The Fed “Is Complicit In Creating Fragilities In The System”

Authored by Richard Breslow via Bloomberg,

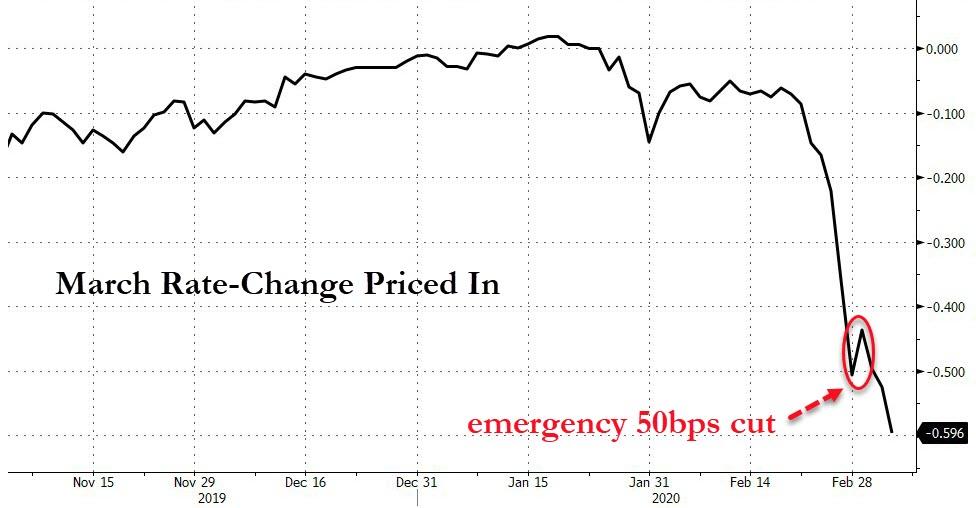

When the Fed cut interest rates this week, everyone had an opinion about it.

-

The economy needs it to fend off recession.

-

The economy has been hanging in well and they shouldn’t have rushed to spend dwindling monetary policy resources.

-

They were responding to the stock market.

-

They were helping keep the financial plumbing functioning.

-

They were bold.

-

They folded to criticism.

-

More is needed immediately.

-

Enough is enough for now.

-

Their communication strategy was sloppy.

-

They were willing to show flexibility in the face of evolving circumstances.

-

They are scaring people.

-

They are reassuring people.

The list is endless. As are the number of commentaries taking each side.

Who was right?

To a very real extent, they all were.

Sometimes, you just have to take action. And that is what they had at hand. Even if there will be both positive and negative consequences. But, if the rest of the government fails to demonstrate proper and immediate resolve to do its part in fighting the disease, it will all be for naught. They are buying time. But there isn’t a lot of it. Especially because, while fiscal policy would be a help, it remains to be seen if and when it can be expected to take its rightful place in manning the laboring oar.

It doesn’t mean the Fed can allow itself to be assumed to be at the complete mercy of the markets. Although, to be honest, they ultimately are.

They have been complicit in creating fragilities in the system through their encouragement of desperation investing that they bear a responsibility to be responsive to it. Perhaps at the moment, more than we thought or would like.

If there is one thing everything is at the mercy of, it’s the virus. And there was just too much uncertainty to be ignored. The authorities can show urgency without it necessarily being taken as panic. To use the well-worn cliche, we can handle the truth. In fact, will benefit from hearing it. The last thing anyone needs is for people to begin thinking that they feel fine, so what’s the big deal. That was a factor in slowing the rush for a global response when too many people thought of it as a problem “over there.”

Now the headlines are hitting home. And if we have to take short-term disruptions, even unpleasant ones, to lessen the chance of long-term disaster, so be it. It’s not something we have proved willing or adept at doing in response to too many challenges. Closing schools, banning business travel, the California state of emergency are scary realities indeed. They should provide greater hope than despair. We are safer for them. The equity market has fallen back so far today in response. It means little.

This has become a global problem. And as Mohamed El-Erian, among many others, correctly pointed out, it needs an all-hands response. So far this week there have been four central banks that have cut rates. All four cited this risk as a factor. More cuts are coming, as are other monetary and fiscal responses. It was interesting how much criticism was handed out that other banks didn’t act along with the Fed. They will. There are a lot of meetings scheduled this month. And it won’t be a case of speak now or forever hold your peace.

It was surprising to read, therefore, that currencies such as the pound and euro have been bid based on lessening expectations of any imminent policy action. That may be driving short-term price action. It’s unlikely to be proved correct analysis. They all can do something. Japan is said to be considering a new lending program targeting affected companies. It’s a negative externality that their GPIF is simultaneously considering raising its investment allocation to foreign bonds. Distortions in markets will necessarily have to continue for the foreseeable future. Maybe for longer than that. Current 10-year Treasury yields are a reflection of global fears far more than domestic ones.

When the stock market was up big on Wednesday, it didn’t mean everything was right with the world. Today’s downdraft doesn’t mean the opposite is suddenly true. At the moment, you should trade whatever opportunities daily momentum provides.

And don’t get lulled into giving away your safe havens without serious consideration.

Tyler Durden

Thu, 03/05/2020 – 08:24

via ZeroHedge News https://ift.tt/2ToVm1l Tyler Durden