Crisis-O-Rama

Authored by James Howard Kunstler via Kunstler.com,

All of a sudden, events are looking a bit fluxy out there, as though the world is shuddering through some spooky ch-ch-ch-changes, like a monster waiting to be born, with strange convergences of ecology, politics and economy, and there’s only so much you can do to prepare, really. Criticality is in the air!

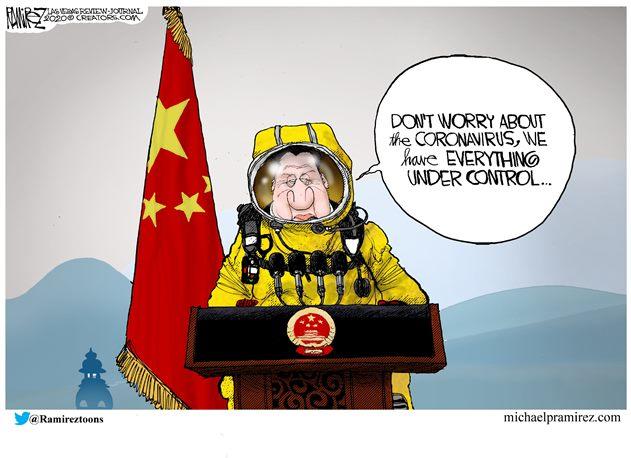

The horses are out of the barn on the Wuhan Coronavirus. Air travel was curtailed too late in the game — and still only partially — with asymptomatic-but-infectious human carriers winging to every corner of the world and probably contaminating airports all along the way. There’s plenty of thought and counter-thought on what exactly is going on behind the scenes in China. The ruling party has knocked itself out demonstrating its earnestness in the crisis, performing great feats like the construction of a one-thousand-bed hospital in ten days, shutting down the lunar new year festivities (like cancelling Christmas here), and locking down a hundred million citizens in quarantine. Pretty impressive.

But there’s also a theory that the Coronavirus affords a cover for cascading failures in China’s corrupt and shifty banking system. The country had already stepped across some frontiers in demographics, energy consumption, and industrial growth that were shoving it toward contraction for the first time in two generations. Coronavirus has shut down a lot of production in big things like cars and big-little things like cell phones, and supply lines are shutting down to world markets. This amounts to the first big test of the integrated global economy, as well as the world’s debt-saturated business model.

When a lot of parties and counterparties can’t pay each other because their revenue flows are cut off, the securities, currencies, equities, and other abstract representations of wealth go south. The US and Europe are no better positioned for a crisis in their banking arrangements, and confidence is starting to crack. Both economic mega-regions have relied on central banking hocus-pocus to prop up stock markets and maintain the illusion that the logic of bonds still applies. The first thing to go moneywise in a contracting financial system is the magic of compound interest.

The US Federal Reserve has been massively gaming the Repo markets — overnight lending that uses bonds as collateral — since September, raising suspicions that more than one of its “primary dealer” banks are insolvent. Juicing them with “liquidity” is like painting over sheetrock infested with black mold. Looks good for a week or so, and then you’re in intensive care. Nobody knows yet what the effect of Britain’s escape from the EU will do to the Union’s remainers, but Europe’s bonded debt arrangements are even dodgier than America’s, since there is absolutely no EU central control of each member’s fiscal affairs. Anyway, the meta-trend now is the devolution of governance from giant-and-central to smaller-and-local, so the real question is how much disorder and damage do these nations endure as that happens. It’s been manifesting vividly in France for a year in the yellow vest protests.

Here in the USA, the knock-on effects of converging crises begin to look like a game of four-dimensional eight-ball. The oil markets are getting slammed around the $51 hashmark, making it more difficult for the shale oil producers to meet their onerous debt repayments (in an industry that just doesn’t make a profit). Lower gasoline prices may seem like a boon for US motorists, but it comes at the expense of bankrupting more oil companies and punishing lenders like pension funds that invested in shale securities in the desperate search for “yield.” Shale never was a rational business model despite its fabulous production surge in a very short span of years. Don’t be surprised if there’s an attempt to nationalize it, which will induce new problems of capital allocation and sheer incompetence in a world where central planning of anything is more and more a bad bet.

Looming and converging multiple crises are also behind the gross disorder in US politics, though the connections may not be so discernably visible. President Trump foolishly took credit for financial markets that he had correctly described as being “one big, fat, ugly bubble,” back in the febrile days of the last election. Now it threatens to leave him holding a big fat ugly bag of trouble. That booby trap is surely more hazardous to his reelection chances than the frenetic efforts of pissants like Adam Schiff running Wile E. Coyote ambuscades in the DC Swamp. Mr. Trump spent three years working, jawboning, and bluffing over global trade arrangements that are now suddenly falling apart. How much of that will turn out to be a temporary effect of the Coronavirus, nobody knows. Or maybe it’s an inflection point in the workings of our over-hyper-complexified human ecosystem.

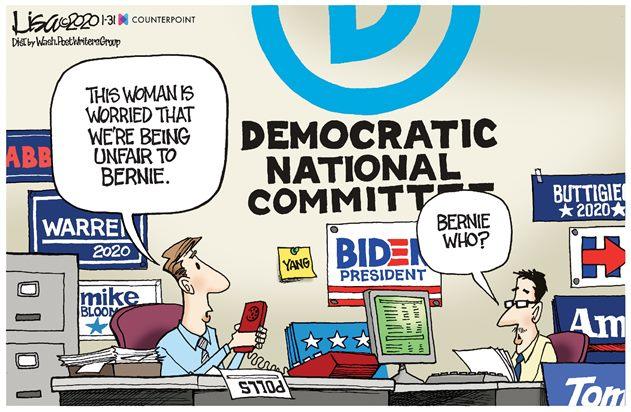

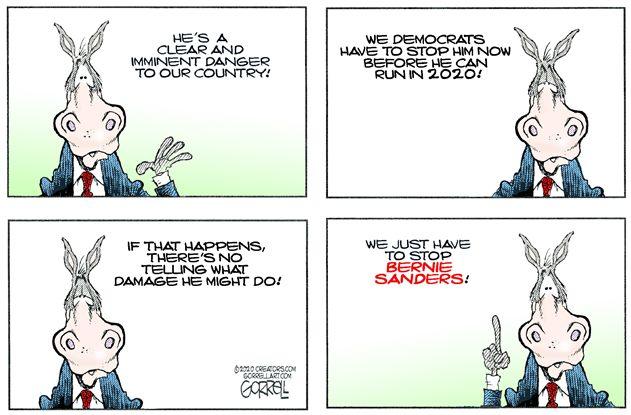

These shifting quandaries leave the Democratic Party between that ol’ rock and a hard place. All of their bad faith ploys against Mr. Trump have failed so far. I speak to supposedly educated people every day upon whom the failure of the Mueller Investigation, the fiasco of impeachment, and the revelations of IG Michael Horowitz have made no impression at all. The Golden Golem of Greatness is still Putin’s Puppet to them. It’s a wonder of the age that they can’t cut their losses. And now Bernie Sanders suddenly looks poised to win the Iowa caucus and inflame the not-quite-so-socialist factions of the party, who appear to be ratcheting up some Wile E. Coyote traps against him.

If that works, it’ll blow the party apart, 1860 style, into rump factions. But if Bernie somehow perseveres and gets the nomination… and the Potemkin financial markets tank… and Coronavirus turns out to be a very big deal for upsetting global trade… then, America may get its first zealous socialist president.

Yes, history repeats and rhymes and all that, but I don’t see Bernie replicating the triumphs of Franklin D. Roosevelt in Great Depression 2.0. Rather, by attempting to overlay command-and-control policies on a zeitgeist that wants to take us smaller and local, Bernie Sanders will only be bucking reality.

The net effect of Bernie Sanders in the White House will be to finish off the economy… and imagine where that will take us.

Tyler Durden

Mon, 02/03/2020 – 14:45

via ZeroHedge News https://ift.tt/393Zrgr Tyler Durden