“Cash Out” Refi Fever: Which Places In America Are Taking On The Most Mortgage Debt?

Submitted by Priceonomics

As the trauma from the Great Recession fades from memory, are Americans increasingly embracing one of the financial maneuvers that caused a great amount of pain a decade ago – cash-out refinancing?

For those of you that are unfamiliar with types of mortgage refinancing, a bit of context might be in order. People typically refinance their existing mortgages for two reasons: to take advantage of falling interest rates, or to “cash-out” a bit of the home equity they’ve built up, typically because their home has increased in value. There’s nothing wrong with accessing this cash, but it means taking out a bigger mortgage and increasing your monthly payments.

During the last recession, these cash-out refinancing caused havoc on people’s budgets when home prices ended up falling and many people lost their jobs. The lower home prices meant that equity had actually been wiped out and the lost jobs meant people couldn’t afford their new, higher mortgages and defaulted. And the cash from the refinancing? It was usually long gone spent on something like a car or home renovation.

A decade later, we’re starting to see signs that people are using mortgage refinancing as a way to generate cash. Along with Priceonomics customer Refiguide.org, in this article we’ll show the data for the typical person refinancing their mortgage, the amount being “cashed out” is approaching Great Recession levels. And while the overall amount of money being cashed out is still substantially less than prior to the last recession, it’s rising very rapidly.

Lastly, in this article, we’ll show that the regions and states where refinancing activity is starting to surge. Cash-out refinancing now makes up 76.6% of refinances in America, with it being the highest in the South and lowest in the Northeast. Moreover, some states like Alaska and Nevada are seeing a surge of refinancing in this most recent quarter. While not necessarily a harbinger of doom, these are likely to be places that could face troubles in a future economics contraction.

***

Each quarter, Freddie Mac publishes data on mortgage refinance and cash-out refinancing. The data goes back to 1990 and most recently in the first quarter of 2019. The time frame gives us a glimpse into the relative sobriety of financing in the 1990s, the massive run-up in the 2000s, followed by the austerity following the Great Recession and then the renewed exuberance of today.

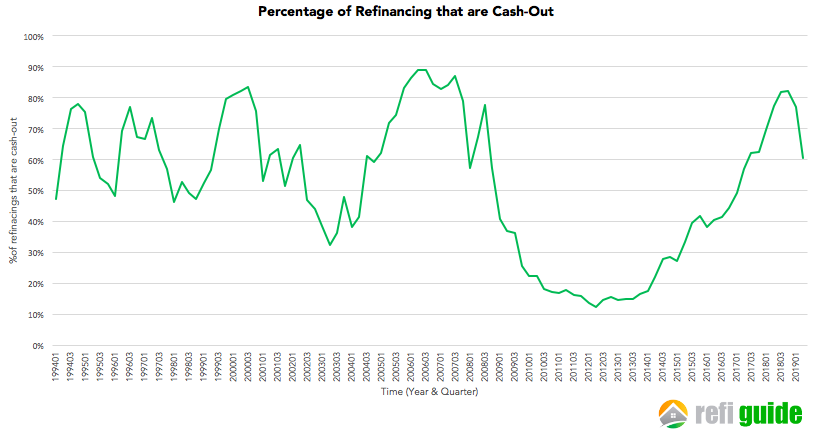

The chart below shows the percentage of refinances that are cash-out, as defined by the new mortgage being 5% or more than the amount that was previously due:

In the run-up to the Great Recession, nearly 90% of refinances were cash-out events. By 2012, that number has fallen to just 12%. From 2012 until today the percentage of refinances that are cash-outs have exploded. At the end of 2018 over 80% of refinances were cash-outs.

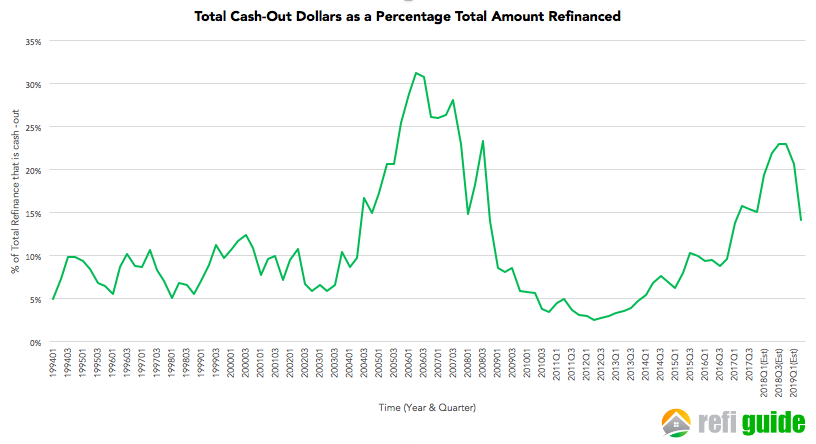

When people do refinance, they’re also taking out a lot more money. Below shows the percentage of people’s new refinanced mortgages that was the cash-out portion.

At the peak of financial frenzy in 2006, the cash-out portion of the refinancing was 31% of the total mortgage. Put differently, people would have had a 31% lower monthly mortgage payment if they hadn’t pulled cash out. Following the recession that amount dropped to near zero. Ominously, by the end of 2018 that number raised to 23%, approaching pre-recession levels.

Cash-out refinances are resembling levels seen in the real estate bubble of the 2000s. When people do get a refinance, they’re taking on a lot more debt. If there is a saving grace, it’s that the amount of refinances is much lower today than it was before the crisis.

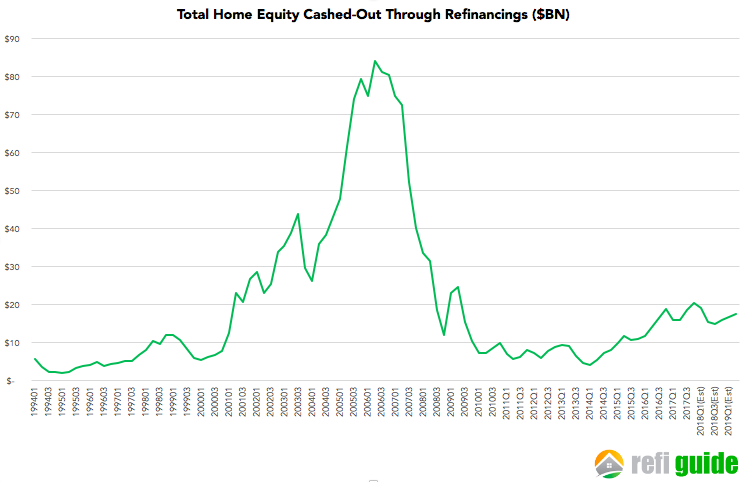

So while the amount of money being cashed out is on the rise, it’s still nowhere near the previous era:

In 2006 people were cashing out over $80BN per quarter before the economy fell off a cliff. The amount cashed out prompted fell to the levels of the 1990s. By 2014 American’s were cashing out just $4BN per quarter. However, since that point, Americans total cash-out has risen 337% to over $17BN per quarter. While not at levels that preceded the economic crisis, Americans are cashing out a lot more money than they were a few years ago.

***

So where are these financings most common and which states are most at risk?

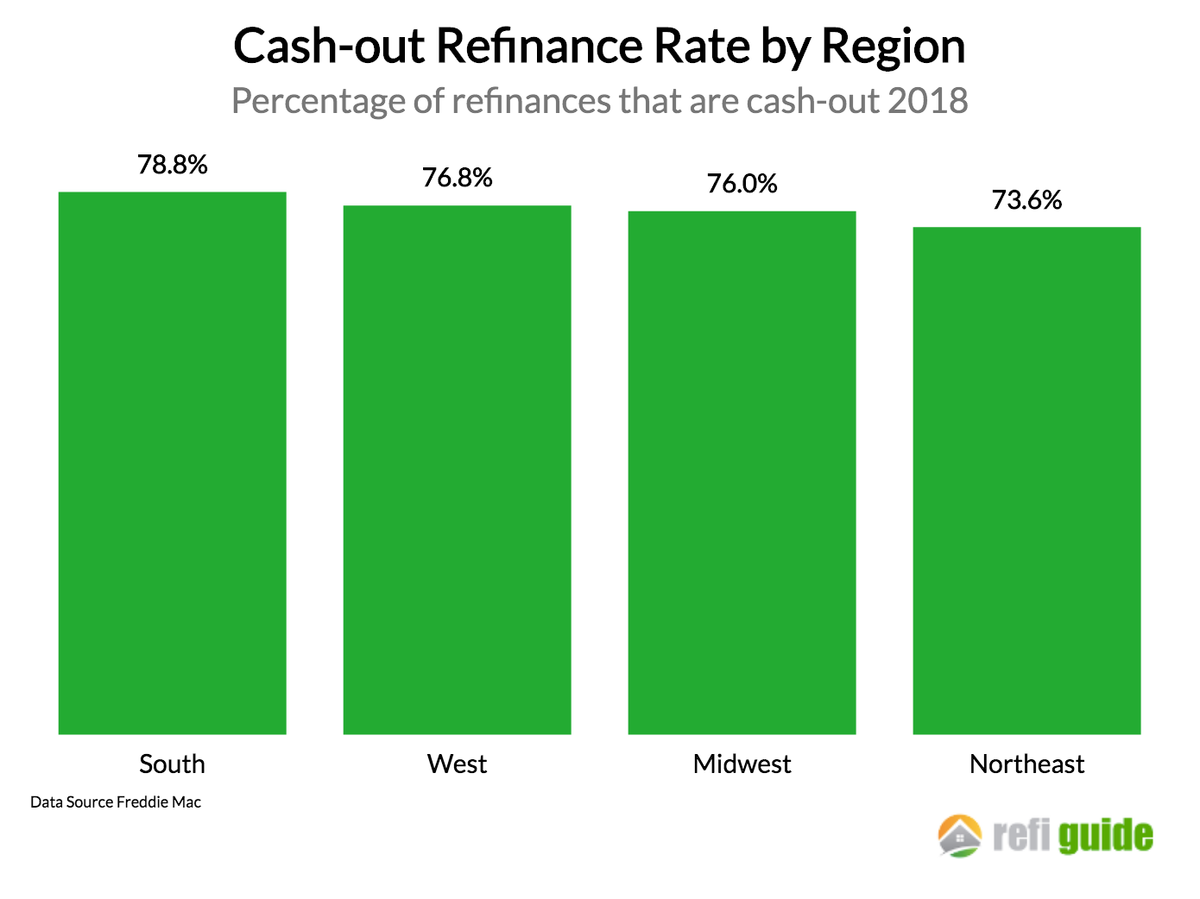

According to Freddie Mac data, 76.6% mortgage refinances are cash-out. That number is high throughout the country, but below percentages of refinanced mortgages by region that are cash-out:

Cash-out refinances are most common in the South, where they comprised 78.9% of all refinanced mortgages. Cash-out refinances are second highest out West were they make up 76.8% of mortgages. Even in the Northeast, where they are lowest, cash-outs are 73.6% of refinanced loans.

As people refinance at exuberance not seen since before the Great Recession, which states are seeing a spike in refinancing and people taking on more debt? While the state breakdown of cash-out refinancing is not available, total refinancing activity is available and most of these are cash-out.

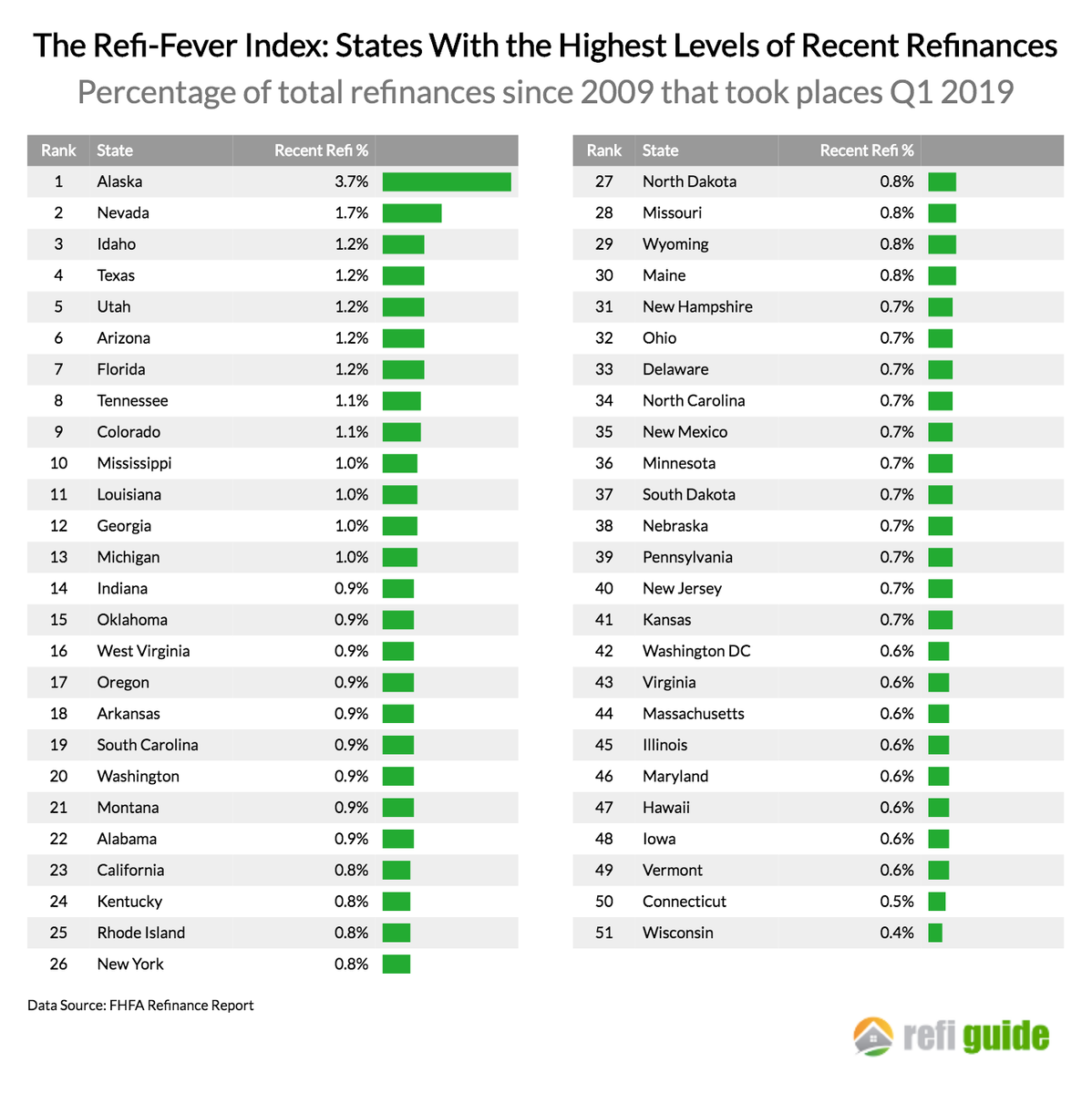

To conclude, we decided to look at which states have had unusually high (and low) levels of refinancing activity this year. To do so, we looked at how many refinances originated in the first quarter of 2019 as a percentage of the total number of refinances in that state since 2009. States that have a high percentage of recent activity are exhibiting exuberance while those with a low percentage are showing more sobriety:

By a considerable margin, the state with the highest level of recent refinancing is Alaska where 3.7% of all refinances over the last decade took place last quarter. All of a sudden, people are refinancing their loans in Alaska and the vast majority of those involve cashing-out. In second place is Nevada, with a 1.7% recent refinance rate. Given that Nevada was ground zero of falling home prices during the last recession, the level of exuberance for new mortgages could be a cause for concern. In third place is Idaho, a state that has had tremendous real estate appreciation in the last decade, indicating that its citizens are tapping into this equity.

When it comes to refinancing, Wisconsin leads the way with the lowest recent refinancing rates, followed by Connecticut and Vermont. Despite the increase in refinances and historically low rates, citizens in these states are showing the most restraint in 2019.

***

In some ways, cash-out refinancing gets a bad rap. Your house is a financial asset and this kind of refinancing allows you to convert some of the equity to cash. That cash can be used wisely or even invested. But that cash can also evaporate if spent on a vacation or a luxury item and then you’re just left with a bigger mortgage to pay every month. That’s generally okay unless you have a financial calamity that makes it hard to pay that hefty bill, which is what happened last decade.

Over the last 5 years we’ve seen cash-out refinances explode in popularity. During this time they’ve gone from extremely rare to extremely common. Almost all refinanced mortgages today have a cash-out component, a milestone last hit in 2006. Let’s hope this time it ends differently.

Tyler Durden

Tue, 10/15/2019 – 22:15

via ZeroHedge News https://ift.tt/2nU1FNK Tyler Durden