ADP Confirms The Worst Is Yet To Come

Submitted by Christopher Dembik of Saxo Bank

The ADP estimates that US companies cut 27,000 jobs from March 1 to March 12 after an increase of 179,000 in February. This is the first monthly contraction since September 2017. The 6-month average is down at 119,000 vs 183,000 in February. The final print is better than expected (consensus at -154,000), but it is important to keep in mind the report does not reflect the full impact of the COVID-19 outbreak on the labor market. The most severe measures of containment were implemented after the survey, especially in the third week of March. There is no need to say that today’s statistic has zero value in forecasting the BLS number that will be released at the end of the week (see our conservative forecast here).

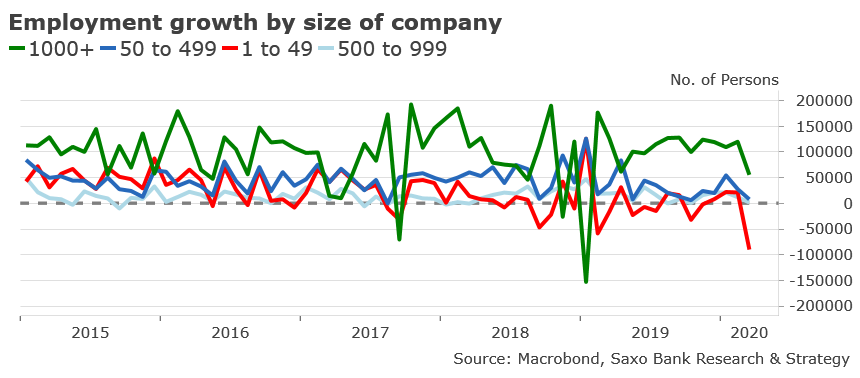

Digging into data, the only interesting trend is the very sharp cut in employment by small businesses (1 to 49 employees). As you can see in the below chart, over the first twelve days of March, small businesses have cut 90,000 jobs, which is the highest drop since the GFC. Given we don’t have data for the whole month and that the lockdown measures we re after the survey, it is likely that job cuts surpassed the previous record of February 2009, at minus 174,000.

We are living in unprecedented times and figures do not match historical reference anymore. We can discuss for a long time the real data for March, but what is really of prime importance is that job cuts by small businesses are doomed to last for many months. Investors need to keep in mind that small firms make up 90% of all companies in the United States and, in a normal economic expansion phase, they create around 3 million jobs every year. This is an understatement to say that small businesses are at the heart of employment growth. We need to get ready to a wave of bankruptcies and job cuts in the coming months.

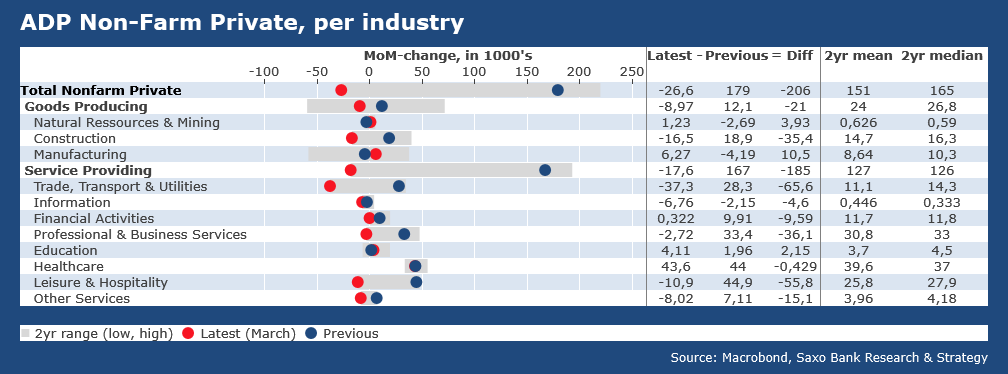

The below tab represents the employment trend by industry. The goods-producing sector posted 8,000 job cuts in March mostly due to a drop in the construction sector (-16,000). We notice a slight increase in the manufacturing sector (+6,000) that is unlikely to last considering the slump in manufacturing demand and the steep downturn in production.

With the exception of the healthcare sector (for obvious reasons), all the service providing sectors experienced job cuts in March with the biggest decrease in trade and transport (-37,000) and leisure and hospitality (-10,000). It confirms that the service sector has been badly impacted by the crisis, with consumer-facing industries directly affected by social distancing and lockdown measures, while tourism has virtually been decimated.

Tyler Durden

Wed, 04/01/2020 – 15:01

via ZeroHedge News https://ift.tt/3bJe4Hm Tyler Durden