“Very Ugly Setup” – As Unemployment Claims Rise, Missed Mortgage Payments Soar

Authored by Mike Shedlock via MishTalk,

Over 22 million people have filed for unemployment benefits in the past 4 weeks. Many struggle with payments.

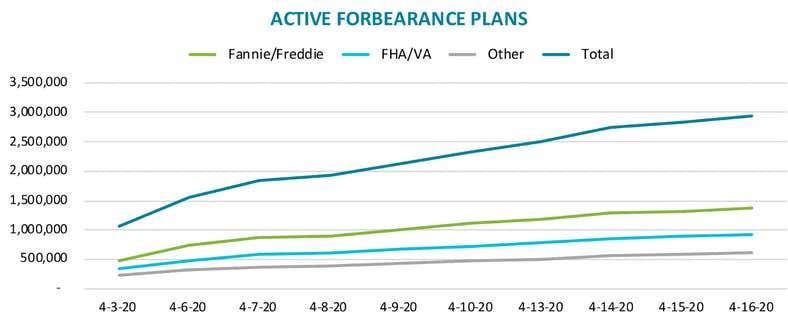

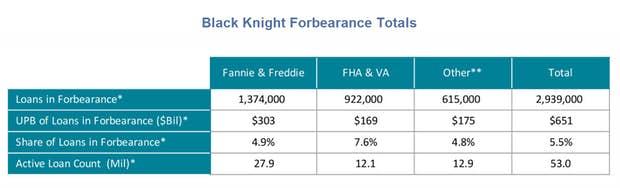

Black Knight reports More than 2.9 Million in Forbearance, 5.5% of All Mortgages

Key Details

-

As of April 16, more than 2.9 million homeowners – or 5.5% of all mortgages – have entered into COVID-19 mortgage forbearance plans

-

This population represents $651 billion in unpaid principal and includes 4.9% of all GSE-backed loans and 7.6% of FHA/VA loans

-

At today’s level, mortgage servicers would be bound to advance $2.3 billion of principal and interest payments per month to holders of government-backed mortgage securities on COVID-19-related forbearances

-

Another $1.1 billion per month in lost funds will be faced by those with portfolio-held or privately securitized mortgages

Forbearance Totals

Payment Forbearance Under Cares Act

On March 27, 2020, President Donald Trump signed the Coronavirus Aid, Relief, and Economic Security Act (also known as the CARES Act) into law. A provision of the CARES Act allows borrowers with federally backed mortgages to request temporary loan forbearance for up to 180 days. Borrowers also have the right to apply for an extension of another 180 days of forbearance.

Once a borrower requests hardship forbearance due to the COVID-19 pandemic, the act requires the servicer to offer a CARES Act forbearance.

Pitfalls

Forbes warns of Mortgage Forbearance Pitfalls.

John Ulzheimer, an Atlanta-based credit expert formerly of FICO and Equifax, warns of a potential balloon payment.

“If the lender or servicer demands that you pay back the deferred amount all at once or in an otherwise expedited manner, that could be impossible for the borrower.”

Unfortunately, having a mortgage servicer ask for a “balloon” payment once your forbearance period ends is a very real possibility. Borrowers from multiple national banks have reportedly been informed of the need to repay any delayed payments in a lump sum at a future date.

Three Things Not to Do

-

Don’t apply for forbearance if you don’t need to.

-

Make sure you understand the terms being offered. A huge balloon payment at the end could do you in.

-

Don’t pay your mortgage with a credit card. The interest rates are outrageous.

Very Ugly Setup

Over 22 million people have filed for unemployment. I discuss the numbers in With Over 22 Million Claims, What’s the Unemployment Rate?

The unfortunate answer is around 18%. That is a bit better than my earlier estimates of 20-22%. But it may be a bit optimistic.

Some states will be much worse. For example, Over 25% of Michigan Workforce Filed For Unemployment.

A recent number crunch on Michigan yields an unemployment rate of 24%-29%, truly a disaster.

No V-Shaped Recovery

Add it all up and you should quickly arrive at the correct viewpoint: The Covid-19 Recession Will Be Deeper Than the Great Financial Crisis.

Tyler Durden

Mon, 04/20/2020 – 15:25

via ZeroHedge News https://ift.tt/2zipwMn Tyler Durden