“I’ve Never Seen Anything Like This”: Small Businesses Beg For ‘Speedy’ Stimulus Delivery

“I have never seen anything like this in my lifetime,” one small business owner was cited in Reuters as saying. The real question now is how long can small and family businesses — which account for some half of all US employment and are fast blowing through whatever cash remains (many say they’re good for no more than two weeks)— wait till they actually feel the effects of the $2 trillion stimulus package? After all it could take weeks to process checks and get loans out, and yet April remains essentially “cancelled”.

“Without something we wouldn’t be able to keep our employees,” another business owner with just five employees said. “My biggest goal is to keep them and of course make sure there’s a business for them to come back and work for.”

Congress’ $2 trillion includes $349 billion meant to rescue small firms through the Payroll Protection Program, intended for businesses to cover eight weeks of payroll and basic operating expenses via a forgivable loan of up to $10 million, which companies of up to 500 employees or fewer can access, available through June.

This as 50,000 retail stores have already shuttered in just over a week nationwide with no clear re-opening date, resulting in over 600,000 workers on furlough, based on Bloomberg data — also as new soaring unemployment numbers come out weekly, with last week the Labor Department reporting a record 3.3 million people filing unemployment insurance claims in the week prior.

“Speed is the operative word,” spokesman for the specific Treasury Dept. agency (the Small Business Administration, SBA) which is to oversee getting the funds to businesses, Jovita Carranza, said. And CEO of the Bank Policy Institute, Greg Baer, pointed out that “This is the kind of program that in ordinary times would take a year to get started.”

Indeed as details and crucial processing elements on the rollout continue to come into focus, investors will remain wary of bottlenecks which would detract from the economic upside, given that ensuring as many firms as possible remain operating in the wake of the outbreak is vital to preserving as much of the previously robust employment market as possible.

We noted last week that now with the stimulus passed into law, it’s precisely this next hurdle of speed and timeliness which will be as great (if not greater) than the first and presents a significant degree of execution risk. There are several aspects of the proposed stimulus measures which have well-established distribution channels; unemployment benefits and the injection of cash directly to households. As for the corporate, small business, and state/local government allocations, this leg of the process presents a greater challenge.

“There’s a fair amount of money,” Yale University finance professor Andrew Metrick told Bloomberg this week:

“But ultimately we have capacity problems getting the money into the hands of the small businesses fast enough, without fraud or bad actors effectively figuring out how to siphon money off.”

And Reuters adds further on the question of timing: “Banks have been telling customers to be patient and asking them to get relevant paperwork ready so that loans are processed quickly when it all comes together. Some expect cash to begin moving as soon as Friday.”

In short, there’s the classic question of speed vs. qualitative oversight. Either the government gives everyone what they want without checking — leaving the potential to unleash unprecedented fraud — or they do a meticulous check of everything and businesses fail during the long wait in limbo.

But the following doesn’t lend toward optimism:

The White House is dispatching staff to the Small Business Administration as that agency struggles with a flood of requests for financial aid, according to people familiar with the matter. So many people tried to access one SBA loan program last week that the agency’s website failed repeatedly.

Mnuchin has vowed to have the small business loan program “up and running” by the end of the week.

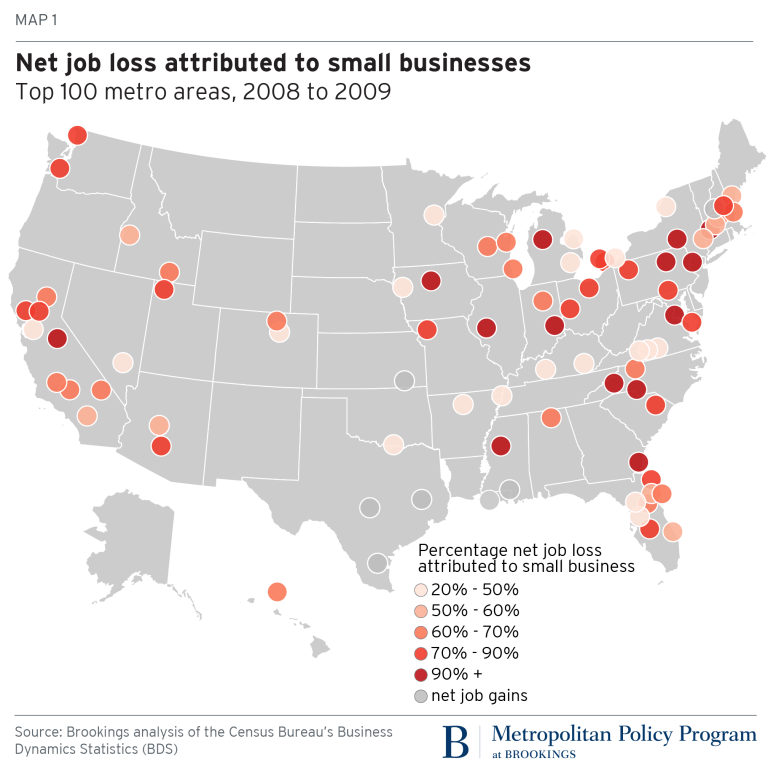

Via Brookings: Sifan Liu and Joseph Parilla observe that small business, particularly newer ones, were hit hardest during the 2007-09 recession. As the economy continues to suffer impacts from coronavirus-induced measures, they look back at what happened to such businesses then. In 16 of the largest metro areas, they find, small businesses were responsible for more than 90% of the net job loss:

But assuming we’re still having this discussion into next week, and possibly the next after, and as confused business owners struggle to fight through the red tape, it is sure to be too late for many who are still paying the bills today only on revenue from yesterday (or rather, from two weeks ago).

“This last week we’ve been working diligently with our banker to keep every single cash reserve dollar we’ve got to take care of things we absolutely have to pay until some of these loan programs become available and we can get cash out of them,” Jerry Akers, who co-owns over a couple dozen Great Clips hair salons locations in Iowa and Nebraska, told Bloomberg. “I’m not a big government-subsidy guy by nature, but right now, that’s our lifeline.”

Tyler Durden

Wed, 04/01/2020 – 20:05

via ZeroHedge News https://ift.tt/3dMkaIX Tyler Durden