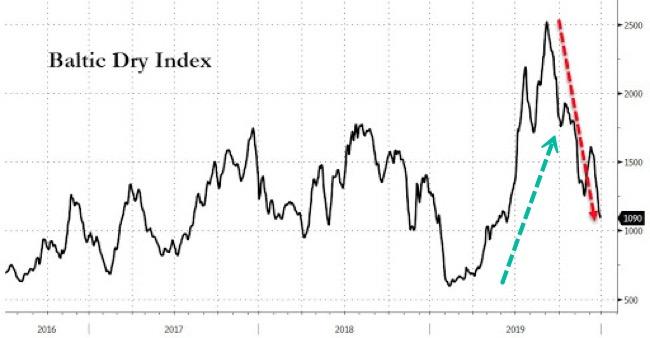

Baltic Index Has Worst Day In Six Years – Vessel Demand Sinks As Front-Loading Ends

The Baltic Dry Index (BDI), a composite of the Capesize, Panamax and Supramax time charter averages, recorded its most significant one-day percentage drop in six years, reported Reuters.

BDI was pressured 10.5% on Thursday thanks to waning demand for dry bulk vessels. It was the most significant one-day percentage drop since January 2014. The index fell 114 points to 976 points, the lowest print since May 2019.

“Some of it represents the fact that it is the first quoting for almost a week now. We expect a bit more softness to come around and we see … China as the main locomotive behind this,” Peter Sand, the chief shipping analyst at BIMCO, told Reuters.

It wasn;t just the headline Baltic Dry Index (h/t @JHannisdahl):

-

Capesize -16.47% to $11,976

-

Panamax -13.76% to $7,695

-

Supramax 58k tons -9.11% to $7,539

-

Handysize -9.21% to $6,410

“The market as such is not strong in a fundamental way,” Sand said, adding that the global economy will continue to weaken into 2020.

Slowing demand for bulk carriers could be due to the decline in firms’ front-loading goods ahead of tariff deadlines as trade resolutions have been found between the US and China.

Chinese firms and US importers rushed to ship goods to the US through 1Q19 to Septemeber as the US and China were engaged in a tit-for-tat trade war. The implementation of tariffs by both countries on billions of dollars in goods forced importers and exporters to increase outbound and inbound delivers before tariff deadlines went into effect.

As a result of trade policy change, demand for bulk carriers increased throughout the year, raising the Baltic index +318% from January to Septemeber. With a possible trade resolution and the need to front-load has subsided, the dry bulk index topped out in September and has plunged 61% in the last three months.

Front-loading also gave the economy a boost, but since that has ended, the US economy continues to decelerate into 2020.

The JP Morgan Global Manufacturing PMI printed at 50.1 in December, versus a 50.3 in November, suggesting a global slowdown will continue into 2020.

Plunging shipping rates and waning global manufacturing data signals the world has entered a period of low-growth, and the probability of a massive economic rebound in early 2020 is unlikely.

Tyler Durden

Thu, 01/02/2020 – 20:25

via ZeroHedge News https://ift.tt/2Qko5mL Tyler Durden