Stocks Bid Into Month-End Despite Americans’ Unprecedented Scramble For Cash

Amid an ever-escalating guess at the size of pension fund re-allocations funds (latest we saw was $150 billion) into month-end, both bonds and stocks were bid early on today, but as the day wore on, bonds weakened as stocks gained (driven by record IG issuance-driven rate-locks)…

Source: Bloomberg

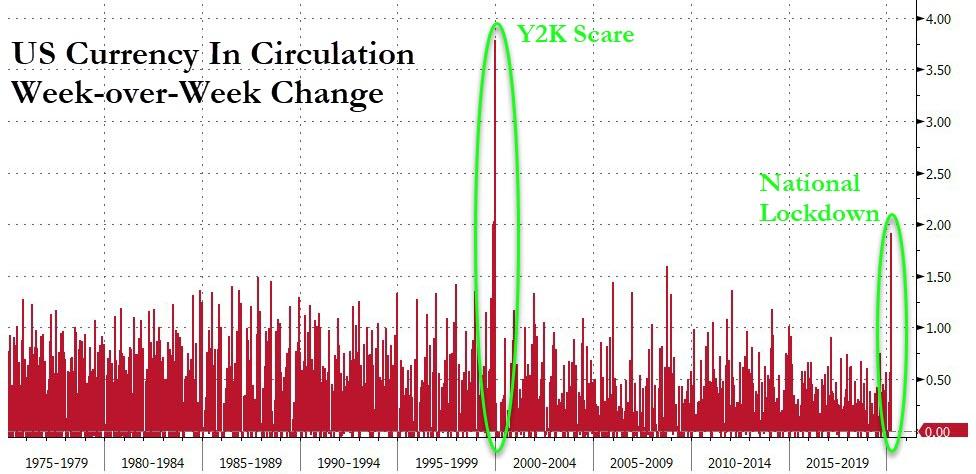

But while some are rebalancing into stocks, the scramble for cash among average Americans has almost never been more panicky…

Source: Bloomberg

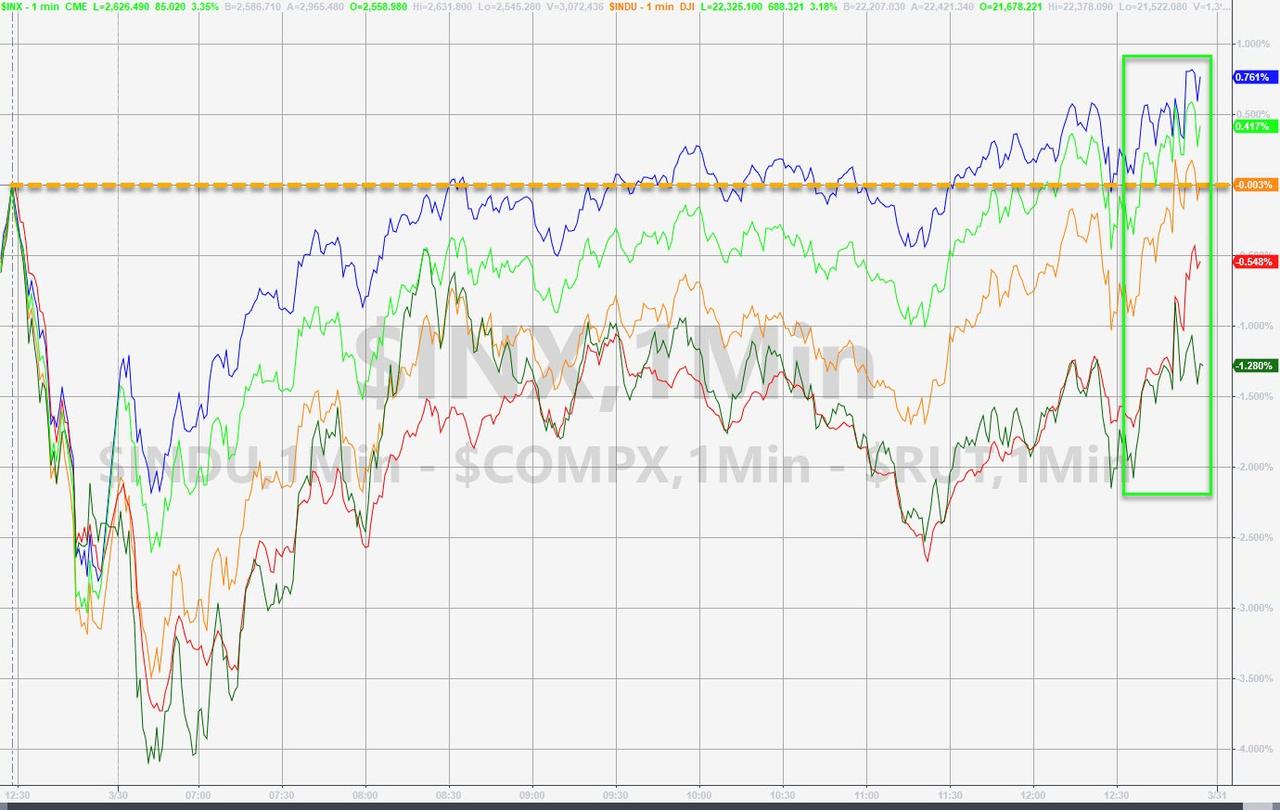

Just as notably, crude oil prices crashed to multi-decade lows today, completely decoupling from stocks (correlation crashed)…

Source: Bloomberg

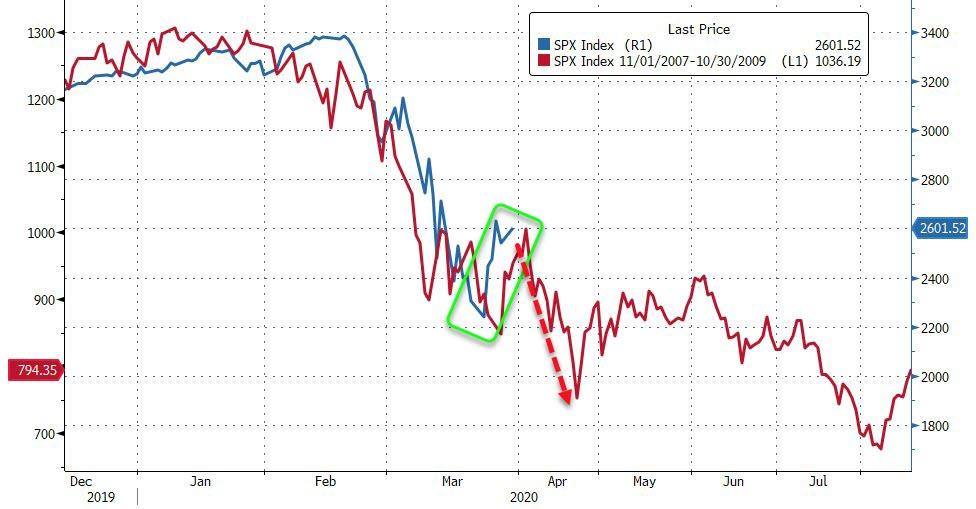

The question is – how long will the bounce last? If it’s month-end, then 2008 is still in play…

Source: Bloomberg

Maybe it’s better not to play…

And most of all, some context shows that today’s ramp merely unwinds the carnage from the last 30 minutes of Friday… (note this was a 1300 points rally off overnight lows)

S&P and Nasdaq managed to erase that late-day plunge…(Note the Dow ended perfectly unch from Friday highs)

Breadth was very weak with declining volume dominating advancing volume for most of the day…

Source: Bloomberg

The Dow pushed back above the Dec 2008 lows today…

Source: Bloomberg

Defensives outpeformed cyclicals today…

Source: Bloomberg

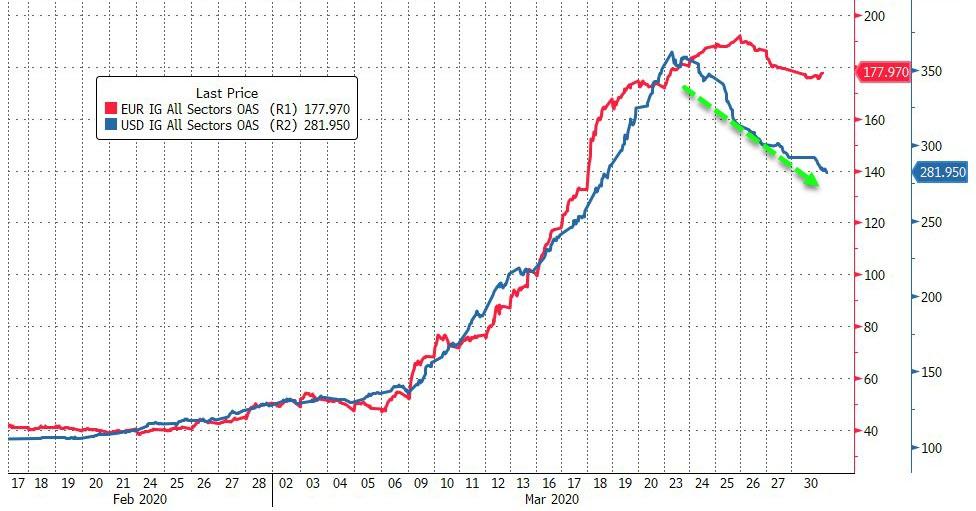

US IG credit has dramatically outperformed Europe since The Fed promise to start buying…

Source: Bloomberg

Treasuries were bid overnight but selling pressure accelerated as the US day session wore on (month-end rebalance and record IG issuance-driven rate-locks – U.S. companies borrowed a record $109 billion, which was met with $550 billion of demand, in what one dealer called a “food fight” for new bonds, according to Bloomberg)

Source: Bloomberg

Intraday, 10Y Yields fell back to a 59bps handle before the US session sell-off…

Source: Bloomberg

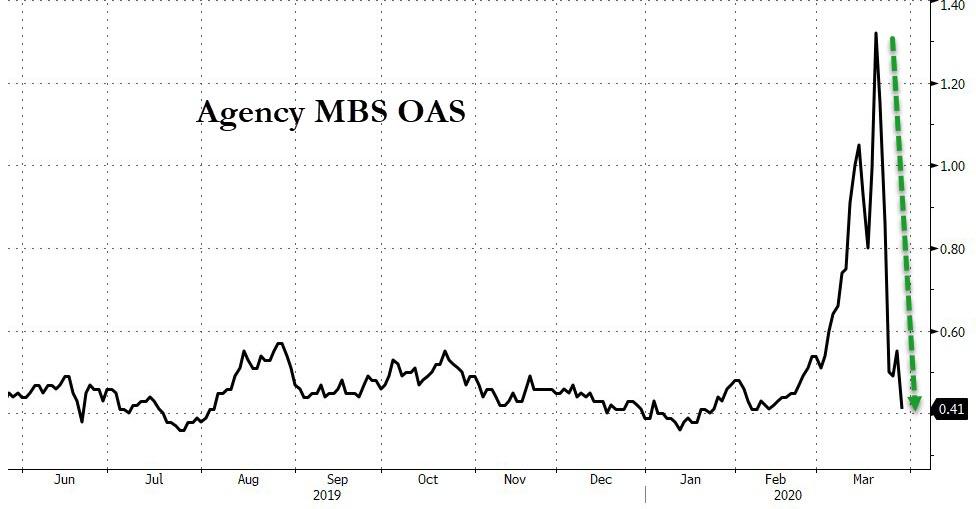

Mission Accomplished for The Fed as Agency MBS dislocations have corrected…

Source: Bloomberg

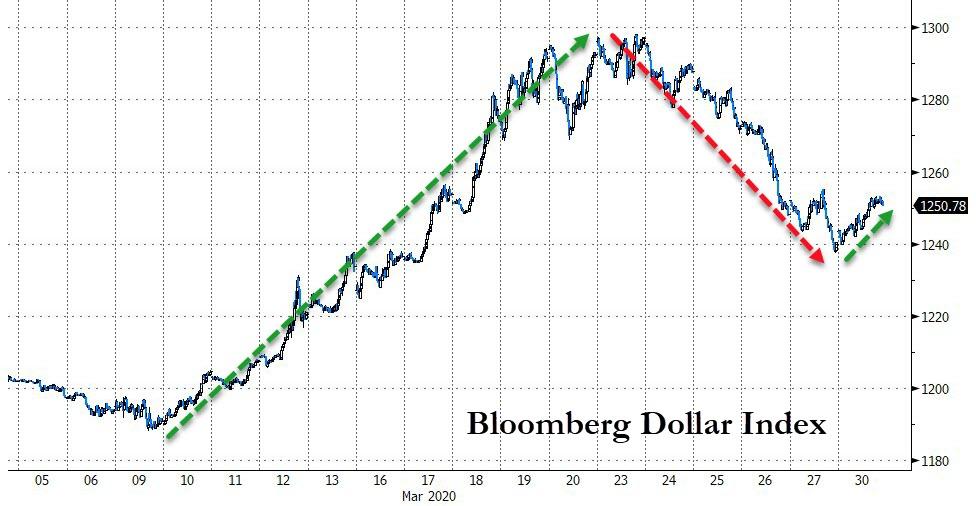

The Dollar Index managed gains today (the first in 5 days and best in 7 days)…

Source: Bloomberg

Cryptos rallied today but were unable to erase the losses from the weekend…

Source: Bloomberg

Commodities were all lower today led by crude’s carnage…

Source: Bloomberg

WTI broke down to $19.27 at its lows (before bouncing back above $20.00 on the settle)…

And finally, as the oil market struggles with an unprecedented hit to demand caused by the coronavirus, its main measure of supply and demand is screaming that a historic glut is emerging.

Source: Bloomberg

As Bloomberg details, Brent crude futures for May are now trading at an incredible $13.30 a barrel discount to November prices, a deeper and more bearish super-contango than the market saw even in the depths of the 2008-09 global financial crisis. Consultants say that, as things currently stand, the world is just a few months from running out of places to stash crude.

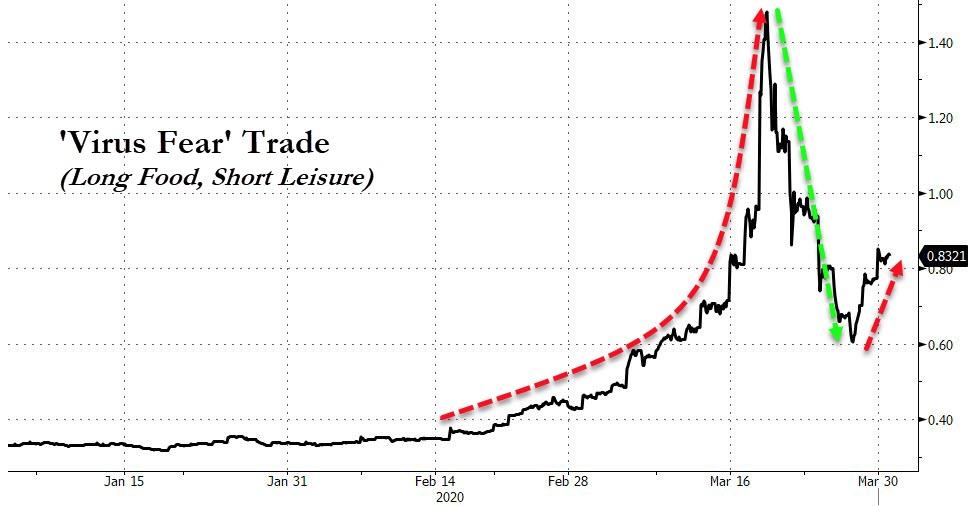

And we note that the ‘Virus Fear’-trade started to pick up again today…

Source: Bloomberg

Tyler Durden

Mon, 03/30/2020 – 16:01

via ZeroHedge News https://ift.tt/2UMkJKa Tyler Durden