ECB Buys LVMH Bonds To Finance Tiffany’s Acqusition, Making France’s Richest Man Even Richer

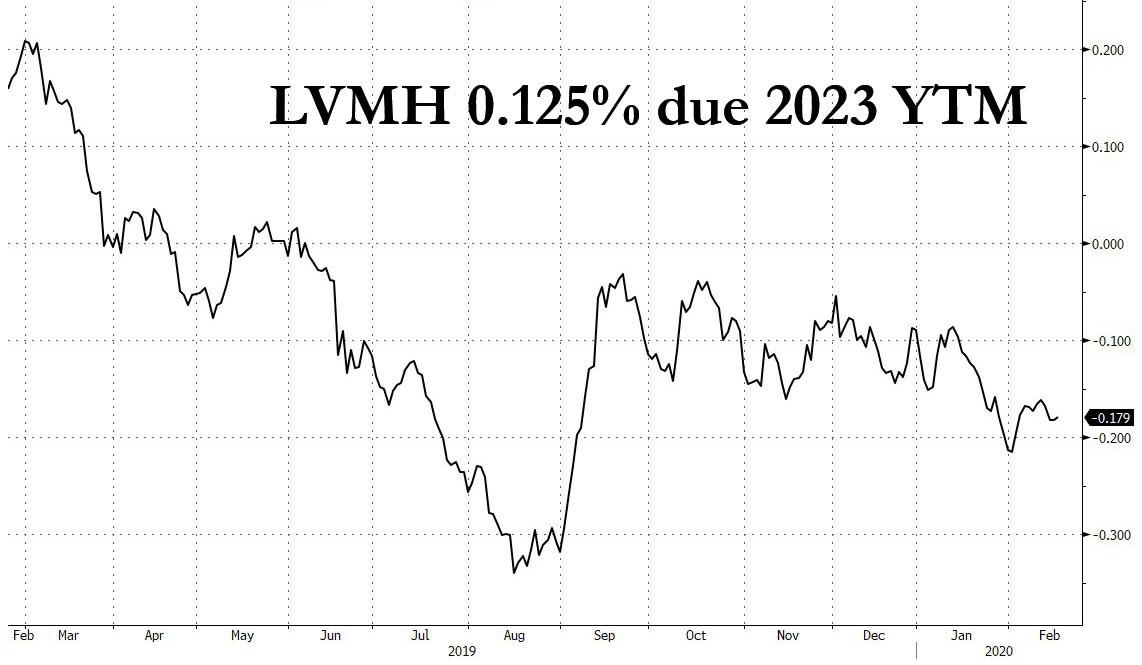

When France’s richest man, LVMH boss Bernard Arnault, shocked the market last November with his $16 billion purchase of jewelry icon Tiffany, he knew he would have to issue about $10 billion in bonds to fund the deal. He also knew it wouldn’t be a problem, for one reason: the ECB would be there to make sure the deal got done. But not even Arnault, who expected the yield from the bond issuance to be “between 0% and 1%” anticipated that the deal would get done in a way that the bond market would end up paying him.

Yes, thanks to the lasting legacy of one Mario Draghi, the richest man in France is now even richer because he had to issue debt.

What happened? As the financial world was closely following every fabricated data point out of Beijing in China’s fight with the coronavirus epidemic, LVMH quietly raised €7.5 billion ($8.3 billion) and GBP1.55 billion ($2 billion), over a range of maturities from two to 11 years, to help finance its $16 billion purchase of Tiffany.

Here’s the kicker: as Reuters reported last week, not only was the €9.3BN bond deal more than 50% upsized from the initial price talk of €6BN just earlier that day, but two of the five euro tranches were placed at negative yields, meaning investors would pay the A-rated LVMH to borrow money. Even the longest maturity, an 11-year euro tranche, had a yield of just 0.43%.

And it didn’t even have to be pitched as a “green” bond.

Here, as Bloomberg’s Marcus Ashworth writes, the French billionaire can thank Mario Draghi and the ECB for two reasons.

First, it was the restart of the ECB’s €189 billion CSPP (Corporate Sector Purchasing Program) corporate bond buying program that helped drive credit spreads ever lower, and in many cases to negative levels meaning investors pay not sovereigns but corporations to take their money. And while the central bank may have wanted to lessen the funding costs of European companies to make it easier for them to invest, “it may not have been meaning to help a French luxury behemoth snap up an American jewelry icon”, Ashworth writes.

There is second way the ECB made the richest Frenchman richer: for the collateral starved central bank, a major issuance of this size means that at least portion of the original offering will have been bought by the ECB (or will be at some point in the near future). As the Bloomberg commentator notes, “often the bank takes up to 20% of eligible issues, and there has a been a real paucity of high-quality credit since the Quantitative Easing program kicked back into life.”

Indeed, the ECB’s ravenous purchases of virtually any corporate debt led to the infamous holdings of Steinhoff debt, with Mario Draghi emerging as one of the biggest holders of debt just as the company imploded, its ratings cut instantly from investment grade to deep junk, and had the ECB not sold its holdings, the central bank would have ended up as a stakeholder in the post-reorg equity, in effect owning stock in a private corporation even though the ECB is not legally permitted to buy equities (at least not that we know of).

The ECB wasn’t just making billionaires richer as part of its “trickle down” mandate in a time when credit spreads are at the tightest ever levels: as Bloomberg’s Ashworth also notes, there was another jumbo corporate sale in Europe at the start of February by U.S. Media giant Comcast Corp., which issued notes worth 3 billion euros and 1.4 billion pounds.

This type of sale is known as a “reverse Yankee,” where an American company issues debt, but not in dollars. Maybe we could refer to LVMH’s use of dirt cheap funding in its home currency to buy an American company as a “reverse, reverse Yankee.” The world of finance is ever flexible.

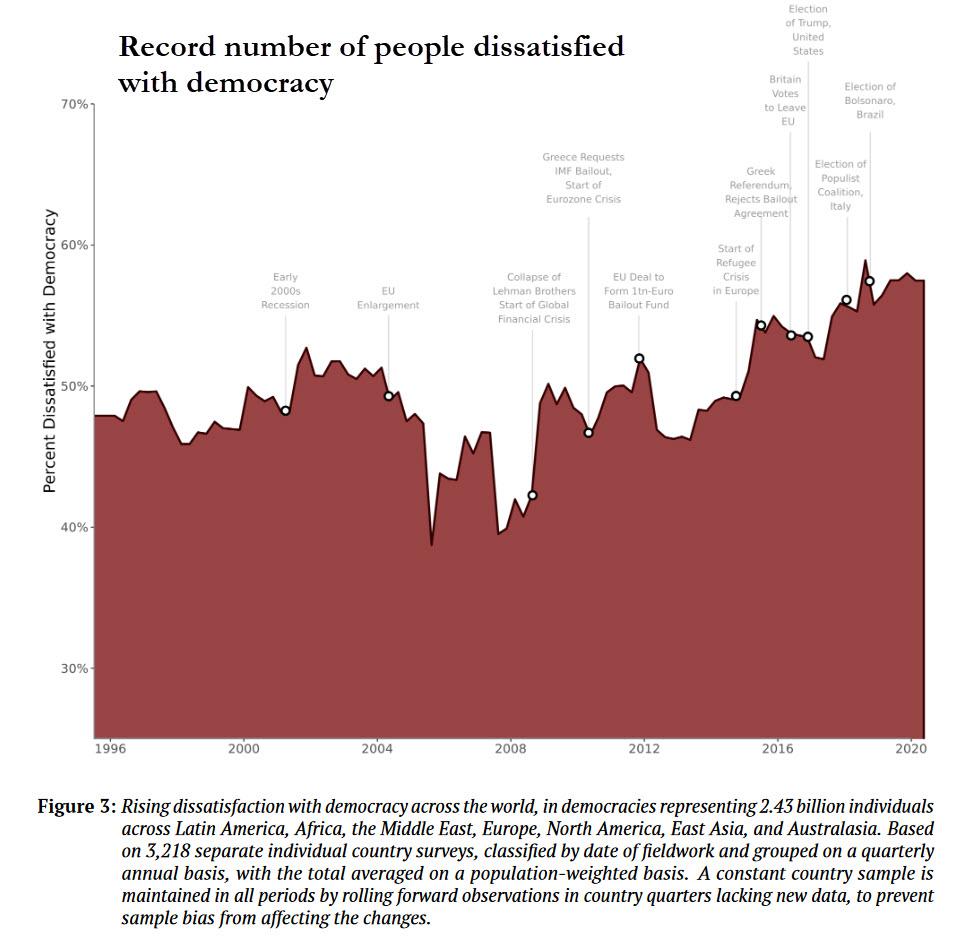

Armed with this information readers can now freely accost anyone who claims that central banks have failed in their mission of making the general population richer. Well, actually they have, but to compensate at least they make the occasional billionaire hundreds of millions of dollars richer. As for everyone else, well they understandably pissed that none of these free handouts ever make it to them and so they get to vote for populists, even as the highly educated establishment is puzzled why for the first time ever, a majority of the world’s population is dissatisfied with “democracy” and thinks the world has become a banana republic.

One wonders how Europeans would react if the Fed so overtly helped a US acquiror take over a European company; Americans, of course, have many other things to distract them than to pay attention to the biggest wealth transfer from one giant group of people to another, vastly smaller one.

We give the parting words to Jonathan Tepper, who best summarized the patently absurd pre-collapse state global civilization finds itself in:

One day we’ll look back and marvel how QE was offered as panacea for virus outbreaks, stock market declines, house price declines, climate change, etc.

The only thing QE hasn’t been offered up yet to do is cure impotence.

— Jonathan Tepper (@jtepper2) February 18, 2020

Tyler Durden

Tue, 02/18/2020 – 18:05

via ZeroHedge News https://ift.tt/37IKyit Tyler Durden