Rally Fizzles, Futures Slide As Dollar Surge Returns

The torrid quarter-end rally which many attributed to a flood of forced pension fund buying as part of aggressive rebalancing, reversed overnight as US index futures reversed all overnight gains even as European stocks headed for a fifth increase in six sessions amid ongoing debate whether the market meltdown has ended despite the accelerating spread of the coronavirus (spoiler alert: no), while treasury yields dipped below 0.7% while the disconcerting dollar rally is back front and center.

S&P 500 futures rose as high as 2,640 before sliding back under 2,600 as politicians were said to contemplate a fourth round of stimulus, but they struggled to stay in the green as speculation the pension fund bid had faded. Oil producers Exxon Mobil Corp. and Occidental Petroleum Corp. jumped in the premarket thanks to a rebound in oil prices from 18-year lows after the United States and Russia agreed to discuss stabilizing energy markets.

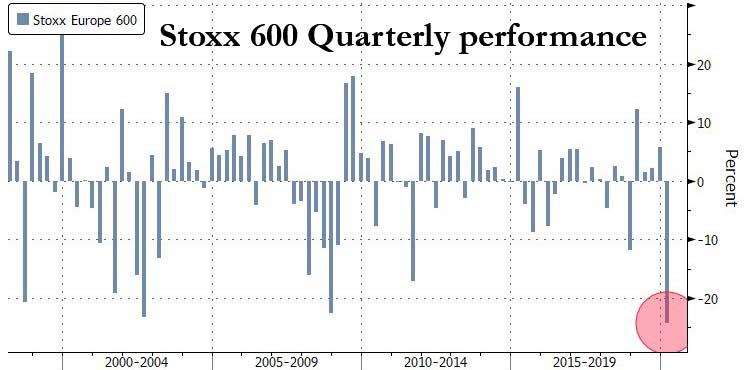

In Europe, energy shares led gains in the Stoxx 600 Index after the World Health Organization said signs emerged of some stabilization in the region’s outbreak. A measure of European corporate-credit stress eased further. Even with today’s modest rebound Europe is still set for its worst quarter on record.

The US was no better, and despite the recent rally the slump from the mid February record highs has set the Dow Jones .on course for its worst first quarter ever, while the S&P 500 is on track for its worst since 1938.

Earlier in the session, Asian stocks were little changed, with energy rising and industrials falling despite China reported ridiculously strong manufacturing data, which saw the mfg PMI surge to three year highs, in what was a clear political message from Beijing that China’s economy had a V-shaped recovery and had put the coronavirus concerns behind it.

China’s official manufacturing purchasing managers’ index (PMI) bounced to 52.0 in March, up from a record-low 35.7 in February, but analysts cautioned that a durable near-term recovery is far from assured as the global coronavirus crisis knocks foreign demand.

As Bloomberg notes, signs of a recovery across equities worldwide have arrived at the end of their worst quarter since 2008, which has put investors in a quandary, questioning whether some $12 trillion in extraordinary monetary and fiscal stimulus by countries and central banks can counter further the global economy grinding to a halt as the outbreak spreads. New York City, which is emerging as the new epicenter of the pandemic, reported a 16% increase in deaths in six hours. Italy and the Netherlands are considering extending lockdowns, and Spain’s 849 deaths were the most in one day for the country.

“We just don’t know how long the lockdown or stasis of the world economy is going to be,” said Toby Lawson, head of global markets at Societe Generale Securities Australia, told Bloomberg TV. “It would be very premature to say that we’ve seen the bottom.”

In FX, the dollar rose at least 1% versus the euro and three other major peers. The yen sank as the end of Japan’s fiscal year brought positioning adjustments after suffering a mini flash crash at the Tokyo fixing. Japan’s ruling party proposed the country’s biggest-ever stimulus package worth 60 trillion yen ($554 billion). EUR/USD fell under 1.10 as the dollar extended gains for a second day, supported by month- and quarter-end flows; the Bloomberg Dollar Spot Index was set for its best quarter since 2016.

Elsewhere, Norway’s krone was the best performing currency of the day among Group-of-10 peers as oil prices rebound; the currency was still set for its worst quarter since 1992 against the greenback on the back of the worst quarter on record for oil. Yen declined on dollar demand from Japanese investors to re-balance their portfolios on the final day of the fiscal year. The Australian and New Zealand dollars gained with commodities after Chinese manufacturing activity rebounded strongly in March, boosting risk sentiment. The pound slumped and headed for its worst quarter since the 2016 Brexit referendum

Gilts fell after the U.K. Debt Management Office announced it will more than double its issuance to sell 45 billion pounds ($55 billion) of bonds in April, with four auctions being conducted per week. US Treasurys gained across the curve.

Expected data include Conference Board Consumer Confidence. Conagra, McCormick, and Blackberry are reporting earnings.

Market Snapshot

- S&P 500 futures up 0.9% to 2,633.75

- STOXX Europe 600 up 1.9% to 320.86

- MXAP down 0.06% to 136.58

- MXAPJ up 1.4% to 435.89

- Nikkei down 0.9% to 18,917.01

- Topix down 2.3% to 1,403.04

- Hang Seng Index up 1.9% to 23,603.48

- Shanghai Composite up 0.1% to 2,750.30

- Sensex up 4% to 29,577.93

- Australia S&P/ASX 200 down 2% to 5,076.83

- Kospi up 2.2% to 1,754.64

- German 10Y yield rose 1.3 bps to -0.477%

- Euro down 0.5% to $1.0998

- Italian 10Y yield rose 15.0 bps to 1.307%

- Spanish 10Y yield fell 1.4 bps to 0.592%

- Brent futures up 3% to $23.44/bbl

- Gold spot down 0.9% to $1,607.97

- U.S. Dollar Index up 0.3% to 99.45

Top Overnight News

- Italy is discussing an extension of lockdown measures into May as European countries fight to contain the spread of the coronavirus, even as the outbreak shows signs of slowing

- German unemployment rose by just 1,000 in March, significantly less than economists predicted, before far-reaching restrictions on business and movement sparked thousands of furloughs in Europe’s largest labor market

- Stress is easing in dollar funding with key U.S. channels tentatively following overseas counterparts. The three-month dollar Libor fixing fell for the first time in over two weeks on Monday, while commercial paper rates — the yield on short-term notes issued by companies — also retreated

- The worst quarter for credit markets since at least the global financial crisis is ending with some signs of improvement. Spreads on credit-default swaps and dollar bonds in Asia dropped Tuesday

- Japan’s ruling party proposed the country’s biggest-ever stimulus package worth 60 trillion yen ($554 billion) as the spreading coronavirus locks the economy in a recession

- A surge in hedging costs for Japanese investors has wiped out the attraction of a popular trade — French bonds. Yen investors had to pay as much as 0.7% to hedge their euro exposure for three months last week, surging from just above 0.2% last month, a Bloomberg gauge showed

Asia equity markets were mostly higher (before trimming some gains) as the region took its cue from the gains on Wall St following recent global stimulus efforts and with sentiment also underpinned by an improvement in the latest Chinese PMI figures. ASX 200 (-2%) and Nikkei 225 (-0.9%) were lifted from the open with early outperformance in Australia led by the largest weighted financials sector and with sentiment also boosted after yesterday’s record AUD 130bln stimulus announcement, while Japanese exporters initially benefitted from a weaker currency, although both indices then gave up the gains amid Q1-end rebalancing and amid some doubts regarding the Chinese data. Hang Seng (+1.3%) and Shanghai Comp. (+0.1%) conformed to the early constructive tone following encouraging Chinese PMI data in which headline Manufacturing and Non-Manufacturing PMI topped estimates and the Composite PMI also printed in expansion territory. However, gains in the mainland were somewhat limited as some downplayed the data given that it was a recovery from the prior month’s record low base and with China’s stats bureau warning the rebound does not mean the economy has returned to normal and that this month’s data alone cannot determine an improving trend. Finally, 10yr JGBs were pressured in a continuation of the pullback from the 153.00 level, with demand subdued by the early upbeat tone in risky assets and following weaker results at the 2yr JGB auction.

Top Asian News

- Japan Plans Record 60 Trillion Yen Stimulus as Virus Spreads

- Yunda Jumps After Report Alibaba Plans to Buy at Least 10% Stake

- China Factory Rebound Hints Worst Is Over as Stimulus Lies Ahead

- Hong Kong Retail Sales Plunge Record 44% in February on Virus

European equities trade on a firmer footing once again (Eurostoxx 50 +0.3%) as sentiment remains upbeat alongside quarter-end rebalancing flows and post-Chinese PMI metrics, albeit stocks have drifted off highs. On the data front, price garnered some support from the last survey data out of China in which headline Manufacturing and Non-Manufacturing PMI topped estimates and the Composite PMI also printed in expansion territory. However, it is worth noting that some desks have downplayed the data given that it was a recovery from the prior month’s record low base and with China’s stats bureau warning the rebound does not mean the economy has returned to normal and that this month’s data alone cannot determine an improving trend. In terms of sector specifics, energy names sit near the top of the pile in a bounce-back from some of the declines yesterday with WTI now back above USD 21/bbl and Shell (+4.0%) shares shrugging off expectations of a USD 400-800mln Q1 impairment charge and weak refining margins. Elsewhere, travel and leisure names have also seen support during today’s session as hopes continue to be pinned on government support measures, albeit, from a UK standpoint, Times’ Swinford noted comments from Transport Secretary Shapps that the “UK government is attempting to find the right solution for airlines”, something which Swinford inferred as meaning that it “doesn’t sound like a big bailout is coming”. The main theme in the pre-market was largely centered around the suspension of buybacks and dividends (details of which can be found in the European equity opening news) with particular focus on the UK banking sector with the latest reports via Sky News suggesting that the Prudential Regulation Authority will, on Tuesday or Wednesday, state that Barclays, HSBC, Lloyds and RBS will not be paying dividends as part of FY results. Notable individual movers include Imperial Brands (+12.4%) after signing a new revolving credit facility of EUR 3.5bln and noting no material impact on group performance, Bayer (+2.0%) has reached a settlement with US plaintiffs and WPP (+6.9%) are firmer despite suspending its buyback, dividend and outlook, whilst noting that it maintains a strong balance sheet.

Top European News

- Euro-Area Inflation Slows More Than Forecast on Oil Slump

- Nightmare Haunting Euro’s Founders May Now Be Reality With Italy

- Smiths Delays Ventilator Unit Spinoff as Virus Roils Markets

- Strong Start to Pandemic QE Raises Hopes of Credit Turnaround

In FX, the Buck has extended gains vs major counterparts, albeit to varying degrees as a sharp rebound in Chinese PMIs, some consolidation in crude and remaining asset rebalancing flows for the final trading session of March, Q1 and the current financial year help some rival currencies to resist the Greenback’s advances. However, the DXY looks more assured around 99.500 and certainly back on the 99.000 handle within a 99.694-99.100 range, and could continue its recovery towards resistance at 99.915 (prior 2020 high before the psychological 100.000 mark was breached precisely one month later on March 20 when the index hit 102.999).

- NOK – The G10 outlier and outperformer, partly due to the aforementioned bounce in oil prices, but mainly as the Norges Bank plans to jack up foreign currency sales against the Norwegian Krona to the equivalent of Nok2 bn per day in April from Nok1.6 bn this month and only a quarter of the new daily total in February. Eur/Nok is hovering just above 11.5100, but has been under 11.5000 in contrast to Eur/Sek flat-lining between 11.1040-0610 parameters.

- CAD/AUD/NZD/GBP/EUR/JPY/CHF – Firmer or more stable crude is also providing the Loonie with some underlying support around 1.4200 vs its US peer, while the Aussie and Kiwi are both holding off overnight pre-Chinese PMI flash crash lows of 0.6080 and 0.5948, though down from best levels reached (0.6200+ and 0.6037 respectively) when the headline prints exceeded consensus and regained 50+ growth rather than deep contraction levels. Elsewhere, the Pound has lost its grasp of 1.2400, but faring better against the Euro circa 0.8900 as the single currency retreats through 1.1000 vs the Buck on soft Eurozone inflation and the ongoing nCoV spread in Spain. Note, hefty Eur/Usd option expiries do not seem likely to impact at this stage, but for the record there are several ranging from 1 to 1.6 bn rolling off from 1.1000 to the 1.1100 strike and beyond. Meanwhile, the Yen and Franc are towards the bottom of 108.70-107.75 and 0.9649-0.9581 bands and hindered by safe-haven outflows, with the latter not deriving any support from considerably firmer than forecast Swiss retail sales.

- EM – Some respite for the Rouble after a call between US President Trump and his Russian counterpart Putin aimed at stopping the dispute with Saudi Arabia over the price of oil and market share, but little joy for the Lira even though the CBRT has rolled out more liquidity provisions for Turkish banks.

In commodities, WTI and Brent front-month futures experience consolidation from the prior session’s hefty losses, in which prices tumbled to their lowest points in almost 20 years. The former outperforms on the prospect of potential US-Russia cooperation in the energy markets to stem the rotting prices. US President Trump conducted a phone call with his Russian counterpart yesterday with Kremlin noting that this was at the request of the US. The leaders agreed on the need for stability in the energy markets, albeit no further details were released. WTI front-month contracts have reclaimed USD 21/bbl to the upside having yesterday printed a base at around USD 19.30/bbl, whilst Brent touched a multi-year low at ~ USD 21.60/bbl, with prices now nearer to USD 23.50/bbl. Elsewhere, spot gold trades subdued amid a firmer USD and with portfolio rebalancing also in the fray. The yellow metal hovers just above the 1600/oz mark having hit an overnight peak at USD 1626/oz. Meanwhile, copper prices remain supported by the strong China NBS manufacturing PMIs which rose back into expansionary territory from last month’s detrimental print. Copper gains a firmer footing above USD 2/lb ahead of resistance at 2.5/lb from a technical standpoint.

US Event Calendar

- 9am: Case Shiller 20-City MoM SA, est. 0.4%, prior 0.43%

- 9am: Case Shiller 20-City YoY NSA, est. 3.23%, prior 2.85%

- 9:45am: MNI Chicago PMI, est. 40, prior 49

- 10am: Conf. Board Consumer Confidence, est. 110, prior 130.7; Expectations, prior 107.8; Present Situation, prior 165.1

DB’s Jim Reid concludes the overnight wrap

We’re straight to Asia this morning where the main story is the significant bounce back in China’s PMIs. The manufacturing PMI jumped to 52.0 for March which is relative to 44.8 expected and 35.7 last month, and is also the strongest print since September 2017. Meanwhile the services PMI printed at 52.3 versus 42.0 expected and 29.6 last month. That left the composite reading at 53.0 versus 28.9 in February. A sub-index of new manufacturing export orders also rose to 46.4 in March, up from 28.7 last month.

Despite the huge jump, the accompanying statement from the NBS said that “while manufacturing PMI rebounded rapidly in March, the survey showed companies still face relatively big operational pressures,” and added that more firms are reporting funding shortages and falling demand than in February. The statement also said that “the global virus spread will hit the world economy and trade seriously and bring new, severe challenges to the Chinese economy.” So the tone still remains understandably cautious but nonetheless the data does provide sliver of hope for expectations of a ‘V or U’ shaped recovery for markets in the aftermath of coronavirus induced lockdowns.

Chinese markets have posted small gains following the data with the Shanghai Comp and CSI 300 up +0.42% and +0.56%, while the Hang Seng has gained +1.09%. Elsewhere, it’s more mixed. The Kospi has risen +1.77% however the Nikkei (-0.48%) and ASX (-1.53%) are both down.

In other overnight news, Bloomberg has reported that the White House and congressional Democrats are preparing for a fourth round of economic stimulus to get the US through its coronavirus outbreak. The report added that the White House has already compiled lists of requests from government agencies totalling roughly $600bn towards this and the proposals include more state aid as well as financial assistance for mortgage markets and the travel industries. Futures on the S&P 500 are little changed.

Following on from this the main story in financial markets yesterday was the astonishing fall in oil prices – albeit one which has reversed this morning – where the combination of an impending global recession and the Saudi-Russia price war saw yet further declines. By the end of the session yesterday, WTI was down by -6.60% to just $20.09/barrel, which is its lowest level since 2002, and the 8th time this month alone that WTI has declined by more than 5% in a single day. With just one day left in the month to go, the price of WTI crude has now more than halved since the end of February (-54.69%), making this month for WTI even worse than the falls in October 2008 (-32.62%) and the biggest monthly decline in data going back to March 1983. Remember that in the first week of the year WTI hit $65.65 intra day after the US/Iranian military strike and escalation, so it’s down -69.11% since that peak.

The movements in the oil market have attracted the attention of global leaders, with President Trump telling Fox News yesterday that he planned to talk with Russian President Putin about oil, also saying that “I never thought I’d be saying that maybe we have to have an oil increase, because we do. The price is so low”.

Over in global equity markets it was a generally positive picture after Friday’s declines, with the S&P advancing +3.35%. The move continues the S&P’s run of having moved by at least 1% in either direction in 20 out of 21 sessions so far this month. In a further sign that some semblance of stability could be returning, the VIX index of volatility fell by -8.5pts yesterday to 57.08pts, which is its lowest level in over two weeks. In Europe, equities pared back losses to close higher, with the STOXX 600 recovering from an intraday low of -2.42% shortly after the open to close up +1.28%. Banks dragged on the index however, with the STOXX Banks index falling a further -5.69% yesterday as lower core rates in Europe have started to become a trend again.

Having said that 10yr Treasury yields were up +5.2bps yesterday to 0.73%, as large equity moves and general optimism saw long end rates rise, even as the short end yields went lower. In Europe, for a second session running there was a notable widening in peripheral spreads. The spread of Italian 10yr yields over bunds was up +16.7bps, bringing its 2-day rise to 37.8bps, while the spread of Spanish (+8.2bps), Portuguese (+8.7bps) and Greek (+6.3bps) yields over bunds also widened yesterday. Italian bonds may have been impacted by continuing concern at there not being any outline of assistance for the country at last week’s meeting of EU leaders and also Conte’s words over the weekend that anti-EU sentiment could increase in the country. Staying with fixed income, credit spreads broadly tightened in the US, with HY cash spreads -17bps tighter and IG tightening -9bps, while EUR spreads widened 11bps and IG widened 1bp.

It was a strong day for the US dollar yesterday, with the Bloomberg dollar index snapping a run of 4 successive declines to strengthen by +0.71%. However, the oil-producing currencies suffered, with both the Canadian dollar (-1.28% against USD) and the Norwegian Krone (-0.57%) struggling yesterday against other major currencies.

Before we look at yesterday’s data with all of the uncertainty around making point forecasts in this environment, Justin Weidner on our US Economics team has built a simple model based on only five parameters (e.g., the length of containment measures, initial decline in output, etc.) to trace out the potential impact of the Covid-19 on US GDP growth over the next two years. Here’s the link to the model: DB US Eco Covid-19 GDP model . The team describes the model in a report out yesterday (see Tracing the economic fallout ) and also detail simulations. They find that the median path has growth falling 37% in Q2 on an annualized basis and -1.1% in 2020 (Q4/Q4). The interquartile range has outcomes ranging from -22% to -51% for Q2 annualized growth and from -4.4% to +0.5% for 2020 Q4/Q4 growth. Their own forecast (-33% in Q2 and -3.2% for 2020) fits well within these ranges.

Now to those economic data releases, the European Commission’s monthly economic sentiment indicator for the Euro Area fell by -8.2 points in March from 103.4 to 94.5. This is the largest monthly decline since records began in 1985. However, the survey responses were collected between 26 February-23rd March, and for many countries the vast majority of responses were collected before lockdown measures began, so further deterioration is still likely ahead of us. Over in the US meanwhile, the Dallas Fed manufacturing outlook survey saw the general business activity index fall to -70.0 in March, well below the -10.0 reading expected and the lowest level since the survey began in June 2004. Finally, we got the German inflation reading for March, where the preliminary estimate of HICP came in at 1.3%, down from February’s 1.7%.

To the day ahead now, and data releases include the flash estimate of Euro Area CPI for March, as well as the preliminary readings for France and Italy. Meanwhile we’ll get the change in German unemployment for March, along with the final reading of Q4 GDP in the UK and January’s GDP in Canada. Finally in the US, we’ll get the Conference Board’s consumer confidence indicator for March, along with the MNI Chicago PMI and the S&P/Case-Shiller US National Home Price Index

Tyler Durden

Tue, 03/31/2020 – 08:10

via ZeroHedge News https://ift.tt/3dFHrw1 Tyler Durden