Commercial And Industrial Loan Growth Stalls Amid Manufacturing Recession

New Federal Reserve data shows commercial and industrial loan growth weakened in 2H19, an indication the industrial recession continues to plague the overall US economy.

C&I loans rose 1.6% in Dec. to $2.4 trillion, with most of the growth seen in the first half of the year. As for 2H19, no “green shoots” have yet materialized in industrials.

The Financial Times said commercial real estate lending marginally increased at smaller to mid-sized banks but dipped at larger ones.

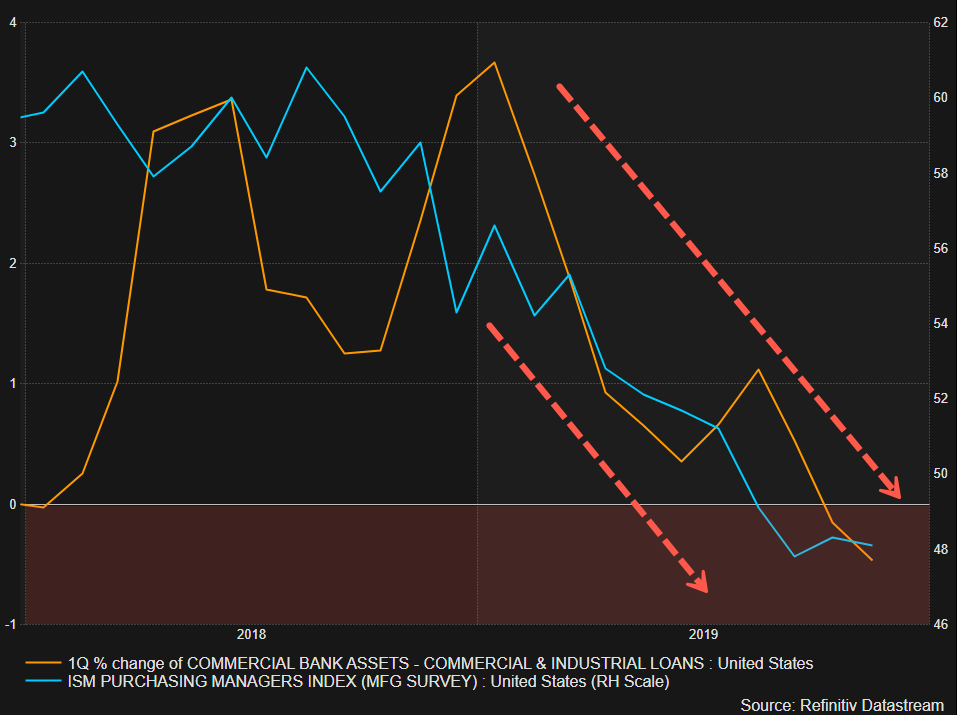

Decelerating C&I loan growth in 2019 is a direct result of an industrial recession that has been deepening in the back half of the year.

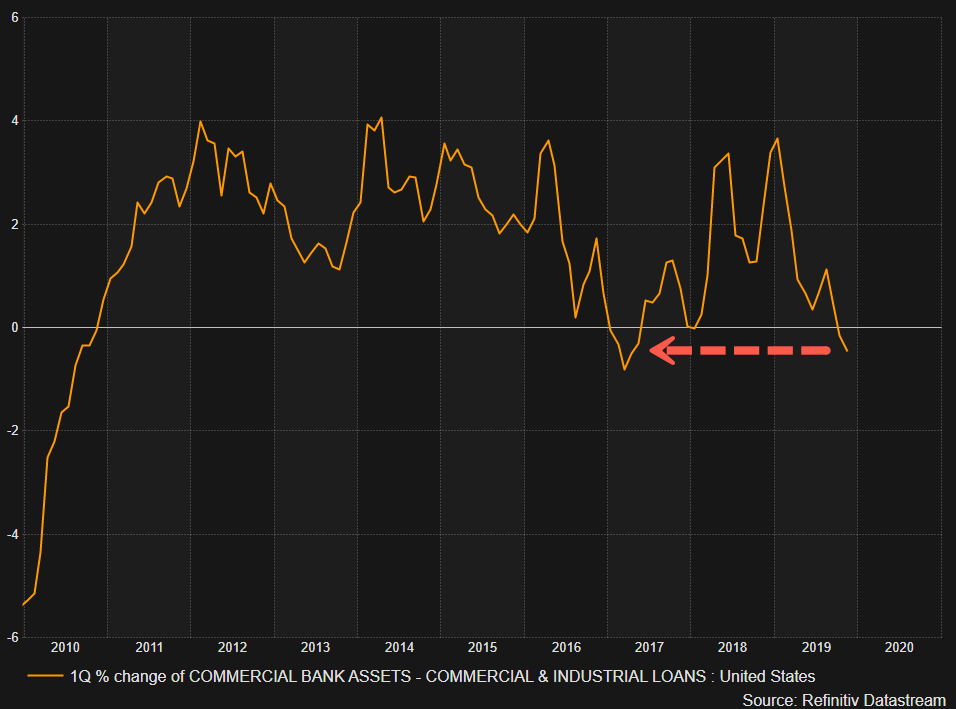

C&I loan growth quarterly quickly decelerated in 2019 and has dove recently into a contraction.

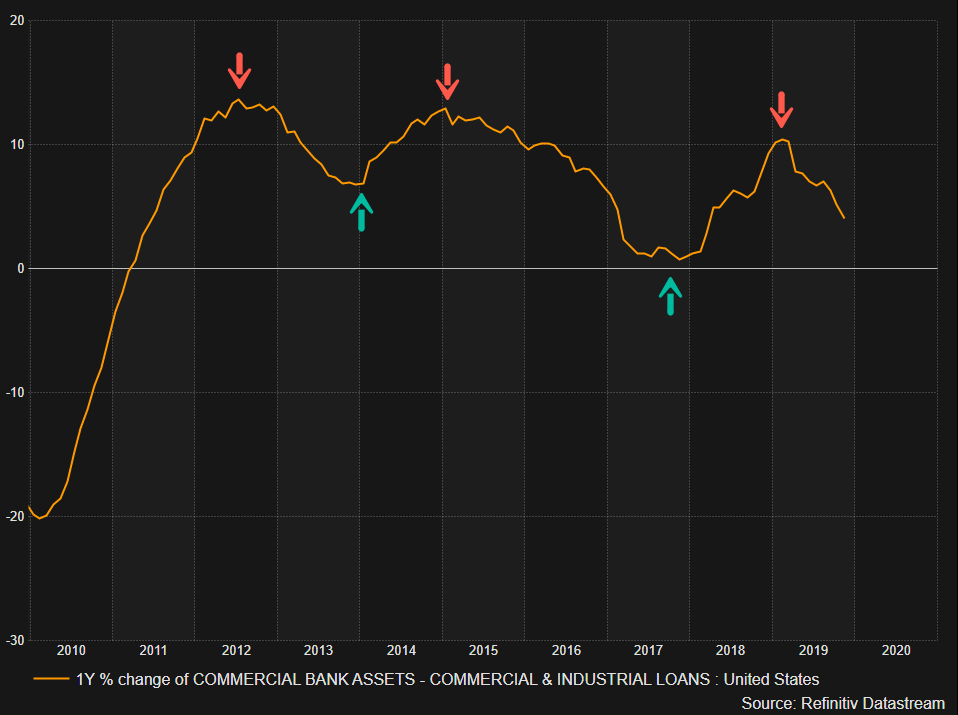

C&I loan growth yearly faded from a top in 4Q18 to levels that are considered stagnate in 4Q19.

Jennifer Piepszak, JPMorgan Chase’s CFO, said business confidence has perked up since a temporary trade war resolution was found in the fall, but uncertainty in an economic rebound remains.

“Trade would, of course, top the list there, but the elections in the US will contribute to an uncertain environment in 2020,” Piepszak said.

Refinitiv data shows that in 4Q19, capital expenditure by S&P 500 firms rose 1%, far from the 12% increase seen a year earlier – a clear sign that President Trump’s tax cut to boost the economy has been exhausted.

CapEx is the primary driver of C&I loans. Still, with massive uncertainty in the global economy and a domestic slowdown that has resulted in an industrial recession, C-suite executives chose to buy back their stock rather than build factories.

Brian Klock, a bank analyst at Keefe, Bruyette & Woods, said, “we’re just not seeing that big CapEx coming through,” and it could remain depressed in 2020.

So far this year, C&I loan growth at the largest 25 US banks has been underwhelming.

Brian Foran of Autonomous Research blamed the slowdown on the trade war.

Foran also said low demand for credit in the oil and gas space was another significant contributor to the slowdown.

With CapEx spending unlikely to significantly turn higher in the near term, forcing C&I loan growth lower amid an industrial recession — the damage to the US economy has likely been seen. It could result in a low growth period in 2020.

Tyler Durden

Thu, 01/02/2020 – 21:05

via ZeroHedge News https://ift.tt/2rNT0OE Tyler Durden