Repo Panic Returns As Fed Injects $99BN In Liquidity, Including First Oversubscribed Term Repo In Three Weeks

And just like that, the repo market is on the fritz once again.

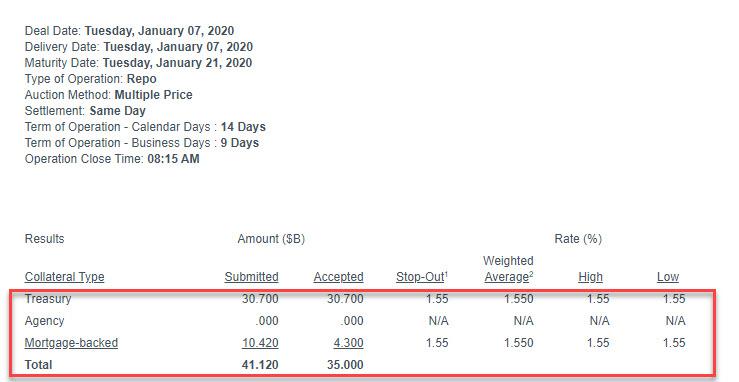

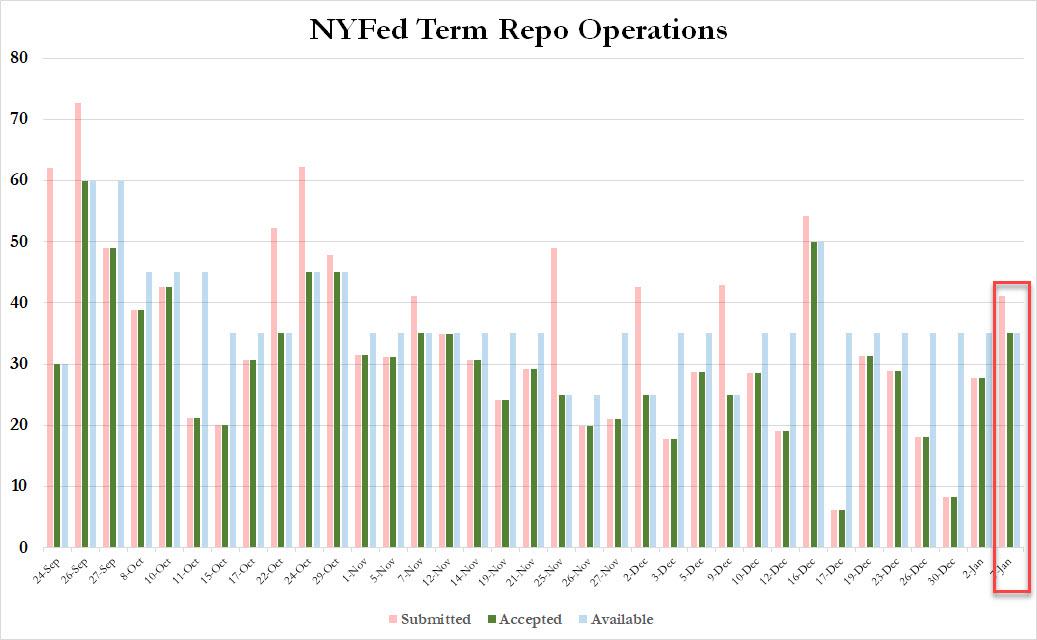

More than two weeks after the last oversubscribed term repo operation on December 16, moments ago the Fed announced that Dealers are once again scrambling for liquidity, submitting $41.12BN in securities ($30.7BN in TSYs, $10.42BN in MBS) into today’s 2-week repo operation, which was oversubscribed hitting the maximum operation limit of $35BN.

Today’s oversubscription was ominous because while the liquidity shortage into year-end was expected, and justified the barrage of term repos ahead of the “turn”, the liquidity shortage was supposed to normalize after the new year. Alas, that appears to not have happened, and today’s submission was the highest since Dec 16.

One reason for today’s repo spike is that as we noted last Friday, this is the first week that sees substantial term repo maturities and liquidity drainage, as follows:

- $25 billion leaves the market on Monday,

- $28.8 billion on Tuesday,

- $18 billion next Friday

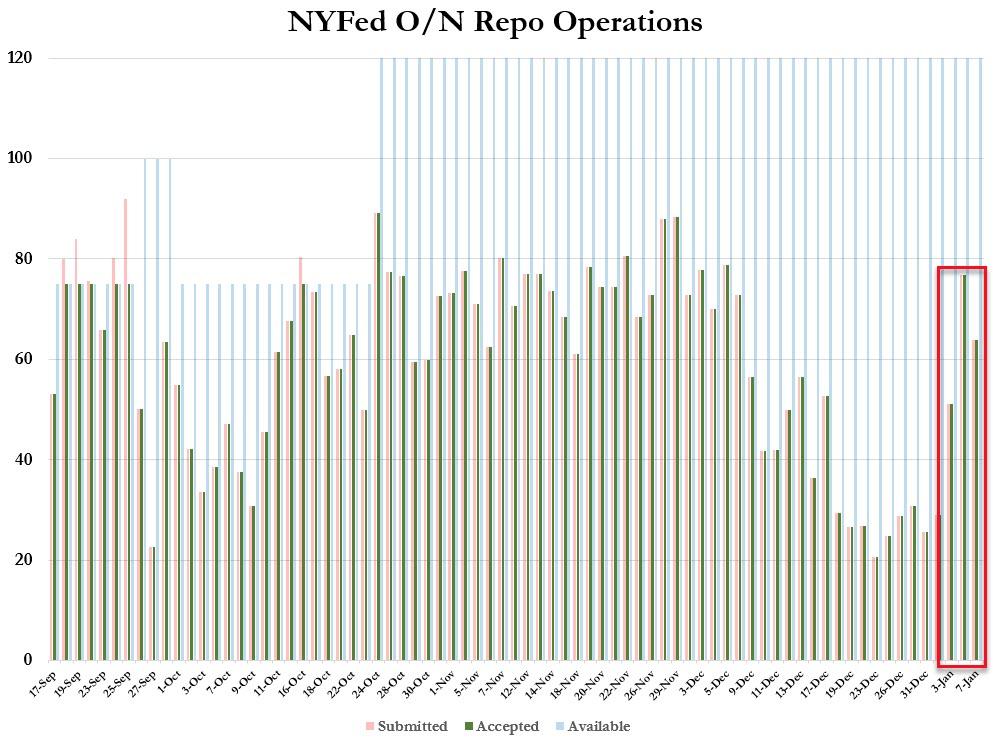

But wait there’s more: today’s oversubscribed term repo, coupled with yesterday’s overnight repo surge and this morning’s $63.919BN overnight repo …

… means the Fed just injected a total of $99BN to keep the levitation party going, and confirms that the repo market remains paralyzed.

Worse, any attempts to drain liquidity from the repo market, or generally slow down the shrinkage of the balance sheet, will be met with failure. It is also another indication that the repo market now holds the Fed hostage, with Powell now trapped in not only injecting liquidity via QE4, i.e., the monetization of T-Bills, but continued reliance on repos in the $250BN range.

Of course, should the Fed threaten to pull even a bit more liquidity than the market is comfortable sacrificing, and stocks get it. The flip side too: as long as the Fed keeps growing the balance sheet at a rate of about $100 billion per month, the market meltup will continue.

Tyler Durden

Tue, 01/07/2020 – 08:44

via ZeroHedge News https://ift.tt/2NiQWGb Tyler Durden