Dick Bove Has “A Simple Theory” Why Surging Stocks Are “Not Likely To Stop Soon”

Authored by Odeon Capital’s Dick Bove

I have a very simple theory related to the growth in stock prices which has been discussed here before. As I see it:

-

There are a number of shares in the equity markets; and

-

A number of dollars available to buy those shares.

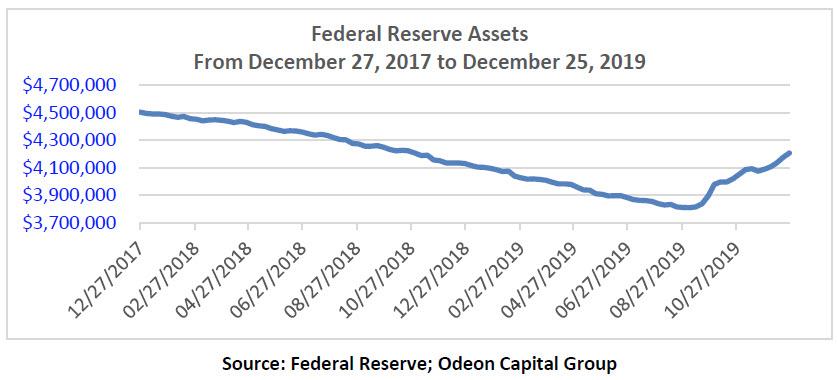

When dollar growth outpaces the growth in shares, the value of shares goes up. When share growth increases faster than the available dollars share values go down. Presently, the Federal Reserve is aggressively increasing the number of dollars available. The assets of the Federal Reserve are up approximately 10.3% in the past three months – an annualized rate exceeding 40%.

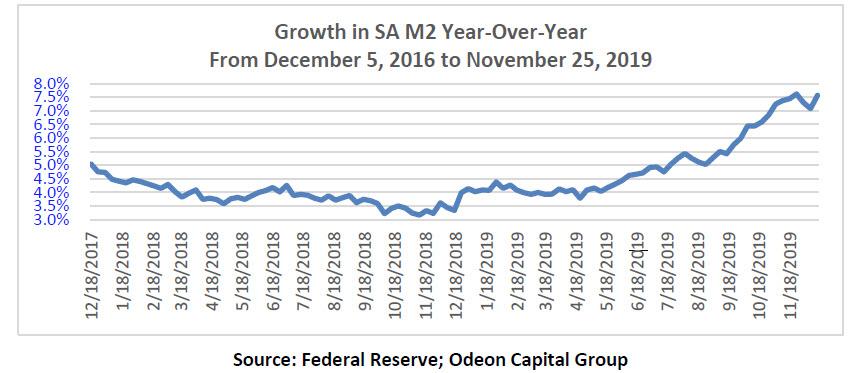

Consequently, M2 growth y-o-y which was growing at 3.2% in November 2018, is now growing at 7.6% y-o-y. The economy is not growing rapidly enough to absorb this growth and the competition from the money and bond markets, domestically and overseas, is not compelling.

I do not have accurate numbers for the number of shares outstanding but press reports suggest that there has been a slowing in the number of new offerings while share buyback programs remain relatively strong.

Money supply is expanding at above average rates and share growth is not. Consequently, share values are expanding — not likely to stop soon.

Tyler Durden

Mon, 12/30/2019 – 14:50

via ZeroHedge News https://ift.tt/2MGV9mB Tyler Durden