Global Markets Rocket Higher After Blue Horseshoe Loves China Trade Deal

The worst start to a December since 2008 for the S&P500 was apparently too much for certain people who asked Bloomberg not to be identified.

With hopes of a trade deal in shambles, optimism that a “Phase 1” getting signed in 2019 cracking after Trump said yesterday it may be better to delay the deal until after the Nov 2020 election, and China threatening retaliation after the latest House bill almost unanimously voted to sanction Chinese officials over Uighur abuse, even the Global Times’ notorious twitter troll, Hu Xijing, tweeted this morning that there is “a high probability that President Trump or a senior US official will openly say in a few hours that China-US trade talks have made a big progress in order to pump up the US stock markets. They’ve been doing this a lot.”

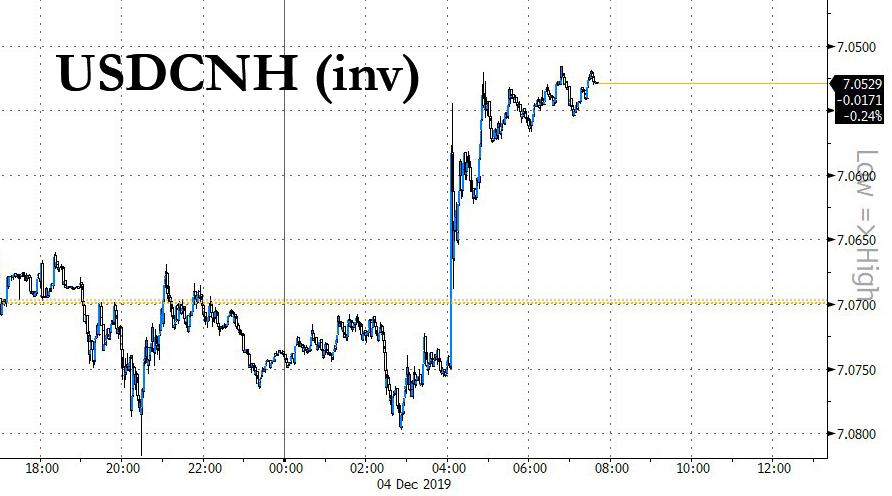

He was almost 100% accurate, because at almost the exact same time, just after 4am as US futures were sharply rolling over, and a perfectly normal time for such articles market-moving articles, Bloomberg reported that according to “people familiar who asked not to be identified”, the U.S. and China were actually “moving closer to agreeing on the amount of tariffs that would be rolled back in a phase-one trade deal despite tensions over Hong Kong and Xinjiang” and that Trump’s comment “downplaying the urgency of a deal shouldn’t be understood to mean the talks were stalling, as he was speaking off the cuff.”

In other words, Larry Kudlow Blue Horseshoe loves China trade deal.

There were naturally question about the Bloomberg piece: like why does an “unknown” source who “thinks” the deal is imminent take presedence, when very known people, , i.e., the US president and Wilbur Ross, both said a deal may not happen for almost a year and that if there is no substantial progress, another round of duties on Chinese imports would take effect on Dec. 15; or why was this “respected” Larry Kudlow source so terrified to give his name on the record if everything checks out?

None of that mattered however, and the market response, as Hu predicted, was instantaneous, sending not only S&P futures sharply higher and importantly, above the critical for dealer gamma level of 3,100, instantly reversing the gloom of the past few days…

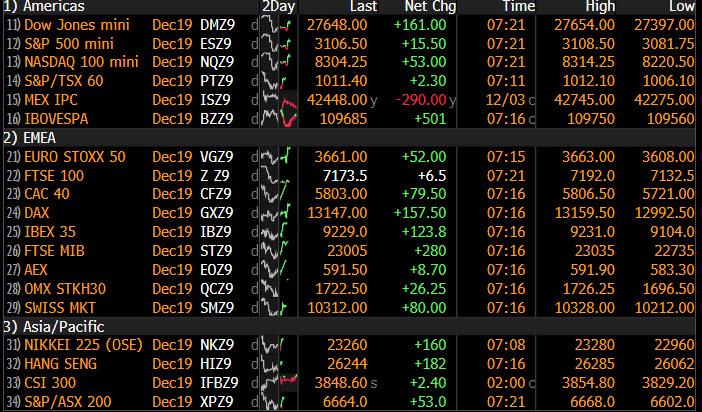

… but sent global stocks into a sea of green.

The short squeeze that was triggered after investors layered on shorts into the worst first two days of a December since the financial crisis, went global and miners and chemical producers led the rise on the Stoxx Europe 600 gauge, which rocketed over 1% higher in early trading, even though IHS Markit’s composite PMI index for the euro zone reading at 50.6 pointed to growth of only 0.1% in the fourth quarter. That would be the weakest since the 19-nation region emerged from recession in 2013.

Earlier in the session, markets closed lower across much of Asia as the Bloomberg deus ex ma-China came out too late to help them, with Australia and Hong Kong bearing the brunt of the declines. Declines were led by energy producers, as investors were still focused on the story du jour – at least until the Bloomberg unnnamed sources became “it” – in which trade tensions mounted between Beijing and Washington with a new tariff hike on Chinese goods looming large. Almost all markets in the region were down, with South Korea and Hong Kong leading declines. The Topix retreated, driven by electronic companies and drug makers, as Japan’s government called for decisive fiscal action combined with powerful central bank easing. The Shanghai Composite Index slid, with large insurers and banks among the biggest drags. China is likely to cut the reserve ratio for lenders in the first quarter of next year, the China Securities Journal said in a front-page commentary Wednesday. India’s Sensex edged lower a day before an expected rate cut aimed at reviving growth, as Reliance Industries and HDFC Bank weighed on the gauge.

Treasuries initially caught a bid to session highs on reports that passage of the latest bill could jeopardize a U.S.-China phase one deal. However, the haven bid for Treasuries during Asia session was unwound in European morning trade on the Bloomberg report, overriding negative comments earlier from China’s Ministry of Foreign Affairs. The TSY curve steepened, unwinding a portion of Tuesday’s aggressive bull-flattening move. Yields were higher by 1.2bp to 2.4bp across the curve led by long-end, steepening 2s10s, 5s30s by 1.2bp and 0.5bp; 10-year yields at 1.738%, cheaper by 2.2bp vs. Tuesday’s close. Treasuries were supported during Asia session after China’s Ministry of Foreign Affairs said U.S. will “pay price” for legislation imposing sanctions on Chinese officials over human-rights abuses.

In FX, the dollar briefly recovered against major peers, then headed sharply lower. The euro edged down after a manufacturing report showed that the single-currency economy is barely expanding. The British pound climbed to an almost seven-month high against the dollar and its strongest level since May 2017 against the euro as polls showed the Conservatives have increased their lead before the election. Tracking the positive newsflow, the Chinese yuan spiked, in a virtual mirror image of the move in US futures.

As expected, crude markets were bolstered on the news that the US and China are moving closer to a deal despite recent “heated” rhetoric. Elsewhere, the latest batch of comments from the Iraqi oil minister continues to support prices; an additional 400k bpd cut for OPEC+ is apparently in circulation but not final, while the Saudi’s also reportedly prefer deeper cuts, although this contradicts sources reports seen last month. “If all members were compliant with the [current] deal this may be the case, however, with a number of members falling well short in cutting output, including Iraq, other members may be reluctant to cut further” says ING, who goes on to conclude that “reassurance of stronger compliance will likely be needed before other members agree to deeper cuts.”

Looking at the day ahead, this morning the focus will be on the final November PMI revisions (services and composite) in Europe while we’ll also get that data for the US, along with the November ISM non-manufacturing and November ADP employment report. Away from that, we’re due to hear from the ECB’s Villeroy, Visco, Makhlouf and Hernandez de Cos while the Fed’s Quarles is due to speak on supervision and regulation. Campbell Soup and Synopsys are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.4% to 3,102.00

- STOXX Europe 600 up 1% to 402.43

- MXAP down 0.7% to 163.21

- MXAPJ down 0.8% to 518.12

- Nikkei down 1.1% to 23,135.23

- Topix down 0.2% to 1,703.27

- Hang Seng Index down 1.3% to 26,062.56

- Shanghai Composite down 0.2% to 2,878.12

- Sensex up 0.4% to 40,822.98

- Australia S&P/ASX 200 down 1.6% to 6,606.51

- Kospi down 0.7% to 2,068.89

- German 10Y yield rose 0.7 bps to -0.341%

- Euro down 0.1% to $1.1070

- Italian 10Y yield fell 6.4 bps to 0.938%

- Spanish 10Y yield rose 0.2 bps to 0.413%

- Brent futures up 1.9% to $61.96/bbl

- Gold spot down 0.2% to $1,474.90

- U.S. Dollar Index little changed at 97.76

Top Overnight News from Bloomberg

- The U.S. House of Representatives overwhelmingly approved legislation that would impose sanctions on Chinese officials over human rights abuses against Muslim minorities, prompting Beijing to threaten possible retaliation just as the world’s two largest economies seek to close a trade deal

- “I don’t have a deadline,” President Trump tells reporters in London after being asked if he sees phase one of a trade deal with China concluding this year. “I like the idea of waiting until after the election for the China deal. But they want to make a deal now and we’ll see whether not the deal is going to be right”

- Australia’s economy slowed last quarter as interest-rate cuts and government tax rebates failed to spur household spending, reinforcing expectations the central bank will need to resume easing next year

- Oil defied trade-deal bearishness to rise for a third day after an industry report pointed to shrinking U.S. crude stockpiles and before OPEC+ decides on its output-cut policy later this week. OPEC+ sends mixed signals about deeper output cuts before talks

- House Democrats laid out their most comprehensive case yet for impeaching Donald Trump, declaring the president “a clear and present danger” over his rush to get foreign governments to investigate a political rival and making his intimidation of witnesses tantamount to a crime

- U.S. President Donald Trump revived both his “Rocket Man” nickname for Kim Jong Un and the threat of military force against North Korea, in the latest sign of rising tensions ahead of Pyongyang’s year-end deadline

- While IHS Markit’s composite Purchasing Managers’ Index for the euro zone stabilized at 50.6 in November, above the flash reading of 50.3, it points to growth of only 0.1% in the fourth quarter. That would be the weakest since the 19-nation region emerged from recession in 2013

- Foreign direct investment into China jumped last year to $139 billion even as trade tensions escalated, bucking a trend that saw global flows sink 13% from 2017 levels

- OPEC and its allies sent mixed signals about whether they were considering deeper production cuts, fanning oil-market speculation before crucial talks in Vienna this week

- Germany’s Social Democrats backed away from a threat to ditch their alliance with Chancellor Angela Merkel and eased demands for the government to abandon its balanced-budget policy

Asian equity markets extended on declines as global risk appetite remained sapped by the turbulent trade climate following yesterday’s comments by US President Trump. ASX 200 (-1.6%) and Nikkei 225 (-1.0%) were lower with pressure in the trade-related sectors resulting in Australia’s continued underperformance which was also not helped by a miss in quarterly GDP growth, while the Japanese benchmark tracked the recent slide in USD/JPY and with reports noting the GPIF’s move to end stock lending could rattle markets. Hang Seng (-1.3%) and Shanghai Comp. (-0.2%) were dampened by the increased trade pessimism after President Trump’s comments and with Global Times suggesting the US appears to be back-pedalling in trade talks. The US House’s overwhelming support for the Uighur human rights bill demanding sanctions on Chinese officials, which it passed through 407-1 vote, also contributed to the bilateral tensions and spurred resolute opposition from China which will respond depending on how the situation develops. Nonetheless, losses in the mainland have been stemmed after strong Chinese Caixin Services and Composite PMI numbers added to the country’s recent flurry of strong activity data and as Chinese press op-ed suggested the PBoC are expected to cut RRR in Q1. Finally, 10yr JGBs were higher after the recent gains in T-notes due to safe-haven bids, but with prices off their best levels after failing to hold above the 153.00 level and with the lack of BoJ presence in the market contributing to the mild overnight retracement.

Top Asian News

- India Is Said to Mull Easing Lending Rules for Shadow Banks

- Hong Kong Announces Further Stimulus Worth $500 Million

- China’s First IPO Flop Since 2012 Shows Confidence Breaking

Major European bourses (Euro Stoxx 50 +1.3%) are firmer following reports that the US and China are moving closer to a deal despite recent “heated” rhetoric gave a boost to risk appetite. The FTSE 100 (+0.3%) is a laggard due to a firmer sterling. In terms of further fundamental catalysts on the horizon; Day 2 of the NATO summit begins and traders will be on the look-out for further clues as to the state of play on the US/EU and US/China front, quite possibly in the form of off-the-cuff comments from the US President, with the former two in the midst of clashes over the WTO’s ruling on EU Airbus subsidies and most recently France’s proposed Digital Services Tax, while tensions between the latter two have most recently been worsened following the US House’s passing of the Uighur Human Rights Bill. Sectors are mostly in the green, with Telecoms (unch.) the laggard as the sector is weighed by underperformance in heavyweight Orange (-3.8%), with traders reportedly disappointed by the Co.’s most recent dividend outlook. Elsewhere, Italian banks, including Intesa Sanpaolo (+1.8%) and UniCredit (+1.6%), are on the front foot after Moody’s upgraded the outlook for Italian banking to stable from negative. Solid earnings from US Microchip last night is acting as supportive for European chipmakers, including Infineon Technologies (+2.2%). In terms of other notable individual movers; Elior (+7.8%) opened higher after the Co. posted strong earnings, in which FY net profit posted solid Y/Y gains. Further gains were seen for easyJet (+2.1%), with the Co. set to join the FTSE 100, and Hiscox (-1.0%) and Fresnillo (-3.8%) to be dropped. In terms of the losers; Aviva (+0.2%) lags the FTSE 100, having been downgraded at Barclays. Elsewhere, Securitas (unch.) underperforms following a downgrade at Deutsche Bank.

Top European News

- U.K. Economy on Course for Contraction as Services Falter

- Euro- Area Economy Is Just About Growing as Factory Slump Spreads

- GAM Faces Regulator Penalty for Misstating Quant Fund Deal

- ECB Places Goldman Unit Under Direct Supervision Amid Brexit

In FX, the sterling rose to the top of the G10 ranks in early EU hours following a relatively sideways APAC session in which GBP/USD meandered on either side of 1.3000. The pair gained momentum after tripping stops at 1.3013 and advanced to a current intraday high of 1.3063 (ahead of its 200 WMA around 1.3100) before waning off highs and back below its 100 WMA at 1.3048. News-flow has been light for Sterling, with the currency little influenced by a revision higher to its November services and composite PMI metrics. That said, IHS noted that the PMI figures point to a GBP contraction of ~0.1% in the Q4, but the December numbers are yet to be released. Meanwhile, the Eur has been moving at the whim of the Buck and largely shrugged off upward revisions to the pan-European services and composite numbers – with the GDP tracker suggesting growth of 0.1% in Q4 for the EZ. IHS did warn that the services sectors are poised for its weakest QQ expansion for fives years, “hinting strongly that the slowdown continues to spread”. EUR/USD moved into negative territory and back below its 100 DMA (1.1069) after hitting an intraday peak 1.1088, with little EU-specific data/speakers left on the docket.

- DXY, JPY – The broad Dollar and Index has recouped earlier losses with upside coinciding with constructive trade headlines from sources, prompting the DXY to rebound off its 200 DMA at 97.63 back to yesterday’s closing levels around 97.75. Meanwhile, USD/JPY ekes mild losses amid the aforementioned headlines with the pair back above the 108.50 mark (coincides with its 50 DMA), to a high of 108.80 ahead of the rough figure. Traders will be eyeing any trade/geopolitical headlines with NATO summit day 2 underway and US President Trump’s presser scheduled for 15:30GMT.

- AUD, NZD – Both lower on the day, but more-so the Aussie on the back of disappointing GDP figures with the QQ metric showing growth of only 0.4%, down from the prior of 0.5%. Analysts mention that the most concerning aspect of the release is the representation of a fifth consecutive quarter which private demand contracted or was flat. Westpac notes that the RBA will be disappointed with the figure and believes that the Central Bank and the Government will have to revisit their growth forecasts. AUD/USD climbed off lows in wake of optimistic US-China trade headlines, but gains remain capped due to the overnight data. The pair remains in the red around the middle of its 0.6813-0.6846 band having briefly dipped below its 100 DMA at 0.6816. The Kiwi piggybacks on the Aussie’s losses and hovers just above the 0.65 mark, off highs of 0.6530.

In commodities, Iraq Oil Minister stated that an additional 400k bpd cut for OPEC+ is in circulation but not final and that all members should share the burden, while he added that slower demand is a bigger impact next year than non-OPEC supply. Furthermore, the Oil Minister added that it is his understanding that Saudi prefers a deeper cut and that deeper cuts are preferred by members. Crude markets are bolstered (in line with other risk assets) on the news that the US and China are moving closer to a deal despite recent “heated” rhetoric. Elsewhere, the latest batch of comments from the Iraqi oil minister continues to support prices; an additional 400k bpd cut for OPEC+ is apparently in circulation but not final, while the Saudi’s also reportedly prefer deeper cuts, although this contradicts sources reports seen last month. “If all members were compliant with the [current] deal this may be the case, however, with a number of members falling well short in cutting output, including Iraq, other members may be reluctant to cut further” says ING, who goes on to conclude that “reassurance of stronger compliance will likely be needed before other members agree to deeper cuts.” Moreover, yesterday saw the OPEC+ Joint Technical Committee meet in Vienna ahead of the full ministerial meetings on Thursday and Friday and they reportedly did not discuss deeper cuts. Reports did suggest that the Joint Technical Committee is considering Russia’s request to exclude condensate from its oil production cuts, which has been rising as of late in line with the country’s rising gas output and has been cited as the reason for the country’s poor OPEC+ compliance. Elsewhere, also underpinning the crude complex is last night’s larger than expected draw in headline API Inventories; traders will now focus on EIA Inventory data this afternoon for further confirmation. WTI futures meanders around USD 57/bbl while its Brent counterpart eyes USD 62/bbl to the upside having earlier eclipsed the level. Moving onto metals, risk on has hit gold prices, which have fallen to just above USD 1470/oz from earlier highs of USD 1490/oz. Meanwhile, copper has been buoyed, popping to USD 2.6450/lbs highs from its earlier USD 2.62-2.63/lbs range. Elsewhere, iron ore prices found further impetus after data showed that shipments from Brazil had dropped since the last week; prices have been underpinned in recent days by the news that Vale, the world’s largest miner of Iron Ore, cut its production outlook and production at its Brutucu mine has been halted due to safety issues regarding a nearby dam.

DB’s Jim Reid concludes the overnight wrap

- 7am: MBA Mortgage Applications, prior 1.5%

- 8:15am: ADP Employment Change, est. 135,000, prior 125,000

- 9:45am: Markit US Services PMI, est. 51.6, prior 51.6; 9:45am: Markit US Composite PMI, prior 51.9

- 10am: ISM Non-Manufacturing Index, est. 54.5, prior 54.7

DB’s Jim Reid concludes the overnight wrap

A quiz question to start this morning. Complete the following sequence… 19.6%, 25.7%, 20.5%, 27.3%, 15.5%, 10.8%, 13%, 16%, 13.3%, 18.7%, xxx%…….??? ….. answer at the end of today’s EMR.

If you’ve had enough of 2020 outlooks as we progress through December then don’t fear as later today my team and I will publish our latest Konzept magazine where we will “Imagine 2030” and look at a number of eclectic articles suggesting what the world might look like at the end of the next decade. So if you want to know about the end of credit cards, whether we’ll still be using cash, the future of crypto currencies, how you will consume food, the rise of the drones, the outlook for India and China, what Europe needs to do to compete and catch-up, and what we think will be the main populism battleground in 2030 then watch out for this later. There are 24 articles in total and some are more serious than others. One of my favourites is one from Luke on the future of pro sports stats. Every potential move will be AI analysed by 2030 and players trained accordingly. Hopefully, I’ll also have a robot swinging a golf club for me by then.

If 2030 is too far out for you, a reminder that you can find our 2020 macro credit view here , and our IG and HY specific views here and here .

Back from the future now and what a difference a couple of days can make. Mr Trump has completely taken the momentum out of financial markets this week and the December 15th date will increasingly become a focal point over the next couple of weeks. Last week the mood music suggested that even if a “phase one” deal hadn’t been reached by then, then there was a good chance tariffs planned to be implemented on that date would be postponed. After the stepping up of negative global tariff rhetoric over the last 48 hours, yesterday’s headlines suggesting that the US is going forward with the December 15 tariffs grabbed the limelight, although markets had already been trading weaker prior to that. Fox’s Edward Lawrence said that “trade sources tell me that the Dec 15th tariffs on basically the rest of what China imports into the US are still going forward as of today.” He went on to clarify that the next tranche could still be called off, if a phase one deal gets finalised or “something else positive happens.” For his part, President Trump said that a trade deal is “dependent on whether I want to make it” and “in some ways it is better to wait until after the election…and we’ll see whether the deal is going to be right”.

This might be a late negotiating ploy ahead of a deal but its impossible to tell at the moment and from something that looked like a case of “when not if” a couple of weeks ago now is a case of “if not when.” If that wasn’t enough, Trump also said later on in the day that “those countries that don’t deal with NATO obligations will be dealt with, maybe through trade”. Meanwhile, Wilbur Ross hardly painted a rosier picture, saying that the US has “more ammunition left against China” and also that the US “has a legitimate complaint with Europe over trade.”

The end result for markets were drops of -0.66%, -0.55% and -1.01% for the S&P 500, NASDAQ and DOW but with markets nearly three-quarters of a percent off their early session lows. The trade sensitive semiconductor index was also hit -1.54%, taking it now down -4.04% over the last three sessions, the worst such stretch since August. In Europe, the STOXX 600 closed down -0.93%, taking the two-day loss to -2.20%. Credit also suffered with US HY spreads +11bps while in bond markets we saw yields rally, including a fairly brutal -10.7bps move for 10y Treasuries, which was the most since August 14. The curve also flattened -3.9bps and there are now 20bps of cuts implied between now and next July. In Europe, yields were broadly lower with Bunds -6.8bps and back within a basis point of where they were before the weekend SPD news (more later). In commodities gold (+1.03%) and silver (+1.54%) benefited from the risk off while in currencies it was the Swiss franc (+0.41%) and yen (+0.33%), which also caught a bid at the expense of EM currencies like the South African rand (-0.67%) and the offshore renminbi (-0.35%).

Overnight, the US House of Representatives passed a bill that would impose sanctions on Chinese officials over alleged human rights abuses. However, the House passed an amended version of the Senate bill by adding provisions that require the president to sanction Chinese government officials responsible for the repression of Uighurs and places restrictions on the export of devices that could be used to spy on or restrict the communications or movement of members of the group and other Chinese citizens. Also, among other provisions, the bill requires the president to submit to Congress within 120 days a list of senior Chinese government officials guilty of human rights abuses against Uighurs in Xianjiang or elsewhere in China. Bloomberg further reported that lawmakers are working to resolve differences between the House and Senate bills to agree on one version that can pass swiftly through Congress before the end of the year. In response, China’s foreign ministry urged the US to stop the bill and vowed to further respond if it progresses, without providing any details. The Global Times editor has just tweeted that “US politicians with stakes in China should be careful”.

Overnight, Asian markets are trading lower following Wall Street’s lead with the Nikkei (-1.06%), Hang Seng (-1.08%), Shanghai Comp (-0.31%) and Kospi (-0.69%) all down. The USDCNY fix earlier was the biggest miss to the daily model since August 2nd just after Trump had tweeted about additional tariffs on China. So one to watch as the stakes are raised.

Staying with FX, the Australian dollar is down -0.351% this morning as the Q3 GDP miss raised the probability of a rate cut by the RBA. Elsewhere, futures on the S&P 500 are up +0.07%. As for overnight data releases, China’s November Caixin services PMI came in at 53.5 (vs. 51.2 expected) thereby bringing the composite PMI to 53.2 (vs. 52.0 last month). So an impressive read but one that will be difficult to get too positive about given the trade news this week. Meanwhile, Japan’s final November services and composite PMI both came in one tenth lower than the initial read at 50.3 and 49.8, respectively.

In other better news on trade, Bloomberg reported that Mexico is considering a US proposal to remove protections for biologic drugs from a renegotiated Nafta trade deal. The proposed change would drop language in the U.S.-Mexico-Canada Agreement offering 10 years of market protection for drug makers from cheaper generic spinoffs. It has proved one of the sticking points in getting the deal passed in the US as House Democrats have raised concern that locking in a time frame for pharmaceutical rules could hinder their ability to reduce protections for biologics sooner, as part of an effort to bring down soaring drug prices. Meanwhile, Ways and Means Chairman Richard Neal, the Democrat who’s in charge of the negotiations in the House, said it’s “possible” that Democrats would agree to a deal this week and added that he would like the House to vote on the implementing legislation by the end of the year.

Later today, we’ll get the final services and composite PMIs in Europe and the US as well. Expectations are for the euro area services PMI to remain at 51.5 from the flash reading, though there is likely some upside to the composite number (50.3 flash) after the upward revision to the manufacturing index on Monday. On a country level, the readings in France and Germany are expected to stay steady from the flash estimates, while the prints for Spain and Italy are both expected to fall, by -0.8pts and -1.0pts, respectively, from the October results. Later in the day, the US services PMI is expected to stay at 51.6 from the flash reading, while the non-manufacturing ISM is expected to decline -0.2pts from October to 54.5. Our economists will be watching the employment subindex, which is a strong leading indicator for private payrolls growth.

As an update to the SPD developments, ahead of their 3-day conference on Friday a draft text suggested that the party will call for additional public investment and that it should not be prevented by ‘dogmatic positions’ such as ‘black zero’. So the stage is set for them to demand more as a cost of staying in the GroKo. We will see after that who is going to call the other’s bluff within the coalition, though it does bode well that the draft does not explicitly call for an end to the coalition. New SPD chief Walter-Borjans even said “one thing is clear, we do not want to get out of the grand coalition head over heels.” Whatever that means.

Staying with politics, in terms of the latest UK polls 8 days before the election, the two yesterday showed a 12pt and a 9pt lead for the Conservatives – up 1pt and flat relative to the last time these pollsters last published a few days before. The Labour Party has definitely had a little more momentum over the last couple of weeks but poll of polls are only back to where they were at the start of the campaign (around 10pt lead) and have perhaps only narrowed a couple of points from the peak lead. So there will have to be a very late swing or a bad widespread polling sampling error across the industry for the Tory’s not to win a majority. Labour’s last hope is probably a last minute collapse of the LibDem vote. Throughout the campaign the support for the Tories has been impressively stable at between 40-45% so it doesn’t feel like this is going to fall away now. Labour will need to get closer to this from elsewhere and likely hope for a hung parliament. At this point even if they are well behind the Tories they are likely to be the only party able to form a coalition.

Finally, there wasn’t much to report from the data yesterday. In the US, November vehicle sales came in quite strong at 17.09mn (vs. 16.90mn expected). Meanwhile in Europe PPI printed at +0.1% mom for October (vs. 0.0% expected) while the November construction PMI for the UK was a little better than expected (45.3 vs. 44.5 expected) – albeit still at very low levels.

Looking at the day ahead, this morning the focus will be on the final November PMI revisions (services and composite) in Europe while this afternoon we’ll also get that data for the US, along with the November ISM non-manufacturing and November ADP employment report. Away from that, we’re due to hear from the ECB’s Villeroy, Visco, Makhlouf and Hernandez de Cos while the Fed’s Quarles is due to speak on supervision and regulation.

*** The answer to the final number in the sequence is 3.5%. Yes, after a decade of expecting large double digit returns in the S&P 500 in his year ahead outlooks, our US equity strategist Binky Chadha is ‘only’ expecting 3.5% return from the S&P 500 out to the end of 2020 from current levels. It’s actually 0% for 2020 as a whole as his YE 2019 and 2020 forecasts are the same. So this is a major relative change in view, considering we’ve all marvelled at the bullishness (proved correct) of his previous numbers. For an explanation of why please see the link here ***

Tyler Durden

Wed, 12/04/2019 – 07:55

via ZeroHedge News https://ift.tt/2Yd0KFQ Tyler Durden