“I Apologize” – Money Managers Sorry For Losing Clients’ Money Amid Brazilian Bloodbath

While American asset-gatherers and commission-rakers were busy demanding investors ‘buy the dip for the long-term’ this week as each leg down just went further down (until Friday, of course), Brazilian money-managers were a little more frank with their clients.

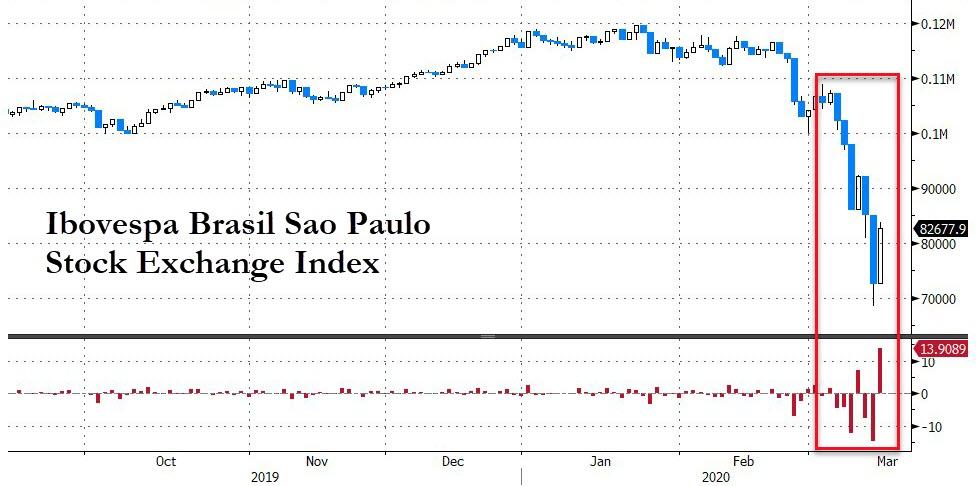

Although US markets were a bloodbath, Brazil was worse with shocking moves intraday – including a high to low drop of 20% on Thursday – leaving a trail of red in Brazil’s fund industry.

And, as Bloomberg reports, the best-performing money managers are reeling after the nation’s markets were especially hard hit by the global selloff. Some took to social media to try to appease anxious investors.

One apologized outright:

“Unfortunately, we were unable to defend ourselves from this fall like we did in 2015, or in the drawdowns of 2016 or in May 2018 and in other moments,” Joao Braga, co-head of equities at XP Asset Management tweeted on Wednesday.

“I apologize and we will work hard to recover.”

He has some apologizing to do as the XP Long Biased fund is suffering its worst monthly loss since its 2013 inception, down 30% through March 11, according to data compiled by Bloomberg. The fund, with about 2 billion reais ($425 million) under management, still has the best five-year return among 100 peers.

Another discussed his sleep patterns:

Alaska Asset Management’s Henrique Bredda and Luiz Alves Paes de Barros took to social media to explain their losses. Their Alaska Black Master fund, one of the nation’s best performers, is down 43% year to date through March 11. Barros says moments of massive stress can take a toll on how much he sleeps, but so far he’s fine.

“I’ve been sleeping like a prince,“ he said.

“I wake up very satisfied willing to start buying.“

And a last manager admitted his mistakes and promised to do better:

After posting a return of 155% in 2019 – more than three times its peers’ average – Logos Capital posted a 51% loss this year through March 11. Assets have dropped to about 170 million reais from a peak of 333.7 million reais in early January.

“Moments like this have happened to us before and we usually manage to recover,” Luiz Guerra, the Sao Paulo-based chief investment officer at Logos Capital, said in an interview, saying the firm also made a mistake with banking stocks, which it scrapped, and is now focusing on utilities, telecom companies and exporters.

This humility in the face of collapse should be worth more than the permabull BTFD hubris of every other talking head on business media.

Tyler Durden

Mon, 03/16/2020 – 23:30

via ZeroHedge News https://ift.tt/2wY2f18 Tyler Durden