Germany Supports Rescue Loan For Italy Through Euro Area Bailout Fund

Who would have thought just one month ago, that “stingy, austere” Germany would emerge in just a few short weeks as a supporter of a European fiscal stimulus gusher.

After a weekend in which Germany’s “debt brake”, aka “black zero” balanced-budget policy was finally dealt a death blow, when we reported that Germany would issue or backstop a record €356 billion in new debt amounting to a whopping 10% of the country’s GDP, which was generally expected and sent Bund yields shbarply higher..

… on Monday Bloomberg announced that Angela Merkel, whose close encounter with the coronavirus appears to have been successful testing negative, is willing to usher in even more debt as German officials are ready to help Italy get through the coronavirus pandemic and “are prepared to support an emergency loan from the euro area’s bailout fund.”

According to the report, Berlin’s preferred option would see Italy granted an enhanced credit line by the European Stability Mechanism which was created during the depths of the European sovereign debt crisis, with minimal conditionality. The bad news for a “federalized” Europe is that while Chancellor Angela Merkel previously said she’s happy to discuss Italy’s request for jointly issued coronavirus bonds to shore up euro members’ finances, the official said Germany isn’t ready to move forward with that idea. In short, so great is Germany’s resistance to backstopping its more profligate neighbors, that not even the biggest economic crisis in European history will be sufficient for Europe to issue jointly-backed debt.

The Germans are also said to be concerned that Italy already had substantial structural problems before the virus struck and they may need to be addressed once it has passed, the Bloomberg source added. Euro-area finance ministers will hold a videoconference on Tuesday to discuss the next steps.

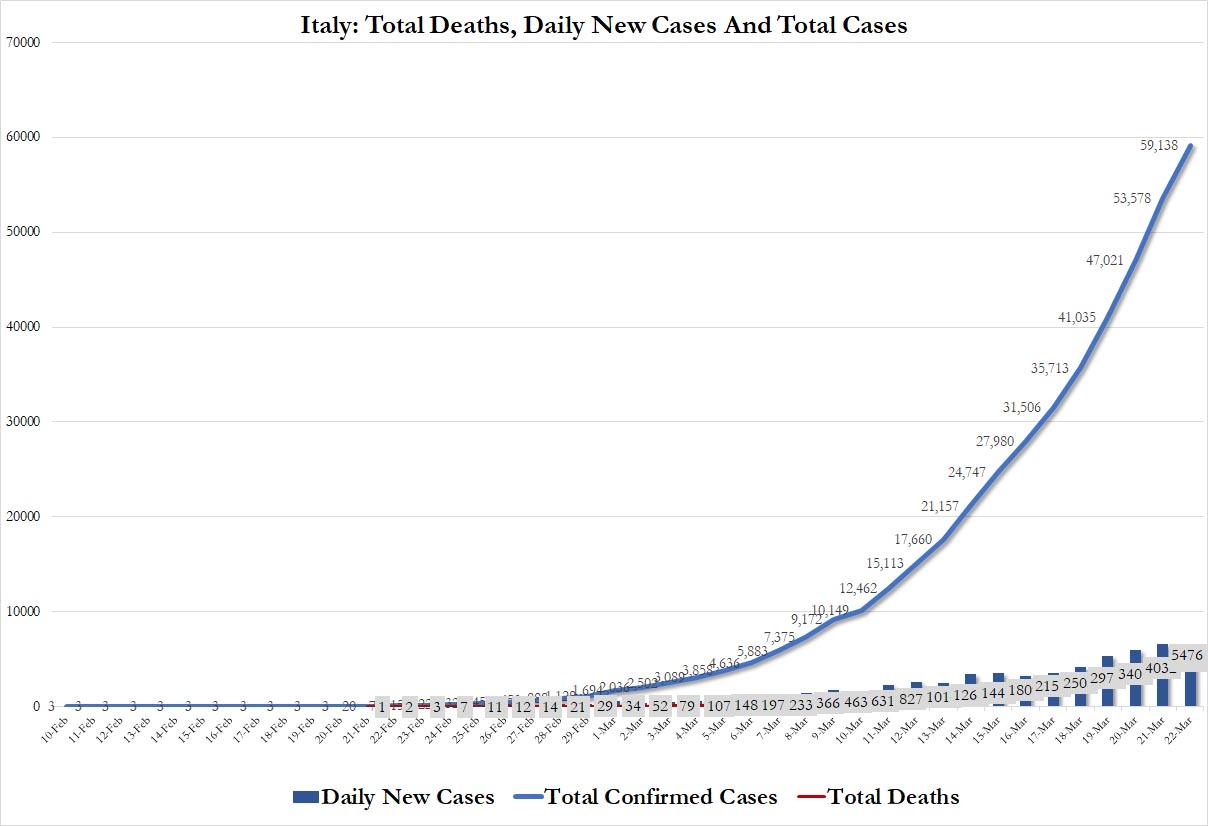

Italy, already the metaphorical “sick man’ of Europe has become that literally, suffering the brunt of the pandemic so far, with its industrial engine room effectively shuttered since March 7 and more than 5,000 people dead.

Making matters more complicated, Italy’s public debt was already at 135% of GDP, the highest in the Eurozone (except for Greece of course) before the outbreak hit, so it has little room for new debt issuance.

Ahead of the German announcement, Prime Minister Giuseppe Conte announced a €25 billion stimulus plan, a effort that is dwarfed by the German program and likely to fall far short of what the economy needs. Bloomberg Economics forecast output could contract by 5.3% in the first quarter, and that was well before the government halted all non-essential activities on Saturday.

As Bloomberg adds, the Germans have already made one big concession to cushion the blow to the Italian economy by endorsing the European Commission’s recommendation to allow extraordinary leeway to struggling nations within its budget restrictions. Euro-area finance chiefs are optimistic that they’ll be able to secure another boost for Italy on Tuesday’s call, though success is not guaranteed, officials said. If they can get a deal, that would allow the bloc’s leaders to sign off during their videoconference on Thursday.

That said, when it comes to new debt, nothing in Europe is certain, and one sticking point may be the conditionality attached to a credit line.

Italian officials are arguing that since they weren’t responsible for the outbreak, European solidarity dictates that there should be no strings attached, according to two officials familiar with the negotiations. The Italians also want all member states to be given credit lines to ensure there is no stigma for them.

The Germans — along with the Dutch — insist that there need to be some conditions, even if they are largely symbolic.

A precautionary credit line from the ESM would pave the way for the European Central Bank to deploy its most powerful tool — unlimited purchases of a country’s debt. Known as Outright Monetary Transactions, the program was developed during the euro zone’s debt crisis in 2012 but has never been used. It requires a country already to have a credit line with the ESM.

But bigger than just the immediate response to the coronavirus, at the core of the debate over how to support Italy, “is a long running dispute at the heart of the euro project over how far member states should share their liabilities.”

Since the single currency was set up, Germany and several allies with robust public finances have tried to resist mutualizing their debts. The sovereign debt crisis forced them to accept some tighter financial integration with the ESM and the single banking regulator.

Italy, with the support of France and Spain, is pushing for the bloc to take a further step toward fiscal union by jointly issuing bonds for the first time in order to finance the virus stimulus program.

Following a conference call with leaders, Merkel said she would ask her finance chief Olaf Scholz to join talks on the proposal with the rest of the bloc. But as Bloomberg notes, “that is as far as Germany is prepared to go, the official said. EU officials are drafting plans for how a such a mechanism could work despite the German opposition.”

The official in Berlin argued that using the ESM is already a form of mutualized obligation because it can take on debt on behalf of the whole euro area.

Bank of France Governor Francois Villeroy de Galhau said in a newspaper interview published Monday that the rescue fund should be activated, and Bank of Portugal Governor Carlos Costa said jointly issued “coronabonds” should be considered.

“That could help,” Isabel Schnabel, a German member of the ECB executive board, told Frankfurter Allgemeine Sonntagszeitung in an interview published Saturday. “No country can be indifferent to what is going on in another European country — not only for the sake of solidarity, but also for economic reasons. I hope that this is understood by the politicians.”

Needless to say, it will be remarkable if the current existential crisis, which is now seen pushing the world into a brief depression for at least one quarter, is not sufficient to prompt a flood of debt in Europe. Because if Europe’s debt-starved politicians are unable to put this epic crisis to good use and issue hundreds of billions in debt, breaching virtually every “fiscal brake” that exists, what happens when normalcy returns – tentatively – in a few months?

Tyler Durden

Mon, 03/23/2020 – 13:15

via ZeroHedge News https://ift.tt/3ae8ywd Tyler Durden