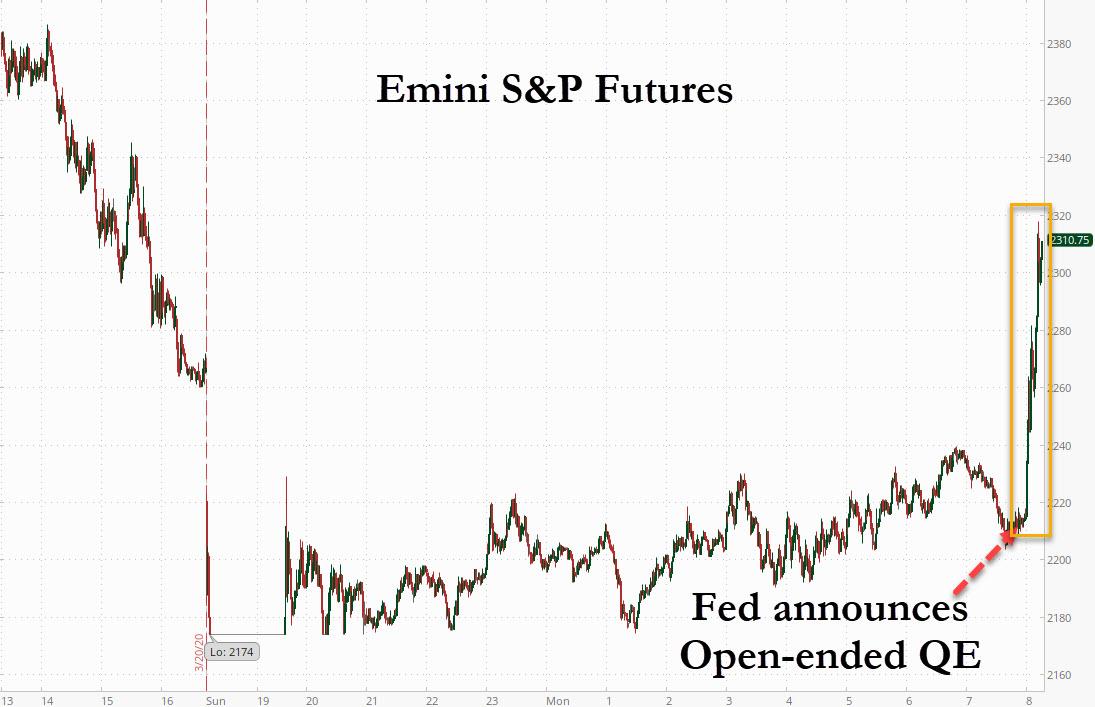

Stocks Soar After Fed Announced Open-Ended QE

Update: ignore all of the below, because moments ago, with futures near limit down, the Fed announced it would pursue an unprecedented open-ended QE, which helped push futures sharply higher and are now green on the session.

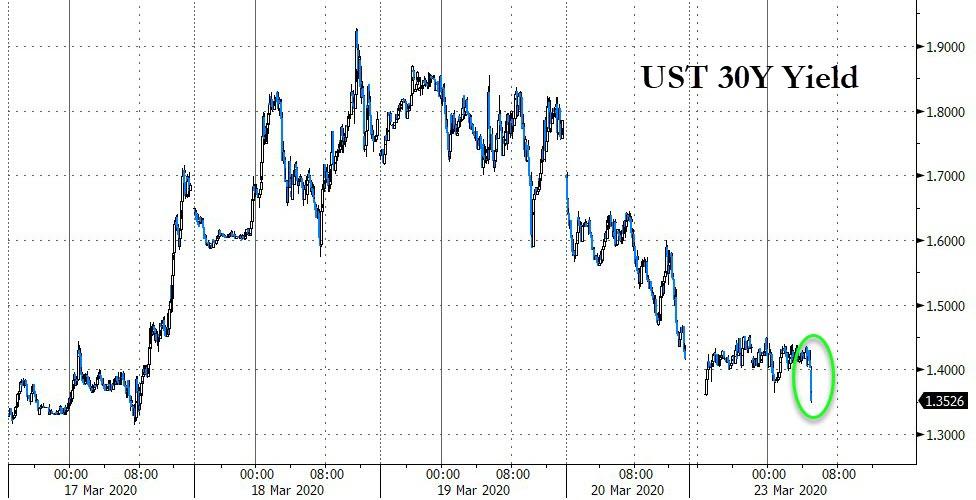

Bonds are bid across the board…

… and investment grade credit is soaring, as the Fed – after every bank demanding it do so – finally caved, and announced it would buy corporate debt.

Finally, with the Fed promising to print literally an unlimited amount of dollar, gold is finally soaring

* * *

Friday’s quad-witching and gamma-decay action was supposed to ease some of the insane market volatility hit late last week, but alas it was not meant to be, and after hitting a session hit of 2,499 on Friday, only to close at the lows, on Monday Emini futures tumbled limit down to start the session after Senate Democrats blocked a mammoth $1.8 trillion Republican stimulus package in a 47-47 vote, as a number of GOP senators were either sick with covid (such as Rand Paul) or in self-quarantine (Mitt Romney and others). Another vote was initially scheduled for 9:45am this morning (just after markets opened) but that was pushed back to noon, which means that the market will have be on pins and needles to see if and what kind of stimulus package passes, while also contemplating that there are now 345,289 global coronavirus cases and almost 14,924 death.

In light of all that it is perhaps somewhat surprising that futures actually managed to rebound from the -5% limit down and were last trading at 2,215, about 200 points above Goldman’s near-term price target of 2,000…

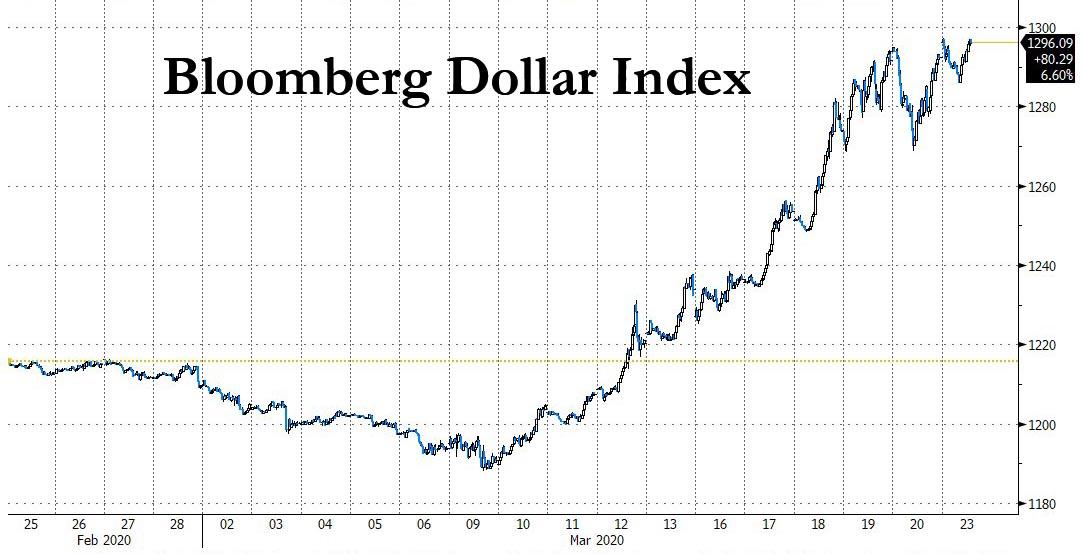

… even as the Bloomberg dollar index rebounded to all time highs as all the Fed’s attempt to ease the dollar funding shortage, and the $12 trillion dollar margin call, appear to have failed to ease the scramble for dollars.

“Further deterioration in the COVID-19 outbreak is severely damaging the global economy,” Morgan Stanley analysts warned on Monday. “We expect global growth to dip close to GFC lows, and U.S. growth to a 74-year low in 2020.”

The latest breakdown of cases is as follows (via RanSquawk):

- CHINA total cases 81,093 (prev. 81,054), death toll 3,270 (prev. 3,261).

- ITALY total cases 59,138 (prev. 53,578), death toll 5,476 (prev. 4,825).

- US total cases 35,070 (prev. 32,356), death toll 458 (prev. 414)

- SPAIN total cases 29,909 (prev. 25,496), death toll 1,813 (prev. 1,381).

- GERMANY total cases 26,198 (prev. 22,364), death toll 111 (prev. 84).

- FRANCE total cases 16,018 (prev. 14,459), death toll 674 (prev. 562).

- SOUTH KOREA total cases 8,961 (prev. 8,897), death toll 111 (prev. 104).

- SWITZERLAND total cases 7,806 (prev. 6,863), death toll 100 (prev. 80).

- UK total cases 5,683 (prev. 5,018), death toll 281 (prev. 233).

- NETHERLANDS total cases 4,204 (prev. 3,631), death toll 179 (prev. 136).

- CANADA total cases 1,470 (prev. 1,328), death toll 20 (prev. 19).

The panic quickly spread around the globe, with the Stoxx Europe 600 slumping led by health-care shares as the continent’s leaders scrambled to enforce more curbs on people’s movements and Italy began shutting most industrial production. Equities fell across most of Asia, where India’s benchmark plunged a record 13% while the rupee sank to the lowest ever amid moves to lock down widespread areas of the second-most populous country.

MSCI’s broadest index of Asia-Pacific shares outside Japan lost 5.01%, with New Zealand’s market shedding a record 10% as the government closed all non-essential businesses. Shanghai blue chips dropped 2.51%, though Japan’s Nikkei rose 2.0% aided by expectations of more aggressive asset buying by the Bank of Japan. In Australia, the S&P/ASX200 dropped 5.62% to take the index to a seven-year low.

UBS Australian head of equities distribution George Kanaan said global financial markets were currently gripped by fear, which seemed unlikely to ease any time soon, despite the co-ordinated efforts of governments and central banks around the world.

“I have been in the financial markets for 27 years and I have never seen anything like this,” he told Reuters by telephone from Sydney. “This is unprecedented in terms of fears and there are two elements driving that.

“First is that this involves masses of people. In the GFC, that was an event that occurred in the investment banks around the world, it didn’t involve people on the street. The second is that social media is helping to drive this fear and panic.”

Globally, analysts are dreading data on weekly U.S. jobless claims due on Thursday amid forecasts they could balloon by 750,000, and maybe by more than a million. U.S. stocks have already fallen more than 30% from their mid-February peak and even the safest areas of the bond market are experiencing liquidity stress as distressed funds are forced to sell good assets to cover positions gone bad.

In contrast to the response by authorities to the global health crisis, however, are calls from some on Wall Street to ease restrictions as soon as possible to give the economy room to recover.

“Extreme measures to flatten the virus ‘curve’ is sensible-for a time-to stretch out the strain on health infrastructure,” former Goldman Sachs Chief Executive Lloyd Blankfein tweeted. “But crushing the economy, jobs and morale is also a health issue-and beyond. Within a very few weeks let those with a lower risk to the disease return to work.”

Quoted by Reuters, E.L.&C. Baillieu financial advisor James Rosenberg said investors would remain cautious as a growing numbers of cities around the world entered lockdown. “The market is going to remain very volatile because nobody knows how to price a looming shutdown,” he said.

“The turning point will be a slowing in the rates of infection and we are probably weeks away from that happening – but it will happen with very tough social measures,” he said.

Elsewhere, Treasuries gained and core European bonds climbed. Yields on the benchmark U.S. 10-year note tumbled to 0.70% having dived all the way to 0.84% on Friday from a top of 1.28%.

In commodities, Brent crude extended losses after its 20% decline last week.

In New Zealand, the central bank announced its first outright purchase of government paper aiming to inject much-needed liquidity into the local market. In currency markets, the first instinct on Monday was to dump those leveraged to global growth and commodity prices, sending the Australian dollar down 0.8% to $0.5749.

Top Overnight News from Bloomberg

- On a weekend in which more than 2,000 people were killed by the virus in Italy and Spain, Germany banned gatherings of more than two people. The U.K.’s Prime Minister Boris Johnson threatened “tougher measures” unless British people stop ignoring calls to avoid social gatherings. Officials in Rome decreed a halt to almost all domestic travel, while Spanish Prime Minister Pedro Sanchez extended the state of emergency in his country for another two weeks. German Chancellor Angela Merkel put herself in quarantine as a precaution after coming into contact with a doctor who tested positive for the virus

- The Swiss National Bank appears to have waged the largest barrage of foreign exchange interventions in four years as amount of cash commercial banks hold with the central bank — called sight deposits — rose by 5.8 billion francs ($5.9 billion) last week, data on the SNB’s website on Monday showed

- The impact of virus on the Italian economy will be strong even as measures by the European Central Bank and European governments help limit the intensity and length of the slump, Bank of Italy chief Ignazio Visco and Prime Minister Giuseppe Conte said in separate interviews in La Stampa newspaper.

- Bank of France Governor Francois Villeroy de Galhau said Europe’s rescue fund should be activated to lend to states struggling with the coronavirus outbreak, a move that could pave the way for further sovereign bond purchases by the European Central Bank

Asian stock markets mostly traded with hefty losses amid further coronavirus-related disruptions and a rising death toll. As such, risk sentiment was spooked which was exacerbated as US equity futures hit limit down within a matter of minutes from the open to set the gloomy tone across the Asia-Pac region with ASX 200 (-5.6%) weighed heavily amid double digit losses across the big 4 banks and with NZX 50 (-7.6%) registering its worst intraday drop on record of more than 10% after the announcement of shutdown measures. Elsewhere, Hang Seng (-4.9%) and Shanghai Comp. (-3.1%) were lower as China conformed to the global coronavirus fears and after continued PBoC liquidity inaction. Nikkei 225 (+2.0%) bucked the trend on return from its extended weekend and with some finding comfort after Japanese PM Abe ruled out the cancellation of the Olympics but was instead open to a postponement, while SoftBank shares surged on the announcement of a JPY 4.5tln asset sale to fund a share buyback in which the Co. will retire 45% of stock. Finally, 10yr JGBs were higher amid the predominantly negative overnight risk tone and with the BoJ also present in the market today which includes unscheduled purchases of JPY 300bln in 3-5yr and JPY 500bln in 5yr-10yr JGBs.

Top Asian News

- Thailand’s Key Stock Index Plunges 8%, Triggering Trading Halt

- Hong Kong Bans Tourist Arrivals, Says Bars Can’t Serve Alcohol

- China Talks Up Post-Virus Rebound as World Economy Shuts Down

- Indonesian Stocks Hit Circuit Breaker Amid Spike in Virus Cases

Another detrimental start to the week for European equities (Euro Stoxx 50 -3.0%), as the negative APAC sentiment reverberated to Europe after US Senate failed to reach the required number of votes to pass its coronavirus bill, although Senate Majority Leader McConnel stated that a re-vote of the motion will proceed 15 minutes after the US Cash open. US equity futures briefly hit the 5% limit down but clambered off lows, whilst major European bourses experience broad-based losses, with the DAX having briefly lost the 8500 level and the FTSE 100 south of 5000. Sectors again reside deep in negative territory, although Telecom names fare somewhat better given the increasing broadband demand as large parts of the world are forced to work from home. Travel & Leisure names meanwhile see more pronounced downside on continued decaying demand. In terms of individual movers, CAC-giant Airbus (-0.4%) fell as much as 10% at the open after withdrawing FY20 guidance, pulling FY19 dividend proposals whilst it also secured a EUR 15bln credit line which will not be covered by the French government’s guarantee scheme. Elsewhere, ITV (-11.0%) sees downside after withdrawing its respective FY20 guidance whilst also announcing cost-cutting measures. Finally, Swedbank (-3.8%) sees losses relatively in-line with the broader market following a report into its money laundering practices which noted that the bank’s Estonian and Latvian arms actively pursued high-risk customers, but the report stopped short of concluding that money laundering practices took place.

Top European News

- Shell Axes Next Tranche of Buyback, Cuts Spending Forecast

- Italy to Start Production Shutdown as Deeper Recession Looms

- ECB’s Villeroy Backs Europe’s Rescue Fund for Virus Crisis

- U.K. Steps in to Save Railways as Johnson Warns of Lockdown

In FX, the Greenback has resumed its march higher after a relatively brief bout of consolidation, with the DXY back above 102.50 and aiming for a retest of resistance just below 103.00 where it faded on Friday following the Fed’s enhanced and expanded liquidity lines to other global Central Banks. However, the ensuing recovery in rival currencies has been rather short-lived as the Kiwi retreats towards 0.5600 in wake of the RBNZ rolling out a Nzd30 bn asset purchase program for 12 months, while the Aussie is back below 0.5800 alongside renewed Yuan weakness circa 7.1400 and Loonie looks destined to test 1.4500 again ahead of Canadian wholesale trade and against the backdrop of waning WTI.

- EUR/CHF/GBP – Also unwinding corrective gains vs the US Dollar as the nCoV pandemic prompts the ECB and BoE to pledge more stimulus via additional QE and/or funding, while the latest rise in Swiss sight deposit balances reveal the extent of heightened SNB intervention to curb the Franc’s appreciation. Eur/Usd has subsequently lost grip of the 1.0700 handle, Usd/Chf is approaching 0.9900 and Cable has recoiled through 1.1600 as Eur/Gbp hovers above 0.9200 in the run up to preliminary EU PMIs on Tuesday.

- NOK/JPY – The G10 outperferformers, with the Norwegian Krona deriving a degree of protection from crude price erosion via heftier Norges Bank foreign currency selling, while the Yen has pared declines on renewed safe-haven demand. Eur/Nok has pulled back from 12.7400+ peaks and Usd/Jpy is meandering within a wide 111.24-109.68 band after another record amount of BoJ ETF buying and Japanese Government supplementary budget reports.

- SEK/EM – Risk off sentiment and the Riksbank’s QE activity are keeping Eur/Sek afloat above 10.1500, while EM currencies are broadly weaker with Usd/Mxn, Usd/Rub and Usd/Try circa 24.8660, 80.6000 and 6.6000 after the Banxico’s pre-meeting ease, in advance of Russia’s next meeting with oil companies circa 14.00GMT and as the coronavirus toll jumps in Turkey.

- FIXED

- Bunds, Gilts and US Treasuries are all retaining the bulk of their latest recovery gains having topped out at 171.39, 134.56 and 138-02 respectively, but the big moves in debt markets of late have been at the Eurozone margins where Spanish bonds have erased all and a bit more of their hefty declines to trade at 154.00 vs 152.71 at one stage, while Italian BTPs have popped just over 140.00 from 138.74. Nothing to substantiate the notion, but it could be that ESCB management and intervention could have kept yields/spreads from spiking/diverging further, or simply the ECB steering QE in that direction according to market conditions. Ahead, the next round BoE APF buying and EZ preliminary consumer sentiment.

WTI and Brent front-month futures have been unable to escape the broader market selloff in the aftermath of a roadblock in the US Senate amid a failure among lawmakers to agree on a COVID financial aid package. WTI May contract briefly slipped below the USD 21/bbl mark to levels last seen in Q1 2002, whilst similarly, its Brent counterpart dipped below USD 25/bbl to hit Q1 2003 levels. Prices continue to feel underlying pressure from parts of the global economy coming to a halt amid coronavirus lockdowns, whilst OPEC+ indecision/uncertainty only adds further pain for the complex. On that front, Russian Energy Minister Novak will be convening with Russian oil producers (1400GMT/1700 local time) to discuss the current environment and low energy prices. This meeting is key to determine Moscow’s stance in OPEC+ and will give an insight as to how much longer Russia can tolerate the continuing slide in crude prices – with the Kremlin noting at the back-end of last week that low prices are unpleasurable but not a catastrophe. Meanwhile, Energyintel’s Bakr has played down the prospect of consensus being reached on an output cut ahead of the meeting. One thing to keep an eye on will be any reaction aimed at Saudi after the Kingdom’s output hike and OSP cuts. As a reminder, Russia’s government spokesperson Peskov on Friday said Moscow sees Saudi oil plan to ramp production as blackmail and will not back down but stated that the country remains ready for contact on prices. Elsewhere, spot gold continues to suffer from position liquidations as investors convert to cash/fund margins – with the yellow metal hovering below the USD 1500/oz mark ahead of last week’s USD 1451/oz low. Copper meanwhile, resumes its slide as COVID’s impact on fundamentals, supply chain and sentiment continues to pressure the red metal which hovered just above the USD 2/lb mark, having dipped below the figure last week.

US Event Calendar

This morning in the PDF (click “view report”) we have again published a sector and individual best and worst review of the last 4 weeks of this crisis and added the numbers from last week. This we’ve done for sectors and individual companies in the S&P 500 and Stoxx 600 and also for individual CDS names in the US and EU IG and HY CDS indices. In the text below at the end we do our usual weekly review of broad global asset performance from last week.

Also in what is a packed PDF we’ve shown the latest new cases update in graph and table form, and we have added mortality rates to account for a world where countries have different policies towards testing affecting confirmed case numbers. This provides added information on how far each country is along in the epidemic and possibly hints at stresses in their healthcare systems.

For now we are seeing a steady slowdown in new case growth across parts of Europe. In Italy for example the daily case growth has dropped to just over 10% from the 13-15% range of the last 5 days. The percentage increase in mortality is also starting to slow. New case numbers are exploding in the US as they start to test more widely, especially in NY State where 15K of the overall cases are. At this rate of growth, over the next few days the US will have the most number of cases worldwide, which given its population size shouldn’t be a huge surprise however the rate of change would be alarming if it continues as testing catches up. There is also some concern that HK and Singapore case numbers are rising again after being fairly flat for a while. It seems imported cases are the problem here. See the PDF for the exhibits.

In terms of how markets are kicking off the week this morning, we’ve seen the all-too familiar sight of US equity futures hitting limit. S&P 500 futures are currently -4.72% as we go to print while in Asia the Hang Seng (-4.17%), Shanghai Comp (-2.05%) and Kospi (-4.75%) are all down. Indian equities have also tumbled -10% and reached their limit down and the rupee slumped to the lowest level on record as the country moves towards to a nationwide lockdown amidst rising cases. The Nikkei (+2.55%) is the exception this morning having reopened following a public holiday on Friday. Meanwhile, the US dollar index is trading down -0.66% this morning and yields on 10y USTs are down -5.1bps to 0.794%. In commodities Brent crude oil is down -3.67% while most base metals are trading lower with Iron ore down -3.89%.

Not helping sentiment overnight was the news that Senate Democrats had blocked the $2tn stimulus bill. Just 47 votes were in favor with 60 needed for it to pass. Another vote has been scheduled for 9.45EST today. Senate Democratic leader Chuck Schumer argued that the “legislation had many, many problems” and that “At the top of the list, it included a large corporate bailout provision, with no protections for workers and virtually no oversight. It also significantly cut back on the money our hospitals, our cities, our states, our medical workers and so many others needed during this crisis”.

House Speaker Pelosi has said that she is planning on releasing her own bill to counter the Senate’s, which could be released as early as Monday. Regardless, any delays to getting stimulus into the economy can risk allowing the downturn to deepen and require even further policy intervention. The plan currently includes $350 billion for small businesses, $250 billion for unemployment insurance, and currently undisclosed billions in relief to distressed industries like airlines, as well as funding for hospitals to address the influx of patients. As discussed there was also talk of empowering the Fed with additional powers in times of market stress. There will be plenty of evidence early this week, when bills and motion come to the floor, to ascertain whether both sides drag this out or if they can quickly come together over an initial package to support the economy.

The Fed’s Bullard also hasn’t helped the mood overnight after suggesting numbers for Q2 US GDP that would make even the most bearish current forecasters’ eyes water. He suggested unemployment could reach -30% and GDP could fall -50%. Bullard also added that “everything is on the table” as far as additional lending programs go which is a view also shared by Kashkari who said overnight that “we’re far from out of ammunition”. He also added that “some people have suggested that we should be providing more support directly to the corporate bonds market, and I’m sympathetic with those views”.

In other news, the Reserve Bank of New Zealand announced a QE program overnight to support the economy of NZD 30bn ($17bn). The program will last over the next 12 months and central bank would buy NZD 750mn of government bonds a week across a range of maturities under the program. Elsewhere, Japanese Prime Minister Shinzo Abe said that a postponement of the Olympics may be inevitable.

In terms of scheduled events this week it’s all eyes on the PMIs tomorrow with the flash numbers for March coming out. It will likely be a bit too early to capture the full impact of all the lockdowns, but I’d imagine some of the numbers coming out tomorrow or in the final numbers a week later will be quite staggering. April’s numbers may still be a better guide to the problems ahead though. We’re going to publish a piece later that uses our PMI vs YoY equity change charts to give a rough approximation of what’s priced in and what the relationship would imply for equities under various PMI figures. Not really much point in saying much about the rest of the scheduled events this week as the unscheduled events will be far more important. Maybe Thursday’s US claims number is another good real time indicator after what was a big jump last week. See the day by day list at the end if you want to see what’s planned.

Also this week we should know a lot more about a stimulus package in Germany. The weekend press discussed how Germany was ready to this week pass through Parliament a €350bn (nearly 10% of GDP) package involving €150 borrowing and potential for another €200bn to buy stakes in companies or back loans.

Looking back at last week now, the S&P 500 saw its worst week since the Financial Crisis, falling -14.98% (-4.34% Friday), with every major sector of the index down over -11%. European equity markets performed remarkably better than their US counterparts, especially with the US selling off 3 out of 5 days in their afternoon session when Europe was closed. The STOXX 600 was down -2.05% on the week (+1.82% Friday, paring gains though after a +4.9% climb at the open). European stocks clearly saw a decent initial reaction to the large stimulus coming in the form of the ECB’s EU750bn bond buying program and the fiscal packages being deployed across the continent. In particular the Travel & Leisure sector saw a +9.8% rally on Friday, which is the sector’s best day since the daily data started in 1991, though the sector still remains -50.0% off its highs. The DAX fell -3.28% (+3.70% Friday), the IBEX slid -2.81% (+0.74% Friday) and Italy saw the FTSE MIB drop -1.39% over the 5 days (+1.71% Friday). Equities in Asia continued to sell off with the Nikkei declining -5.04% (closed Friday), while the CSI 300 dropped -6.21% on the week (+1.79% Friday). Lastly on equities, the VIX jumped on Monday and closed at a new all-time high before declining slightly through the week to finish at 66.0, but this was still up +8.2pts from the Friday prior. Brent and WTI crude oil fell -20.30% (-5.23% Friday) and -29.31% (-11.06% Friday) over the week as the price war between Russia and Saudi Arabia and the growing concern over a prolonged global recession weighed on the commodity from both the supply and demand side.

Even with risk selling off, sovereign bond performance was mixed over the week as correlations to equities have fluctuated and the dramatic fiscal/monetary policy implications of this crisis get digested. The 10yr U.S. Treasury yield ended the week at 0.845% (-29.5bps Friday, -11.5bps last week). 10yr Bund yields gained +22.3 bps on the week even while they fell -12.8bps on Friday to finish at -0.32%. After the miscommunication from the ECB about not being in the business of closing spreads was cleared up, concluding with the new ECB PEPP, markets saw French, Italian, and Spanish 10yr bonds all tighten to 10yr Bunds by -13bps, -38bps, and -11bps over the week respectively. This was a great turnaround for Italy as midweek we saw the BTP-Bund spread stretch to its widest since June 2019, before the policy action on Thursday saw one the biggest drops in spreads since December 2011. Credit spreads had a very bad week in the US. US HY was +278bps wider on the week (+27bps Friday), while IG was +158bps wider on the week (+36bps Friday). In Europe, HY was +203bps wider on the week (-2bps tighter Friday), while IG was +58bps wider on the week (+4bps Friday).

Tyler Durden

Mon, 03/23/2020 – 08:21

via ZeroHedge News https://ift.tt/3dgGGcC Tyler Durden