Fisher Investment Withdrawals Soar Past $2 Billion As New Hampshire And Fidelity Flee

The bleeding at Fisher Investments is showing zero signs of stopping and has now surpassed $2 billion, according to CNBC and Bloomberg, as clients yank cash from the firm faster than we can keep updating this story.

The New Hampshire Retirement system was the latest to abandon the billionaire investing with a 5-0 vote on Tuesday to pull its $239 million. The New Hampshire Retirement system said in a statement:

“The recent statements made by Ken Fisher, the founder and chairman of Fisher Investments, are not only offensive and inappropriate, they are incompatible with the values of the retirement system and bring into question Mr. Fisher’s judgment.”

NEPC, a Boston-based investment consultant for the New Hampshire plan said: “In 2018, NEPC created an internal group called the Unfavorable News Committee to respond to non-investment negative news events connected to our investment managers. Mr. Fisher’s comments clearly fit that mandate.”

Fidelity also pulled $500 million it had invested with Ken Fisher early this week and joined a chorus of investors who have spoken out against Ken Fisher’s lewd comments several weeks ago at an industry conference.

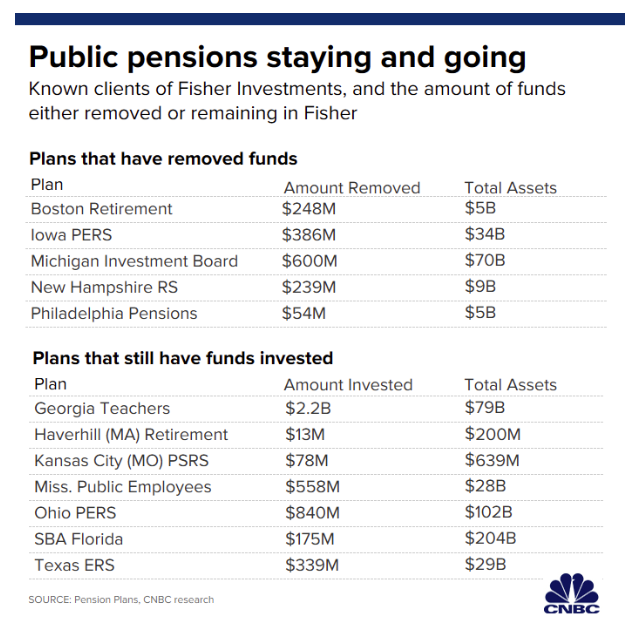

Fidelity and New Hampshire join Iowa, Boston and Philadelphia, who have all yanked pension money from the firm over the last several weeks.

Just days ago, we reported that Iowa had pulled out $386 million from the firm. This was days after we reported that the city of Boston had also pulled out of Fisher Investments to the tune of $248 million.

Shawna Lode, spokeswoman for the IPERS, had said:

“IPERS staff has taken time to evaluate this situation, and it is our opinion that Mr. Fisher’s comments have damaged the credibility of the firm and its leadership. As a result, the risk to IPERS is that the firm could lose investment talent, and/or it may be unable to recruit high caliber talent in the future.”

“Furthermore, the negative publicity will probably continue to be a major distraction to Fisher Investment personnel,” she continued.

Several weeks prior, Lode had commented that the IPERS was reviewing their relationship with Fisher Investments: “Fisher’s remarks are obviously concerning,” she said at the time. “Although our investment management contracts do not include a conduct policy, we hold our partners to the highest standards and reserve the right to amend or sever any contract at our discretion.”

Recall, just days after the $70 billion state of Michigan retirement fund pulled its assets from Fisher Investments, the city of Boston also did the same.

Fisher managed $600 million in retirement funds for Michigan and the state’s exit ends a 15 year relationship with Fisher’s firm. Boston Mayor Martin Walsh said:

“Boston will not invest in companies led by people who treat women like commodities. Reports of Ken Fisher’s comments and poor judgment are incredibly disturbing.”

Michigan’s chief investment officer, Jon Braeutigam, notified the state investment board of the termination on October 10. In his letter, he said that Fisher’s comments were “unacceptable” and that although employees at his fund hadn’t witnessed similar comments, “history does not outweigh the inappropriateness of the comments.”

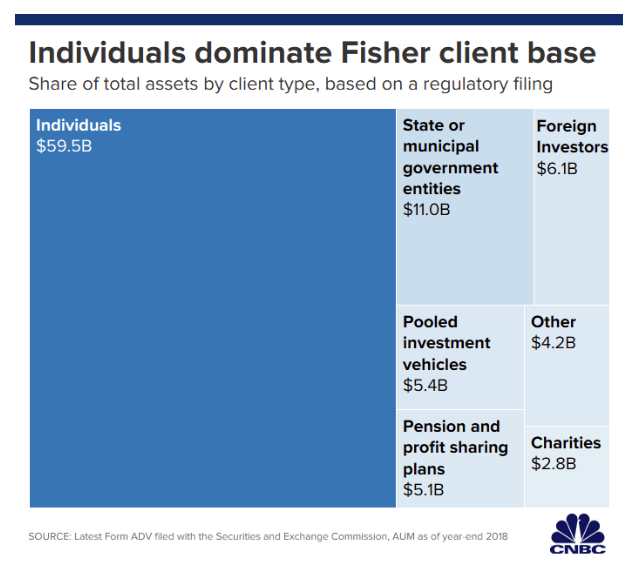

Fisher was managing about $10.9 billion on behalf of 36 state or municipal government entities at the end of 2018, down from $13.2 billion at the end of 2017. That number will be far lower at the end of 2019.

And as we stated weeks ago, the blowback still may not be over: we reported that other clients of Fisher’s were “reevaluating” their relationship with the firm after the manager’s sex jokes at a financial conference.

Maxwell Rule, chief financial officer of Hames, a company who has their 401(k) managed by Fisher, said last week: “It certainly taints their reputation. I wouldn’t comment at this point whether this would lead us to take our business elsewhere, but I will certainly have a conversation with the ownership regarding that. As a fiduciary I have an obligation to have that conversation.”

About three weeks ago we reported that at a conference in San Francisco, Fisher – whose firm manages more than $100 billion – shocked attendees when he compared gaining a client’s trust to “trying to get into a girl’s pants.”

Fisher also said at the same conference that executives who were “not comfortable talking about genitalia should not be in the financial industry.”

Tyler Durden

Tue, 10/22/2019 – 15:45

via ZeroHedge News https://ift.tt/32DzBNF Tyler Durden