“A Decade Of Ignoring Risk Is Confronting Face-To-Face An Exogenous Shock”

Authored by Richard Breslow via Bloomberg,

An ugly start to the day.

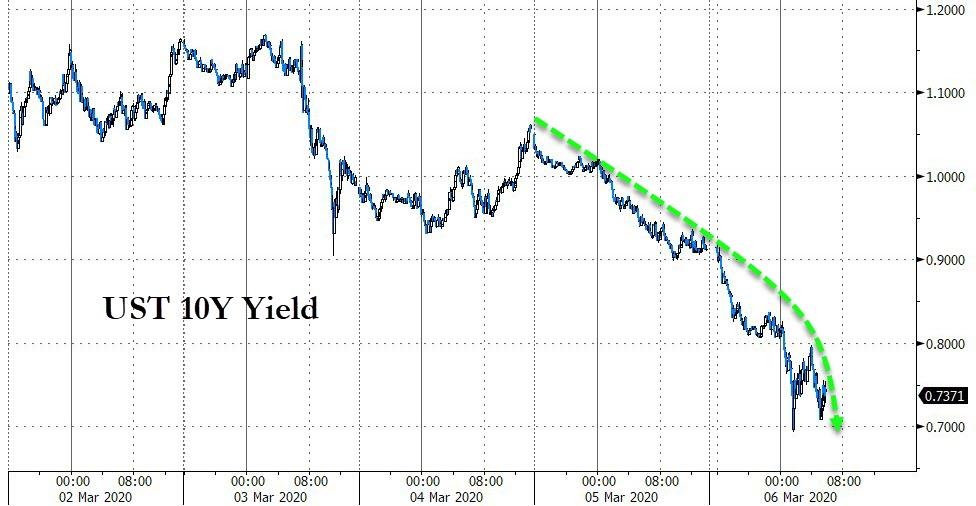

With the possible exception of those owning gold, even investors who held onto their safe haven assets are probably just feeling less unsettled. Buying bonds with yields where they are has been a great trade, but not a lot of fun. And while it is so ingrained in traders’ psyches to keep looking for places to fade these moves, it’s getting harder to be aggressive about it. At least on a Friday.

The real problem with moves that feature massive position liquidation, is that we can’t really know when investors have gotten back on side and the supply will abate.

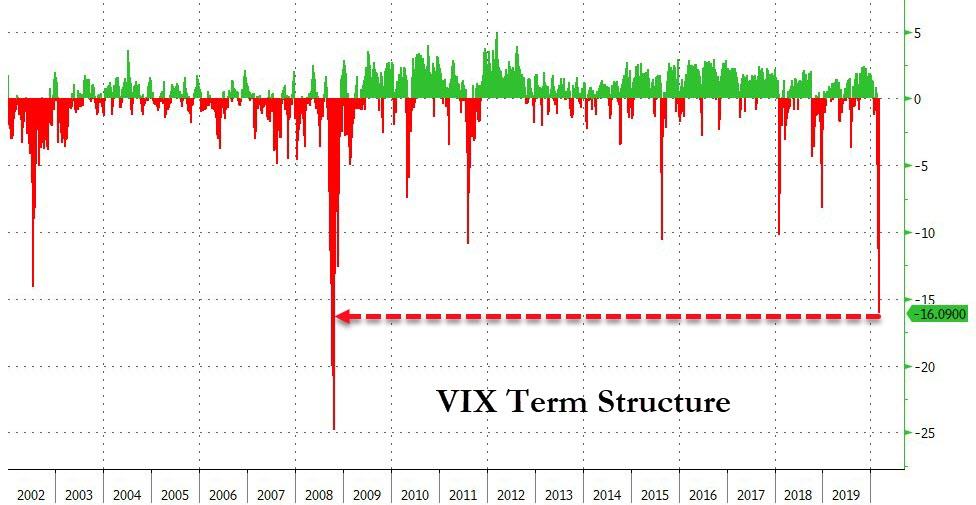

A decade of ignoring credit is confronting, face to face, an exogenous shock that few felt they could afford to hedge against.

Watching the markets trade today, there has been a steady march lower in risk. Then sharp mini-reversals seen by short-term traders as proof that things were overdone. Only for the moves to reassert themselves. That’s a key feature of trend days and it’s best not to try to fade them unless you are as fast as a computer. If it is right to do so, you probably don’t want to be trying to buy the absolute extreme. Price action, not sticker shock, should be the determinant. Or if you are absolutely sure this is wrong, wait until the end of the day and make that the last trade you do before going home.

There have been any number of people who have described this week’s trading as “buy the rumor, sell the fact”. I’m not sure why.

It’s been more, tilting at the wrong windmill. Traders were looking at a down stock market and expecting the Fed’s old fashioned reaction function to kick in.

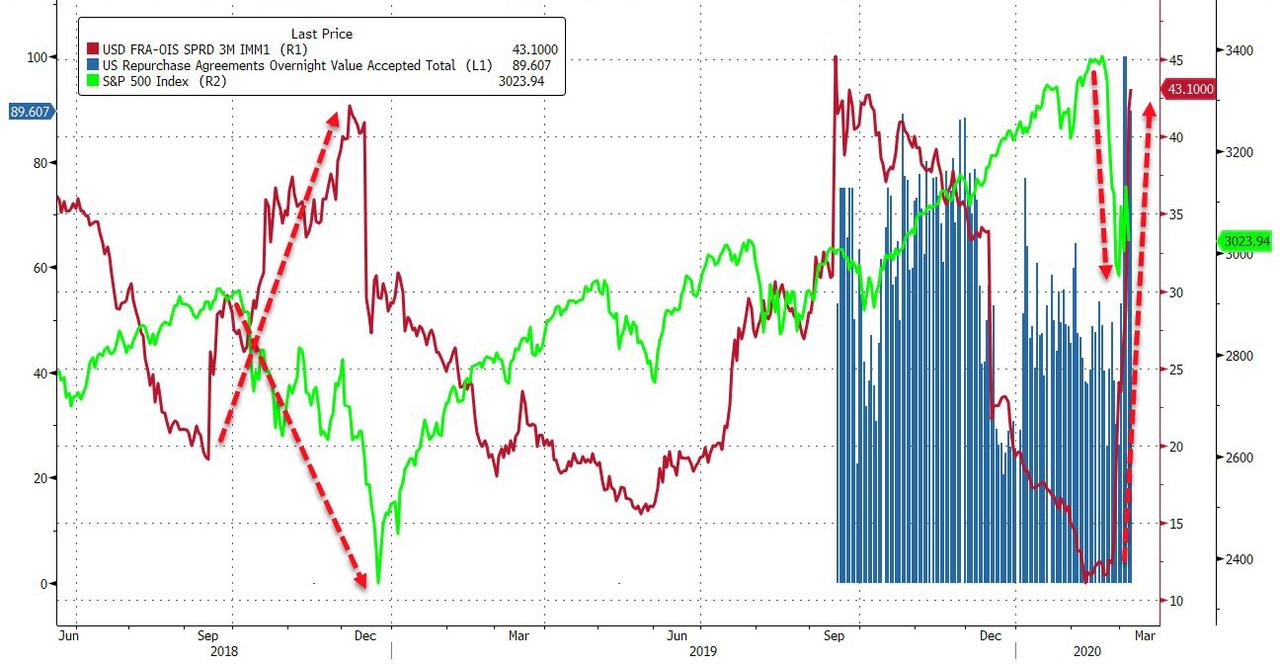

But, the Fed wasn’t fighting a down stock market. It was trying to make sure credit and funding markets didn’t go into full-scale panic. Other central banks will follow. The practical take-away is that the tendency to look at the investible world only through the prism of the S&P 500 isn’t operative here.

The USD FRA/OIS spread will tell you more about market stress than the next percent or two in the S&P e-mini.

The dollar has been under a lot of pressure. It doesn’t mean that it is no longer a safe haven. But it is an indication of just how many U.S. assets were bought unhedged by foreign investors. There are no free lunches in this environment and a price is being extracted. Few think they can afford to sell their bonds, so they are dumping their dollars. This has little to do with changing rate differentials. It’s position liquidation. And the extent of the dollar washout is a testimony to the size of the positions. I would have a hard time selling down here.

Many have said today’s nonfarm payrolls is old news. That events have moved on. There’s some truth in that. But it does still matter. What the economy’s trajectory was before the body blow is relevant.

There is also no shortage of Fed speakers today. They unanimously cut rates. They will couch it as insurance. Which hopefully is true. But the fact of the matter is, until further notice, they all have no choice but to be doves.

They know the size of the positions out there better than we do and are having to own up to the fact that it does matter while investors are better sellers than buyers.

Tyler Durden

Fri, 03/06/2020 – 10:30

via ZeroHedge News https://ift.tt/2Trc5Bf Tyler Durden