Suddenly Nobody Is Bearish Anymore: Managers Of $745BN In AUM See Biggest Jump In Optimism On Record

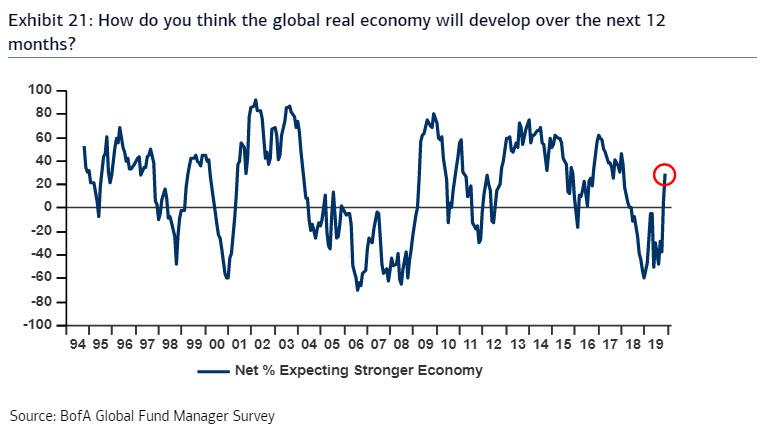

Just a few months after a record number of survey respondents said that the US is late cycle, a recession is imminent, and generally were “the most bearish since the financial crisis”, the latest just released Fund Manager Survey from Bank of America has confirmed that nothing is ever quite as wrong as consensus. The reason: in the past two months optimism across Wall Street professionals has exploded, and FMS investors have now fully reversed the bearish bent, pricing out recession risks as global growth expectations jumped a record 66% – an unprecedented reversal from the -50% in June – and recession fears plummeted 33%, in what BofA said was “a dramatic turnaround from the Most Bearish FMS since the GFC in June 2019.”

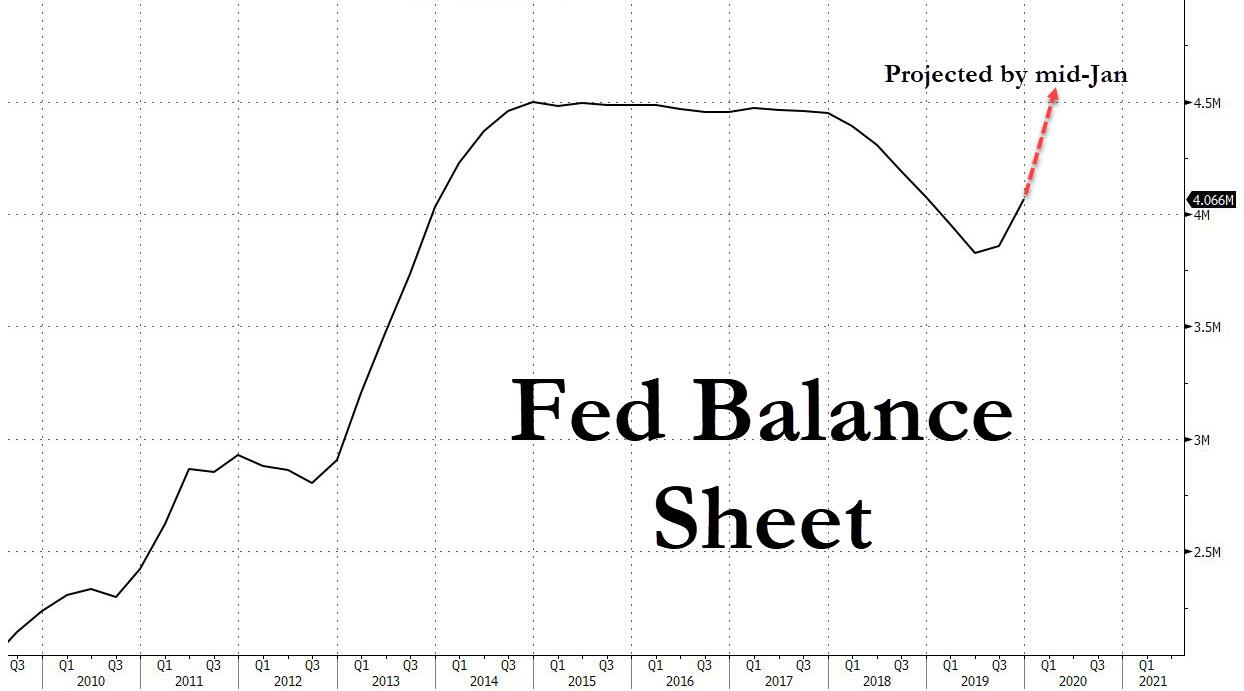

And to think all it took was a $350BN expansion in the Fed’s balance sheet – with another $500 billion on deck – to force a dramatic U-turn in “professional” opinions about the future.

There were various other confirmations of just how pervasive newly-found optimism was across the 247 survey respondents managing $745 billion in AUM. Here are some of the key highlights from BofA:

Global growth expectations jump 22% to net 29% of investors polled indicating they expect global growth to improve over the next year, marking the biggest 2-month jump in growth expectations on record, and as noted above, a record 2-month upswing (+66%) as over two-thirds, or net 68%, now say a recession is unlikely in 2020, largest 2-month drop since May’09. Meanwhile, just a few months after everyone was convinced a recession in 2020 was inevitably, recession concerns have plunged by 33% to net 68% of investors saying a recession is unlikely in 2020.

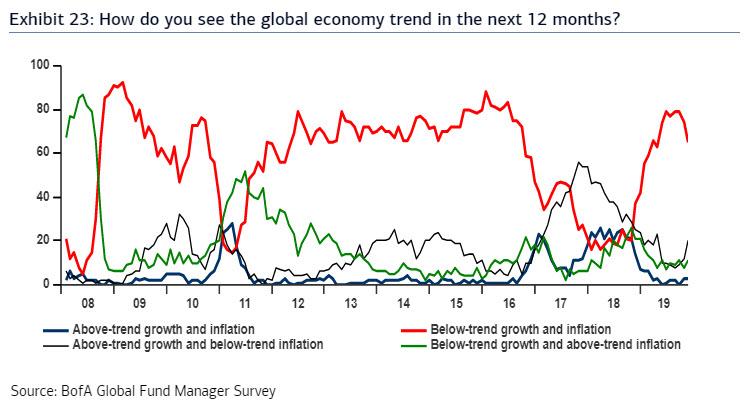

Alongside the surge in growth expectations, there was a parallel spike in inflation expectations, which rose 12% to net 43% of survey participants expecting higher global CPI in the next 12 months. This means that after plunging to near record lows in the summer of 2019, inflation expectations have since risen to a 13-month high and a majority, or net 55% expect steeper yield curve, which also means that calling for a curve flattener is now the contrarian trade.

And another sharp reversal in sentiment: as of December, 20% of fund managers surveyed think the global economy will experience above-trend growth and below-trend inflation, a 7-month high (although 65% continue to expect below-trend growth and inflation).

There has been a regime change not only when it comes to perspectives about the economy: Wall Street’s take on corporations also shifted. And while concerns over the credit cycle remained, with net 39% of those surveyed saying they think corporate balance sheets are overleveraged, down from a record 50%+ a few months ago…

… Global corporate profit expectations surged 23%t from November, with just a net 14% of FMS investors saying they expect profits to deteriorate over the next 12 months, the highest since April 2018.

When asked what they would most like to see companies do with cash flow, 46% of those surveyed say increase capex spending, while just 36% wanted corporates to improve their balance sheets – well below levels hit in late 2018 and early 2019 even though corporate leverage is now higher than ever – and just 15% saying they want corporates to return cash to shareholders, and yet that’s precisely the behavior investors are rewarding. Just look at Apple.

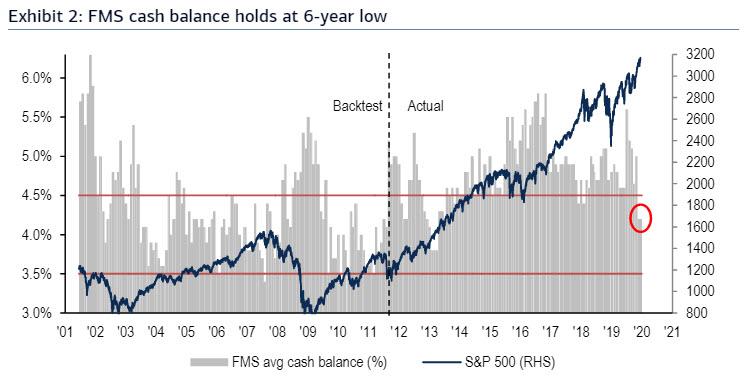

What does all of this mean on capital allocations? Well, acording to the FMS, investor cash levels have dropped to 4.2% in December, the lowest level since March 2013.

At the same time, allocation to cash holds at net 18% overweight, the lowest cash allocation since November 2015

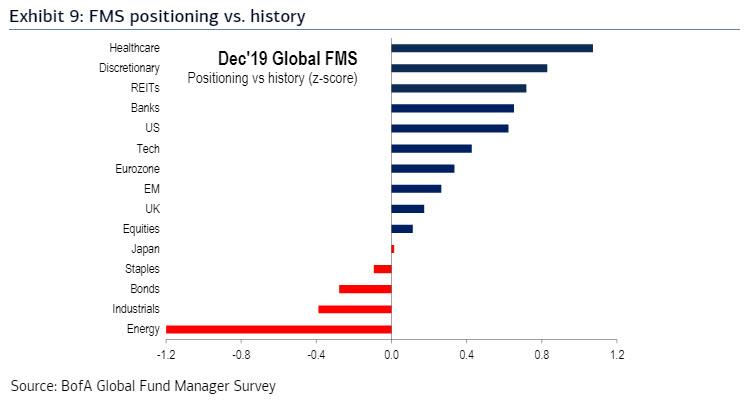

So as they take down cash levels, FMS investors bought equities, commodities, RoW equities, banks & energy; sold bonds, real estate, US equities, utilities & staples.

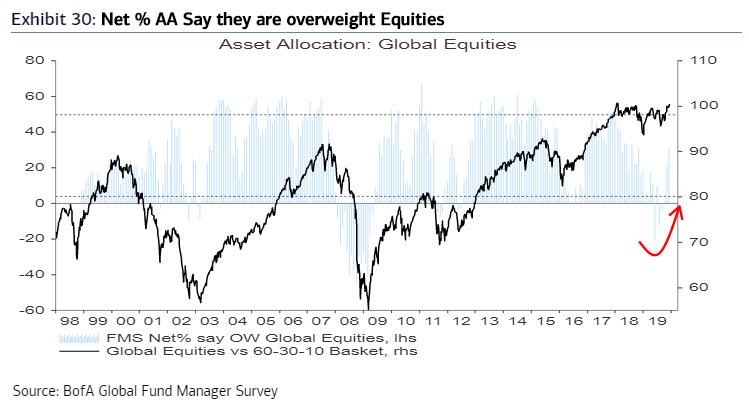

As a result of this newfound euphoria, allocation to global equities jumps 10ppt month-on-month to net 31% overweight, the highest level in one year. Meanwhile, as they rushed into stocks, the allocation to bonds continues to tick down, this month falling 1ppt to net 48% underweight, the most underweight in over a year.

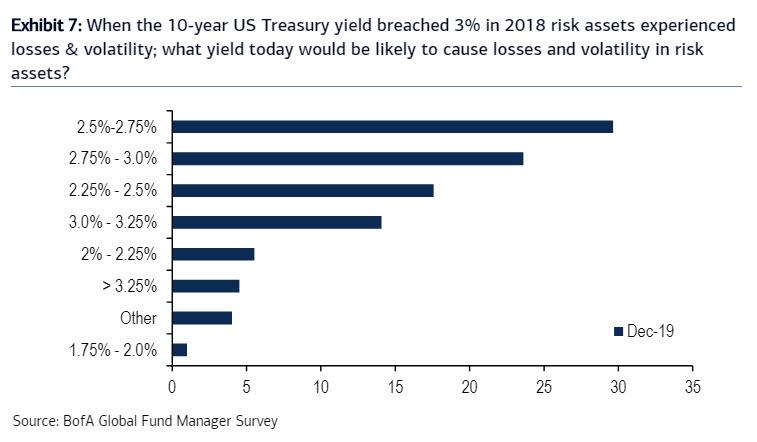

Finally, what will dent sentiments, or end the rally? According to survey, the 10Y TSY can rise a further 84bp, to 2.71%…

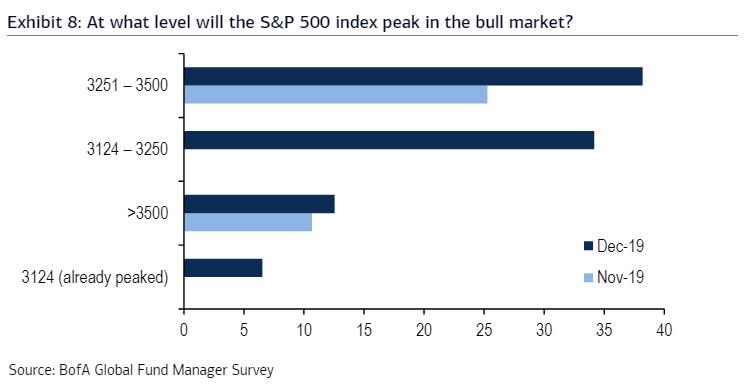

… before causing losses and volatility in risk assets, while consensus now expects the S&P500 to peak at 3,322, up from 3,022 in Dec 2018, and the highest since the question was first asked in Jun’18.

So all in all, an amazing reversal in sentiment. How did we get here? Simple: the answer in one chart, and confirming that what Pozsar expected, namely QE4, has effectively taken place with the Fed’s balance sheet set to surge by almost $1 trillion in just four months, rising to a new all time high as soon as mid-January.

Finally, how long does this go on for? Here is the conclusion from Michael Hartnett:

- FMS investors bullish until global PMI peaks at >55, or GT10 >2.7% pops bond bubble.

and

- FMS bear risk for 2020 is unexpected outcome of upcoming US presidential election.

In other words, it appears that neither Trump, not Powell, will allow the S&P to dip even modestly before November. After that, however, all hell breaks loose.

Tyler Durden

Tue, 12/17/2019 – 12:24

via ZeroHedge News https://ift.tt/2M1NXkr Tyler Durden