Strong 10Y Treasury Sold At Lowest Yield Since August 2016

While yesterday’s 3Y auction was strong if not spectacular, today’s 10Y auction was a bit more impressive.

Printing at a high yield of 1.590%, the auction stopped through the When Issued 1.591% by 0.1bps. It was the lowest stop out for a 10Y auction – technically a 9-year 10-month reopening – since August 2016, and only the 3rd highest stop out for a 10Y auction on record with the 1.459% July 2012 yield the lowest recorded print. It was also the first 10Y auction since May that did not tail.

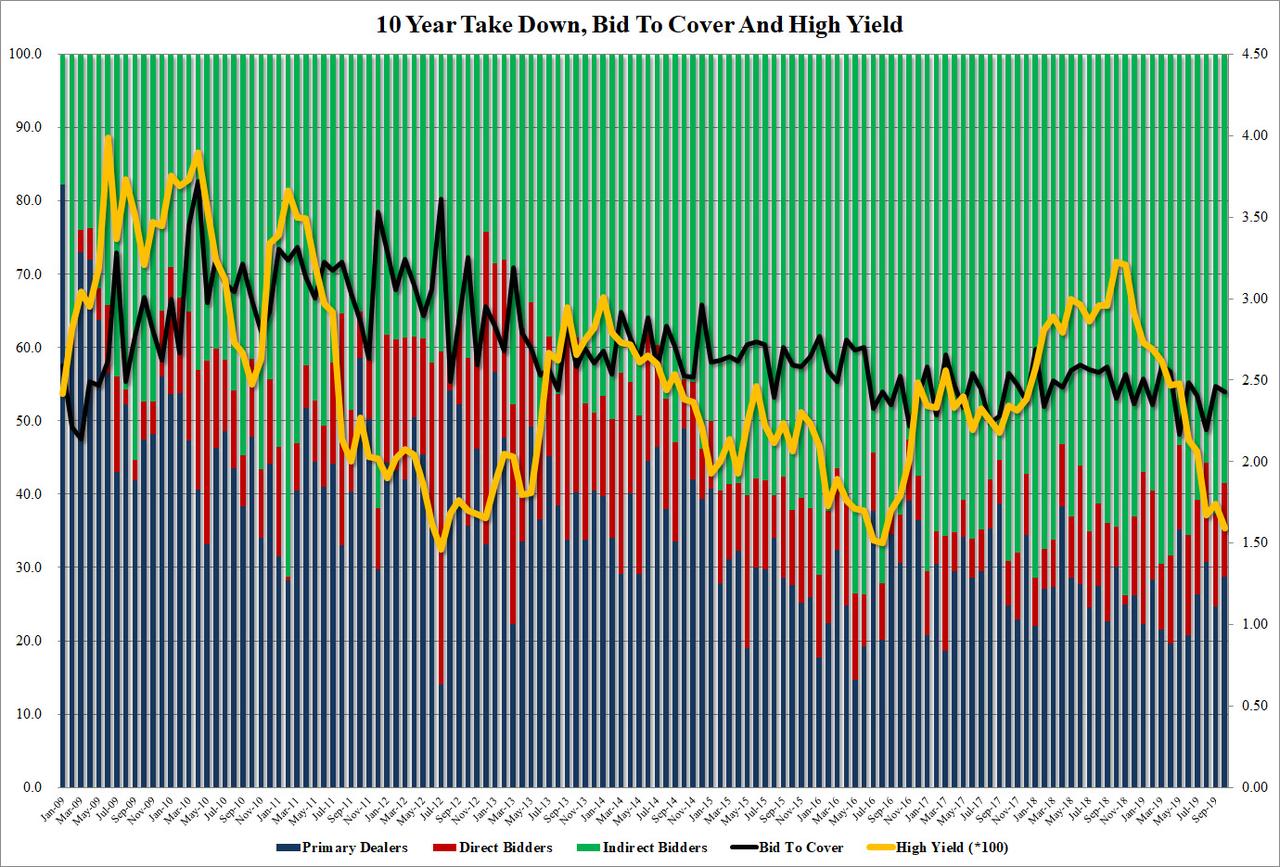

Just like in yesterday’s 3Y auction, the Bid to Cover was almost unchanged at 2.43, down from 2.46 in September, but above the 2.38 six auction average.

The internals were ever so slighly on the weak side, with the Indirects taking down 58.5%, down from 62.6% last month and below the 61.1 recent average, and with Directs taking 12.8%, largely in line with recent auctions, it left Dealers holding 28.7% of the auction, slightly above last month’s 24.7% and the 26.2% recent average.

Overall, a strong auction largely the result of the selloff in the 10Y ahead of 1pm, which dragged the yield on the benchmark paper from 1.53% to a high of 1.59% just before the auction.

And now we look to tomorrow’s 30Y auction which closes this week’s coupon calendar.

Tyler Durden

Wed, 10/09/2019 – 13:15

via ZeroHedge News https://ift.tt/2nAB8EY Tyler Durden