The second outcome is more problematic.

In this scenario, Trump allows emotion to get the better of him, and he blows up at the meeting. In a swift retaliation, he reinstates the “tariffs” on discretionary goods, and increases tariffs across the board as a punitive measure. The Chinese, in an immediate retaliation levy additional tariffs as well.

With both sides now fully entrenched in the trade war, the market will lose faith in the ability to get a “deal” done. The increased tariffs will immediately be factored into earnings forecast, and the market will begin to reprice for a more negative outcome.

In this scenario, Basic Materials, Industrials, Emerging, and International Markets will continue to be the most impacted and should be avoided. Because of the new tariffs which will directly impact discretionary purchases, Technology and Discretionary sectors should also likely be under-weighted.

The increase in tariffs is also going to erode both consumer and economic confidence which have remained surprisingly strong so far. However, once the consumer is more directly affected by tariffs, that confidence, along with related consumption, will fade.

What About Bond Yields And Gold

In both scenarios above, a “No Trade Deal” outcome will be beneficial for defensive positioning in portfolios. Gold and bond yields have already performed well this year, but if trade talks fall through, there will be a rotation back to the “safe haven” trade as equity prices potentially weaken. This is specifically the case in the event our second outcome comes to fruition.

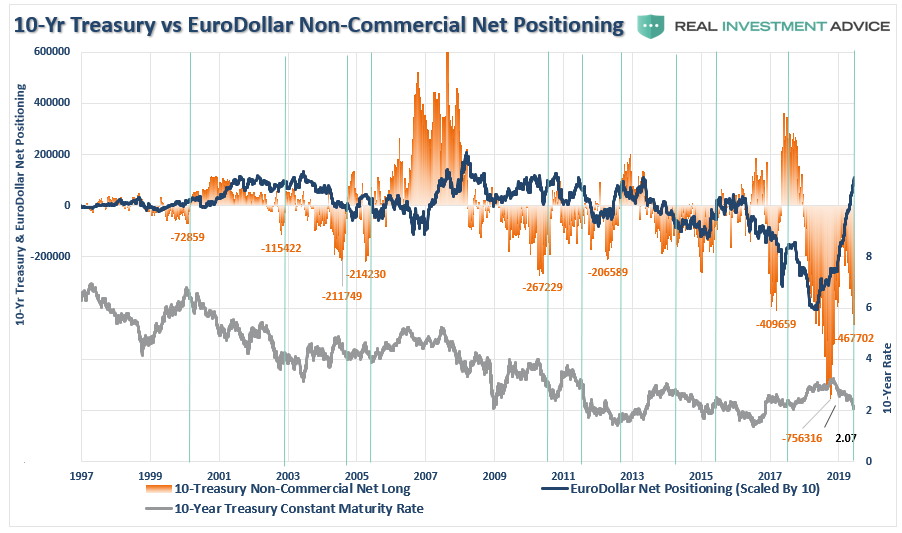

While bond yields are overbought currently, it is quite likely we could see yields fall below 1%. Also, given the large outstanding short-position in bonds, as discussed recently, there is plenty of “fuel” to push rates lower.

“Combined with the recent spike in Eurodollar positioning, as noted above, it suggests that there is a high probability that rates will fall further in the months ahead; most likely in concert with the onset of a recession.”

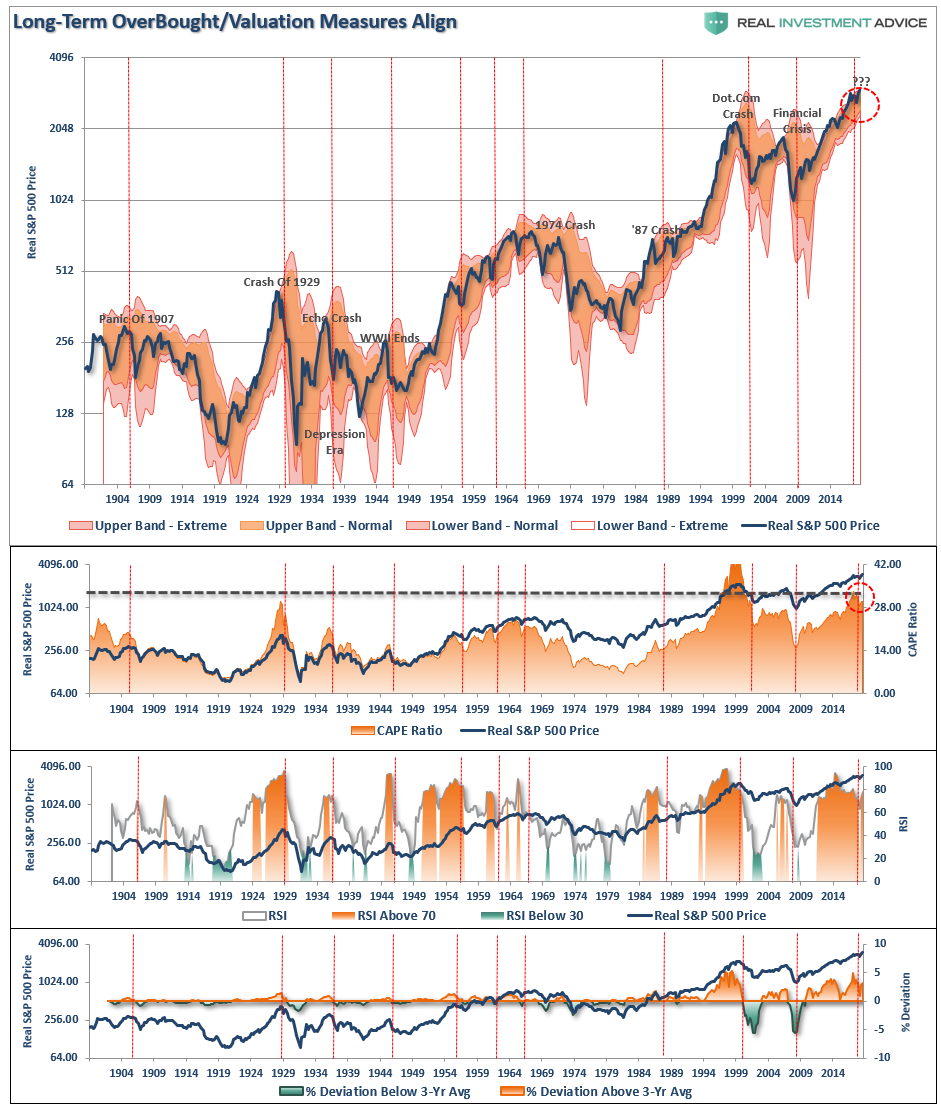

As I noted, there is no outcome that ultimately avoids the next bear market. The only question is whether moves by the Administration on trade, combined with the Fed cutting rates, retards or advances the timing.

“Furthermore, given the markets never reverted to any meaningful degree, higher prices combined with weaker earnings growth, has left the markets very overvalued, extended, and overbought from a historical perspective.”

Our long-term quarterly indicator chart has aligned to levels that have previously denoted more important market tops. (Chart is quarterly data showing 2-standard deviations from long-term moving averages, valuations, RSI indications above 80, and deviations above the 3-year moving average)

While we laid out the “bullish case” of 3300 over the weekend, it would not be wise to dismiss the downside risk given how much exposure to the “trade meeting” is currently built into market prices.

We are assuming that Trump wants a “deal done” before the upcoming election, which should also help temporarily boost economic growth, but there remains much that could go wrong. An errant “tweet,” a “hot head,” or merely a breakdown in communications, could well send markets careening lower.

Given that downside risk outweighs upside reward at this juncture by almost 3 to 1, in remains our recommendation to rebalance risk, raise some cash, and hedge long-equity exposure in portfolios for now.

This remains a market that continues to under-price risk.

Tyler Durden

Tue, 10/01/2019 – 08:21

via ZeroHedge News https://ift.tt/2ngGhC5 Tyler Durden