Buyback Backlash Begins: Fed Will Limit Buybacks & Dividends For Companies Using Its Credit Facility

Over the past week there has been a groundswell of populist anger aimed at companies that used roughly $4 trillion in cash over the past decade to repurchase shares instead of, say, putting the money away for a rainy day fund (one which would be quite useful now that most companies are begging for a taxpayer bailout as a result of plunging liquidity). And while Senate has yet to pass any fiscal stimulus that has explicit language limiting or prohibiting buybacks – this may change at today’s noon vote – moments ago the Fed made it clear that going forward both buybacks and dividends will be frowned upon.

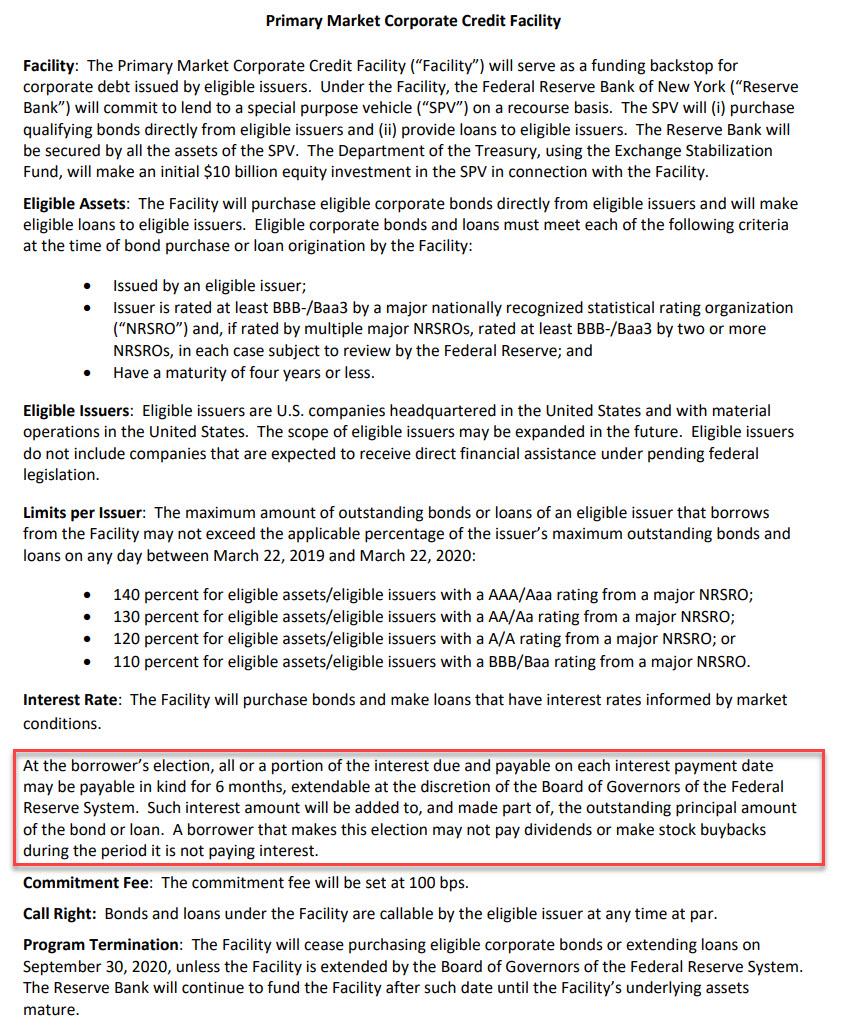

In the term sheet for its Primary Market Corporate Credit Facility which greenlighted the Fed to purchase investment grade bonds and issue loans directly to eligible issuers in the primary market (as opposed to the secondary market where the Fed will also buy IG ETFs such as the LQD), it had the following restrictive language:

At the borrower’s election, all or a portion of the interest due and payable on each interest payment date may be payable in kind for 6 months, extendable at the discretion of the Board of Governors of the Federal Reserve System. Such interest amount will be added to, and made part of, the outstanding principal amount of the bond or loan. A borrower that makes this election may not pay dividends or make stock buybacks during the period it is not paying interest.

Said otherwise any company that takes advantage of the Fed’s PMCCF and then elects to suspend payments on interest and/or principal by converting these to PIK payments, effectively adding them to the loan principal, will not be allowed to buyback stocks or issue dividends.

Which is good. What is not good is that the inverse is also true: the Fed is not limiting buybacks or dividends for companies that borrow money directly from the Fed as long as they remain in compliance with paying their interest on time.

In other words, while the Fed is trying to appear draconian in its “negative covenants”, it is also saying that companies that remain solvent and liquid can use any amount of proceeds sourced directly from the Fed, and use them to repurchase stock!

Somehow we doubt this is what the president meant when he said that he does not believe that buybacks should be encouraged in the future.

Here we will spare readers the drawn-out monologue how it was the Fed’s ultra low rates for the past decade that made the tidal wave of buybacks possible, a tidal wave which became a tsunami in 2018 and 2019 after Trump allowed companies to repatriate over a $1 trillion in offshore cash at negligible tax rates, which was then used to unleash a record stock buyback spree.

Oh, and one more thing: despite loud protests to the contrary, there are no explicit restrictions preventing beneficiaries of the Fed’s loans from laying off workers.

And now we look forward to what prohibitive buyback language the Fiscal stimulus bill will hold. If any.

Tyler Durden

Mon, 03/23/2020 – 10:35

via ZeroHedge News https://ift.tt/2WAycaj Tyler Durden