It Was A Dismal Year For Hedge Funds: Here Are 2019’s Fund Closures And Family-Office Conversions

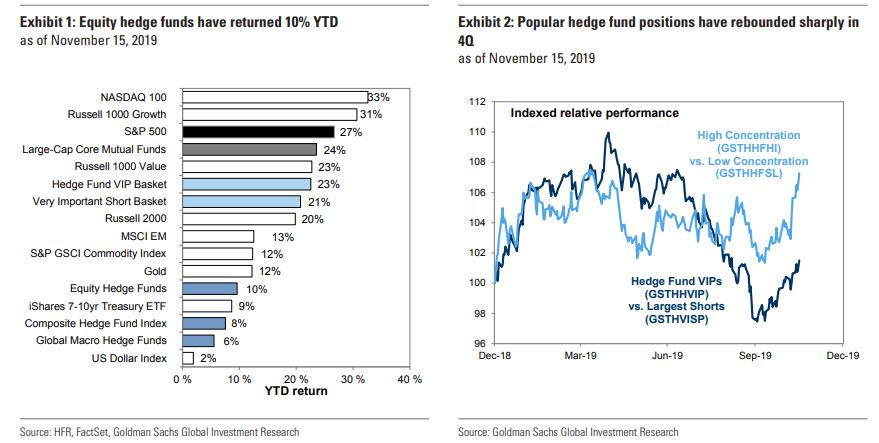

All things considered, it wasn’t a terrible year for hedge funds who unlike 2018, when the average hedge fund was down almost double digits on the year, are up roughly 10% YTD according to the latest Goldman hedge Fund Trend monitor…

… and Bloomberg Equity Hedge Fund index.

The only problem is that when compared to the broader market, which is up over 28% YTD, its best year since 2013, hedge funds are once again substantially underperforming what over the past ten years has emerged as a risk-free benchmark (courtesy of central banks that step in any time there is even a modest drop). And since hedge fund investors get to pay roughly 2 and 20 (in reality, more like 1 and 12) for the privilege of failing to keep up with the free S&P500 for the 10th consecutive year (coincidentally, ever since the DOJ busted the “expert network” insider trading scheme in 2010) they are not happy.

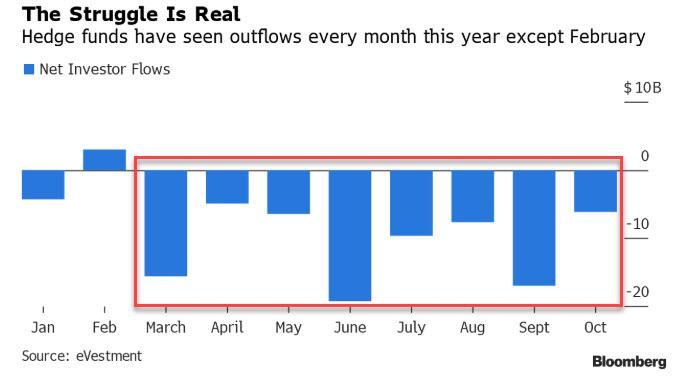

The result is that according to eVestment, through October hedge fund managers suffered a record eighth straight months of client redemptions, the longest stretch of withdrawals since the 2008 financial crisis.

There was a glimmer of good news in November, when this dismal trend reversed and investors allocated $4.45 billion to the industry, easing industry fears that hedge fund outflows would match or surpass the $112 billion that was pulled from the industry in 2016, even though the November 2019 year to date outflows of $81.53 billion – more than twice the amount pulled for the whole of 2018 – were still a shock.

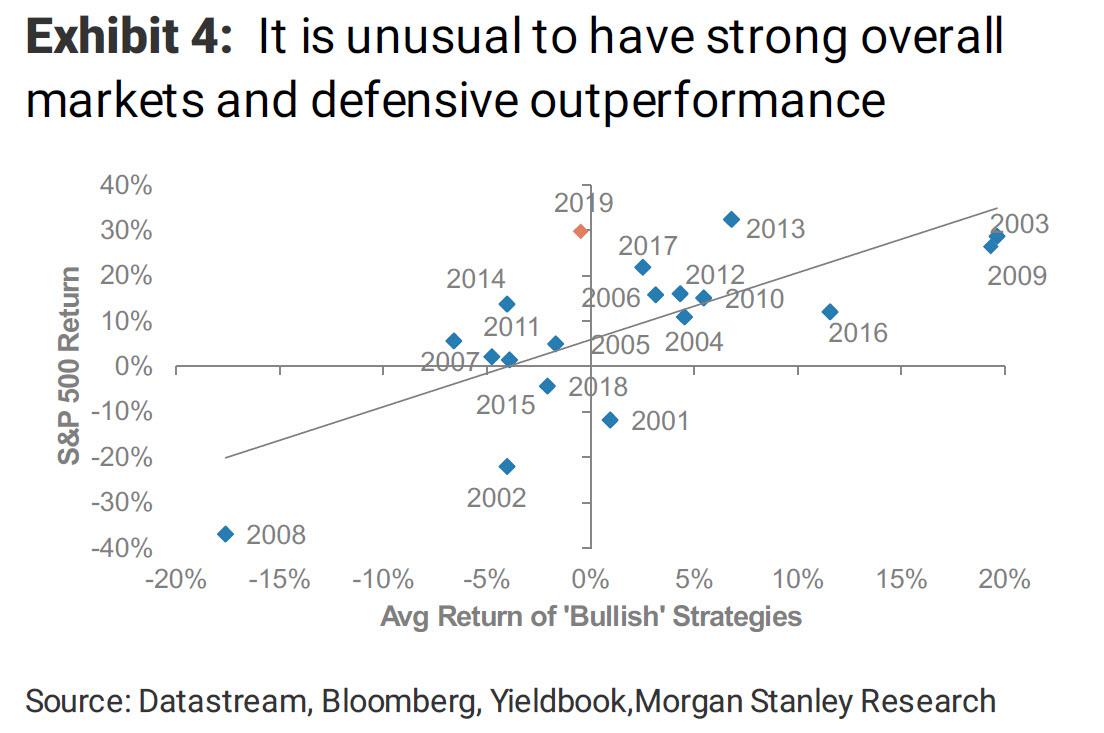

One possible explanation for this striking underperformance is that despite one of the best returns in the S&P in history, bullish strategies – defined as the average of four “bullish” strategies: Cyclical vs. defensive equities, small vs. large cap equities, high yield vs. investment grade (total return), and BBs vs. CCCs (excess return) – actually generated a negative return for the year…

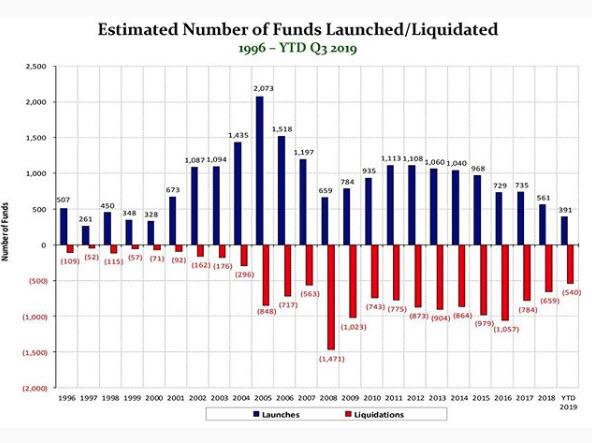

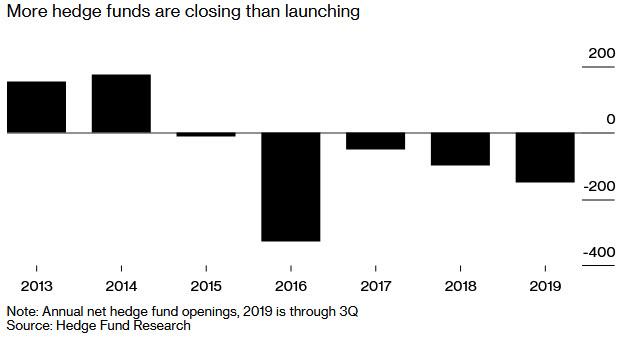

… which whiplashed virtually all hedge funds resulting in the biggest equity outflows on record, and the fewest hedge fund launches since the start of the Millennium.

Confirming the ongoing revulsion toward highly paid active management, Bloomberg notes that the hedge fund industry continues to contract, and is now on track to record more closures than launches for a fifth straight year, a blow to a market that once minted millionaires at a heady pace. More than 4,000 hedge funds have been liquidated in the past five years, according to data compiled by Hedge Fund Research Inc.

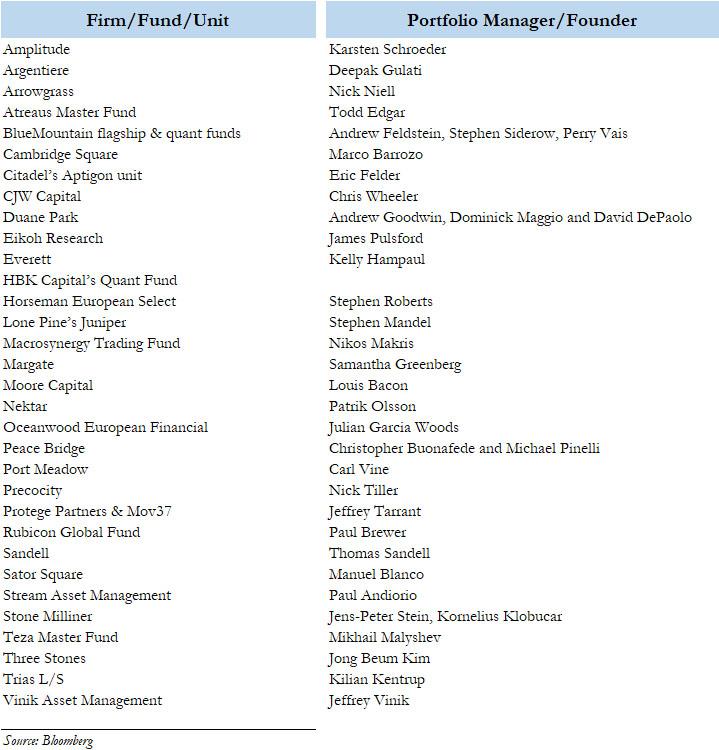

As a result, 2019 saw even more formerly iconic hedge fund names throw in the towel, and as Bloomberg recaps, billionaires Louis Bacon and Jeffrey Vinik were among the many HF veterans who stunned the $3.2 trillion industry this year by handing back capital to clients. Many found themselves out of step with the longest running bull market in history, while others faced investor revolt or couldn’t raise enough to stay in the game. Some had just been doing it for too long, and wanted out.

So, courtesy of Bloomberg, here is a list of some of the more prominent hedge funds that either closed, or returned outside capital and converted to a family office.

Tyler Durden

Tue, 12/31/2019 – 15:00

via ZeroHedge News https://ift.tt/36hVrrO Tyler Durden