Convex Strategies: “A Certain Dichotomy Has Come To Our Attention”

Submitted by Convex Strategies

A certain dichotomy has come to our attention. The whole ream of senior, past and present, central banking elites kicked off the New Year with a stream of comments about the past successes and the future challenges of monetary policy. We’ve copied in a few of their quality quotes here, but would also highly recommend that you take the time to read, in particular, Mr Bernanke’s speech/paper:

- https://www.brookings.edu/wp-content/uploads/2019/12/Bernanke_ASSA_lecture.pdf

- https://www.brookings.edu/blog/ben-bernanke/2020/01/04/the-new-tools-of-monetary-policy/

The gist is, everything they did to save the world post GFC worked. None of the nasty side-effects came to fruition, with “the possible exception of risks to financial stability”. Further, the policies have had no impact on wealth segregation, as long as you ignore asset price inflation. Nevertheless, there is only so much monetary policy can do from here, so it might require a bit more lifting from the fiscal stimulus side to finish the job.

If you don’t mind us saying – we find this laughable, naive and disingenuous.

“It’s generally true that there’s much less ammunition for all the major central banks than they previously had, and I’m of the opinion that this situation will persist for some time,” he said in an interview with the Financial Times to be published Wednesday. “It’s not clear that monetary policy would have sufficient space” if it needs to combat anything worse than a “conventional recession.”

Mark Carney, FT 8 Jan20

“I believe that for the euro area there is some risk of Japanification, but it is by no means a foregone conclusion” if it acts comprehensively to avoid a deflationary malaise, Draghi said via a video link to the conference in San Diego. “The euro area still has space to do this, but time is not infinite,” “This is why the ECB has been consistently calling for fiscal policy to play a stronger role and capitalize” on the low rates, he said.

Mario Draghi, Bloomberg 6 Jan20

“Monetary policy has a meaningful role to play, it’s unlikely to be sufficient in the years ahead,” Yellen said. It “should not be the only game in town.” “We can afford to increase federal spending and cut taxes” to support the economy in a recession even though government debt has risen sharply in recent years, the former policy maker said.

Janet Yellen, Bloomberg 6 Jan20

“There’s been a process of going through the stages of grief about a low neutral rate. These factors are basically the hand we’ve been dealt for the next five to 10 years.”

John Williams, WSJ 5 Jan20

On the other hand, the BIS, the World Bank, and the IMF released year end reports filled to the gills about the concerns of unprecedented debt expansion:

- https://www.bis.org/publ/qtrpdf/r_qt1912.pdf

- https://www.worldbank.org/en/research/publication/waves-of-debt

- https://www.imf.org/en/Publications/WP/Issues/2020/01/03/Debt-Is-Not-Free-48894

“Our results show that public debt in its various forms is the most important predictor of fiscal crises and it does matter always and everywhere.”

IMF: Debt is Not Free 3 Jan20

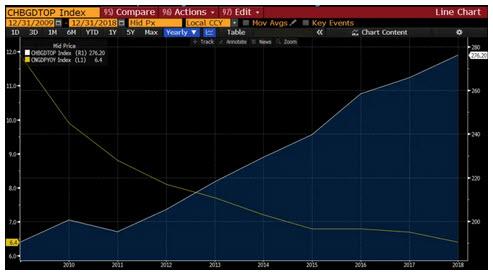

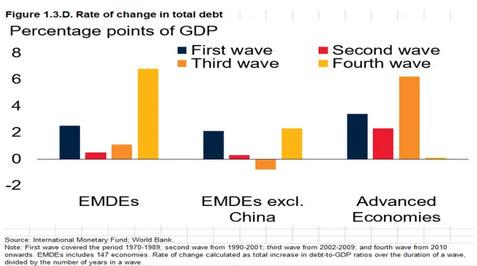

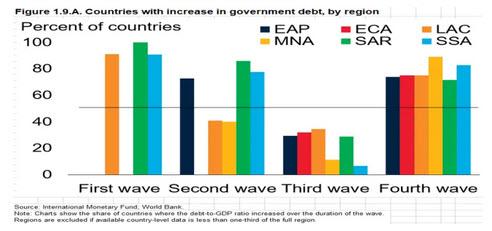

“The global economy has experienced four waves of debt accumulation over the past fifty years. The first three debt waves ended with financial crises in many emerging and developing economies. The latest, since 2010, has already witnessed the largest, fastest and most broad-based increase in debt in these economies. Their total debt has risen by 54 percentage points of GDP to a historic peak of almost 170 percent of GDP in 2018.”

The World Bank, Global Waves of Debt: Causes and Consequences Jan20

We are going to go out on a limb and suggest that it might be the unprecedented inflation (pun intended) of outstanding debt that the monetary policy nobility are missing in each and every of their senseless comments/arguments/conclusions. There is a reason they call end of cycle dislocations something like a “Debt Crisis” or “Credit Bubble” or “Default Cycle”, because debt is what matters! They don’t call it a “Slow Down in Productivity Crisis” or an “Asset Inflation Catastrophe” or a “Core PCE Deflator Bust”. You’ve heard us ask it over and over again – are central bankers idiots, or are they in on a wilful upward redistribution of wealth? Read through the above articles/speeches/papers from the elite of the elite in the central banking world and you will literally find not one mention of debt/credit/leverage. As always, the mention of it is so noticeable in its absence that it is hard to imagine it is anything other than intentional. They are the managers of a Ponzi scheme laying out every possible explanation other than what it actually is.

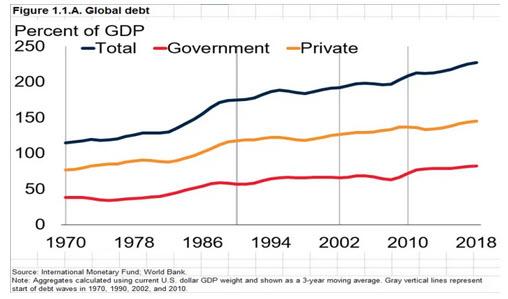

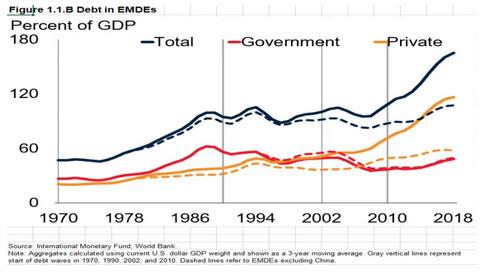

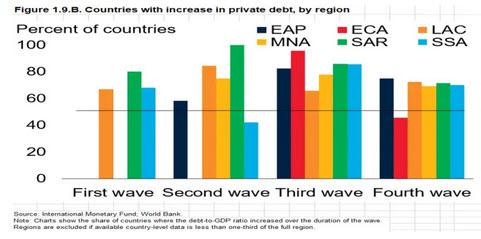

The IMF and World Bank pieces, on the other hand, focus on the actual state of the world. The World Bank piece comes with a link to a spreadsheet with the data behind their wonderful charts. What we take from these pieces, in particular the World Bank book, is that historically long periods of debt accumulation end in financial crisis, notably in Emerging and Developing Economies (EMDEs). The most recent wave of debt commenced in 2010 and now has the world at all-time unprecedented levels of debt, but what really stands out is the relative increase in debt in Emerging and Developing Economies, and specifically Private sector debt, overwhelmingly from China.

Figure 1: Global Debt

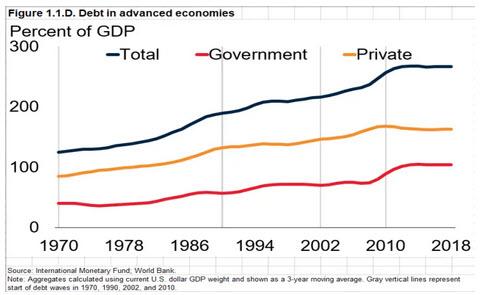

Figure 2: Debt in Advanced Economies

Figure 3: Debt in Emerging and Developing Economies

Other things that stand out – overall there has been no deleveraging post the 2007-2009 financial crisis; virtually all of the growth in accumulated debt in Advanced Economies has come from Government debt; the growth above trend of Private debt in EM, and particularly China, is prodigious. As we have discussed before, the end result of the extreme policy measure of the above noted Advanced Economy central bankers, aside from inflating asset prices in their own countries, was to drive debt accumulation into the developing world.

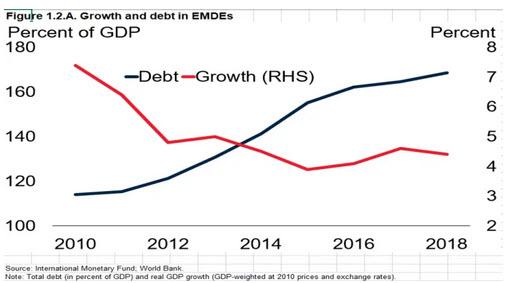

This leads to the problem very clearly depicted in the below graph. Despite the unprecedented expansion of debt, what some might proclaim a bringing forward of demand, growth in EMDEs continues to slow.

Figure 4: Debt to GDP vs GDP growth in Emerging and Developing Economies

This picture, naturally, looks even more extreme if we strip it down to just China. Referencing our distinguished central banking friends, maybe it’s not “secular stagnation”, but rather an excess of accumulated debt? I go back to our old Snickers bar analogy. You have to be a pretty undiscerning doctor if you think your prescription of Snickers bars, to pick up lagging energy in your patient, has nothing to do with his weight gain and subsequent increased lack of energy. Sadly, there appears to be no accountability for the monetary physicians that have orchestrated the current lack of fitness for economies.

We couldn’t help ourselves and had to include the attached link to the recently created biggest Snickers bar ever – as far as we know no central bankers were involved in the making of it!

World’s biggest Snickers bar weighs in at over 2 tons in Texas

Figure 5: Debt to GDP vs GDP growth China

As ever, we have no particular insight as to what the future holds, how or when this cycle might end. Just simply that, thus far, they all end. The accumulation of debt doesn’t, per se, tell you where or when a fire might start, but rather where a spreading fire might cause the costliest damage. Again, the next three charts from the World Bank piece show that EMDEs, and in particular China, are where the combustible material has really built up in this wave.

Figure 6: Rate of Change of Total Debt (EMDEs – Emerging Market Developing Economies)

Figure 7: Pct. Countries with Increase in Govt Debt, EMDEs

Figure 8: Pct. Countries with Increase in Private Debt, EMDEs

All of our central banking gurus commented on the need for greater fiscal policy support in their respective economies, and we touched last month on the growing mainstreaming of things like MMT, Modern Monetary Theory (neither modern nor a theory), but is that sort of thing a solution that will prevent/delay another EMDEs financial crisis at the end of this debt wave? Can EMDEs that rely on foreigners to hold a significant portion of their domestic government debt, and on foreign currency as a significant portion of the private debt, smooth away cyclical end debt instability by ever greater levels of fiscal spending? The soft-landing unicorn has been historically scarce, and the extremes of this cycle make us sceptical that this time the guys behind the curtain will pull the levers just right.

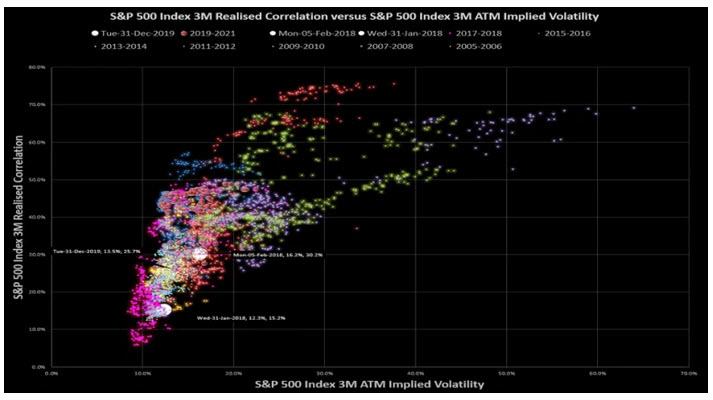

Figure 10: Volatility and Correlation Comet

Figure 11: SGD/JPY ‘Seasons’

All of this leads us, yet again, to the same question: are you sufficiently confident in your defensive strategies that you are able to take sufficient risk to benefit from years like 2019? Are you catching the spectacular compounding opportunities in the up-tail, while confidently protecting the down-tail? Nobody should be satisfied with the high correlation and low returns of absolute return hedge fund strategies. Fixed income, which had a sensational 2019, still massively underperformed equities while offering increasingly little portfolio risk mitigation benefit. Should our central banking overlords continue to extend the cycle, there is no reason why asset prices can’t continue to drive ever higher. Should they fail………

Tyler Durden

Fri, 01/31/2020 – 21:05

via ZeroHedge News https://ift.tt/31fubIX Tyler Durden