Mystery Trader Makes $10 Million In Hours Betting S&P Will Drop 4.5% In One Month

The recent market melt-up is coming to a quick end.

At least that’s the opinion of one investor who spent millions to hedge a multi-billion position against a 5% drop in the next 6 weeks.

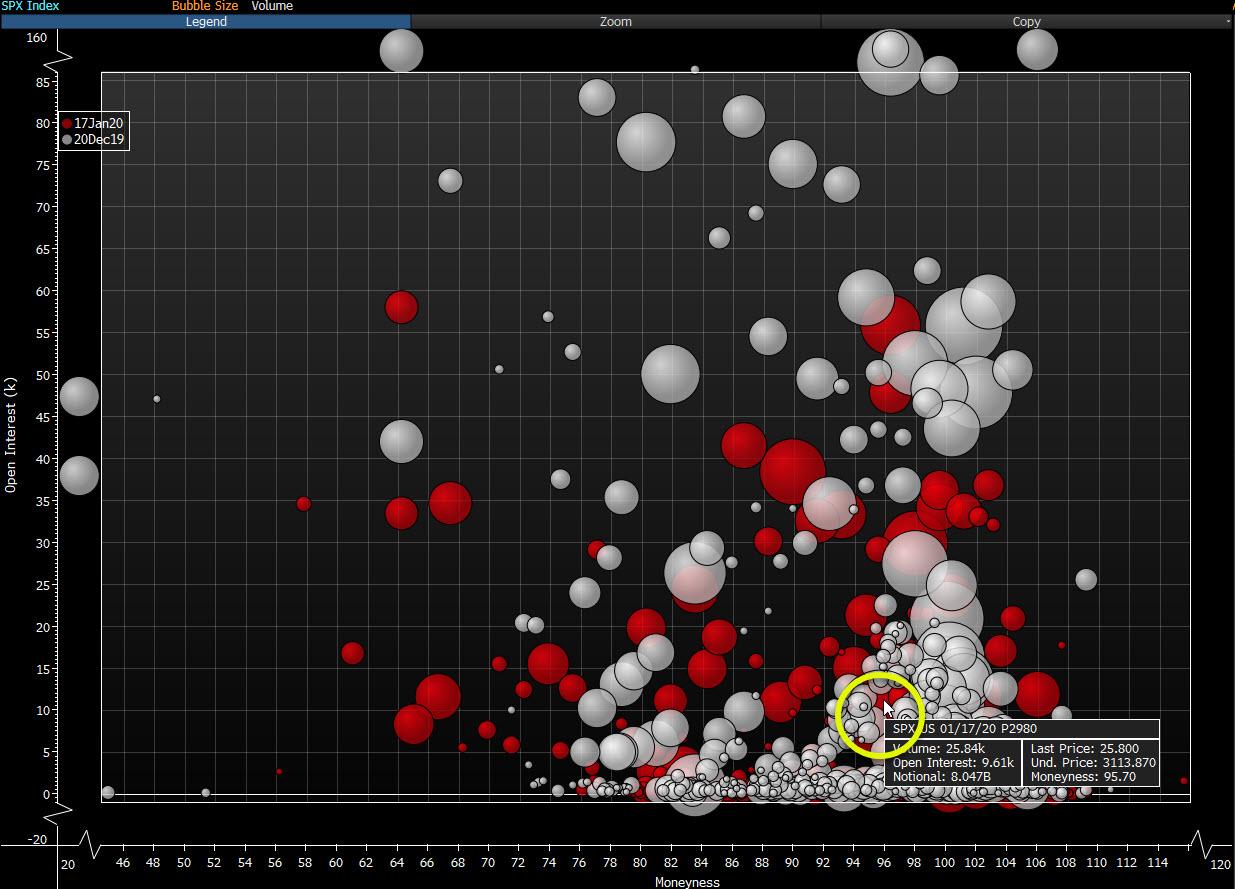

A mystery trader bought 16,000 January 2,980 S&P puts, spending $32 million to protect against a 4.5% drop in the index at 9:44am on Monday morning, just before the Markit manufacturing PMI printed, and about 15 minutes before the latest dismal Manufacturing ISM sent stocks tumbling.

The appears to be hedging roughly $4.8 billion in assets, according to Henry Schwartz, president of Trade Alert in New York.

The price of the put rose by $8.30 or 47% from Friday, closing at $25.80.

This means that while the market is nowhere near the 2,980 Jan 17 strike, the mystery trader has already made just under $10 million in just under 7 hours on Monday. Of course, if this is indeed a hedge, it is just as likely that his $4.8 billion basket suffered similar if not greater losses over the same time period.

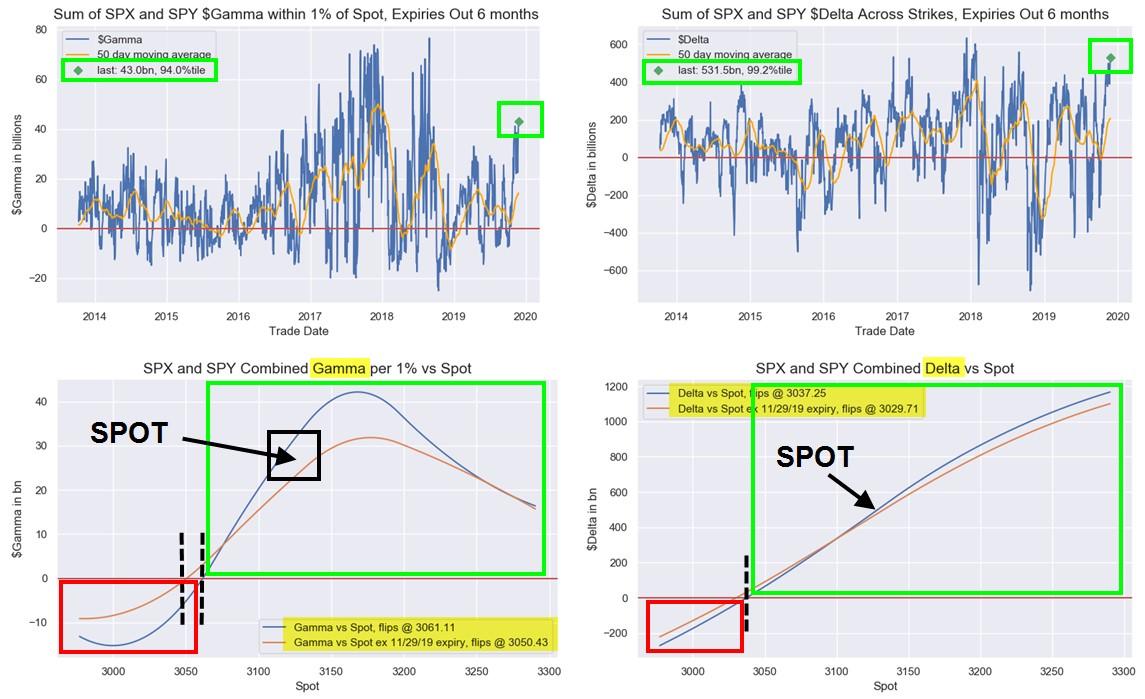

Not surprisingly, in this incredibly illiquid market which has seen both dealer delta and gamma rise sharply in recent weeks…

… it was not immediately clear if the trade was put in response to the early morning market selloff which culminated in 0.9% drop in the S&P – its biggest one-day drop since October – or actually caused it.

Speaking to Bloomberg, Matthew Brill, head of derivatives trading at Tourmaline Partners, said that an options trade of that magnitude “quickly pressured stocks” when it crossed, in the process accelerating the stock selloff.

“The index quickly shed almost 0.5% as it needed to absorb almost $1 billion of stock for sale,” Brill said, adding that the move reflects a recent trend of traders buying 5% out-of-the-money puts for one- to three-month durations on broader market indexes rather than individual securities.

The trade comes just a few days after a different (or perhaps the same) investor bought deep out of the money calls for $1.75 million in a bet that gold would soar to $4,000 by June 2021.

Tyler Durden

Mon, 12/02/2019 – 22:45

via ZeroHedge News https://ift.tt/2RcX0CH Tyler Durden