Late-Day China Trade Headline Spoils Low-Volume Stock Market Party

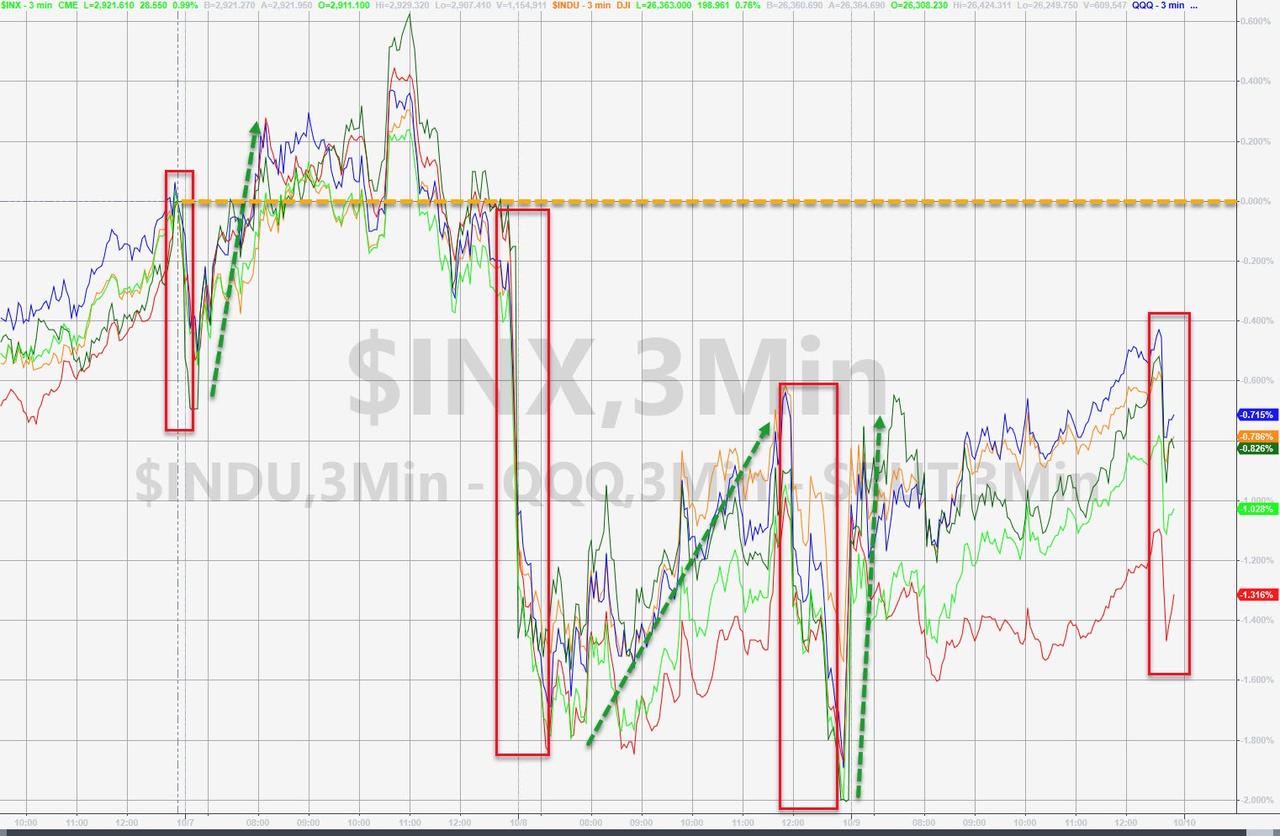

Today’s liftathon in stocks bought to you by the word “partial” (as in “China is amenable to a partial trade deal” which is entirely not news at all) and the number 2829 (the S&P 500 100-day moving average) because that means “all is well”…

Trade deal odds had lifted…

Source: Bloomberg

And the S&P 500 levitated back to its 100DMA…

But a late-day headline that Beijing has lower expectations of progress – due to the goodwill damage from US blacklisting 28 tech firms:

1544ET GOODWILL DAMAGED BY THE U.S. DEPARTMENT OF COMMERCE’S BLACKLISTING OF 28 CHINESE COMPANIES THIS WEEK-CHINESE OFFICIALS

1545ET BEIJING HAS LOWERED EXPECTATIONS FOR PROGRESS FROM U.S. TRADE NEGOTIATIONS THIS WEEK-CHINESE OFFICIALS BRIEFED ON TALKS

Sparked a dump in stocks…

NOTE – the headline timing was extremely odd as it hit right as the S&P hit its 100DMA…

But, despite gains today, US majors remain red on the week…

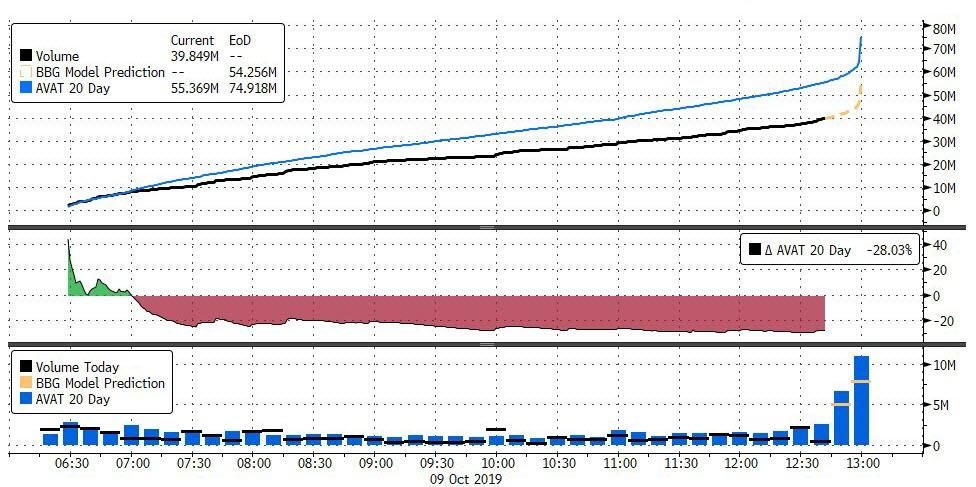

Volume overall was notably weak – around 30% below average…

Source: Bloomberg

While credit markets are not in panic mode yet, leveraged loan markets are starting to crack…

Source: Bloomberg

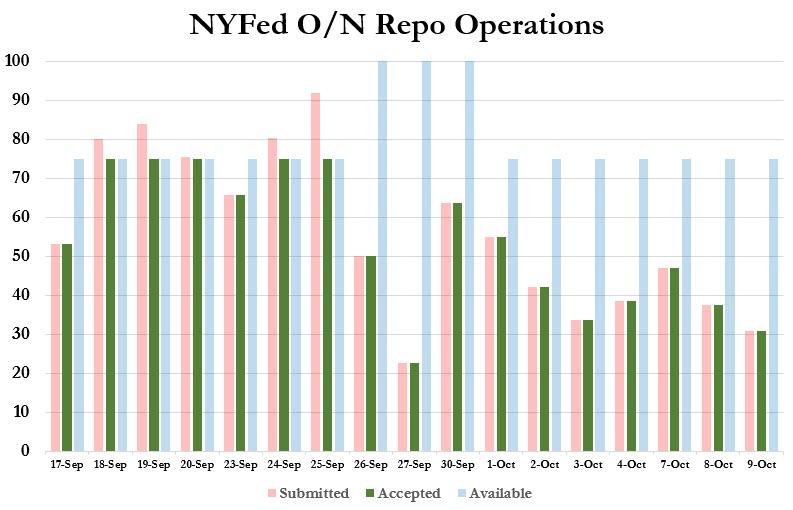

Another day, another $30bn of liquidity rolled with The Fed…

Source: Bloomberg

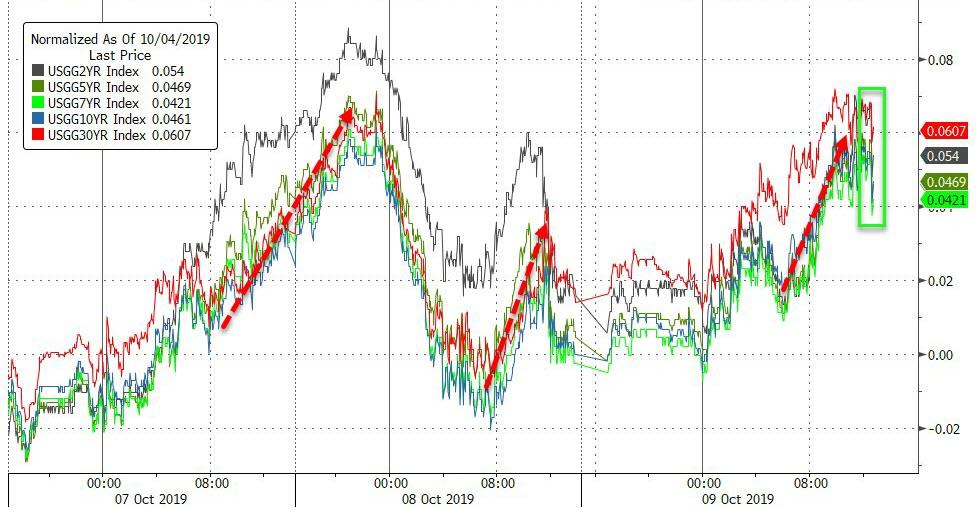

Treasury yields were all higher across the curve (parallel rise of around 5bps) before the late-day headline (note the selling every day that hits around the EU close)

Source: Bloomberg

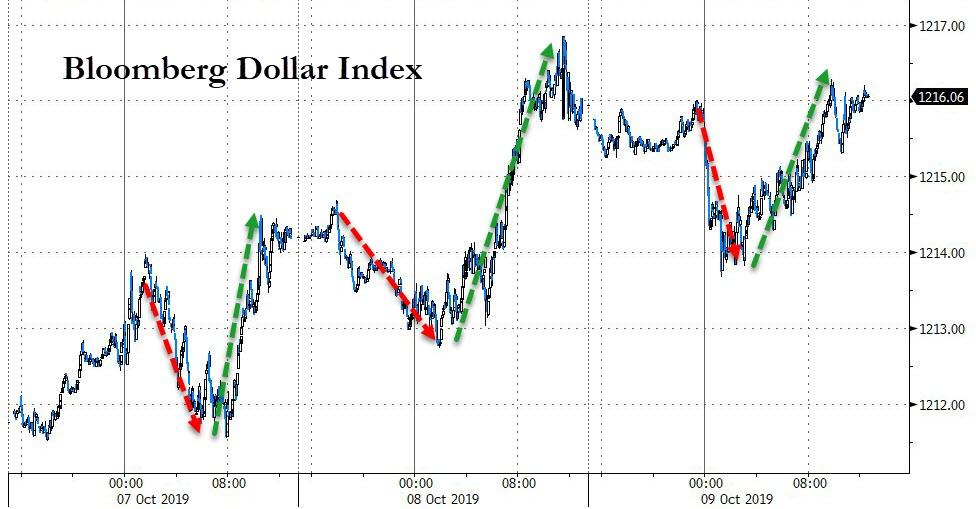

The Dollar managed gains on the day, following the same overnight weakness, European/US strength pattern…

Source: Bloomberg

Cryptos rallied on the day with ETH leading today and XRP up most on the week…

Source: Bloomberg

Commodities were unusually quiet today (apart from oil)…

Source: Bloomberg

Gold spiked to $1518 on the Minutes…

Oil spiked overnight on trade hopes and again on inventories, only to be dumped

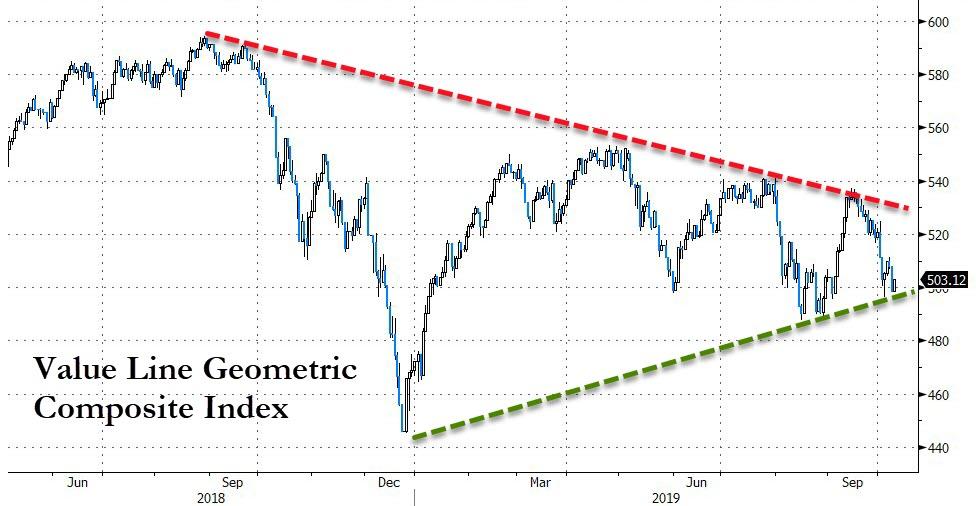

Finally, the median stock is trading at a key trendline level…

And don’t forget, it’s all about fun-durr-mentals…

Source: Bloomberg

Is it time for another quant-quake?

Source: Bloomberg

Tyler Durden

Wed, 10/09/2019 – 16:02

via ZeroHedge News https://ift.tt/35nTtpB Tyler Durden