Platts: 5 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

US oil exports are under pressure as WTI’s differential to Middle Eastern offers narrows, reducing its appeal in Asia. Meanwhile, the gut-punch to global demand from the coronavirus pandemic is playing out across markets, putting EU carbon prices high on traders’ watchlist after last week’s nosedive.

1. WTI loses competitive edge in OPEC+ price war

What’s happening? US crude suppliers could fall victim to the price war triggered by Saudi Aramco’s latest move to slash official selling prices in Asia, as WTI’s discount to Middle East crude benchmark Dubai is being eroded. The spread between the front-month WTI swap and same-month Dubai crude swap has averaged minus $2.34/b to date in March, on course to register the narrowest monthly discount since minus $1.99/b in April 2018, according to S&P Global Platts data. The restart of a price war among producers will have a significant impact on oil supplies for non-OPEC countries. The US would be the main target of Saudi Arabia and Russia in order to regain market share, according to JY Lim, oil markets adviser at S&P Global Platts Analytics.

What’s next? Middle Eastern suppliers sweetening their offers to Asian buyers, South Korea – Asia’s biggest US crude importer – is poised to trim its purchases from the US over the next few trading cycles. South Korea could see its crude imports from the US tumble to around 62 million barrels in the first half of 2020, down 20% from 77.67 million barrels imported during H2 2019, according to feedstock procurement managers and trade sources at major South Korean refiners SK Innovation, GS Caltex and Hyundai Oilbank surveyed by S&P Global Platts.

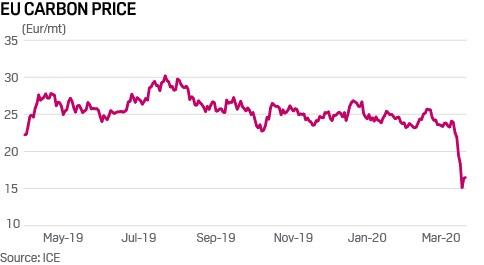

2. EU carbon price sinks on coronavirus

What’s happening? EU carbon allowance prices have fallen 30% since the start of March as the coronavirus pandemic took a heavy toll on generating fuels, power generation demand and the general economic outlook. EU Allowance futures for December 2020 on the ICE Futures Europe exchange fell below Eur16/mt ($16.89/mt) for the first time in 20 months, down 35% in a week before slightly rebounding above Eur16/mt on the back of massive monetary support packages announced by central banks March 19.

What’s next? Lockdowns hitting commercial business plus production halts for large consumer car, steel and other manufacturers are likely to continue to reduce power demand by up to 20%. Marginal gas and coal generation plants are most affected by this demand destruction, in turn reducing the need to buy carbon allowances. European aviation is also covered by the ETS, another bearish blow to EUA demand with most flights grounded. The carbon price fall is seen by some as overdone in relation to demand for the CO2 allowances and the self-correcting Market Stability Reserve, but these are unchartered waters for the ETS.

3. Palm oil dives as Malaysian lockdown bump proves shortlived

What’s happening? Palm oil prices have been pressured by lower crude oil prices which have a negative effect on biodiesel demand, as well as the broader weakness in the global commodity portfolio due to coronavirus fears. When Malaysia, the second largest global producer after Indonesia announced a partial lockdown of the country to prevent the disease spreading on the March 16, futures on the Bursa Malaysia Derivatives Exchange rallied in anticipation of a 50% decline in production. However, supply concerns eased a little when the palm oil industry was allowed to resume operations on the March 18.

What’s next? Despite palm oil plantations resuming operations, the logistics of transporting and shipping palm oil through the supply chain will prove challenging with Malaysia in lockdown. With some buyers not yet covered for Ramadan demand, lower production may result in supply tightness. However, competitive soybean oil prices, with the bumper Argentinian soybean harvest progressing, and sustained bearish crude oil prices, may continue to add downward pressure on palm oil.

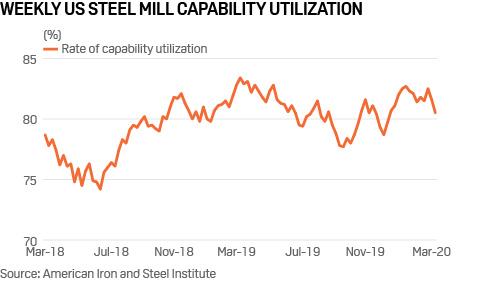

4. US steel mills keep up output, but auto shutdowns loom

What’s happening? US raw steel capability utilization to-date has seen little effect from the ongoing coronavirus pandemic, however shutdowns to automotive production announced by US automakers last week are likely to have a sizable impact on steel demand and output going forward. The Big Three US automakers – Ford, General Motors and Fiat Chrysler – on March 18 said they will suspend production through at least the end of March.

What’s next? A slowdown in North American automotive production is sure to have an effect on steel demand and pricing in the coming weeks. According to the American Iron and Steel Institute, shipments to automotive end users comprised 16.8 million short tons of the 95.3 million st of US steel shipments in 2018, the latest full year for which data was available. This represents 17.8% of domestic steel demand. Based on this data, a two-week auto shutdown could remove 646,000 st of finished steel demand from the market.

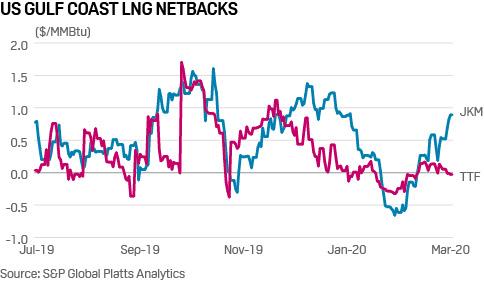

5. Rebounding LNG prices point US cargoes to Asia

What’s happening? While trade flow shifts and uncertainty created by the coronavirus outbreak weigh on the LNG market, US cargoes are able to find a home. Gulf Coast LNG netbacks from the Platts JKM, the benchmark price for spot-traded LNG in Northeast Asia, have trended strongly positive since they bottomed out in mid-February, supported by a recovery in demand in the region coupled with falling supply prices in the US. The comparable netback from the Dutch TTF hub has remained fairly flat as coronavirus-related concerns over demand destruction grip the market.

What’s next? Total utilization at US liquefaction terminals is resuming its upward trend, though is still down from record levels in late January, based on feedgas flows. Cancellations, maintenance, weather – and the arc of the health crisis – could cloud the picture.

Tyler Durden

Mon, 03/23/2020 – 14:30

via ZeroHedge News https://ift.tt/2WFcIsW Tyler Durden