Global Stocks, Futures Jump On Hope China Will Bailout Its Airline Sector

Global stocks reversed Tuesday’s losses and rose on Wednesday after fresh “hope and optimism”TM emerged that China is getting closer to containing the coronavirus epidemic and that Beijing may be planning further measures to support its economy reeling from the virus-induced crash. The yen weakened and the USDJPY hit the highest level since May 2019.

In the latest coronavirus news, China’s Hubei province reported 1693 new cases and 132 additional deaths from the coronavirus as of February 18 vs. 1807 additional cases and 93 deaths on February 17: death toll 1921 vs. Prev. 1800. China’s Mainland reported additional 1749 coronavirus cases and 136 additional deaths as of February 18 vs. 1886 additional cases and 98 deaths on February 17: Total cases 74185 vs. Prev. 72436, total deaths 2004 vs. Prev. 1789. Outside of China, South Korea reported a surge of 15 more cases bringing the total to 46, according to Yonhap.

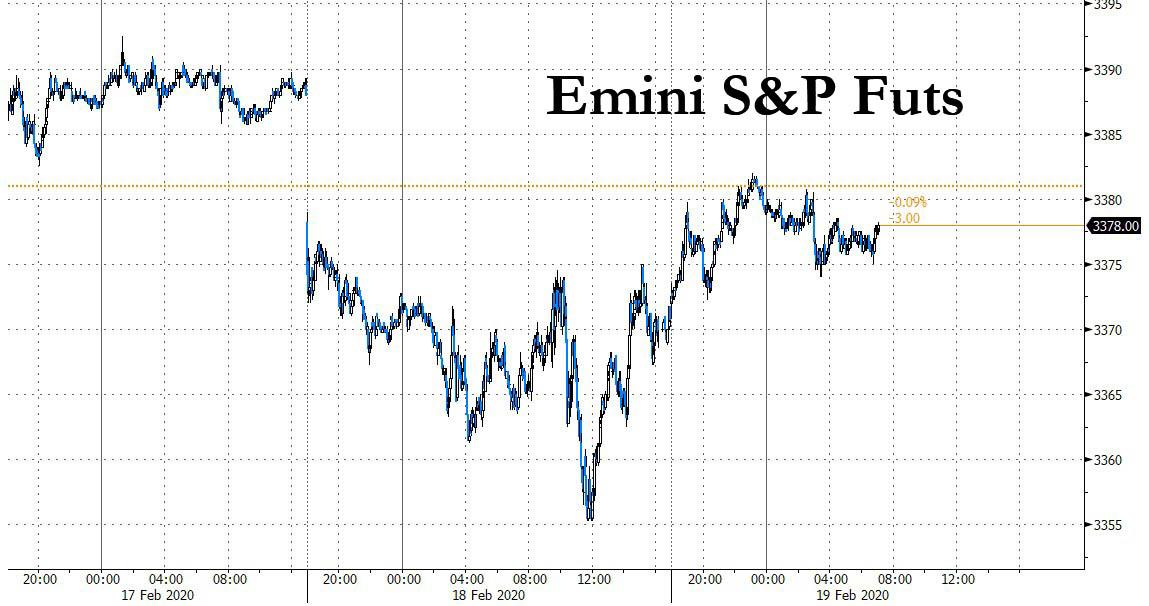

US index futures were all solidly in the green, rebounding from Tuesday’s Apple-induced drop, after China posted the lowest daily rise in new coronavirus cases since Jan. 29, helping to lift the offshore yuan to two-week highs (even if Chinese stocks closed modestly in the red). And while most rational traders view Chinese data on the virus with scepticism, sentiment was further lifted by a Bloomberg report that Beijing was considering cash injections or mergers to bail out airlines hit by the virus. Those steps would come after this week’s cut in the medium-term lending rate, which has fed expectations for a reduction in the benchmark loan prime rate.

The Stoxx Europe 600 Index headed toward a record close, with all 19 sectors in the green. Shares in clothing and luxury-goods companies were among the best performers as the Stoxx Europe 600 rose 0.6%. Among European stocks, shares in Deutsche Telekom rose 3.6% after the German telecommunications company reported a 78% increase in 2019 profit and forecast further growth in 2020. Shares in Puma jumped 7.9% after the German sports-apparel producer reported a 40% increase in annual net earnings and proposed a higher dividend.

Earlier in the session, Asian stocks gained, snapping a four-day decline, as sentiment toward riskier assets improved following a report that China may introduce more supporting measures to counter its virus-hit economy. Shares climbed in Tokyo, Hong Kong and Sydney, while Shanghai stocks dipped from their highest level in about four weeks. Treasuries edged higher along with European bonds. The benchmark MSCI Asia Pacific Index rose as much as 0.5%. Most of the markets in the region were up, with Japan’s Topix index ending a seven-day decline, while China’s Shanghai Composite Index reversed an earlier gain. India’s Sensex index rose for the first time in five days. Bloomberg reported that China is considering measures such as direct cash infusions and mergers to bail out an airline industry crippled by the coronavirus outbreak.

Edward Park, chief investment officer at Brooks Macdonald, cited President Xi Jinping’s latest commitment to meeting 2020 growth targets. “This in itself implies there will be more fiscal and monetary stimulus,” Park said. “That’s the real carrot for markets today.”

China, the world’s second-largest economy, is also struggling to get manufacturing back online after severe travel restrictions were imposed to contain the coronavirus. Japanese exports fell for the 14th straight month in January, data showed.

The recovery in global stocks came after China’s Ministry of Industry and Information Technology said the government would connect factories with technology companies to identify weak links in their supply chains. The assistance is one of several steps that Beijing and local Chinese authorities have taken to limit the economic fallout of the coronavirus, which has sickened 75,200 people world-wide and killed more than 2,000.

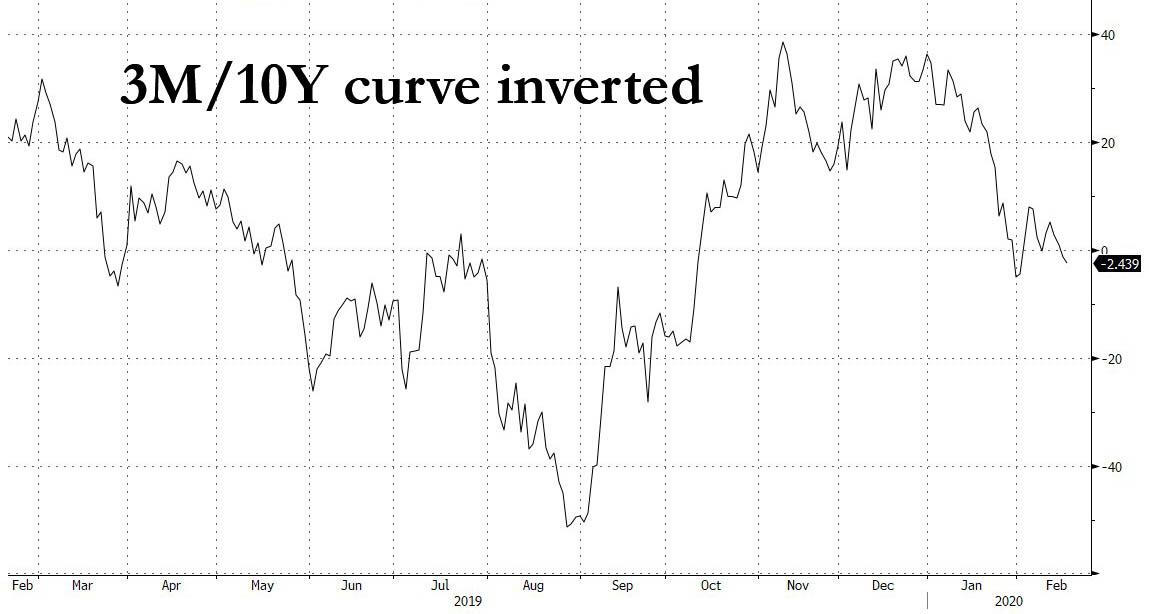

Growth worries were reflected in a dismal German investor sentiment survey and the U.S. Treasury curve, where the yield curve is again inverted as yields on three-month bills rose above 10-year yields. The yield on three-month bills stood at 1.5949%, above the 10-year yield of 1.5661%. “There is some nervousness that economic data outside the United States is not amazing,” Park said.

Confidence that Beijing can contain the economic fallout from the epidemic spilled over into currency markets. The Japanese yen, seen as a haven, fell 0.4% to trade at ¥110.27 against the dollar. The Australian and New Zealand dollars, which are dependent on China’s appetite for imports, strengthened. The New Zealand dollar rose after RBNZ Govornor Orr said the domestic economy and monetary policy were “in a good position,” tempering expectations for further interest-rate cuts. The Australian dollar advanced, although gains were cut short as options-related selling curbed momentum from broader risk-on trend. The pound climbed to the day’s high on faster-than-expected inflation, before falling back to trade slightly lower versus the greenback. Sweden’s krona fell to a two-week low against the euro after inflation slowed more than forecast

In commodities, brent-crude oil prices rose 1.1% to $58.39 a barrel after the Trump administration blacklisted a trading brokerage owned by Russian oil giant Rosneft, which the U.S. said has helped Venezuela export crude. The sanctions could reduce Venezuelan oil exports by up to half a million barrels a day, reducing global supplies, according to Helge Andre Martinsen, an energy analyst at Norway’s DNB Bank. Separately, a reduction in supply from Libya offset concerns about weaker Chinese demand.

A stealthy flight to safety pushed gold above $1,600 and to its highest price since 2013, while palladium extended its record-breaking rally on forecasts for a widening deficit.

Investors are waiting to see what other growth-supportive measures could be introduced, particularly in the euro zone. They will also keep an eye on the minutes from the U.S. Federal Reserve’s last meeting. The Fed has signaled that it’s keeping an eye on the coronavirus impact but has no intention of cutting interest rates anytime soon. Many analysts reckon it could be forced to change its mind.

“Given the risks we see to both growth and inflation falling short of expectations this year, we still expect the Fed’s view on the need for additional rate cuts to shift later this year,” NatWest analysts told clients, adding they were “not at this time removing rate cuts from our forecast.”

To the day ahead, which this morning includes January housing starts and building permits along with January PPI. In the afternoon we also receive the FOMC minutes from the January 29th meeting. Away from that it’s a busy day for Fedspeak with Bostic, Mester, Kashkari, Kaplan and Barkin all scheduled to speak. Expect there to also be some focus on the Democratic Party debate.

Market Snapshot

- S&P 500 futures up 0.3% to 3,378.25

- STOXX Europe 600 up 0.7% to 433.15

- MXAP up 0.3% to 168.76

- MXAPJ up 0.5% to 553.76

- Nikkei up 0.9% to 23,400.70

- Topix up 0.4% to 1,671.86

- Hang Seng Index up 0.5% to 27,655.81

- Shanghai Composite down 0.3% to 2,975.40

- Sensex up 1% to 41,311.43

- Australia S&P/ASX 200 up 0.4% to 7,144.56

- Kospi up 0.07% to 2,210.34

- German 10Y yield unchanged at -0.408%

- Euro up 0.1% to $1.0804

- Italian 10Y yield rose 2.5 bps to 0.765%

- Spanish 10Y yield fell 0.5 bps to 0.283%

- Brent futures up 1.4% to $58.55/bbl

- Gold spot up 0.4% to $1,608.11

- U.S. Dollar Index down 0.02% to 99.42

Top Overnight News

- Traders and investors are eager for more detail on the Federal Reserve’s plans to wrap up its balance sheet expansion and a related short-term lending program when minutes of the Jan. 28-29 policy meeting are released Wednesday in Washington

- China is considering measures such as direct cash infusions and mergers to bail out an airline industry crippled by the coronavirus outbreak, according to people familiar with the matter. One proposal involves allowing some of the biggest state-controlled carriers to absorb smaller ones suffering the most from the collapse of travel

- U.K. inflation picked up for the first time in six months in January, tempering expectations for a Bank of England interest-rate cut later this year. Consumer prices rose a stronger-than-forecast 1.8% from a year earlier, the most since July, official data showed Wednesday

- A growing number of China’s private companies have cut wages, delayed paychecks or stopped paying staff completely, saying that the economic toll of the coronavirus has left them unable to cover their labor costs

- Chinese refineries are throttling back production even further to cope with weak demand and a lack of workers due to the coronavirus, and are now processing 25% less oil than they were last year

Asian equities traded with cautious gains following on from a mixed lead on Wall Street, where the Dow fell for a third consecutive day following Apple’s profit warning, albeit the Nasdaq ended the session relatively flat. ASX 200 (+0.4%) traded sideways throughout most of the session and failed to gain much traction from a slew of earnings, although heavyweight Westpac’s shares were under pressure amid additional costs expected to be incurred due to its regulatory investigation. Nikkei 225 (+0.9%) outperformed following the prior session’s steep losses as tech names recouped losses and with the index underpinned by a softer JPY, meanwhile, Nissan shares led the gains despite its alliance partner Renault’s downgrade to junk status at Moody’s. Elsewhere, Hang Seng (+0.5%) and Shanghai Comp (-0.3%) pared opening losses with the former propped up by its behemoth oil names and financials (ex-HSBC), whilst the latter saw support amid further anticipated easing measures ahead of tomorrow’s LRP announcement – with the rates widely expected to be reduced following the 10bps MLF cut by the PBoC earlier in the week. Finally, Singapore’s Straits Times Index (+0.7%) was buoyed following the unveiling of a generous Singapore Budget, which allocated almost USD 5bln to tackle the impacts of the coronavirus outbreak.

Top Asian News

- China Star Trader’s New Fund Lures $17 Billion in a Day

- Vodafone Idea Surges on Report Cabinet May Mull Dues Repayment

- Japan’s Top Bank Is Said to Invest Over $700 Million in Grab

- Thai Billionaire’s Hotel Arm Expects Only Short-Term Virus Jolt

European equities (Eurostoxx 50 +0.4%) are posting steady gains in early EU trade after mounting a recovery from yesterday’s losses with macro newsflow otherwise relatively light thus far. Gains across sectors are relatively broad-based with IT names being granted some reprieve from yesterday’s Apple-inspired declines (STMicroelectronics +2.8%, Dialog Semi +2.6%, Infineon +1.9%), whilst HSBC (+2.7%) are also recouping recent losses following its recent restructuring announcement. Lagging its peers are energy names with recent upside in crude prices not enough to bolster sentiment for European producers. Elsewhere, above-forecast earnings from Puma (+8.6%) has sent its shares to the top of the Stoxx 600, helping to lift competitor Adidas out of negative territory after it warned that it has endured a material negative impact in China as a result of the coronavirus. Other gainers include Deutsche Telekom (+3.4%) and Covestro (+2.9%) post-earnings, whilst to the downside, Renault (-2.1%) shares are suffering after its debt was downgraded to junk status at Moody’s, with auto names/parts producers also suffering.

Top European News

- U.K. Inflation Accelerates to Its Fastest Pace in Six Months

- Boris Johnson Is Told to Rein In Top Aide After Racism Dispute

- BOE Speech Leaked Early to Trader in 2017, Times Reports

- Intesa’s Messina Turns Dealmaker to Create Italian Champion

In FX, inflation metrics have given the Rand, Pound and Swedish Crown something else to consider aside from the broader fluctuations in risk sentiment largely on unfolding events in China and the external impact of COVID-19. Usd/Zar is consolidating around 14.9500 in wake of headline SA CPI rebounding towards the SARB’s 2020 average rate, while Cable pared declines from another test of decent sub-1.3000 support on the back of UK headline and core rates (y/y) both beating consensus, in stark contrast to Swedish readings falling far short of expectations and even recently downgraded Riksbank projections. Hence, Eur/Sek is hovering just shy of resistance circa 10.6000 and diverging from Eur/Nok that is back down around 10.0300 amidst a pick-up in risk appetite on more speculation about additional Chinese stimulus. Back to Sterling, fresh lows now being forged on a lack of follow-through buying and persistent jitters about a hard Brexit given little sign of the EU budging from level playing field lines.

- NZD/AUD/CAD – Not quite zero to hero, but the Kiwi has pared more losses from Tuesday’s lows following supportive comments from RBNZ Governor Orr overnight claiming that the domestic economy and OCR rate are both in a good place presently. Nzd/Usd has rebounded to 0.6400 in response, but Aud/Nzd remains above 1.0450 as the Aussie gleans traction from the YUAN reclaiming 7.0000+ status (just) after a first PBoC fix under the handle since Xmas Day. Indeed, Aud/Usd is straddling 0.6700 where a mega 2.6 bn expiries roll off compared to yesterday’s 0.6674 base and awaiting jobs data for more independent direction, while NZ Q4 CPI also looms for the Kiwi. Prior to all that, the Loonie will be looking for impetus via Canadian inflation as Usd/Cad retreats from post-manufacturing sales peaks close to 1.3280 and hovers near 1.3230.

- JPY/XAU – The Yen has succumbed to more pronounced safe-haven flow/position unwinding, as Gold appears to be the port of choice and store of value most avidly sought at the current juncture. As such, Usd/Jpy has breached the prior ytd apex and is now aiming for 110.50 in front of a Fib (110.64), while spot bullion inches further beyond Usd1600/oz and to within a whisker of the January 8 pinnacle (Usd1611.42).

- EUR/CHF – Both narrowly mixed against a firmer Dollar in general, with the DXY inching closer to 99.500 in advance of US data and FOMC minutes amidst a raft of Fed speakers, and by definition displaying relative resilience. The single currency is pivoting 1.0800 with underlying support in the form of decent expiry interest at 1.0785 (1.2 bn), while the Franc continues to meander between 0.9800-50 and 1.0600-50 vs the Euro.

- EM – The Lira is still languishing below 6.0000 vs the Greenback in wake of the latest more measured CBRT rate cuts (-50 bp) and a reiteration of cautious guidance for further easing given recent spikes in inflation and above forecast Turkish CPI prints. Moreover, on top of his usual pre-policy meeting prompting for further rate normalisation (easing) President Erdogan upped the ante vs Russia and Syrian Government forces with a warning that attacks in Idlib will not be tolerated.

In commodities, WTI and Brent prices are firmer at present, as focus moves away from the demand side and the coronavirus to potential supply headwinds. Via the tensions between Ukraine and Russia yesterday, US’ sanctions on Rosneft as well as the ongoing dispute in Libya. On the latter, the recent attacks on Tripoli’s ports have caused the Government to pull out of ongoing peace talks. From an OPEC perspective, we are still awaiting word from Russia on the JTC’s recommendations and today sees OPEC meeting with the IEA amongst other agencies; so, focus will be on any pertinent remarks or guidance from this. Note, due to the US President’s day holiday tonight will see the API weekly inventory release where last week’s headline crude printed a larger build than was expected (+6mln vs. Exp. +3mln). Turning to metals, where spot gold retains a firm bid this morning, as sentiment overall remains conflicted and tentative due to the ongoing geo-political updates and in what has been a relatively quiet session thus far; particularly when compared to yesterday’s mid-day flurry. The yellow metals recent high from January 8th is 1611.42, after which we return to levels not seen since 2013. Elsewhere, China has increased its H1 rare earths output quota by 10% in an attempt to increase production following the coronavirus induced disruptions.

US Event Calendar

- 8:30am: Housing Starts MoM, est. -11.23%, prior 16.9%; est. 1.43m, prior 1.61m

- 8:30am: Building Permits, est. 1.45m, prior 1.42m;

- 8:30am: Building Permits MoM, est. 2.11%, prior -3.9%

- 8:30am: PPI Final Demand MoM, est. 0.1%, prior 0.1%; PPI Final Demand YoY, est. 1.6%, prior 1.3%

- 8:30am: PPI Ex Food and Energy MoM, est. 0.2%, prior 0.1%; PPI Ex Food, Energy, Trade MoM, est. 0.1%, prior 0.1%

- 8:30am: PPI Ex Food and Energy YoY, est. 1.3%, prior 1.1%; PPI Ex Food, Energy, Trade YoY, prior 1.5%

- 2pm: FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

While the economic impact may be more limited and short-lived outside of China, Apple’s latest earnings guidance was a decent reminder that second order impacts on both demand and supply shocks remain a risk for markets. It remains to be seen how long the impact will persist, however it did cause US markets to pause for breath, even if equity markets closed off their lows in the US last night.

Indeed having re-opened following the long-weekend the S&P 500 closed down -0.29% last night, only the 3rd down day in the last 11 sessions. An interesting fact worth highlighting is that the index has only fallen for two consecutive days once this year. Apple shares were -1.83% lower however they did pare a bigger decline of as much as -4.58% overnight and -3.00% intraday. In fairness the NASDAQ was basically unchanged (+0.02%), as the largest declines in the US were in the financials and energy sectors, so markets didn’t seem overly concerned with the impact on technology companies even as Apple warned investors. The mild risk-off helped 10y Treasury yields to edge down 2.5bps to 1.562% and to the lowest since 3 Feb – the 2s10s curve also flattening to 14.5bps and flattest since late November – while Gold rallied +1.30% and therefore putting it up an impressive +5.61% this year already. Meanwhile WTI oil finished flat (+0.10%) after being down nearly 2% before the US opened.

This morning the news that China is considering more stimulus measures to prop up the economy in the face of the virus is helping sentiment to turn more positive. Specifically this includes direct cash infusions and mergers to bail out the airline industry. The State Council also announced that SMEs would be exempt from paying pension contribution and social insurance fees from February to June. The Nikkei (+0.94%), Hang Seng (+0.44%) and Shanghai Comp (+0.35%) are all up as a result with only the Kospi (-0.20%) trading down following news that South Korea confirmed 15 more cases of the coronavirus overnight bringing total cases in the country to 46. The death toll in China now stands at 2006 with confirmed cases at 74,186, with new case numbers continuing to decline.

Back to yesterday, where helping to perhaps balance out some of the negative read-through from the Apple news was the latest US data. Specifically, it was the empire manufacturing print, which rose a much better than expected 8.1pts to 12.9 (vs. 5.0 expected). That’s the biggest one-month jump since July last year and highest reading since May. The new orders component also surged to the highest since September 2017 while the ISM adjusted series rose to 56.9 which is the strongest since June 2018 and clearly positive in the face of the virus concerns. That being said there is a divergence of sorts between the new orders and six-month outlook for new orders which suggests some possible one-offs in the data. Elsewhere the NAHB housing market index slipped 1pt to 74 however still remains historically high.

In contrast to the empire manufacturing data, the February ZEW survey in Germany was much weaker than expected. The expectations component fell 18pts to 8.7 (vs. 21.5 expected) while the current situations component weakened a further 16.2pts to -15.7 (vs. -10.0 expected). For the expectations survey that is the weakest reading since November last year however it is still comfortably above the levels of all last year. The STOXX 600 and DAX closed -0.38% and -0.75% lower respectively with Apple suppliers like Dialog and AMS struggling, while HSBC closed down -5.59% following the restructuring news.

Looking ahead to today, something to keep an eye on is the Democratic Party debate in the US at 9pm EST/2am GMT. Former New York City Mayor Michael Bloomberg will be on the debate stage for the first time after there was a change in the qualifying rules. Candidates had needed to reach a certain threshold of individual donations to their campaign to qualify, but as the former Mayor is self-funded his only donor is himself. While the Democratic National Committee has taken some criticism from dropping the rule so late in the process, Bloomberg’s relatively high polling numbers make it nearly impossible to exclude him as voters are clearly considering the former three-term mayor. In RealClearPolitics.com’s average polling over the last two weeks, Sanders leads the field in national polls at 24.8%, Biden is now second at 17.8%, but Bloomberg has jumped into 3rd place with 14.6%. Tonight will be the first chance for the other candidates to debate Bloomberg, who has mostly been making his case to voters in TV ads purchased across the country. If he holds up well he could start consolidating the moderate/centre-left vote that Biden/Buttigieg/Klobuchar have been fighting over, but a poor performance could strengthen Sanders position as the moderate vote continues to splinter among 3-5 candidates. The debate is taking place in Nevada, which will host a primary on Saturday and is a potential swing state in the general election after former Secretary Clinton won the state over President Trump by 2.4% of the vote.

In other news, it’s worth highlighting that a number of WSJ reports in recent days suggest that the US is considering new export restrictions on China. The articles have included restrictions or the halting of jet engine deliveries to China and access to chip technology and makers. Something worth keeping an eye on. Staying with China, yesterday President Xi was quoted as saying that China would still be able to meet 2020 economic targets despite the virus impact on the economy. That would suggest that large stimulus is a big factor, something our China economists highlighted in their latest note here. They make the point that while the government’s focus remains on battling the virus for now, it could shift rapidly towards boosting economic activities once the outbreak is contained.

Perhaps related to the WSJ stories, President Trump tweeted yesterday that the US “cannot, and will not, become such a difficult place to deal with in terms of countries buying our product”. The President called some of the regulations being circulated as “ridiculous” and that he wants to make it “easy” to do business with the US. The tweet also included a direct reference to wanting China to purchase jet engines. The President also made it clear that he wanted to keep the current trade rules in place to ensure that US companies did not lose these business deals to other countries

Wrapping up, in the UK the latest employment data showed strong employment growth but weak wage data. The former included a 3.8% unemployment rate – unchanged versus last month – and a slightly higher than expected employment change print (180k vs. 148k expected). The latter however showed weekly earnings ex bonuses of 3.2% (vs. 3.3% expected).

To the day ahead, which this morning includes January inflation data in the UK. In the US the data due are January housing starts and building permits along with January PPI. Later this evening we also receive the FOMC minutes from the January 29th meeting. Away from that it’s a busy day for Fedspeak with Bostic, Mester, Kashkari, Kaplan and Barkin all scheduled to speak. Expect there to also be some focus on the Democratic Party debate.

Tyler Durden

Wed, 02/19/2020 – 07:49

via ZeroHedge News https://ift.tt/2vKTXZJ Tyler Durden