The Price Of Year-End Market Stability: $414 Billion

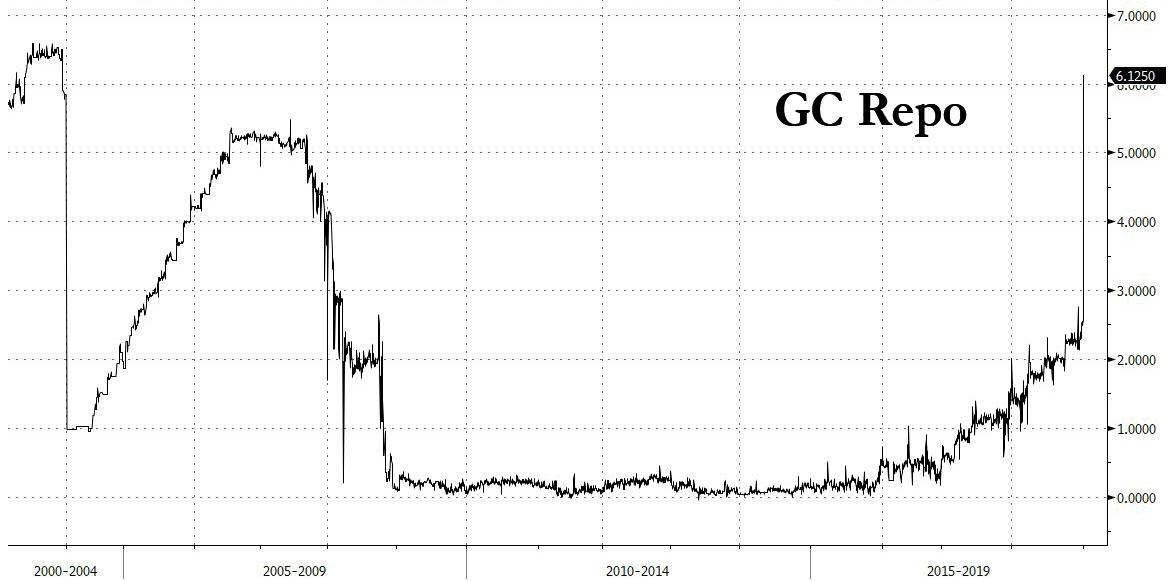

One year ago today, when only a handful of market insiders were aware such a thing as the repo market exists (and even fewer were worried about how broken it would soon become), something unexpected happened: as we reported on January 1, 2019, the closing print of the overnight general collateral rate exploded to 6.125%, the highest GC repo rate observed since January 2001, and roughly 400 bps higher than the Fed funds rate.

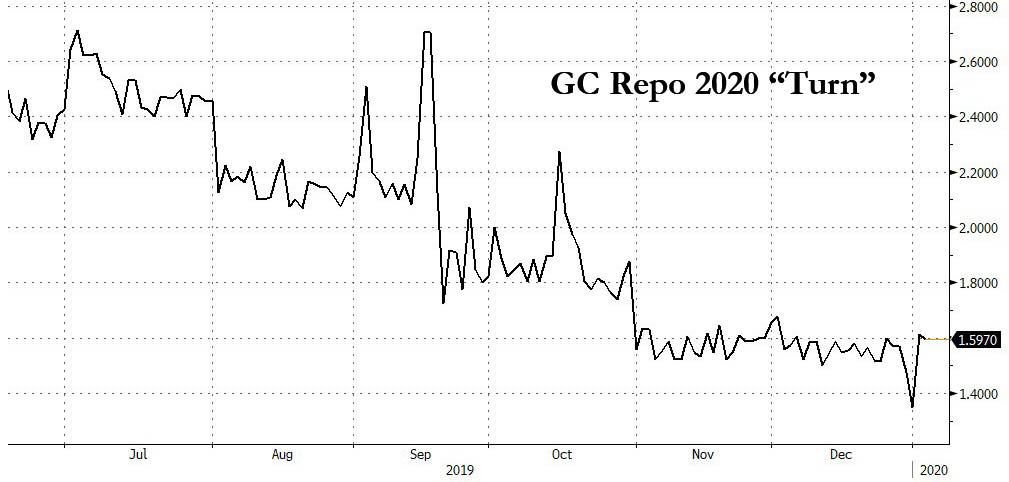

Of course fast forward about 9-10 months later, and suddenly everyone had become an expert, and – in the aftermath of the Zoltan Pozsar report predicting year-end fire and brimstone in the repo market, which could eventually culminate with a market crash and QE4 – everyone was squarely focused on whether the year-end repo print this year would replicate what was observed a year ago. It did not, and in fact, the last day of the year saw the O/N general collateral rate tumble as low as 1.35%!

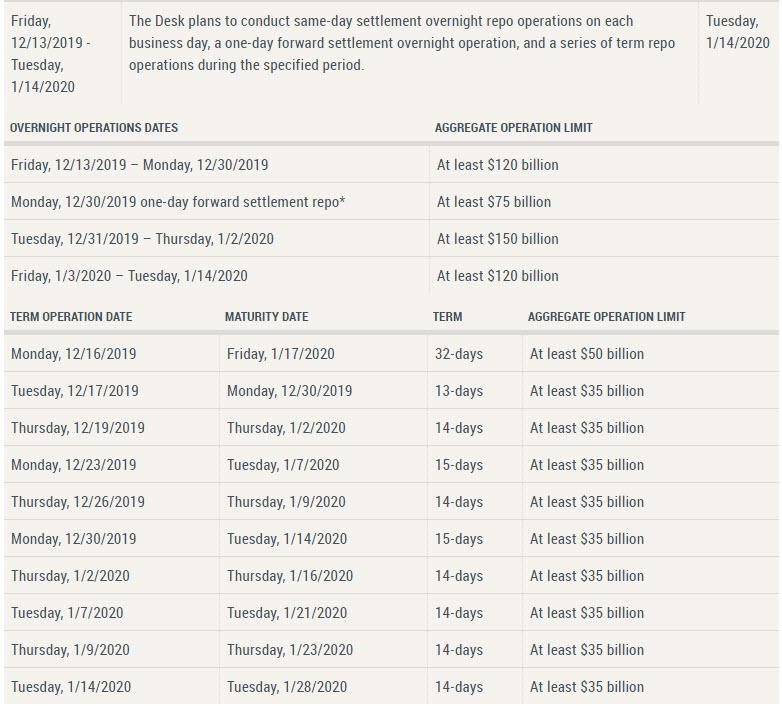

What happened? Simple: as we first reported on Dec 13 in “Massive… Huge… Largest Ever”: Fed Will Flood Market With Gargantuan $500 Billion In Liquidity To Avoid Year-End Repo Crisis“, perhaps spooked by Pozsar’s dire warning, the Fed unveiled a kitchen sink liquidity injection-cum-backstop, in which the central bank unleashed an unprecedented year-end liquidity barrage amounting to as much as $500 billion over a one month period from mid-December to mid-January, all in the hopes of preventing the repo crisis that shook the world most recently in September, and before that, on Dec 31, 2018.

And while the Fed may have avoided crossing the threshold from “NOT QE” to “QE4” (which merely depends on whether the Fed will monetize coupon bonds in addition to just T-Bills), the effective impact of its liquidity backstop was virtually identical, and prevent a year-end, and decade-end, repo market freakout.

Commenting on the repo market action, BMO’s Jon Hill writes this morning that “the short takeaway is that secured markets were tame, in no small part due to the massive scale of the central bank’s liquidity operations.”

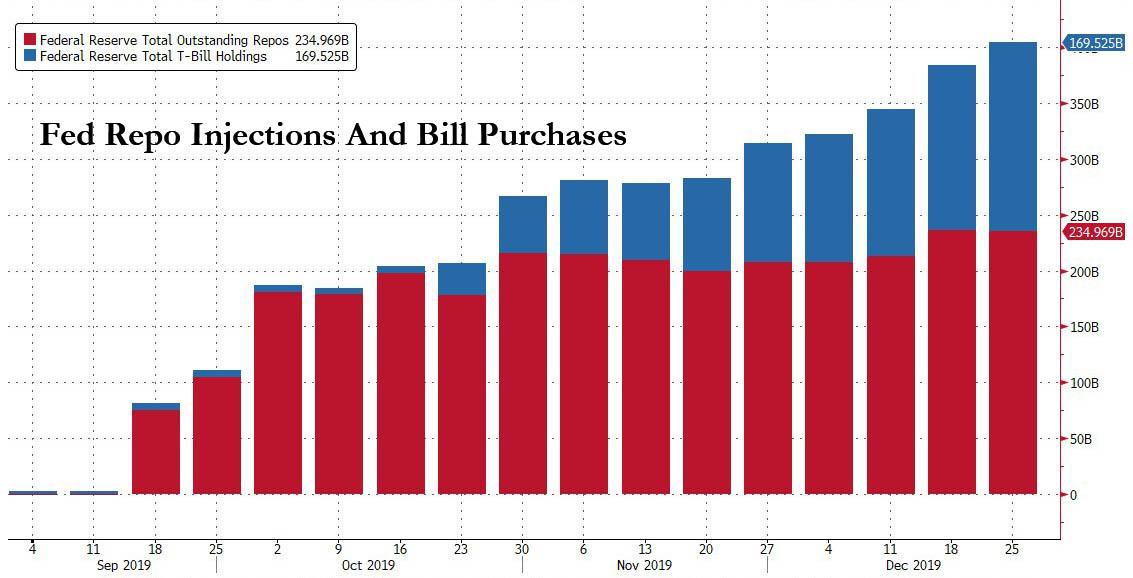

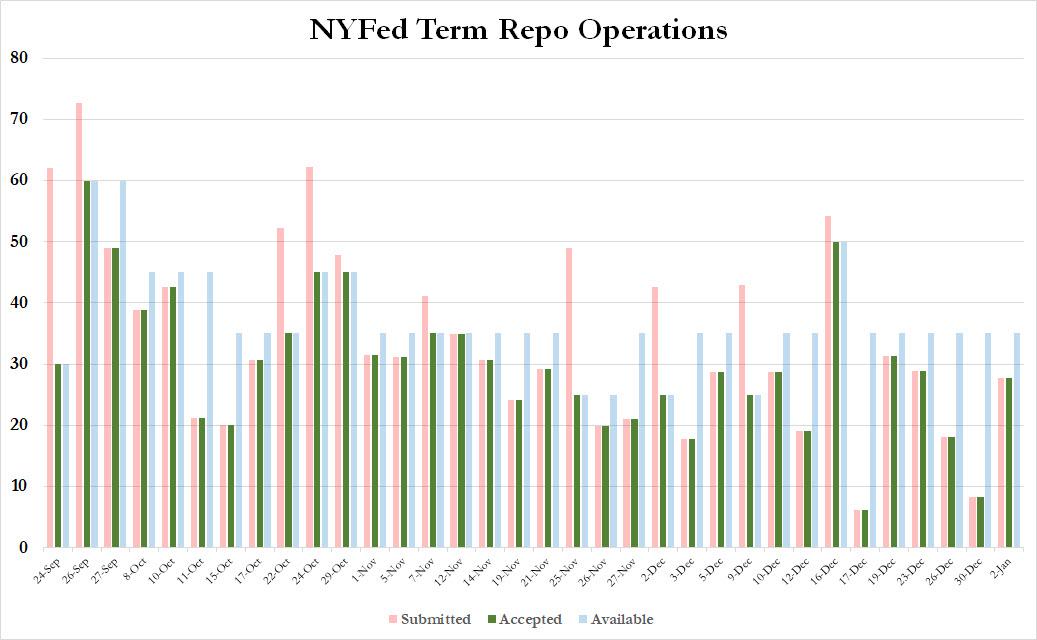

What was the price tag for this market “calm”? Just about $414 billion, which as Hill notes was the scope of the Fed’s footprint in the front-end: $256 billion in repo injections ($211.4 term and $44.3 in overnight) and $157.5 bn in Bill purchases. A rough approximation of this is shown in the chart below, which shows the Fed’s repo injections (both overnight and term) and “NOT QE” T-Bill purchases since the mid-September repo market freakout.

Meanwihle, even as tear-end passed, today the Fed still added $56.7 billion of liquidity to the Repo market, as a result of $29 billion of overnight RP operations and $27.7 billion in two-week term repo ops, and as Curvature’s Scott Skyrm writes “customer cash is filtering back into the market over the next few days, so most Fed ops going forward are more convenience than to prevent a real liquidity shortage.”

The bottom line: the repo market hurricane failed to make landfall on Dec 31, and all it cost was just over $410 billion in liquidity injections and debt monetizations.

That’s the good news. The bad news is that the Fed will now somehow have to withdraw some of this liquidity (not all, as NOT QE is here to stay until at least Q2, which is why last week Morgan Stanley wrote that it sees “Melt-Up Lasting Until April, After Which Markets Will “Confront World With No Fed Support“). Yet the Fed’s repo operations, which as of today amount to roughly $256 billion, will start getting unwound over the next few days and week, and absent another (JPMorgan catalyzed) crisis, may shrink back to zero by early/mid February even as liquidity from T-Bill monetizations slowly takes their place. The question is how will the market react as tens of billions in term repos mature in the next few weeks, and the liquidity is not rolled over.

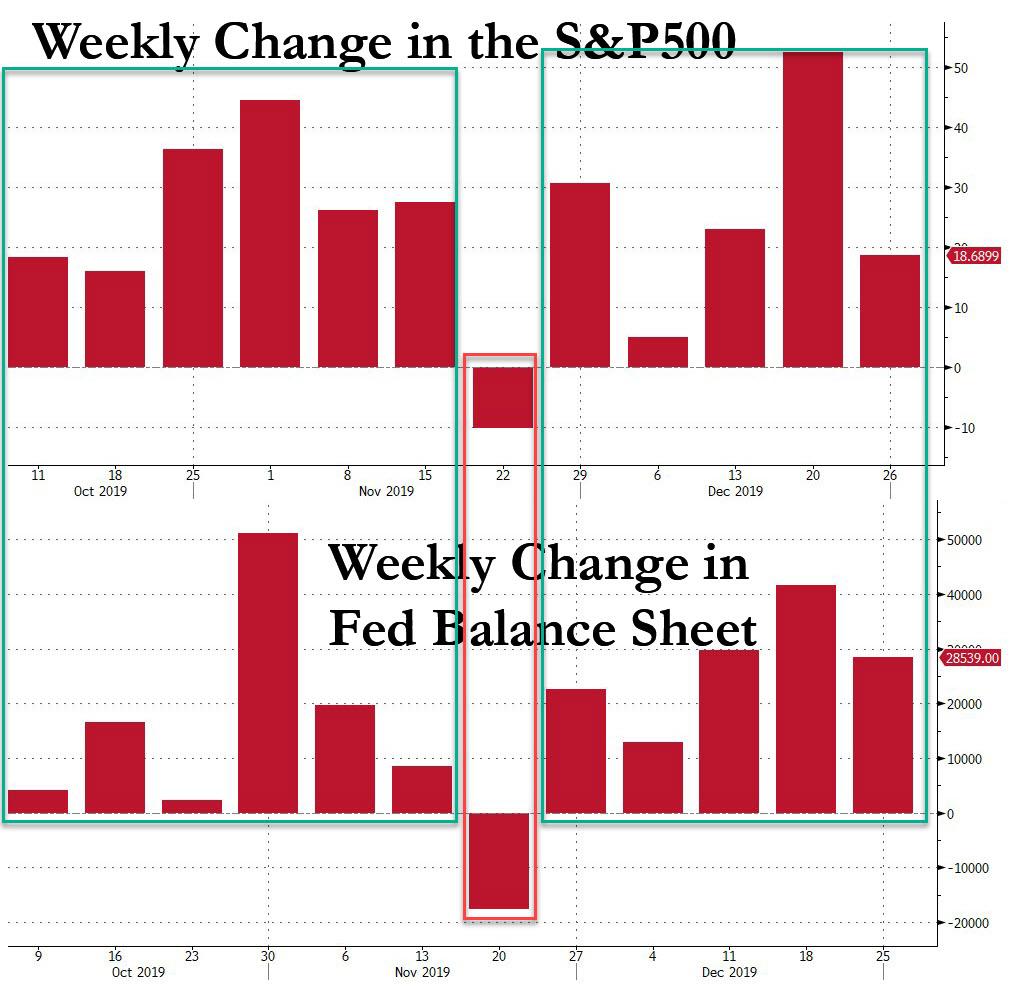

One thing is certain: the Fed’s balance sheet explosion helped boost the stock market such that every week since the start of October, any time the Fed’s balance sheet rose, so did the S&P and vice versa, as we have shown repeatedly:

Will the imminent contraction in the Fed’s balance sheet as repos start unwinding, be the catalyst that finally forces the melt up to break? We will find out in the next few weeks.

Tyler Durden

Thu, 01/02/2020 – 15:53

via ZeroHedge News https://ift.tt/37FCvDR Tyler Durden