“The Collapse Is Here”: Initial U.S. Auto Sales For September Paints An Ugly Picture

After a couple months of stagnation, automobile sales in the United States took a significant step backwards in September, according to Bloomberg.

This sets the stage for increased incentive spending by carmakers, who will be desperate to clear inventory heading into the end of the year.

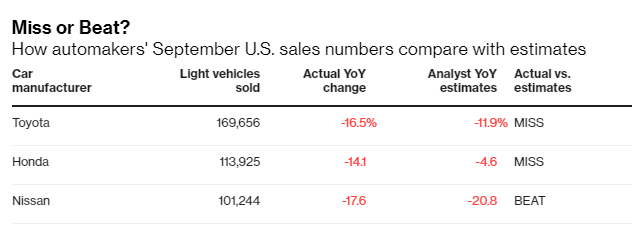

Initial auto sales results from Toyota and Honda can only be described as disasters. Both companies suffered double digit declines in September, with Honda missing its estimated numbers by nearly 10% and Toyota missing its estimates by about 5%.

General Motors also missed estimates, posting an increase in sales of 6.3% versus estimates of 7.1%.

The performance of these automakers suggests that the picture could get even uglier when other companies report US results this week. Overall deliveries of cars and light trucks could come in worse than the 12% drop that is estimated.

These sharp misses continue to paint the picture of a global auto market that is steeped in recession, namely due to a broke consumer after a decade of low interest rates and endless incentives. Any prolonged slowdown would put significant pressure on auto dealers, who are already in a precarious position with outgoing model year vehicles “clogging their lots”.

Meanwhile, automakers already spent more than $4,100 per vehicle in incentives in the third quarter, marking a record.

The seasonally adjusted annualized rate came in at 17.2 million in September, which was up from 17 million in August – a small silver lining in the data so far.

Toyota’s 16% plunge in September was attributed to its namesake and Lexus brands dropping by double digit percentages. Deliveries fell for almost every model, including its best selling RAV4.

Honda immediately snapped back after logging its best US sales month in August. Its Pilot SUV sales fell 40%, while its Accord sedan sales fell 20%.

Nissan saw sales decline by 18%, technically a “beat” versus estimates of a 21% drop.

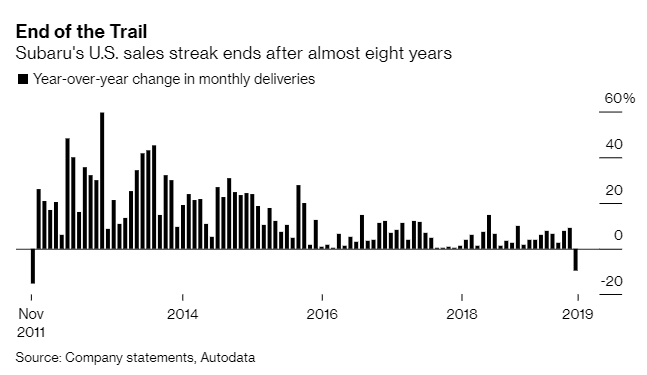

And possibly serving as the biggest canary in the coalmine, Subaru saw its nearly 8 year streak of monthly sales increases end after 93 months. Deliveries dropped 9.4% in September.

Hyundai also saw its vehicle sales drop 8.8%, despite it still expecting to have gained market share for the quarter.

General Motors ended September with inventory of 759,633 units.

We will update these U.S. numbers as they become available during the week.

And as a reminder, the auto recession isn’t just in the U.S. Chinese auto sales fell 14 times in the last 15 months under the weight of a trade war and a far overextended consumer and Mexico saw its total vehicle exports collapse 12.7% in August, a sharp drop for one of the biggest exporters of vehicles in the world.

If Mexico’s export data is any indication as what we have to look forward to in the rest of September’s sales numbers, look out below…

Tyler Durden

Wed, 10/02/2019 – 20:35

via ZeroHedge News https://ift.tt/2oFyeyG Tyler Durden