“Apocalyptic April”: Trump Fails To End Oil Price War As Saudis Unleash Oil Tsunami On The World

Oil held steady near $20 on Wednesday, after President Trump’s pledge to meet with feuding producers Saudi Arabia and Russia (whose real feud is with US Shale producers) to support the market failed to bolster prices after their worst ever quarter.

Having crashed by a record 66% in the first three months of the year, as the coronavirus destroyed demand and the world’s biggest producers embarked on a catastrophic supply free-for-all, oil prices extended losses on Wednesday even after Trump said he discussed the collapse with his Russian and Saudi counterparts, adding that Moscow and the kingdom would “get together” to seek a solution.

However, as Goldman noted last night, any agreement to cut output is likely too late and would fall short of the loss in consumption, not that one is imminent mind you because after Trump’s comments last night, on Wednesday Russia said it is not in talks with Saudi Arabia on oil market situation and President Vladimir Putin has no immediate plans to speak with Saudi Arabian leadership, though Moscow remains open for talks, Kremlin spokesman Dmitry Peskov tells reporters on conference call.

“Russian side traditionally welcomes mutual dialog and cooperation in order to stabilize energy markets” Peskov said adding that “our relations with Saudi Arabia remain on a high level. Of course, we may have certain disagreements, but in general our bilateral relations with SaudiArabia allow us to act effectively when there is such need.”

In short, no meetings between the two oil exporters any time soon, and yet they may have no choice but to arrange a deal.

“I do think both Russia and Saudi Arabia will be forced to cut back production, not because there’s a deal or they’re talking, but because of market forces,” Amrita Sen, chief oil analyst at Energy Aspects said in a Bloomberg TV interview.

“The possibility of negotiations is offering a rare ray of light to a heavily beleaguered market,” said Howie Lee, a Singapore-based analyst at Oversea-Chinese Banking Corp. “There are too many uncertainties involved to determine how strong a driver this would be, but it would probably take more than output cuts to lift prices back to pre-crash levels.”

So there is some hope, but for now with Trump failing to defuse the oil price war, Saudi Arabia has flooded the market as it warned it would less than a month ago, with Saudi Aramco’s oil supply surpassed 12 million bpd on the first day of April, up from 9.7mmb/d in March, and is boosting its production to its maximum, Bloomberg and the WSJ reported. As a reminder, in early March, Saudi Arabia instructed its state-owned oil company to boost supply to 12.3m b/d in April, and told Aramco to boost maximum production capacity to 13m b/d as soon as possible, something it has taken quite seriously as a tweet it just sent would indicate.

الموثوقيّة ليست مجرّد مؤشّر أداء، بل هي ثقافة الاستدامة في إمداد العالم بالطاقة. نفخر في أرامكو بتحميل 15 ناقلة نفط بـ 18.8 مليون برميل

هذه هي #الطاقة

هذه هي #أرامكو pic.twitter.com/Nz3YhHqP2x— أرامكو (@Saudi_Aramco) April 1, 2020

In it, Aramco says that it is loading 15 oil tankers with 18.8 million barrels of oil.

As a result of this unprecedented surge in output coupled with plunging demand, the outlook for oil looks terrible, with Bloomberg noting that “oil is facing a potentially apocalyptic April“, according to top industry analysts. Making matters worse, Iraq has pledged to boost its output this month, while U.S. industry data is signaling the biggest weekly increase in American stockpiles since 2017.

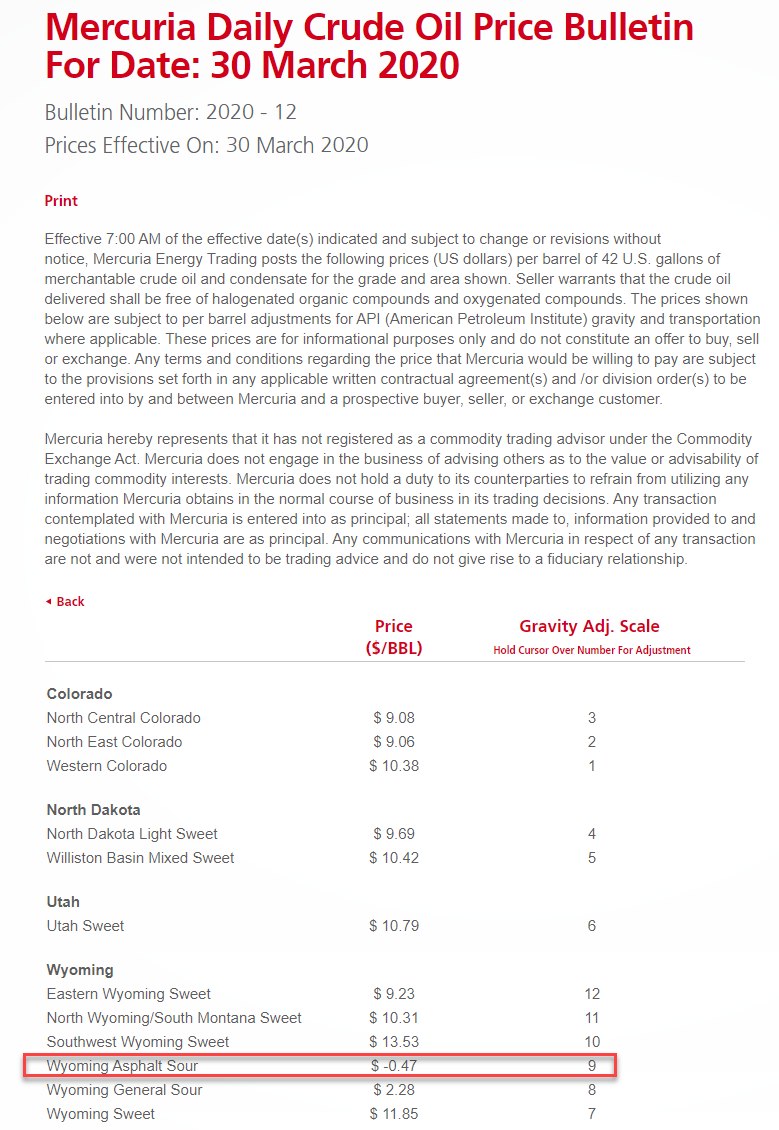

Fears that oil storage space may run out as early as 2 months from now have already pushed certain crude grades to negative prices as we reported last night.

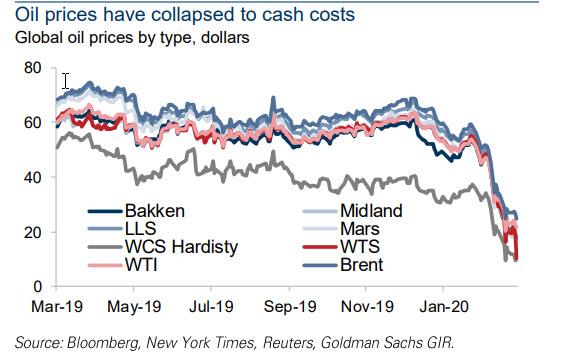

Meanwhile, virtually all energy products are now trading at cash costs, and set to drop further as countless oil producers file for bankruptcy.

Tyler Durden

Wed, 04/01/2020 – 08:49

via ZeroHedge News https://ift.tt/2JxKuZv Tyler Durden