Who Was Forced To Liquidate Oil Today? Goldman Answers

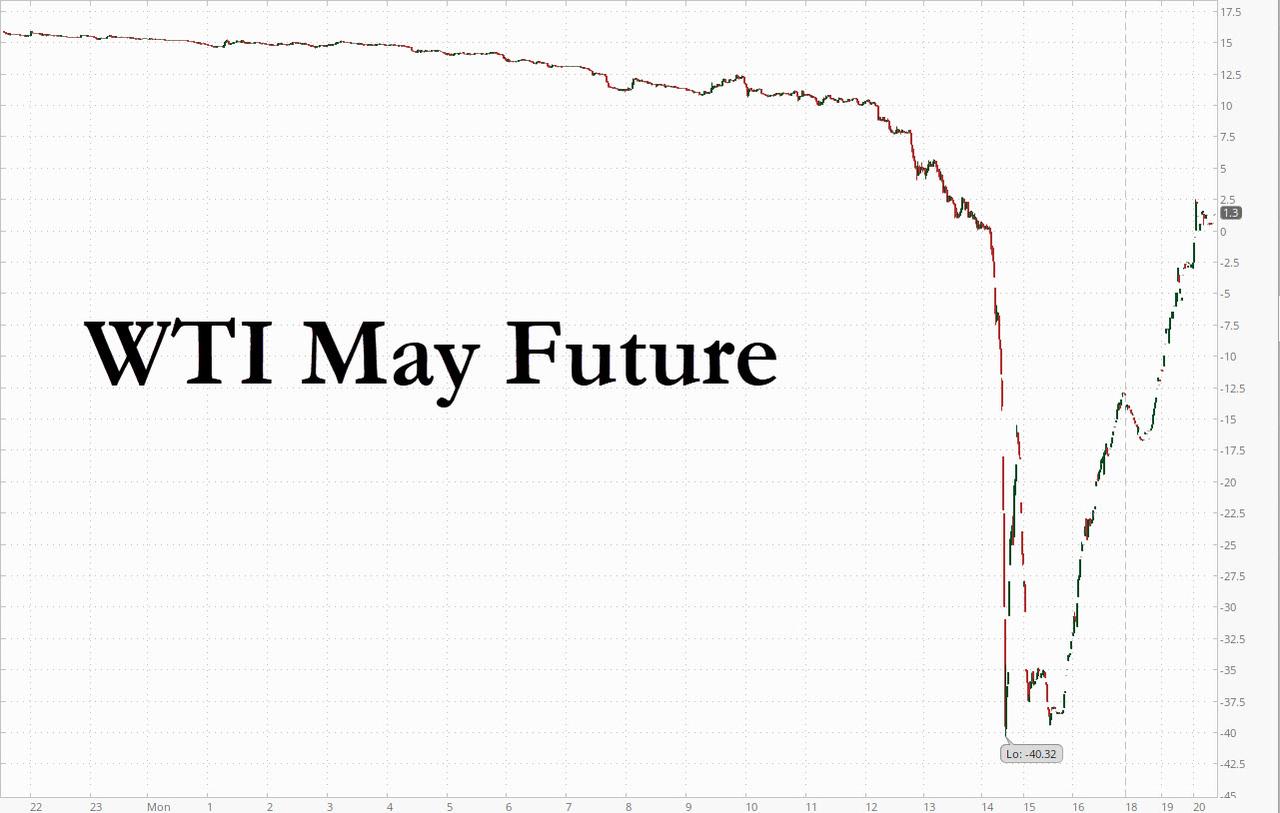

In the annals of market history, April 20, 2020 will be forever remembered the day when, for the first time ever, the deliverable WTI future contract plunged 50%, 60% – the drop accelerating – then 70%, 80%, 90%, 99%, … and then the unthinkable happened: after the May WTI contract dropped to $0.00, meaning it was free to get delivery of oil, it proceeded to slide into negative territory – an unprecedented event in market history – as oil producers were willing to pay their customers to take delivery of physical oil in a world in which oil storage has almost run out.

And so the price of oil tumbled, dropping to negative $10, then negative… negative $30, before finally stopping at -$40.32, the lowest price ever recorded for a barrel of WTI.

In many ways, the move was a mirror image of what happened during the legendary Volkswagen short squeeze, when countless shorts found out there was not enough stock in the float to cover all existing shorts, unleashing a scramble to buy shares at any price and avoid being the last man standing, as the alternative was – in theory – a stock price hitting infinity (Volkswagen did end up becoming the world’s most valuable company briefly, destroying dozens of iconic shorts in the process). Today’s move was similar, as many inexperienced traders suddenly realized that instead of an asset, oil had become a liability, having only hours to find a place where to receive delivery of physical barrels of oil.

A game of explosive hot potato (or rather black gold) then ensued around noon, when the deliverable WTI contract hit $10 and then dropped diagonally before triggering hundreds of $0.01 stops, at which point oil plunged vertically, crashing $40 dollars in minutes.

As Roger Diwan explained the dynamics, “speculators found themselves unable to resell the WTI contract, and have no storage booked to get delivered the crude in Cushing, OK, where the delivery is specified in the contract. This means that all the storage in Cushing is booked, and there is no price they can pay to store it, or they are totally inexperienced in this game and are caught holding a contract they did not understand the full physical aspect of as the time clock expires.”

So what happens now?

Well, some stability appears to have been restored, because since its settlement close around -$37, May WTI has recovered all its losses for the day and was last trading just above $0.

But don’t count on the relative stability lasting into tomorrow’s contract expiration – or the next month – because as Goldman’s commodity strategist, Damien Courvalin, who first predicted one month ago that negative oil prices are coming for landlocked producers, warns of “potential further distress ahead of the settlement window” tomorrow for the May WTI contract.

It gets worse from there because as we discussed earlier, the pain will then shift to the June contract, which expires on May 19:

The June contract will then become the prompt contract until its expiration on May 19. While it has outperformed significantly today, down only $4.60 to $+20.43/bbl, it will nonetheless likely see downward pressure in coming weeks

In other words, there will be more fireworks tomorrow for the May future, for the simple reason that there are likely still tens of thousands of maturing May contracts that need to find a literal home, which – with Cushing effectively full – is a problem, to wit:

The May CME WTI contract expires tomorrow, April 21. Any holder of a long position going into settlement would then be obligated to take delivery of crude in Cushing during the month of May (either by transfer into a designated pipeline or storage facility or by in-tank transfer). This means that an investor long a WTI May contract would be forced to sell out of this position (at any price) before tomorrow’s settlement to avoid being stuck having to find room for barrels in the Cushing storage hub which will likely be completely full by then (it is 77% full as of last Friday with the last 2-week builds pointing to stock-out by the first week of May).

Goldman then lists the following three reasons why the June future will be crushed next:

- the potential exit of spooked long retail investors given the violence of today’s move (and the negative carry incurred at each contract roll),

- the negative impact of investors rolling their long positions from the June to the July contract in early May (the USO rolls on May 5-8), and ultimately

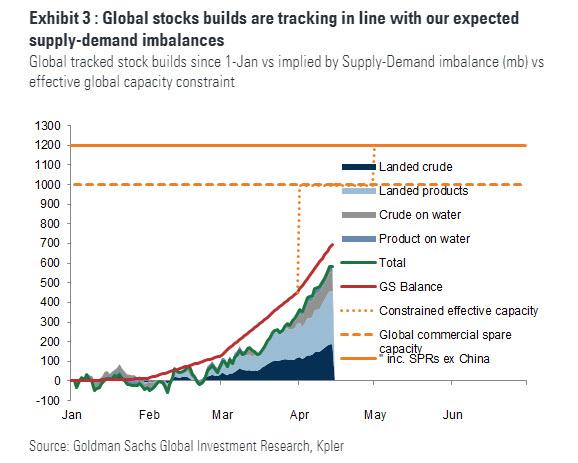

- the still unresolved market surplus that will hit binding storage capacity in coming weeks.

Finally, here is Goldman’s answer to the question on everyone’s lips: who was left long heading into today’s record price drop, and who was selling at any price?

Given the difficulty and costs of storing oil (even in normal times), investors typically never keep positions into expiration. The size of the long positions in May WTI had therefore already shrunk significantly as all the major commodity indices and ETFs rolled earlier this month into the June contract. Illustrating that point, the unprecedented collapse in May WTI prices occurred with only 100k contracts trading today, a tenth of the June contract volumes.

In terms of holders, the surge in retail interest in recent weeks — as illustrated by the USO ETF which now represents 30% of the June WTI contract open interest — suggests that retail positions (in outright WTI contracts rather than systematically rolling products) were likely still long May WTI contracts into this week and now forced sellers (consistent with the sell-off accelerating in the 30 minutes ahead of the close and the sharp rebound that followed).

And so it was once again the mom and pop daytraders and r/wallstreebets amateurs, who however have felt quite professional if not invincible, thanks to the Fed’s constant market manipulation and bailout out of every crash… but not in the commodity sector. It was they that suffered unprecedented losses having held on to a contract they did not understand, and without realizing that they faced not only a total wipe out, but a wipe out more than 100% of their invested capital, a privilege traditionally only reserves for short sellers.

And while we agree with Goldman that retail was the biggest victim of today’s crash, we doubt it’s the only one, because if there is one thing this market has created – if not real value (sorry but rising nominal stock prices due to printing money is the opposite of value creation) – it is an army of professional money-managing idiots who think they are geniuses whenever they are not on CNBC declaring how brilliant they are. And in the next few days we will find out not only just how many of them were wiped out, but also the names of all those “pros” who at the end of the day were as clueless as 23-year-old reddit discussion board “traders.”

Tyler Durden

Mon, 04/20/2020 – 21:42

via ZeroHedge News https://ift.tt/3aoRHWD Tyler Durden