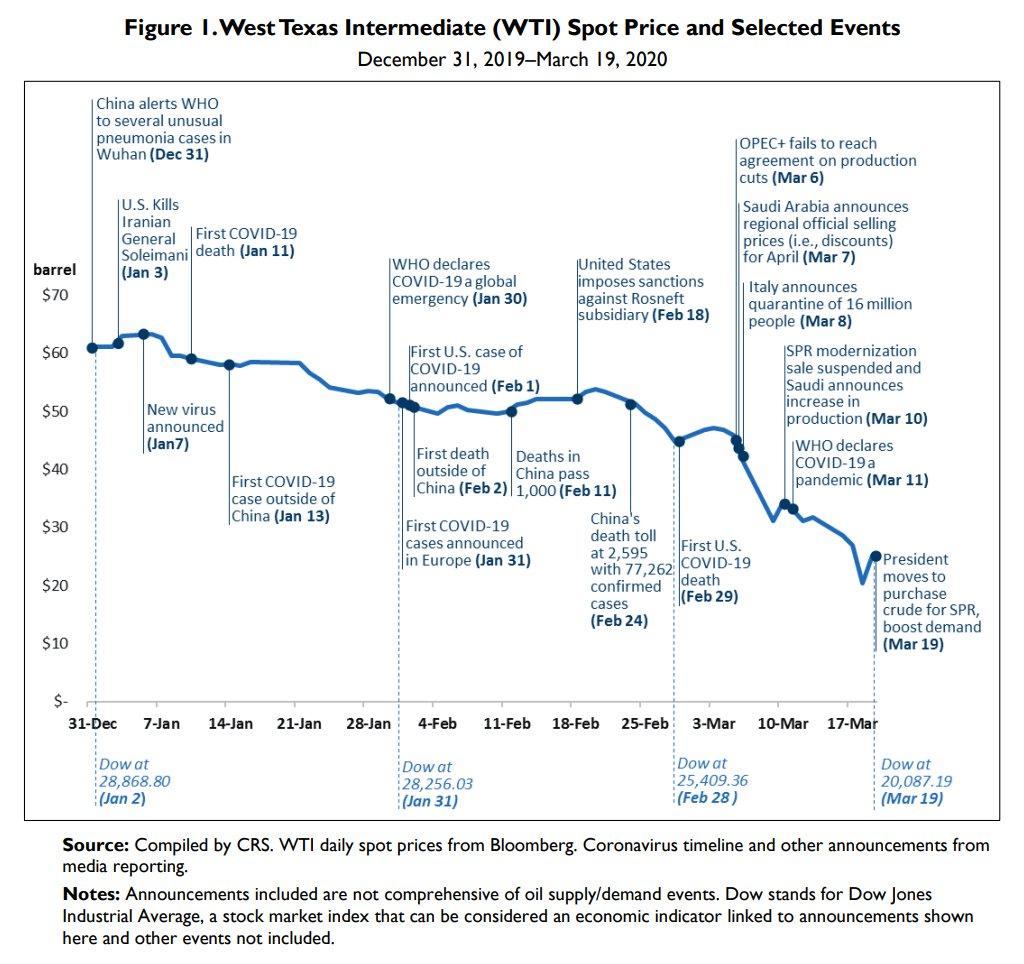

WTI Tumbles To $19 Handle After Biggest Crude Build Since 2016

After its worst quarter ever, as COVID-19 lockdowns crushed demand, raising fears about overflowing storage tanks amid a price war that has flooded the market with extra supply, all eyes are glued to today’s official inventory data (after API reported a major surprise build in crude and gasoline stocks) as Standard Chartered analysts, including Emily Ashford warned in a report, oil tanks around the world could fill in six weeks, a move that will likely force significant production shut-downs,

“Huge inventory builds, potentially exhausting spare storage capacity, will mean that market balance requires an unprecedented output shutdown by producers,” they wrote.

So, eyes down…

“There is the very real possibility that this week’s storage reports could be the energy patch version of last Thursday’s Weekly Jobless Claims,” Robert Yawger, Mizuho Securities USA’s director of energy said in a note.

“I would expect the numbers to be supersized and challenge multi-year highs/lows on multiple data points. Of course, I have been expecting big numbers for the past couple week, but the fireworks have not happened. That leads me to believe that the data explosion will likely happen this week … Exports will likely be down big, and refinery utilization will likely pull back dramatically. That will leave a lot of crude oil on the sidelines … EIA crude oil storage has been higher for nine weeks in a row. Storage will likely double up and increase at the rate of around 10 million for another nine weeks…at least.”

API

-

Crude +10.485mm (+4.6mm exp) – biggest build since Feb 2017

-

Cushing +2.926mm – biggest build since Feb 2019

-

Gasoline +6.058mm (+3.6mm exp) – biggest build since Jan 2020

-

Distillates -4.458mm (-600k exp)

DOE

-

Crude +13.833mm (+4.6mm exp) – biggest since Oct 2016

-

Cushing +3.521mm – biggest build since Mar 2018

-

Gasoline +7.524mm (+3.6mm exp) – biggest build since Jan 2020

-

Distillates -2.194mm (-600k exp)

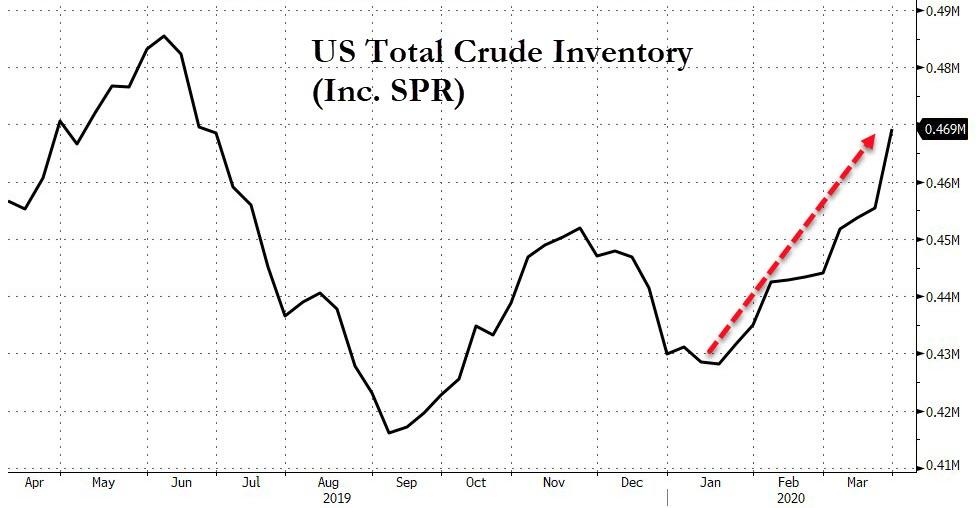

API reported a massive crude build (and gasoline build) overnight but the official data showed an even bigger 13.8mm barrel crude build – the biggest since Oct 2016 and a huge increase in stocks at Cushing…

Source: Bloomberg

Total US crude inventories are now at their highest since June 2019…

Source: Bloomberg

U.S. oil production has remained at a strong 13-13.1 million barrels a day in recent weeks, despite a big drop in the rig count last week (which could presage a shift)…

Source: Bloomberg

Bloomberg notes that it’s important to remember that while prices are low, we haven’t seen the sort of uniform production cut that many are expecting. There are a few reasons.

For one, many of these firms are hedged, so even with WTI trending at $20, that’s not necessarily the price a shale firm receives (there’s nuance here, but that’s another issue). Also, many of these firms may be just completing their wells instead of drilling new ones, which means production continues to rise. The trickle down effect of the rout isn’t quite here yet, but hold on – it might be here soon, particularly if oil remains at these levels.

WTI hovered around $20.20 ahead of the official inventory print and tumbled to a $19 handle after the big build…

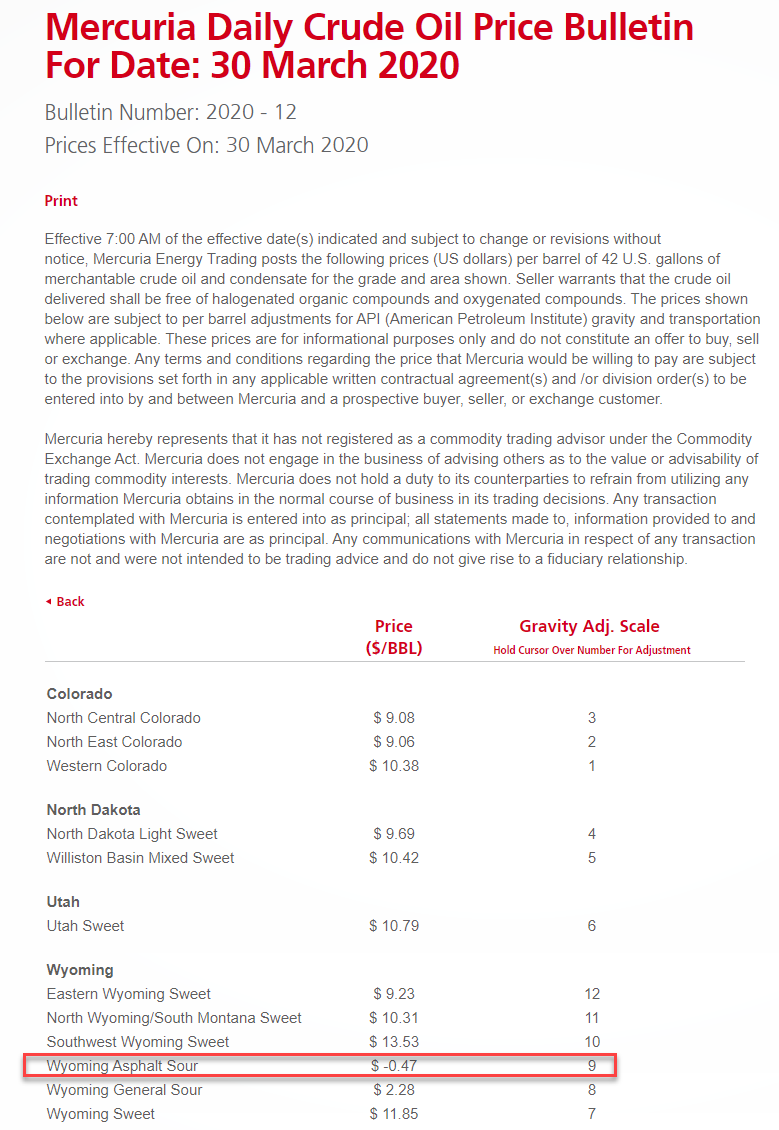

How low can prices go? Well, as we detailed last night, the first crude stream to price below zero was Wyoming Asphalt Sour, a dense oil used mostly to produce paving bitumen. Energy trading giant Mercuria bid negative 19 cents per barrel in mid-March for the crude, effectively asking producers to pay for the luxury of getting rid of their output.

Echoing Goldman, Elisabeth Murphy, an analyst at consultant ESAI Energy said that “these are landlocked crude with just no buyers. In areas where storage is filling up quickly, prices could go negative. Shut-ins are likely to happen by then.”

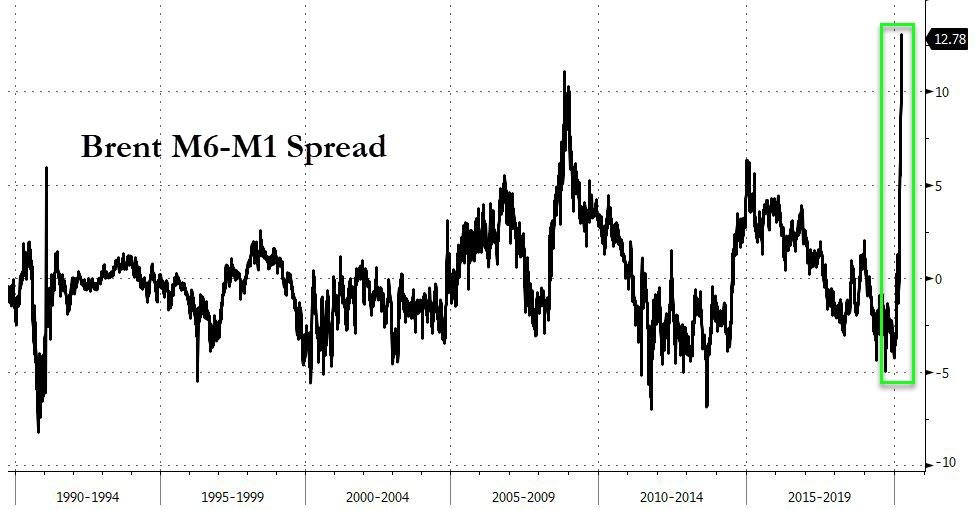

Finally, we note that Brent futures are signaling a historic glut is emerging.

The May contract traded at a discount of $13.66 a barrel to November, a more bearish super-contango than the market saw even in the depths of the 2008-09 global financial crisis.

Tyler Durden

Wed, 04/01/2020 – 10:36

via ZeroHedge News https://ift.tt/2yj525s Tyler Durden