The “Real” Phillips Curve Is Not Flat

Submitted by Joseph Carson, former global director of economic research at AllianceBernstein

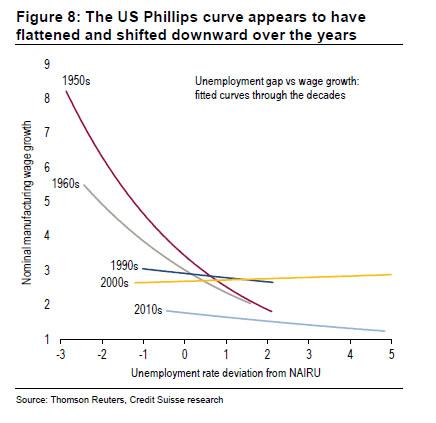

Jerome Powell, Chairman of the Federal Reserve, has stated that the relationship between unemployment and inflation “was a strong one 50 years ago…. and has gone away”. This relationship, called the Phillips Curve, now has disappeared according to the Fed view.

Contrary to Powell’s assertion, the ”real” Phillips curve is not flat, but the appearance of a “flatter” relationship between prices and wages is largely due to a technical change in the measurement of housing prices, the single most important item in the inflation index.

In 1998, the Bureau of Labor Statistics (BLS) made a technical change in the measurement of owner-occupied housing. Because of an inadequate and declining sample of owner-occupied housing, BLS statisticians felt the process was “time-consuming” and “futile” as it could no longer provide a consistent and accurate reading of housing costs from the owner-occupied units.

So the remedy, according to BLS, was to drop the owner-housing sample. They instead linked the price data from the rental market to owner-occupied market, even though the two markets are fundamentally separate.

At the time, there was little reaction or opposition from the technical change for the simple reason no one knew, perhaps even the statisticians at BLS, what the new measurement would eventually show in real time.

Yet, in hindsight, the impact of the change should have been obvious to all parties since the change involved replacing a house price series that accelerates during economic growth cycles with a rental series that does not. In reality, the technical change had the effect of “flattening” reported consumer price inflation.

Why is this important?

First, before declaring the Phillips curve relationship is gone, it is advisable to look at all of the factors that could be altering the relationship between prices and wages. Comparing inflation-to-inflation readings before and after 1998 is a non-starter due to materially different measures of housing inflation. The removal of the house price signal from reported inflation contributed to the breakdown of the Phillips curve for the simple reason it removed the single largest cyclical driver of consumer price inflation.

Second, companies use reported consumer price inflation, among other things, to help them gauge wage increases, so it’s not surprising that there has been a close affinity between reported inflation and wage increases. To the extent the post-1998 measure of consumer price inflation rises less quickly than the older version, it would follow logically that wage growth would be slower as well, as else being equal. In other words, “flatter” reported inflation results in “flatter” wages so it theoretically takes even lower levels of unemployment to generate wage increases.

Third, reported consumer price inflation has a direct connection to policy rates, even more so since the introduction of an inflation-targeting regime to help guide monetary policy decisions. Policymakers have yet to acknowledge how the 1998 change in reported inflation and the direct link to official rates have impacted the economy and the financial markets in real time.

It’s always difficult to prove causation but since 1998 there have been three asset price cycles – two involving unprecedented increases in equity prices relative to GDP and the other one centered in real estate prices. The occurrence of a single asset price spike could be considered a one-off, but three in a span of 20 years strongly suggests there is a cause and effect from monetary policy.

Policymakers have mistakenly misread the breakdown of the Phillips curve, resulting in prolonged loose monetary policy. The Phillips curve is not dead, but it changed it stripes. The most important price signals nowadays mainly flow through the asset markets, which from operational standpoint shift the focus of monetary policy towards financial/market stability and away from price stability.

Kathleen Curran Aguiar, Chartered Financial Analyst, contributed to this article.

Tyler Durden

Tue, 01/07/2020 – 18:45

via ZeroHedge News https://ift.tt/2T1mmEp Tyler Durden