SocGen Presents “The Most Depressing Chart Ever”

Whereas SocGen’s Albert Edwards is mostly concerned with global macro phase transitions, and specifically when the current global economy will transform into a terminal deflationary singularity, one which Edwards calls the “Ice Age”, his just as bearish SocGen colleague Andrew Lapthorne has been more preoccupied with the micro in recent years, and this morning the strategist believes he has uncovered the “most depressing chart ever” (especially for active managers).

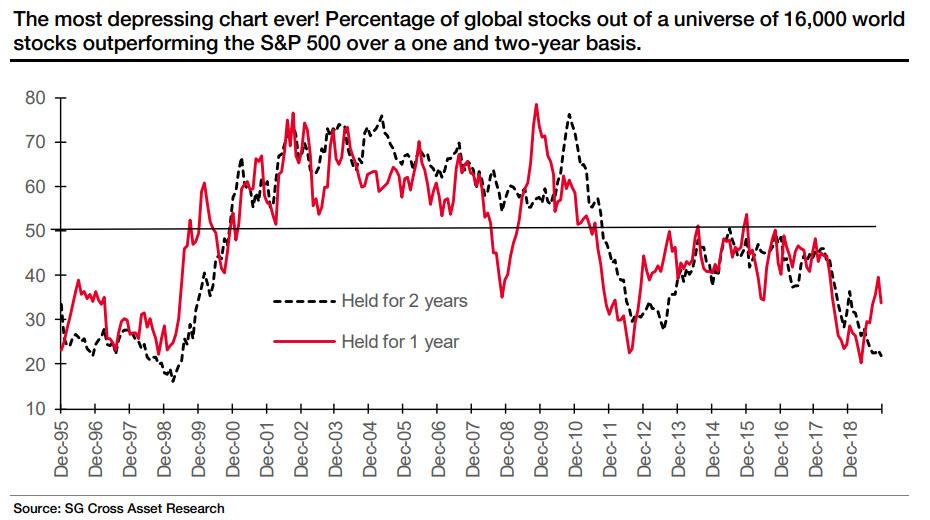

The chart, shown below, measures how many of the world’s 16,000 stocks have beaten the S&P 500 over one and two years. What it finds is that over the last couple of years, nearly 80% of stocks have failed to beat the broader index, making a mockery of the concept of “alpha” creation, and paying someone 2 and 20 to find value beyond the broader market. On the other hand, with activist central banks actively targeting broad market indexes for the past decade, and especially any time there is even a modest swoon, or whenever they fill like boosting investor (and consumer) confidence with a little NOT QE here and not so little NOT QE there, it should not come as a surprise that it is now virtually impossible to outperform the overall market.

Below we present the highlights from Lapthorne’s note, which start of by noting that “if the world is heading into a slowdown, global equity markets don’t seem to be that bothered.”

MSCI World rose 2.7% in November, which leaves it up 21.7% in 2019. Of course, 2019 performance figures are helped by the starting point, which coincided with the turn of the year and a handbrake turn from the Fed. Picking a less generous starting point, say end-January 2018, and global equities have returned 8.6% versus 10% for 10-year global government bonds. On a total return or a risk-adjusted return basis you were better off owning bonds. Though really, and as ever, the best asset to own was simply the S&P 500.

Lapthorne then reminds us of Warren Buffett’s famous recommendation, which urged retail investors to buy the S&P 500, as stockpickers regularly failed to beat it.

“He’s not wrong. The strong performance of the S&P 500 leaves everything in its wake. This is lauded as a success and an abject failure of active fund management. But, the S&P 500 is less a measurement of corporate success and increasingly an ingredient of ever more complex financial products.”

Which brings us to the punchline: “Once in a while we create a chart that is truly depressing.”

The chart below measures the percentage of global developed and emerging market stocks that have beaten the S&P 500 on a total return USD basis over one and two years. This is a very big universe of 16,000 stocks and over the last couple of years 78% of stocks (so over 12,400 stocks) have failed to beat the S&P 500. Over the last year things have got a little better with only 66% of stocks underperforming. This high-profile index provides such a tough performance benchmark that increasing it convinces investors that just buying the S&P 500 will do.

As the Socgen strategist concludes, “this is a big shame” and explains why:

Not because I want to bang the drum for active management (admittedly a big part of our client basis), but if the measurement of company success is outperforming the 500 largest-cap US businesses supported by the US Federal Reserve, debt-funded share buybacks, and increasingly sophisticated financial products, then you can understand why less business are going public and private equity is booming. I find this depressing.”

So to all those who financial professionals who still foolishly support and cheer for the Fed, even though it is the Fed itself that is making all financial professionals obsolete in a world in which any dumb robot can just buy and hold the S&P for 0 and 0 as opposed to 2 and 20, we wonder just what else you need to see or experience before you too realize that central planning ends in tears for everyone involved. The only question is when.

Tyler Durden

Tue, 12/03/2019 – 15:10

via ZeroHedge News https://ift.tt/2RcrGEd Tyler Durden