“This Ain’t No Foolin’ Around” – Jim Kunstler Warns “Fragile Markets Susceptible To Dangerous Disorder”

Authored by James Howard Kunstler via Kunstler.com,

The shadow of Corona virus creeps ever-darker across the scene like a cosmic messenger from Karma Central telling mankind to stop and assess. We’re about to find out what we’ve wrought with the wonders and marvels of globalism. Is there anything you can think of over at the Wal Mart or the Walgreens that isn’t made in China? I mean, everything from a dustpan to a lint brush? I can’t say for sure, because I’m not over in China, but the place is apparently not open for business these days. One must surmise that a lot of activities in the USA may not be open for business much longer, either.

The action in my local supermarket yesterday had an undercurrent of stealth desperation; no overt panic buying, no fighting in the aisles, but an edge of suspense. Personally, I cleaned out an entire product-line of cat food, loaded up on cooking oil, rice, dry beans, and evaporated milk — and I wasn’t the only one checking out with the sixteen-roll bindle of toilet paper. Obviously, many products were still there on the shelves to get (minus that cat food). Is the time perhaps at hand when a lot of stuff won’t be? Just sayin’.

The message is getting out — though not from US authorities yet — that everybody may soon be spending a lot of time home alone. That’s exactly what has happened in China and a region of northern Italy. France banned events with more than 5,000 people (why that number, exactly?). Japan has canceled school for the time being — duration unknown for now. So a USA lockdown is not merely hypothetical. These, then, are two fundamental conditions the world faces for a while: nobody moves and nothing gets produced.

Are we taking this thing too seriously (some might ask)?

I don’t pretend to know the answer, except, again, to point to China and think that they can’t possibly just be fooling around with all those zombified cities and shuttered factories.

The next question might be: will the global economy return at some point to “normal” operating conditions, that is, the fabulously complex network of supply lines, markets, and payment arrangements as they worked up until January 2020?

I am for sure not sure about that. Once a gigantic and fantastically precise mechanism breaks, I doubt it comes back together neatly and quickly. In the physical universe, the power of emergence is like the cue ball on a billiard table, and it appears that all the rest of the colored balls will be bouncing off the bumpers and sinking into pockets for while… and eventually the global table will look a lot different.

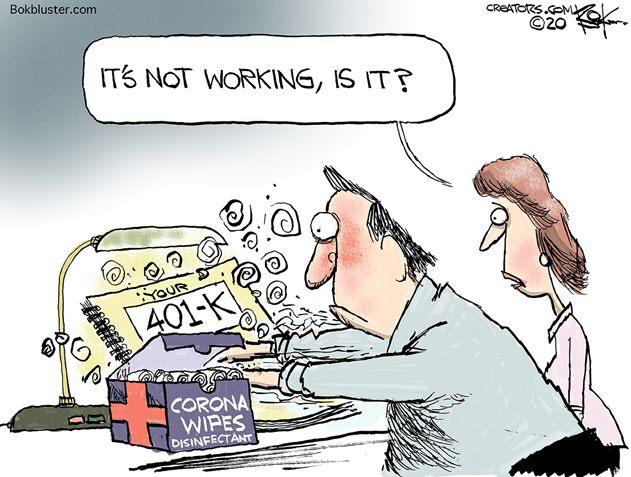

I’ve long maintained that of all the many networked systems we depend on, banking and finance are the most fragile, the most susceptible to dangerous disorder. And, of course, that is exactly what we’re seeing in the stock markets. Trillions of dollars in notional wealth have vaporized. Over on the bond side, interest rates are crashing toward zero as loose capital desperately seeks a safe harbor. But how safe is Bond Harbor, exactly, when all the advanced nations are so deep in the borrowing hole that they can never really meet their obligations? And Gawd knows what is going on with the “innovative” financial IEDs in Derivatives Land? How can they not be blowing up with price movements of the kind that went down last week?

As that colossal hairball unravels, nobody will get paid for anything for a period of time, again, duration unknown. There was chatter last week about a supposed Sunday meeting of global Central Bank poohbahs looking to come up with a battle plan for arresting the damage. It must have been mighty secretive because there’s nothing about it on the news wires Monday morning.

But what can they do, really, except the only thing they know how to do, which is to jam more “money” into crumbling arrangements? And then, we must ask, when does this stuff lose its credibility as “money?” Answer: when the contours of the black hole it is disappearing into become obvious and undeniable — and some might argue that we can already see all that. If the equity markets turn up today, that will probably be an indication that the CB Boyz and Gurls have launched a direct stock-buying blitz… meaning that, until further notice, markets are not really markets. That would be a set-up for another round of cratering when the CBs shoot their wads on that gambit.

One thing I’m hearing a lot is how much this emergency spotlights the USA’s need to reindustrialize. That would be a natural conclusion, but I warn you it will not work out the way they’re saying. I’m not going to harp on this for now, but our energy supply situation is not what it’s cracked up to be, specifically shale oil, which depends utterly on a reliable stream of loans to keep up the incessant fracking — not a bright prospect with credit markets frozen — and above and beyond that, it’s an industry that doesn’t pay for itself, doesn’t make a red cent. So, watch for carnage in the shale oil patches. The next trick will be to nationalize the industry, and that will only add another layer to a looming national bankruptcy.

Now, that suggests to me that we’re not actually able to return to manufacturing at the scale we abandoned a few decades ago — in other words, Make America Great Again. If we make anything, it’ll be at a much smaller scale, and maybe even a scale that would seem laughably humble. When the dust settles from present financial meltdown — and that might take a while — Americans with any remaining capital might want to invest in water-power and hydroelectric sites. (Note, there are plenty here in Washington County, New York). The hydroelectric part is a bit iffy, since that does require a lot of copper and steel for the turbines. But water-power itself can drive machinery. Again, just sayin’.

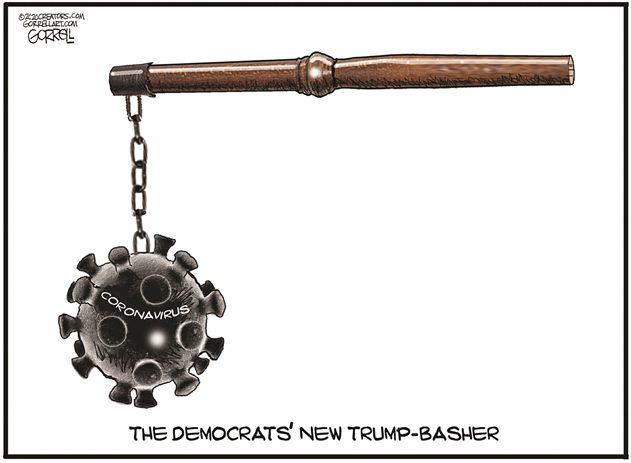

Of course, one of the ironies of this situation is that the entire news media assumes that the election contest is proceeding along the usual formal trajectory. No one seems to wonder whether the party conventions can even be held if the corona virus sticks around through the spring, or even the election, for that matter.

Tyler Durden

Mon, 03/02/2020 – 13:30

via ZeroHedge News https://ift.tt/2PHZ18e Tyler Durden