Fed’s Second 42-Day Repo Oversubscribed As Rising Repo Rate Confirms Year End Liquidity Rush

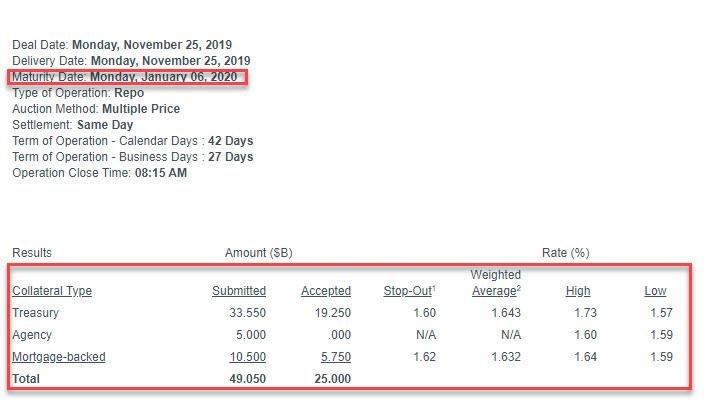

One week after the Fed’s first 42-day term repo which for the first time allowed dealers to lock in funding into the new year and which was 2x oversubscribed, confirming a growing scramble for year-end funding, traders were keenly looking ahead to the result from today’s second 42-day repo which matured on January 13. And, as we noted last week, year-end liquidity fears remain front and center as the $25 billion operation proved to be roughly 40% below the required size to satisfy all liquidity demands.

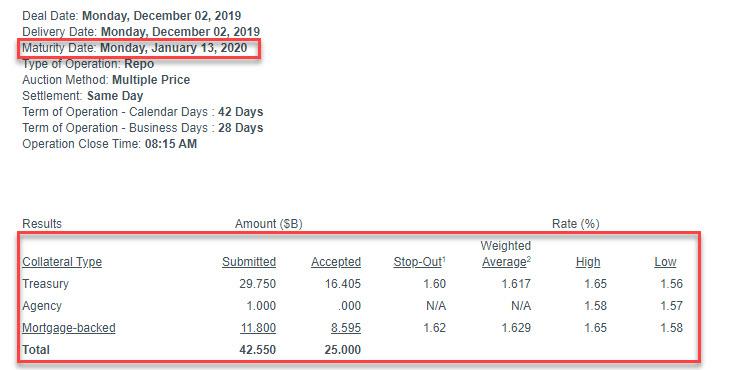

Dealers submitted $42.550BN in bids for the 42-day op ($29.750BN in Treasurys, $1BN in Agency, $11.8BN in MBS paper), resulting in an oversubscription of the $25BN in available repo.

This was modestly below the $49.050 billion submitted in the first 42-day repo operation conducted on November 25:

It remains a key question for funding markets why, even with QE4 in place and now daily overnight and short-term repo operations in place, banks continue to rush to lock in year-end liquidity, where some fear a similar explosion in overnight repo rates as was observed on Dec 31, 2018 when General Collateral soared amid a widespread liquidity shortage. Indeed, as Bloomberg put it, “even with the Fed’s commitment to continue providing liquidity to the financial system around year-end, the market is still showing concerns. This is due to banks’ year-end balance-sheet constraints related to capital surcharges and other regulatory requirements.”

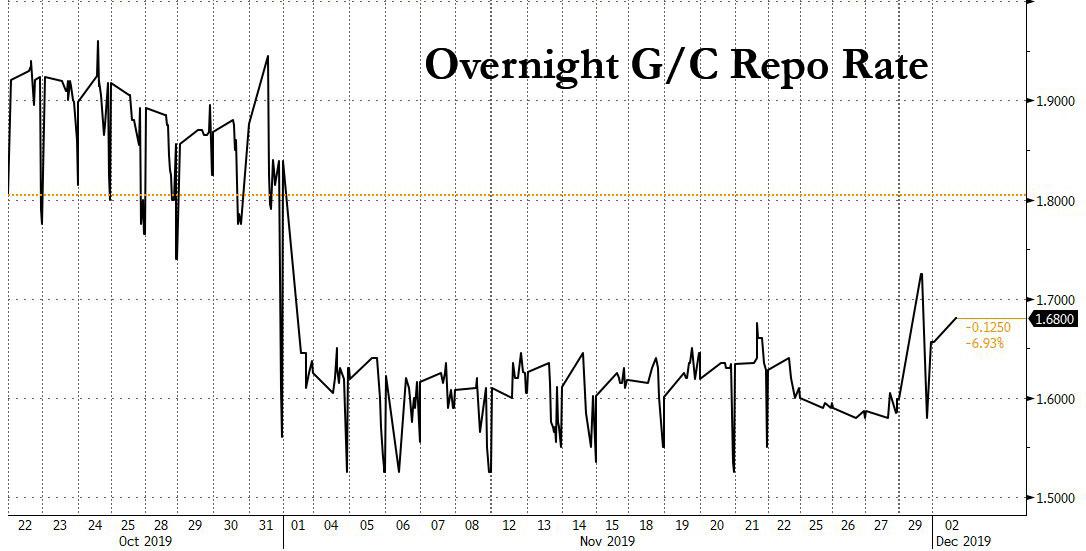

The clearest indication that despite the massive liquidity injections that have taken place since mid-September liquidity remains scarce was today’s initial print in the overnight General Collateral rate, which rose from 1.60% to 1.68%, the highest since the Fed cut rates on Oct 31.

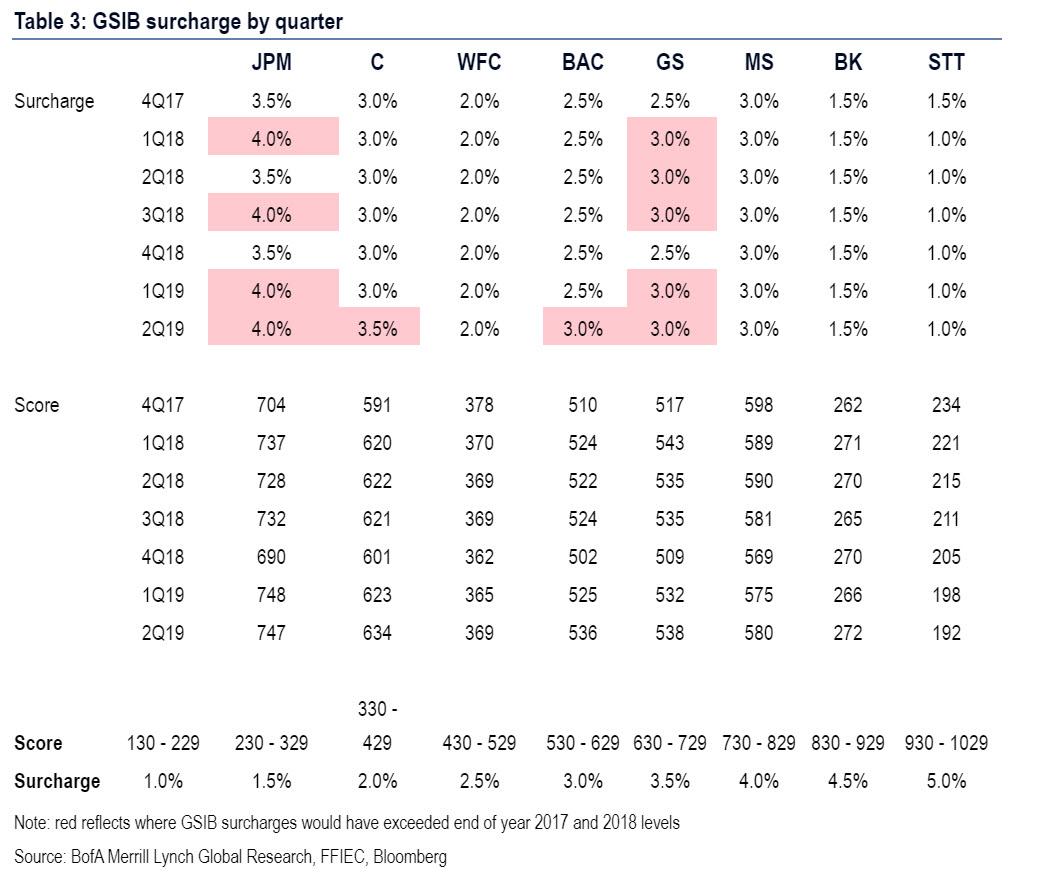

So what is it about quarter and year-end that is forcing banks to shore up their balance sheets with liquidity? As a reminder, while most US bank have a GSIB surcharge of around 2%-3%, JPMorgan remains an outlier – and is perceived as the “riskiest” bank – with its 4.0% surcharge. It’s also the reason why the bank has been quietly pulling liquidity away from funding markets ahead of quarter-end periods.

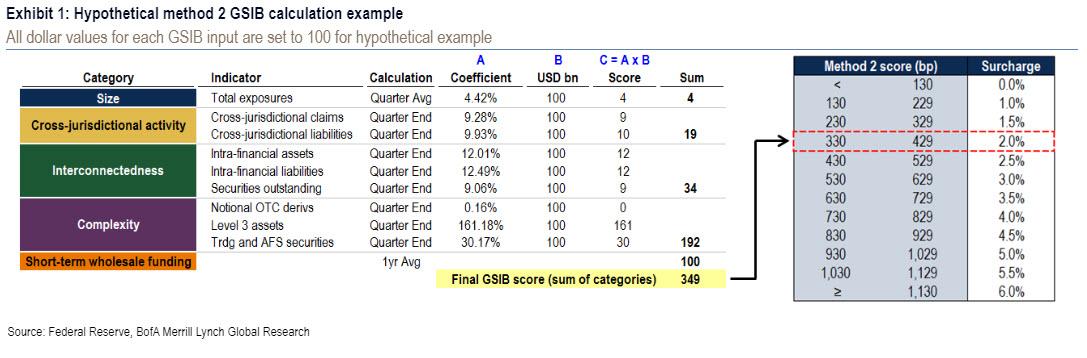

For those curious how the Fed calculates the GSIB surcharge, Bank of America provided the following handy schematic:

Two weeks ago, when commenting on why it expects to see sharp year-end liquidity pressures, BofA said that funding markets are currently very stable but the bank sees risks of repo pressure into year-end, as the Fed faces two funding issues into Y/E:

- a low level of reserves requiring ongoing large Fed repo injections

- dealer repo intermediation constraints stemming from the GSIB surcharge.

The way these issues are linked is through the Fed’s short-term repos; Fed repos pressure dealer balance sheets larger while GSIB constraints encourage dealers to shrink the overall size of their market making activities.

Tyler Durden

Mon, 12/02/2019 – 08:33

via ZeroHedge News https://ift.tt/2OJpKS5 Tyler Durden