One Bank’s Stunning Chart Showing The Second Tech Bubble In All Its Glory

If there is one thing the WeWork fiasco has taught us, it is that cracks in many legacy narratives – most notably that of “growth at any cost” over “profits and margins” – are starting to finally appear and affect investment decisions: just ask SoftBank’s Masayoshi Son who in the span of just a few months has transformed from one of Wall Street’s most admired investors to a pariah who not only does not understand simple fundamentals and instead like a clueless teenage girl chases after tall dudes with silky, long hair even if that means billions in losses, but will throw his investors under the bus just to chase a vanity investment to its bitter chapter-11 end.

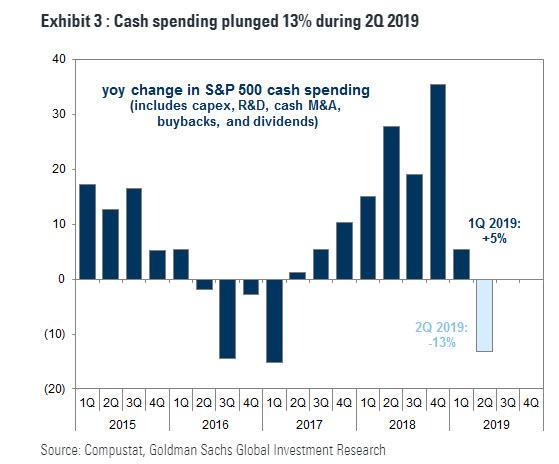

But if one digs deeper, WeWork’s house of shared office space came crashing down only after it became clear that the primary source of its heretofore unlimited growth, virtually unlimited cash spending by both companies and investors, was coming to an end, something which Goldman showed finally took place this year, as the total change in cash spending – including spending on CapEx as well as buybacks and dividends – in Q2 plunged 13% Y/Y. It’s is hardly a coincidence that that’s when WeWork’s troubles first emerged, and when its bankers scrambled to take the company public.

This is a very critical point because as Morgan Stanley’s Michael Wilson points out, at some point, the slowing business spend was likely to impact even the fast growing companies with the best secular growth stories – such as WeWork – especially if they are more dependent on corporate rather than consumer spend.

It then stands to reason that companies with structural tailwinds from strong products and high value add would best withstand any slowdown in the business spending environment, and over the last year, the valuation premium embedded in many of these structural growth companies has come to reflect that.

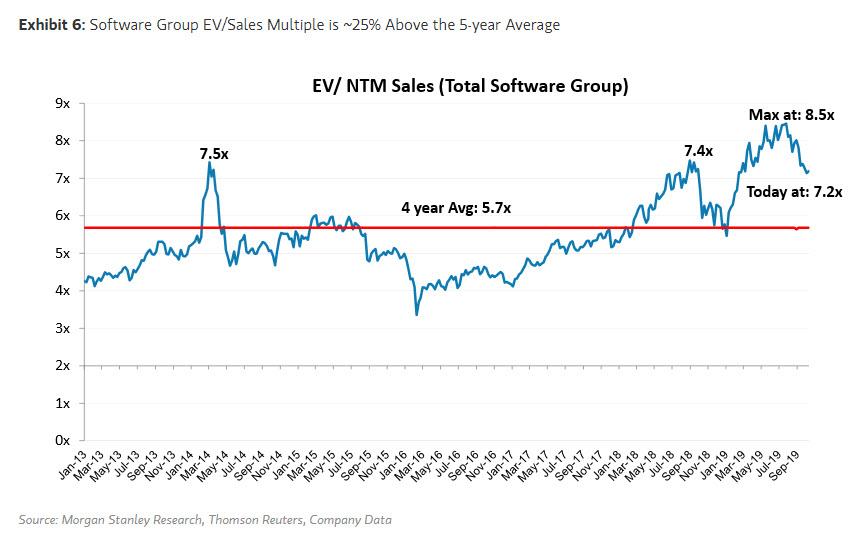

As Morgan Stanley points out, nowhere is this more evident than in Software.

It’s hardly a surprise that Morgan Stanley, which has been bearish on the market in general, and on tech in particular for the better part of the past year, has picked software as the proxy of all that is breaking with the market: despite being high quality businesses with recurring cash flows, high margins and secular tailwinds, Software companies are not immune to a slowing in corporate spend and recent data points have begun to indicate some weakness.

To wit, two weeks ago, Morgan Stanley saw the fourth consecutive decline in spending intentions in its CIO Survey, and this decline was noticeable for its size – CIOs initial read on 2020 IT spending looks for a 100 bps growth deceleration with 53% of CIOs expecting lower IT budget growth in 2020. Software and Hardware budgets were expected to see the steepest deceleration in 2020. Last week, commentary from Workday which epitomizes the strong performance from secular growers showed that some orders are being “pushed out” in time, though they maintained that the delays were not having an impact on their business. The comments did have an effect in the market though as a stock that was already down 20% from its June highs fell by almost 15% over the next few days. At roughly the same time, small cap software firm Forescout recently lost over ⅓ of its market cap after noting that “extended approval cycles” had pushed back several deals, most of which were ex-US.

While some software firms like Atlassian maintained they have not seen “any material change in customer buying patterns,” “the market has begun the process of repricing macro economic risks for secular growers and we think there is further to go,” according to Michael Wilson. For the Software group specifically, Morgan Stanley sees “unfavorable risk/rewards for a lot of the high fliers in software.” Finally, and as noted above, the recent collapse in many high flying IPOs and inability of WeWork to go public – and in fact only a multi-billion bailout package prevented it from filing for bankruptcy – signifies a new found and long overdue market discipline on profitability and valuation that has yet to run its course, in Wilson’s opinion.

As a result, “previously underappreciated economic exposure is finally becoming more apparent in the Software group,” something Wilson was expecting and why Morgan Stanley has remained steadfast underweight the Tech sector: “Much of our underweight call on tech from July 2018 has been predicated on our view that capital spending was likely to disappoint from 2H18 forward given our call for an earnings recession in 2019. Objectively, that is precisely what has happened on both counts.”

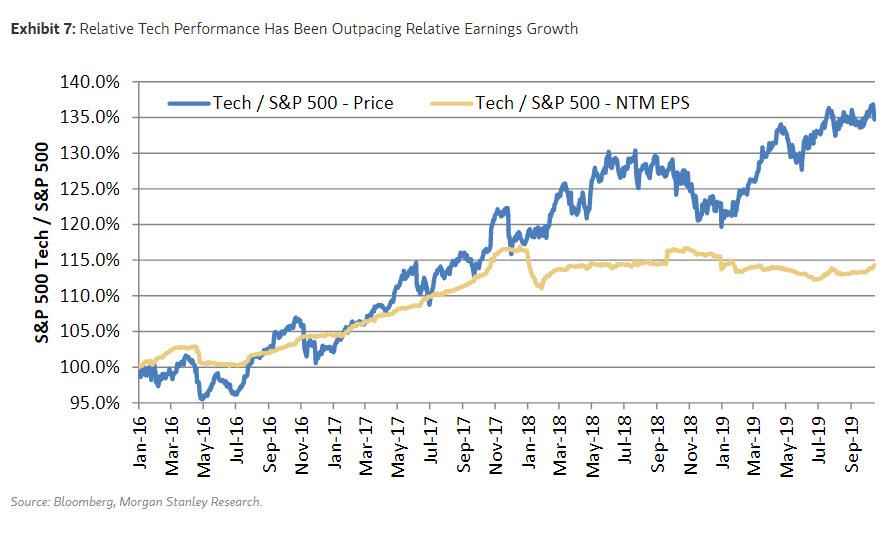

And yet, despite this sharp decline in capital spending, which has translated into flat earnings for the past two years, since July 2018 the tech sector has broadly outperformed the S&P 500 driven by multiple expansion as the forward earnings outlook of the sector relative to the market has barely budged.

Thankfully, Morgan Stanley has shown this unprecedented divergence in the following chart which makes it all too clear that the second tech bubble started some time in the summer of 2017 and some time this summer, just as it was set to burst, it had never been bigger. And so, without further ado, here is Morgan Stanley’s chart showing the second tech bubble in all its multiple expanding glory.

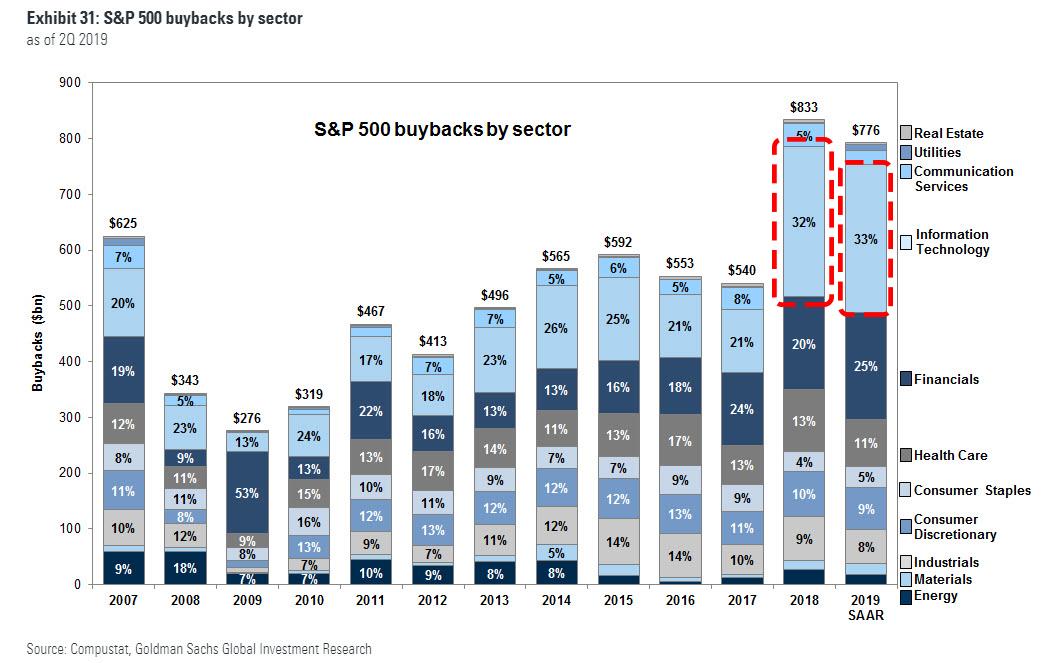

Incidentally, for those wondering just what made this historic divergence possible, look no further than the companies themselves: in the past two years, thanks to Trump’s tax repatriation holiday, tech companies unleashed a historic stock buyback spree that makes everything else pale by comparison. It is this furious stock repurchasing by tech companies that allowed their stock prices to diverge so massively from their underlying fundamentals.

How does it all end? While it is taking the market a long time to realize what was obvious to Wilson for over a year, slowly but surely, the unpleasant truth is started to emerged. And as the Morgan Stanley strategist concludes, “with a slowing economy and mounting evidence that even Software companies are not immune to this slowing, and continued demand weakness in the more capital intensive parts of Tech, we remain underweight.”

Said otherwise: the second tech bubble is now over.

Tyler Durden

Tue, 10/22/2019 – 15:17

via ZeroHedge News https://ift.tt/2pIoCUu Tyler Durden