AAPL’s Market Cap Increase Today Was Bigger Than The Entire Market Cap Of 300 S&P500 Companies

AAPL stock roared 2.4% higher today – exactly a year after the company pre-announced earnings downgrades…

Source: Bloomberg

Today was AAPL’s best day since Nov 1st…

…and the stock is now its most overbought since Sept 2018…

Source: Bloomberg

Since pre-announcing the lowered earnings expectations AAPL has added an incomprehensible $660 billion in market cap (adding over a stunning $31 billion in market capitalization today alone)…

Source: Bloomberg

That is more market cap added today than the total market cap of 300 S&P 500 companies…

- Zimmer Biomet Holdings, Inc. 30,787

- The Hershey Company 30,707

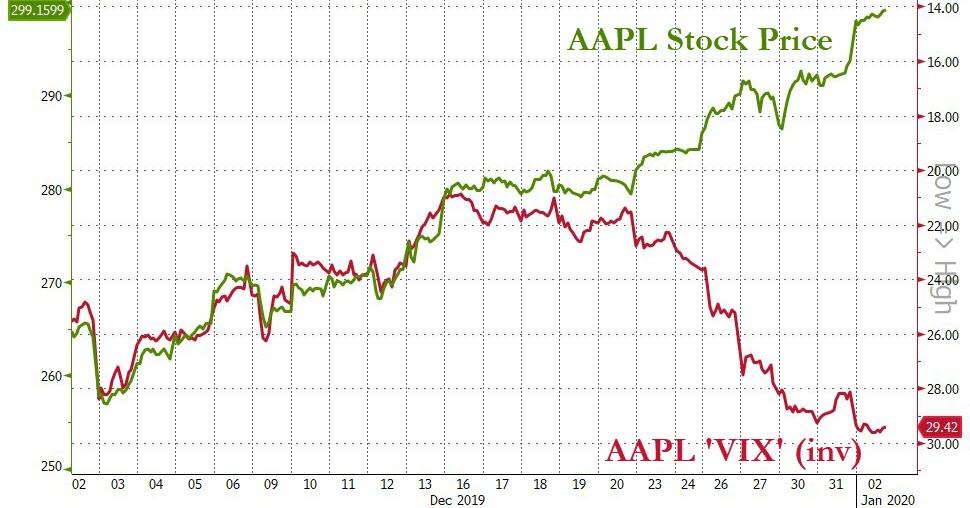

- Paychex, Inc. 30,484

- YUM! Brands, Inc. 30,467

- IHS Markit Ltd. 30,214

- Consolidated Edison, Inc. 30,075

- Equity Residential 30,050

- TransDigm Group Incorporated 29,987

- IQVIA Holdings Inc. 29,981

- Public Service Enterprise Group Incorporated 29,863

- HP Inc. 29,863

- eBay Inc. 29,376

- AvalonBay Communities, Inc. 29,222

- WEC Energy Group, Inc. 29,093

- State Street Corporation 28,763

- The Williams Companies, Inc. 28,750

- Republic Services, Inc. 28,605

- T. Rowe Price Group, Inc. 28,471

- Southwest Airlines Co. 28,408

- KLA Corporation 28,114

- AutoZone, Inc. 28,106

- Royal Caribbean Cruises Ltd. 27,988

- Cintas Corporation 27,904

- Motorola Solutions, Inc. 27,609

- Eversource Energy 27,542

- PACCAR Inc 27,359

- SBA Communications Corporation 27,136

- Cummins Inc. 27,077

- Edison International 27,042

- Discover Financial Services 26,588

- Agilent Technologies, Inc. 26,462

- Parker-Hannifin Corporation 26,441

- FirstEnergy Corp. 26,259

- Centene Corporation 26,015

- Willis Towers Watson Public Limited Company 25,964

- ViacomCBS Inc. 25,962

- PPL Corporation 25,942

- Archer-Daniels-Midland Company 25,802

- Fortive Corporation 25,652

- Stanley Black & Decker, Inc. 25,194

- Pioneer Natural Resources Company 25,074

- Microchip Technology Incorporated 25,026

- Digital Realty Trust, Inc. 24,992

- FleetCor Technologies, Inc. 24,969

- DTE Energy Company 24,949

- McKesson Corporation 24,924

- Twitter, Inc. 24,834

- Xilinx, Inc. 24,586

- Verisk Analytics, Inc. 24,472

- Aptiv PLC 24,245

- Hormel Foods Corporation 24,122

- Realty Income Corporation 23,997

- Alexion Pharmaceuticals, Inc. 23,933

- Entergy Corporation 23,852

- Kellogg Company 23,590

- Rockwell Automation, Inc. 23,479

- Synchrony Financial 23,269

- Chipotle Mexican Grill, Inc. 23,268

- The Kroger Co. 23,209

- Cerner Corporation 23,052

- Fox Corporation 22,830

- AMETEK, Inc. 22,800

- Best Buy Co., Inc. 22,721

- VeriSign, Inc. 22,622

- McCormick & Company, Incorporated 22,572

- Northern Trust Corporation 22,510

- Weyerhaeuser Company 22,503

- M&T Bank Corporation 22,403

- IDEXX Laboratories, Inc. 22,400

- Corning Incorporated 22,389

- United Airlines Holdings, Inc. 22,291

- ResMed Inc. 22,283

- Dollar Tree, Inc. 22,258

- American Water Works Company, Inc. 22,208

- Corteva, Inc. 22,123

- ANSYS, Inc. 22,030

- Align Technology, Inc. 21,992

- The Hartford Financial Services Group, Inc. 21,903

- Discovery, Inc. 21,894

- MSCI Inc. 21,870

- Fifth Third Bancorp 21,815

- Ventas, Inc. 21,522

- Halliburton Company 21,480

- Boston Properties, Inc. 21,316

- Fastenal Company 21,192

- Ball Corporation 21,156

- Copart, Inc. 21,139

- Ameriprise Financial, Inc. 21,105

- Synopsys, Inc. 20,955

- Skyworks Solutions, Inc. 20,595

- CDW Corporation 20,523

- Hewlett Packard Enterprise Company 20,506

- Hess Corporation 20,357

- CBRE Group, Inc. 20,077

- KeyCorp 19,936

- Essex Property Trust, Inc. 19,881

- First Republic Bank 19,793

- Cadence Design Systems, Inc. 19,462

- D.R. Horton, Inc. 19,456

- Keysight Technologies, Inc. 19,340

- Mettler-Toledo International Inc. 19,320

- The Clorox Company 19,270

- Vulcan Materials Company 19,058

- Freeport-McMoRan Inc. 19,036

- Ameren Corporation 18,895

- Western Digital Corporation 18,876

- Incyte Corporation 18,809

- Alexandria Real Estate Equities, Inc. 18,606

- DISH Network Corporation 18,547

- Garmin Ltd. 18,546

- Fortinet, Inc. 18,260

- W.W. Grainger, Inc. 18,235

- International Paper Company 18,057

- CMS Energy Corporation 17,835

- Arthur J. Gallagher & Co. 17,763

- Citizens Financial Group, Inc. 17,654

- Omnicom Group Inc. 17,641

- Nasdaq, Inc. 17,555

- AmerisourceBergen Corporation 17,508

- Martin Marietta Materials, Inc. 17,478

- Concho Resources Inc. 17,467

- Teleflex Incorporated 17,428

- Amcor plc 17,375

- Lennar Corporation 17,302

- Church & Dwight Co., Inc. 17,262

- Cincinnati Financial Corporation 17,179

- MGM Resorts International 17,134

- Nucor Corporation 17,065

- Healthpeak Properties, Inc. 17,061

- Equifax Inc. 16,966

- Dover Corporation 16,743

- Conagra Brands, Inc. 16,663

- Baker Hughes Company 16,656

- Maxim Integrated Products, Inc. 16,645

- WellCare Health Plans, Inc. 16,619

- Regions Financial Corporation 16,553

- Laboratory Corporation of America Holdings 16,426

- Tiffany & Co. 16,036

- NortonLifeLock Inc. 15,905

- The Cooper Companies, Inc. 15,763

- Expedia Group, Inc. 15,668

- Seagate Technology plc 15,631

- Loews Corporation 15,613

- Huntington Bancshares Incorporated 15,574

- Arista Networks, Inc. 15,540

- Genuine Parts Company 15,435

- Principal Financial Group, Inc. 15,272

- Kansas City Southern 15,181

- Old Dominion Freight Line, Inc. 15,149

- Live Nation Entertainment, Inc. 15,061

- Waters Corporation 15,055

- Mid-America Apartment Communities, Inc. 15,041

- Wabtec Corporation 14,913

- Campbell Soup Company 14,908

- Diamondback Energy, Inc. 14,899

- Celanese Corporation 14,882

- Wynn Resorts, Limited 14,835

- Evergy, Inc. 14,834

- Cardinal Health, Inc. 14,794

- Ulta Beauty, Inc. 14,470

- Hasbro, Inc. 14,452

- Citrix Systems, Inc. 14,441

- CenturyLink, Inc. 14,402

- Quest Diagnostics Incorporated 14,384

- MarketAxess Holdings Inc. 14,377

- CarMax, Inc. 14,360

- NetApp, Inc. 14,207

- Xylem Inc. 14,188

- Broadridge Financial Solutions, Inc. 14,163

- NVR, Inc. 14,072

- Akamai Technologies, Inc. 13,959

- Leidos Holdings, Inc. 13,858

- Hologic, Inc. 13,828

- Gartner, Inc. 13,785

- International Flavors & Fragrances Inc. 13,776

- Zebra Technologies Corporation 13,774

- CenterPoint Energy, Inc. 13,696

- UDR, Inc. 13,686

- Extra Space Storage Inc. 13,679

- Atmos Energy Corporation 13,676

- Qorvo, Inc. 13,503

- Darden Restaurants, Inc. 13,365

- Arconic Inc. 13,322

- Host Hotels & Resorts, Inc. 13,304

- Cboe Global Markets, Inc. 13,293

- Expeditors International of Washington, Inc. 13,287

- Masco Corporation 13,284

- The AES Corporation 13,212

- Alliant Energy Corporation 13,152

- Take-Two Interactive Software, Inc. 13,134

- IDEX Corporation 13,082

- Franklin Resources, Inc. 12,968

- SVB Financial Group 12,946

- FMC Corporation 12,938

- STERIS plc 12,923

- Varian Medical Systems, Inc. 12,910

- Duke Realty Corporation 12,744

- W. R. Berkley Corporation 12,692

- Vornado Realty Trust 12,692

- DENTSPLY SIRONA Inc. 12,586

- Lamb Weston Holdings, Inc. 12,566

- Universal Health Services, Inc. 12,564

- American Airlines Group Inc. 12,564

- United Rentals, Inc. 12,534

- J.B. Hunt Transport Services, Inc. 12,446

- Norwegian Cruise Line Holdings Ltd. 12,427

- Raymond James Financial, Inc. 12,410

- Jacobs Engineering Group Inc. 11,970

- Noble Energy, Inc. 11,881

- The J. M. Smucker Company 11,877

- Lincoln National Corporation 11,704

- Molson Coors Beverage Company 11,691

- Allegion plc 11,572

- Globe Life Inc. 11,397

- Everest Re Group, Ltd. 11,290

- The Western Union Company 11,228

- Jack Henry & Associates, Inc. 11,207

- WestRock Company 11,081

- Tractor Supply Company 11,062

- Advance Auto Parts, Inc. 11,027

- LKQ Corporation 10,941

- Avery Dennison Corporation 10,924

- Marathon Oil Corporation 10,863

- Rollins, Inc. 10,858

- PerkinElmer, Inc. 10,788

- Eastman Chemical Company 10,778

- C.H. Robinson Worldwide, Inc. 10,577

- Regency Centers Corporation 10,572

- Packaging Corporation of America 10,520

- PulteGroup, Inc. 10,515

- NiSource Inc. 10,400

- CF Industries Holdings, Inc. 10,380

- Mylan N.V. 10,374

- Comerica Incorporated 10,343

- Huntington Ingalls Industries, Inc. 10,261

- Textron Inc. 10,181

- E*TRADE Financial Corporation 10,160

- Pinnacle West Capital Corporation 10,109

- NRG Energy, Inc. 10,001

- Devon Energy Corporation 9,975

- Henry Schein, Inc. 9,791

- Mohawk Industries, Inc. 9,768

- Federal Realty Investment Trust 9,722

- National Oilwell Varco, Inc. 9,665

- DXC Technology Company 9,623

- Apache Corporation 9,623

- DaVita Inc. 9,612

- TechnipFMC plc 9,585

- Whirlpool Corporation 9,324

- Snap-on Incorporated 9,291

- Under Armour, Inc. 9,200

- Iron Mountain Incorporated 9,151

- Fortune Brands Home & Security, Inc. 9,092

- BorgWarner Inc. 8,958

- The Interpublic Group of Companies, Inc. 8,957

- Zions Bancorporation, National Association 8,851

- Ralph Lauren Corporation 8,747

- Kimco Realty Corporation 8,744

- Coty Inc. 8,526

- F5 Networks, Inc. 8,490

- News Corporation 8,394

- Alaska Air Group, Inc. 8,345

- Juniper Networks, Inc. 8,244

- The Mosaic Company 8,196

- Invesco Ltd. 8,161

- Newell Brands Inc. 8,138

- HollyFrontier Corporation 8,124

- Kohl’s Corporation 7,977

- Xerox Holdings Corporation 7,971

- Assurant, Inc. 7,948

- A. O. Smith Corporation 7,771

- Albemarle Corporation 7,745

- Pentair plc 7,710

- Abiomed, Inc. 7,703

- IPG Photonics Corporation 7,691

- Apartment Investment and Management Company 7,690

- PVH Corp. 7,672

- People’s United Financial, Inc. 7,498

- Tapestry, Inc. 7,442

- SL Green Realty Corp. 7,361

- Nielsen Holdings plc 7,223

- Robert Half International Inc. 7,202

- Cabot Oil & Gas Corporation 7,102

- Perrigo Company plc 7,031

- FLIR Systems, Inc. 6,985

- Leggett & Platt, Incorporated 6,689

- The Gap, Inc. 6,600

- Flowserve Corporation 6,513

- Nordstrom, Inc. 6,355

- Sealed Air Corporation 6,154

- Unum Group 6,015

- Quanta Services, Inc. 5,794

- Capri Holdings Limited 5,785

- Harley-Davidson, Inc. 5,668

- Hanesbrands Inc. 5,371

- Macy’s, Inc. 5,252

- Cimarex Energy Co. 5,250

- Alliance Data Systems Corporation 5,168

- L Brands, Inc. 5,010

- Helmerich & Payne, Inc. 4,927

- H&R Block, Inc. 4,584

So bulls must be hoping that Tim Cook downgrades earnings expectations again this quarter!!

And while it’s all shits and giggles for the bulls, we do note that AAPL’s volatility is rising…

Source: Bloomberg

Hedgers? Or leveraged longs panicking into the “can’t lose, won’t lose” stock?

Tyler Durden

Thu, 01/02/2020 – 16:26

via ZeroHedge News https://ift.tt/2MMAJsb Tyler Durden