April Fool’d – Bonds Bid, Stocks Slammed As Rebalance-Bid Evaporates

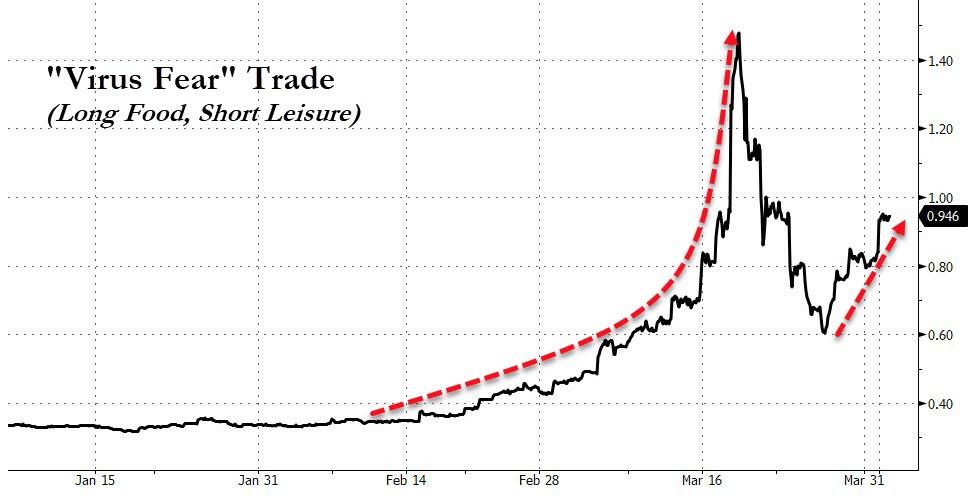

With month-/quarter-end rebalancing flows now a thing of the past…

Virus-fear is back…

Source: Bloomberg

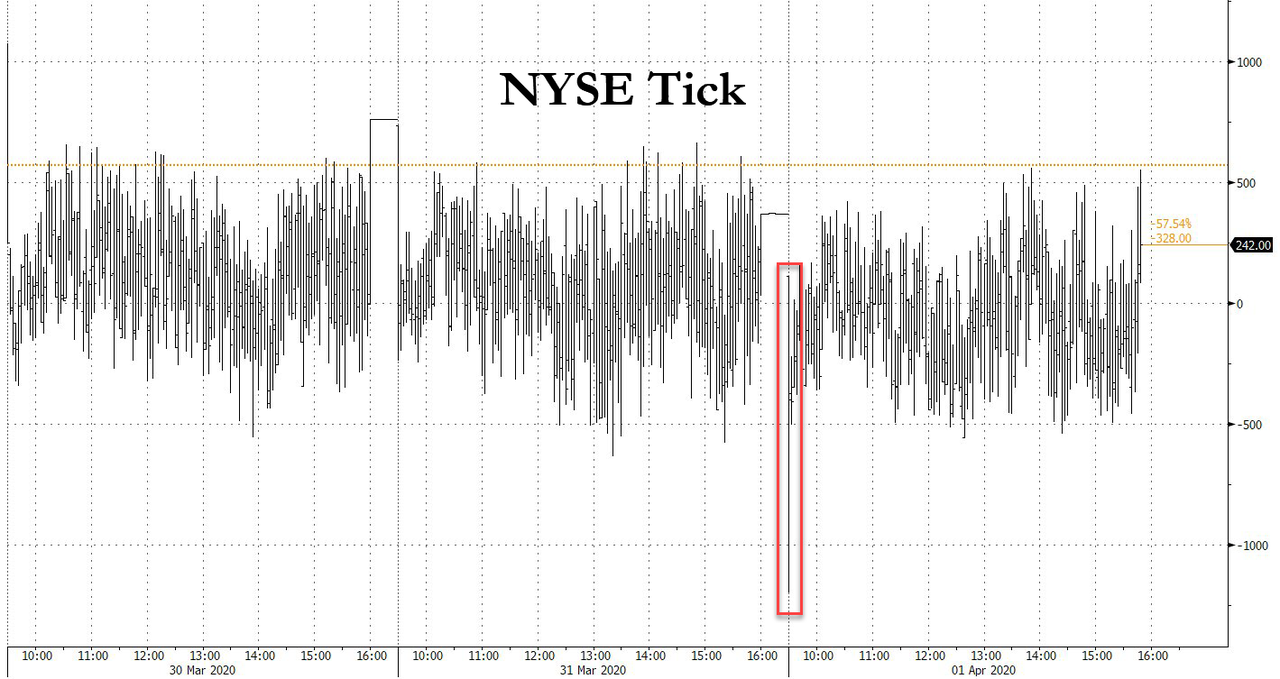

But the day started off ugly with a huge sell program…

Source: Bloomberg

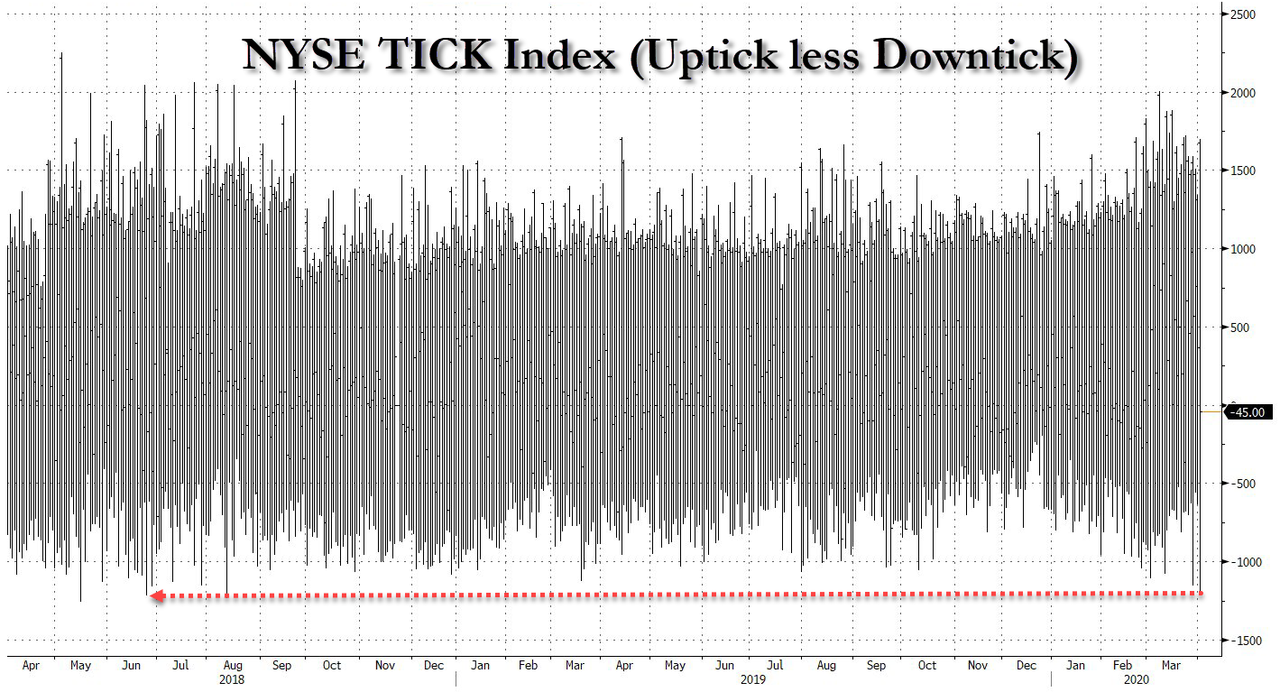

…the biggest negative TICK since Aug 13th 2018…

Source: Bloomberg

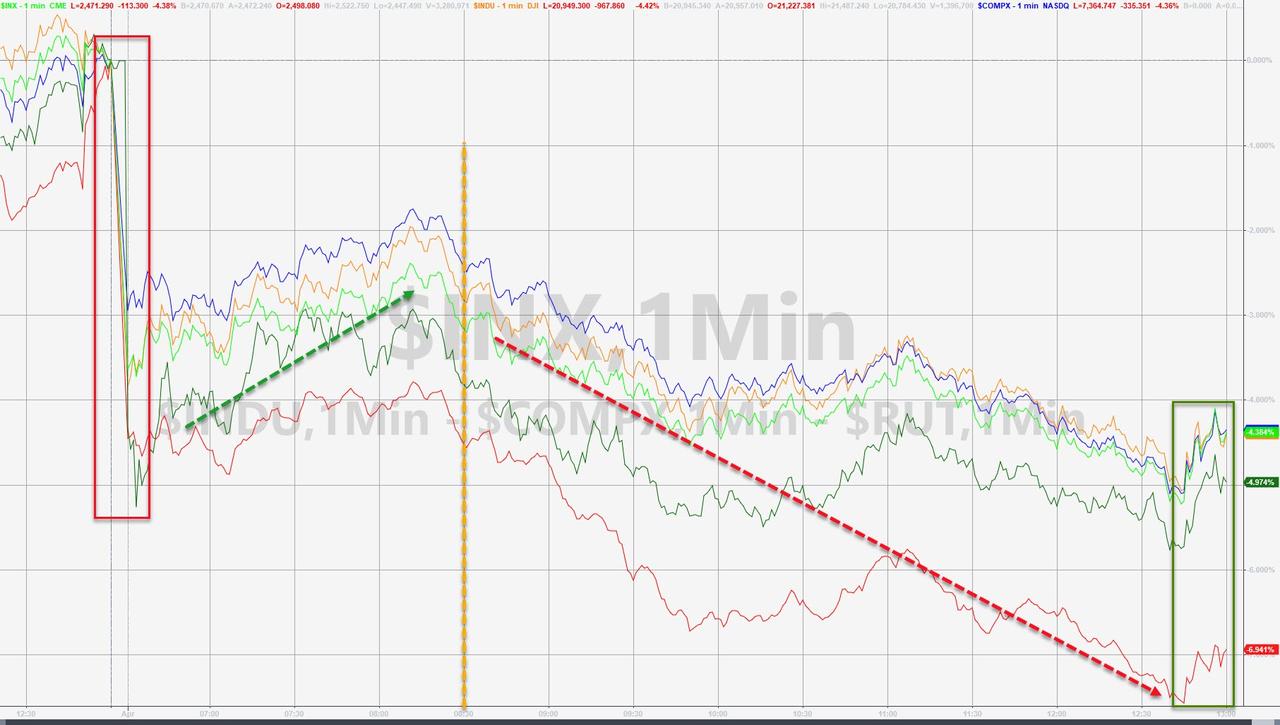

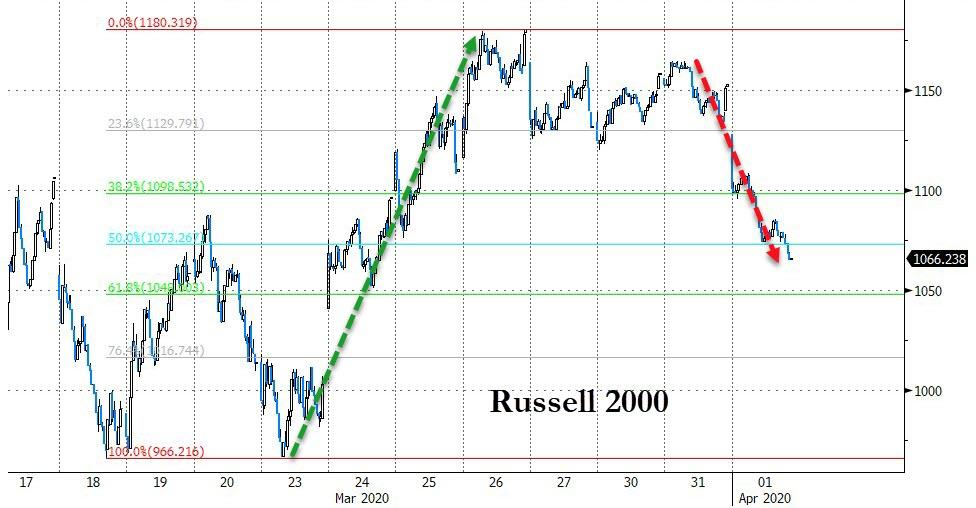

Small Caps led the bloodbathery with a near 7% collapse today (limit-down) but all the major US indices were ugly (note the weak open, bounce into EU close, then selling fir the rest of the day…

The Dow lost 21k; S&P dropped below 2,500; and Russell 2000 broke back below 1,100… erasing over 50% of the dead-cat-bounce from last week…

Both Defensive and Cyclicals were equally hit today…

Source: Bloomberg

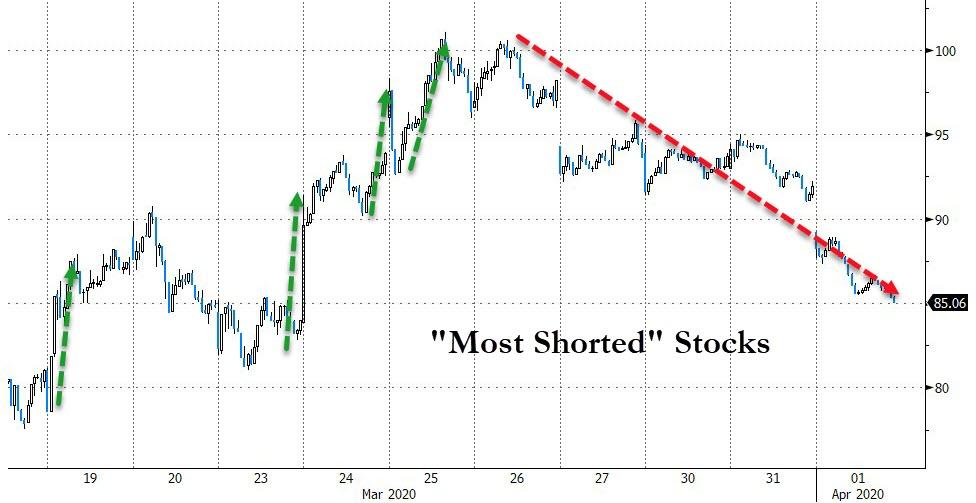

It appears the short-squeeze ammo has run out again…

Source: Bloomberg

FANG stocks were slammed, as the opening and closing bid ramps from last week have disappeared…

Source: Bloomberg

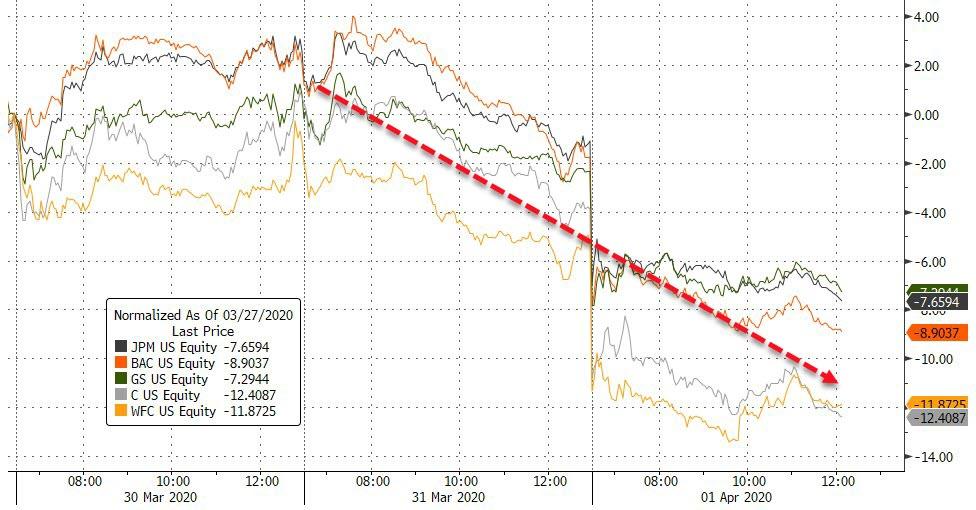

Bank stocks continued yesterday’s losses…

Source: Bloomberg

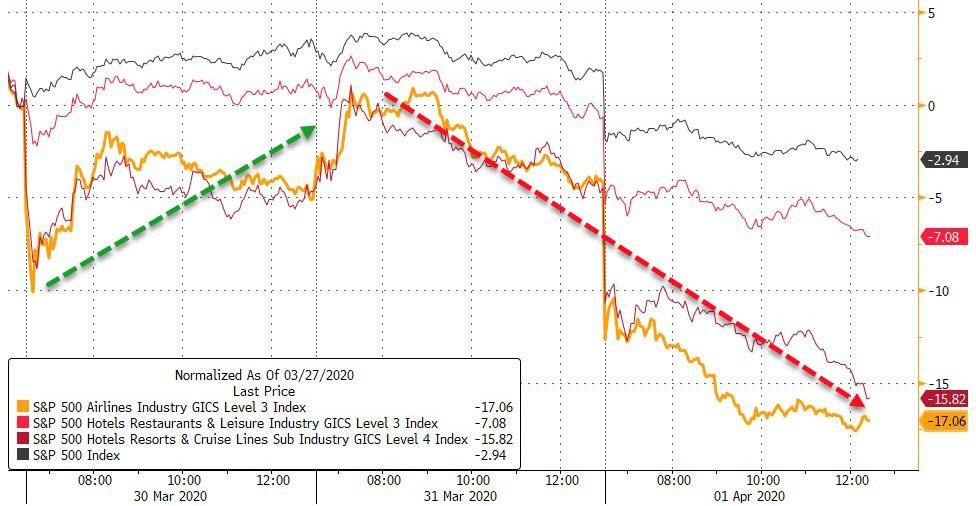

Directly-Virus-Affected sectors were monkey-hammered today with Airlines collapsing…

Source: Bloomberg

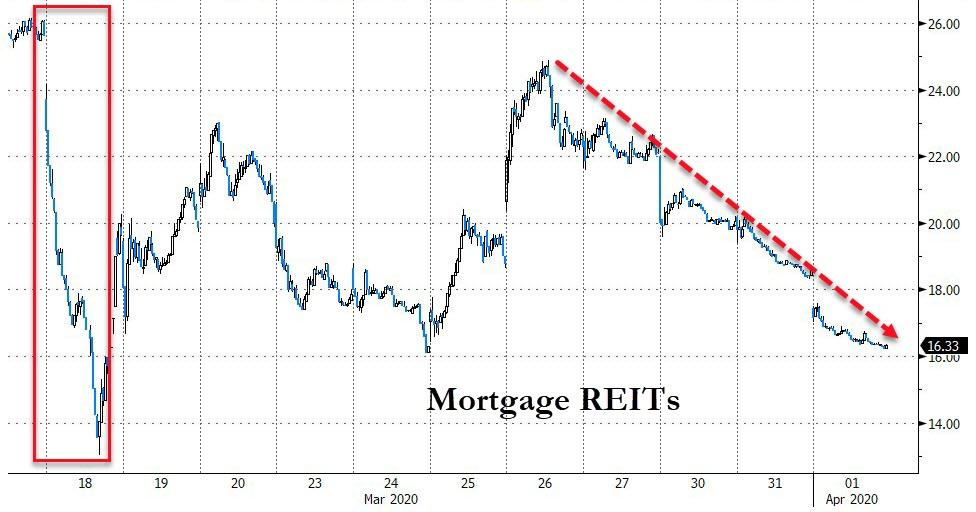

Most worrisome today was the crash in Mortgage REITs – despite weak markets and tumbling yields… systemic issues?

Source: Bloomberg

Credit was weaker today (HY worse)

Source: Bloomberg

Will stocks catch-down to bond yields now that the rebalance flows are done?

Source: Bloomberg

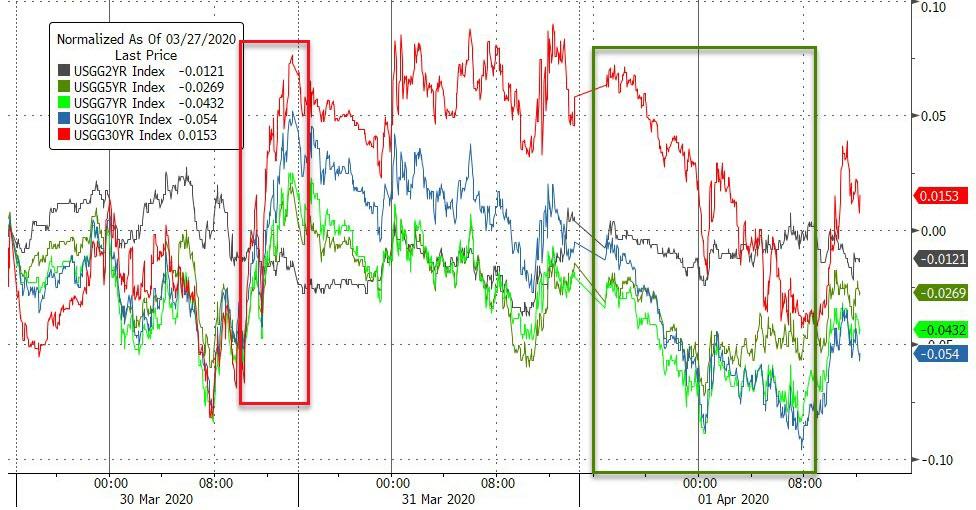

Treasury yields were all lower today as the rate-locks from record issuance lift (led by the long-end: 30Y -6bps, 2Y -1.5bps)…

Source: Bloomberg

10Y Yield tumbled back below 60bps today (57.7bps lows)…

Source: Bloomberg

The Dollar rebounded from yesterday’s weakness…

Source: Bloomberg

The Dollar shortage is back, with FRA-OIS widening notably today

Source: Bloomberg

Cryptos faded today…

Source: Bloomberg

Commodities were noisy today with oil and gold up, copper down…

Source: Bloomberg

Oil prices turmoiled around today but ended higher after plunging back below $20 again

Gold futures bounced back above $1600…

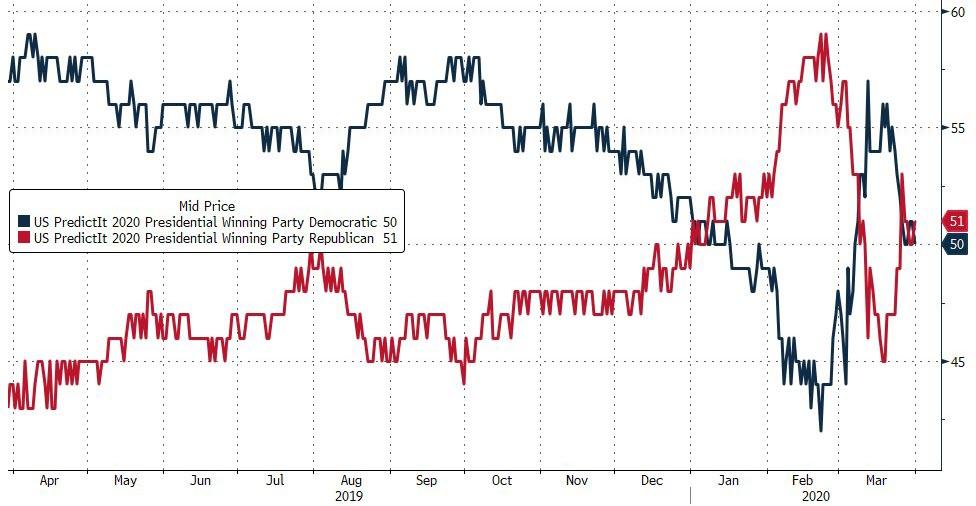

Finally, we note that Republicans have retaken the lead (albeit very marginally) in the prediction markets for the November election…

Source: Bloomberg

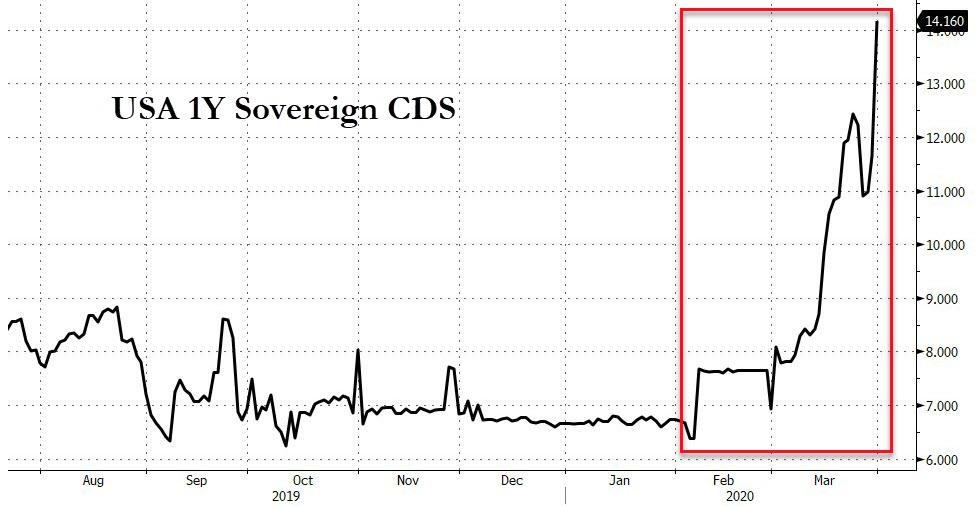

And amid all the ongoing calls for more and more rounds of fiscal stimulus and helicopter money, USA sovereign/deval risk is starting to rise rapidly…

Source: Bloomberg

Tyler Durden

Wed, 04/01/2020 – 16:00

via ZeroHedge News https://ift.tt/2UQQFgo Tyler Durden