Stocks Soar, Shorts Squeezed; Bullion, Bitcoin, & Black Gold Bruised

The pointless search for catalysts or market-moving headlines hit a wall today for sure as US equities went panic-bid vertical at the US cash open on the basis of absolutely nothing.

-

China (negatively) snubbed Trump’s trade deal overnight, demanding tariffs removed before Ag buy.

-

China (negatively) saw CPI surge, somewhat reducing option of brad-based stimulus

-

Brexit (positively) was reported as being closer to becoming a deal.

-

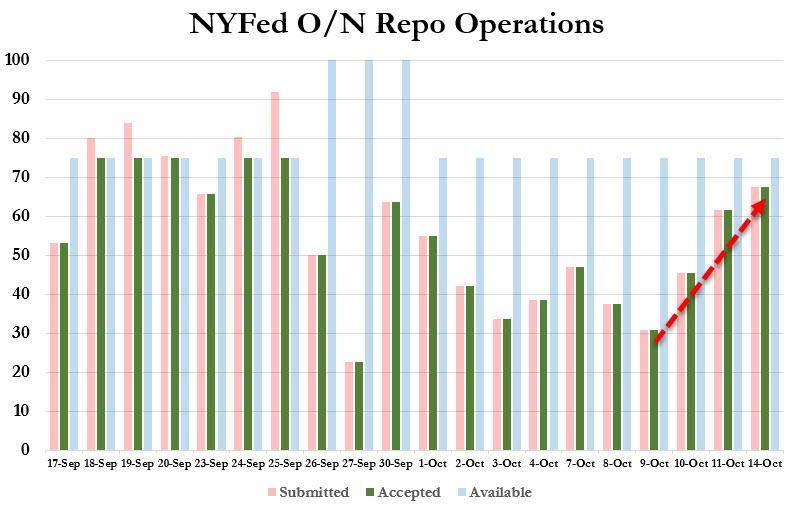

Fed Repo bailout (negatively) surged to its highest since September.

-

Tariffs (positively) did not get implemented today (which is, of course, old news).

-

Earnings (negatively) signaled ugliness persists for GS and WFC.

-

Earnings (positively) beat (with UNH, JPM and JNJ helping support The Dow).

-

IMF (negatively) downgraded global growth to weakest since Lehman.

But the machines went full Monty (Python) today…

Because the US cash equity market open is now ‘bullish’…

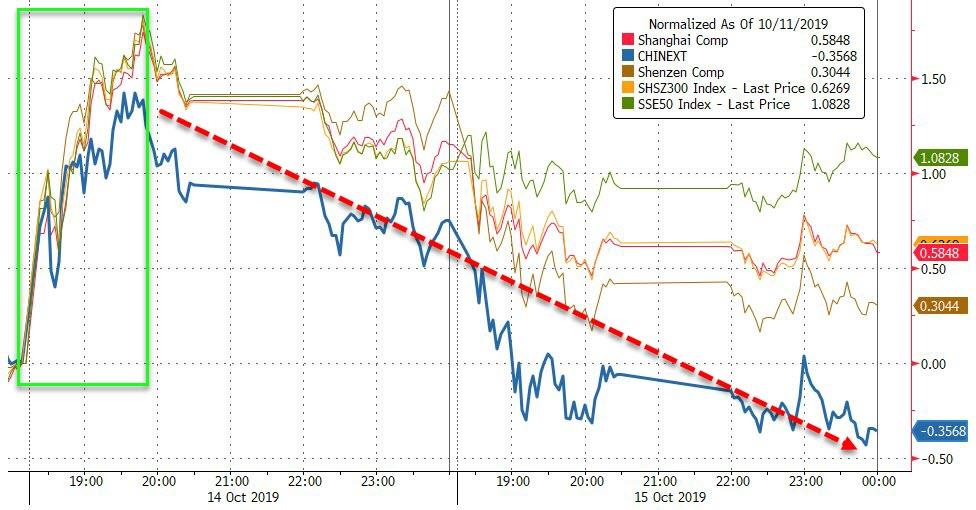

Chinese stocks were broadly lower overnight…

Source: Bloomberg

European stocks benefited from the US spike and positive Brexit headlines…

Source: Bloomberg

US equities manage to push back above the pre-trade-deal levels, but Small Caps were barely able to hold that gain…

S&P 500 algos was utterly bemused by the 3,000 level all day (S&P back above 3,000 for first time since Sept 24)

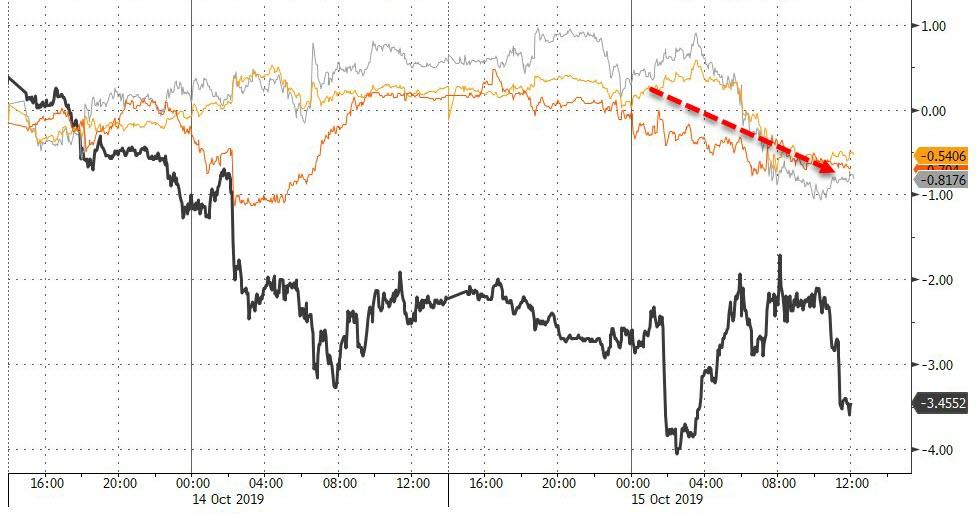

A juicy short-squeeze starting at the US cash open provided just the momentum ignition needed to cross that 3k level…

Source: Bloomberg

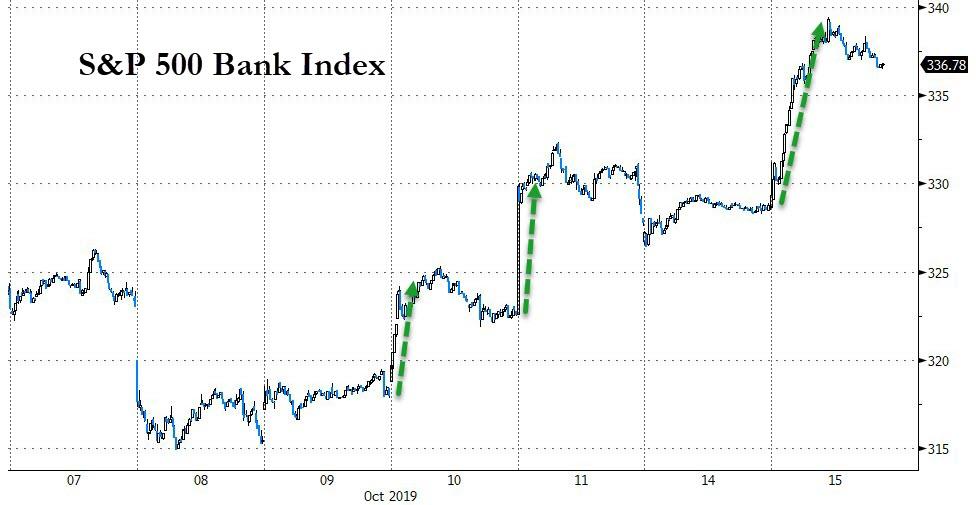

Bank stocks rallied for the 5th straight day…

Source: Bloomberg

And just look at Goldman’s big reversal…

Source: Bloomberg

And Semis surged to a new record high…

Source: Bloomberg

VIX was clubbed like a baby seal, back to a 13 handle – its quad witch lows…

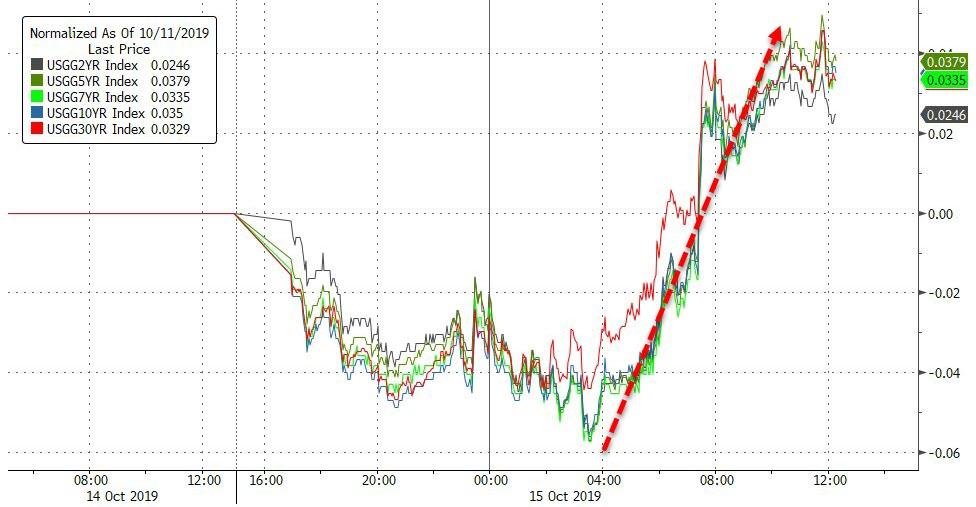

Bonds are back from celebrating Columbus Day and were unceremoniously dumped from overnight highs in price (lows in yield)…

Source: Bloomberg

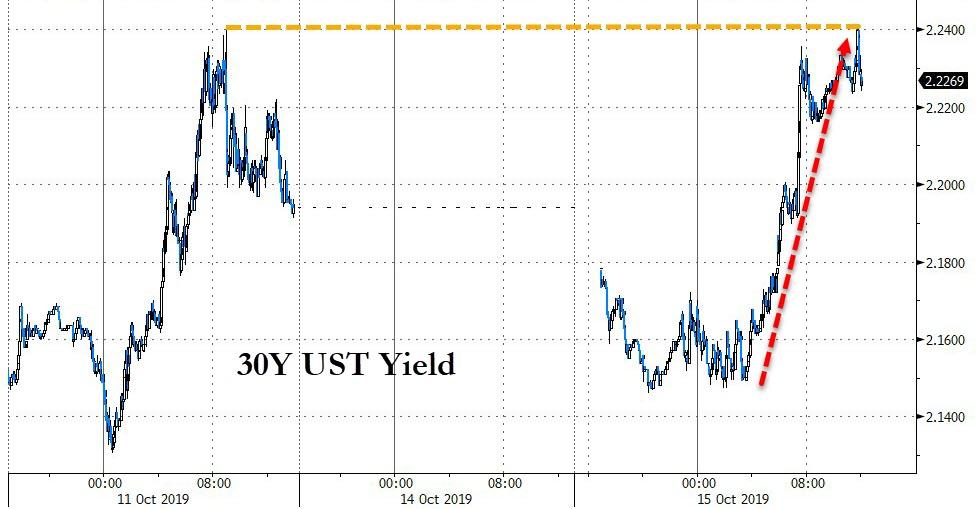

30Y Yields pushed up to Friday’s highs, then fell modestly…

Source: Bloomberg

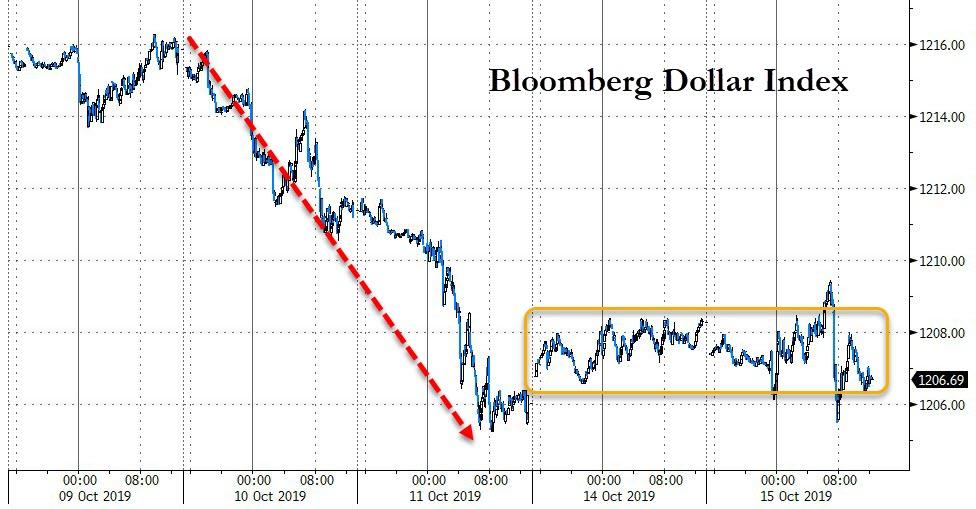

The dollar was more volatile today but ended the day modestly lower…

Source: Bloomberg

Cable squeezed higher once again – to its highest since May 16th…

Source: Bloomberg

This is the biggest 4-day surge in sterling since Dec 2008 (and 2nd biggest since July 1989) – BUT note where today’s surge stalled – at the bottom of the initial plunge in cable after the Brexit vote…

Source: Bloomberg

Cryptos were all lower on the day…

Source: Bloomberg

Commodities were down across the board today…

Source: Bloomberg

WTI was very volatile today (ahead of tonight’s API inventory data)… critically crude did not follow stocks…

Gold futures tagged $1500 for the second day in a row, then tumbled (for the 3rd day in a row)…

Finally, there’s a resurgent demand for Fed liquidity…

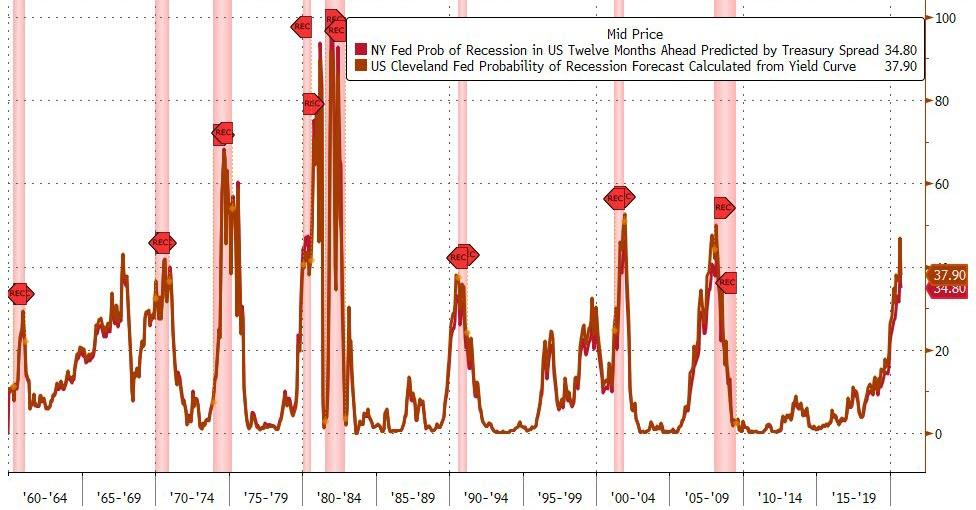

And soaring recession risk…

Source: Bloomberg

“probably nothing”

Tyler Durden

Tue, 10/15/2019 – 16:01

via ZeroHedge News https://ift.tt/33zVFsG Tyler Durden